Originally featured as “The Resistance”, this group of politicians only pretends to oppose the fleecing of taxpayers. They endorse the climate change hoax 100%, and only argue against the Carbon tax on narrow technical grounds. Now this is finally at the Supreme Court of Canada.

But it’s not just politicians and their parties involved. A number of private groups are attempting to change the course, for their own selfish and ideological reasons.

1. Debunking The Climate Change Scam

The entire climate change industry, (and yes, it is an industry) is a hoax perpetrated by the people in power. See the other articles on the scam, the propaganda machine in action, and some of the court documents in Canada. Carbon taxes are just a small part of the picture, and conservatives are intentionally sabotaging their court cases.

2. Important Links

CLICK HERE, for Saskatchewan Court of Appeal ruling.

CLICK HERE, for Saskatchewan Courts, info for users.

CLICK HERE, for Ontario Court of Appeal ruling.

CLICK HERE, for ONCA challenge documents, pleadings.

CLICK HERE, for Alberta Court of Appeal ruling.

CLICK HERE, for ABCA challenge documents, pleadings.

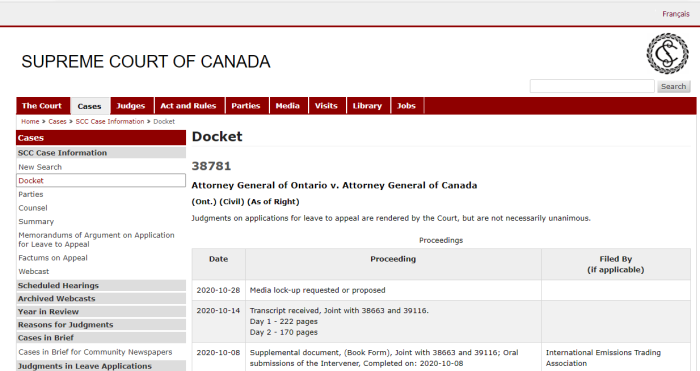

CLICK HERE, for Supreme Court of Canada constitutional challenge.

CLICK HERE, for the David Suzuki Foundation.

CLICK HERE, for Int’l Emissions Trading Ass’n.

CLICK HER, for IETA’s governance and leadership.

CLICK HERE, for Int’l Carbon Reduction Offset Alliance.

CLICK HERE, for ICROA’s partners and members.

CLICK HERE, for Smart Prosperity Institute.

(also see the last section for many more links to parties attempting to intervene in the Carbon tax challenges. Note: that list is not exhaustive.)

3. NGOs To Profit From Climate Scam

- Amnesty International

- Canadian Labour Congress

- Climate Justice Saskatoon

- David Suzuki Foundation

- Intergenerational Climate Coalition

- International Emissions Trading Association

- Smart Prosperity Institute

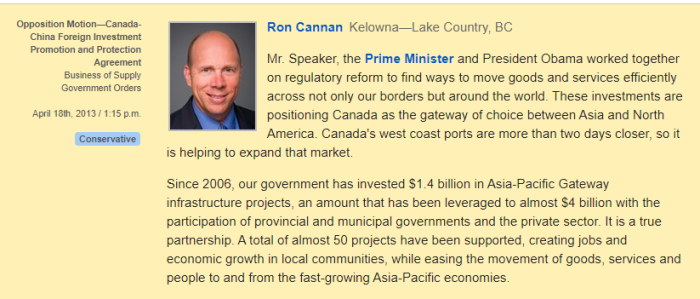

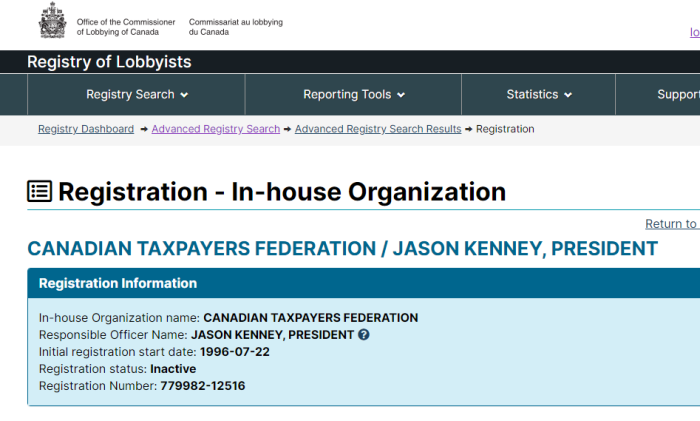

The Canadian Taxpayers Federation opposes the Carbon tax, but stays pretty neutral on the issue of climate change itself. It’s worth a mention for 2 reasons: (a) CTF is part of the Koch-funded Atlas Network; and (b) CTF was once headed by Jason Kenney, now Alberta Premier. Now, let’s take a look at a few groups.

4. David Suzuki Foundation

Revenue (August 31, 2018)

Receipted donations $5,820,601.00 (49.84%)

Non-receipted donations $784,563.00 (6.72%)

Gifts from other registered charities $2,727,009.00 (23.35%)

Government funding $0.00 (0.00%)

All other revenue $2,347,296.00 (20.10%)

Total revenue: $11,679,469.00

Expenses (August 31, 2018)

Charitable programs $7,378,892.00 (70.41%)

Management and administration $638,154.00 (6.09%)

Fundraising $1,779,300.00 (16.98%)

Political activities $583,341.00 (5.57%)

Gifts to other registered charities and qualified donees $96,578.00 (0.92%)

Other $4,234.00 (0.04%)

Total expenses: $10,480,499.00

Revenue (August 31, 2019)

Receipted donations $6,847,386.00 (53.92%)

Non-receipted donations $1,132,648.00 (8.92%)

Gifts from other registered charities $3,242,143.00 (25.53%)

Government funding $0.00 (0.00%)

All other revenue $1,476,568.00 (11.63%)

Total revenue: $12,698,745.00

Expenses (August 31, 2019)

Charitable programs $8,738,812.00 (75.28%)

Management and administration $808,096.00 (6.96%)

Fundraising $1,964,567.00 (16.92%)

Gifts to other registered charities and qualified donees $93,302.00 (0.80%)

Other $4,234.00 (0.04%)

Total expenses: $11,609,011.00

According to the Canada Revenue Agency, the Suzuki Foundation took in $12.7 million in the period ending in August 2019, and $11.7 million the previous year. There is clearly good money, so where is it going?

Suzuki Foundation 2019 Annual Report

Suzuki Foundation 2019 Audited Financials

How does pricing carbon pollution build more sustainable communities?

.

Putting a price on carbon pollution through a carbon tax or cap-and-trade system helps speed the transition to cleaner, better energy solutions. We have low-carbon alternatives to our largest emissions sources that are improving by the day.

Working toward a fair and effective national price on carbon pollution

For more than a decade, the Foundation has been a leading voice in calling for a carbon price in Canada. Through research, policy work and public engagement, we built support for this foundational climate change policy.

The Foundation offered the B.C. government support to introduce North America’s first carbon tax in 2008. Our policy experts met with leaders at all levels of government and across industries to advocate for a national approach to carbon pricing.

The Foundation is an intervener in court cases in Saskatchewan and Ontario to support the federal government’s right to implement fair and effective climate policies that include carbon pricing.

In both cases, the courts of appeal agreed with us that the federal government has the power to take national action to tackle climate change. With Parliament and cities across the country declaring climate emergencies, including carbon pricing in the solutions toolkit is essential to meeting Paris Agreement climate commitments and avoiding the worst impacts of climate breakdown.

Can we assume that they either bribed or leaned on the B.C. Government to get that Carbon tax imposed? The Suzuki Foundation doesn’t come right out and say it (though it’s implied), that making certain comforts unaffordable by various carbon pricing schemes will lead to this great transition. It’s stated that causing a drastic change in the Western lifestyle is the only way to do this.

The Foundation is also involved with Youth Climate Lawsuit. This has young adults trying weaponize the Courts by forcing Governments to adopt their environmental demands. The claim is that ignoring climate change violates Section 7 of the Canadian Charter, which is security of the person.

And of course, the Suzuki Foundation has attached itself to the various Carbon tax challenges. It’s fair to assume that Suzuki’s donors are paying him to advance (by whatever means), policies that will lead to more money coming in. In a sense, it’s like paying a lobbyist.

Suzuki’s recent donors include: Power Corporation, the Bronfman Foundation, Tides Canada, Smart Prosperity Institute, several anonymous donors, and many more.

5. International Emissions Trading Association

IETA Economic Potential Article 6 Paris Accord

IETA Partnership For Market Readiness

IETA is the International Emissions Trading Association. It is an organization that tries to monetize the climate change agenda, by convincing countries to pay out money for “polluting”. A quote from their market readiness report:

Understand what emissions trading is:

emissions trading is a market-based approach to controlling pollution by providing an economic incentive to achieve CO2 emissions reductions. To succeed in managing such a cap-and-trade system, your company will need strategic, technical and financial skills.

Find the appropriate department to coordinate the organisation: emissions trading is linked to climate change strategy. Climate strategy often lies between the sustainable development and finance functions. Emissions trading is about financial management, but it also implies a deep understanding of regulation, CO2 management strategy and a good technical knowledge of industrial installations which fall under the cap. Whichever the appropriate department is, the most important thing is to have a project manager. Start a working group: the working group should be able as a first step to define whether or not emissions trading could be managed internally or outsourced. A cost/benefit analysis should be carried out to evaluate the choice between delegating trading to a specialised broker or to carrying it out internally. Such an approach gives the opportunity to create a “CO2 network” within the company.

Assess possible optimisation among installations: if entities are spread geographically, a centralised option could be considered. For example, in the European emissions market it is often the case that installations of one company are spread across a number of member states. Local exchanges with local brokers co-exist with European CO2 exchange platforms and may be able to offer more targeted solutions.

Understand that none of this actually helps the environment. It is simply a way to get wealthy under a misleading banner of cutting pollution. This is an expansive wealth transfer scheme.

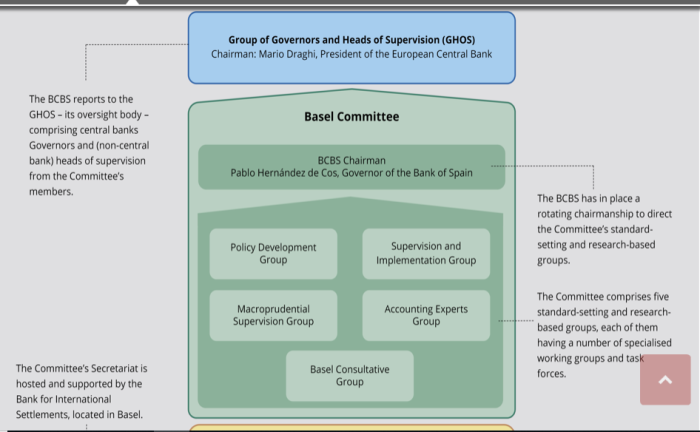

IETA received legal non-profit status from the government of Switzerland in June 2000, and received United Nations Framework Convention on Climate Change non-governmental organisation accreditation in October 2000.

It should trouble Canadians that this “non-profit” with financial motivations to keep the Carbon tax should be filing for intervenor status in four court cases (Saskatchewan, Ontario, Alberta, & the Supreme Court). Theie interests are different than ours.

6. Smart Prosperity Institute

The Smart Prosperity Institute has a number of government and private sector donors, and perhaps most notably includes the Tides Foundation. SPI writes extensively about transitioning Canada to a low carbon economy, and is promoting the green bonds industry, and have partnered with HSBC and the Climate Bonds Initiative. They also push the “sustainable finance” narrative, and are enthusiastic supporters of the UN.

Smart Prosperity Institute’s annual “Green Bonds – State of the Market in Canada” reports provide unique insight on the role of green bonds in funding environment and climate-related projects in Canada. The annual report is a special supplement to the Bonds and Climate Change: The State of the Market global report and is prepared collaboratively with Climate Bonds Initiative. Commissioned by HSBC, the report marks specific highlights from the current year, emerging trends, and identifies specific opportunities for market development of green bonds in Canada.

Keeping the Carbon taxes intact is very much in their interest, as it is tied to many of the initiatives that SPI advances. Another NGO that Canadians should be weary of meddling in local affairs.

7. Amnesty International

Amnesty International was founded by Peter Benenson, grandson of Russian banker, Grigori Benenson. The organization has been used to bring large numbers of people from the 3rd World to the West. The group appears to have no direct financial motive, but rather an ideological one. It argues that forced Carbon taxes amount to a human rights issue for the planet. Is this not foreign interference though? AI is based out of Britain.

8. Constitutional Challenges: SK, ON, AB, SCC

(A.1) SK COA Ruling On Carbon Tax

http://archive.is/tNe2k

(A.2) Saskatchewan Court Of Appeal Reference Question

(A.3) SKCA Attorney General Of Canada

(A.4) SKCA Attorney General Of Ontario

(A.5) SKCA Attorney General Of New Brunswick

(A.6) SKCA Attorney General Of British Columbia

(A.7) SKCA Canadian Taxpayers Association

(A.8) SKCA David Suzuki Foundation

(A.9) SKCA International Emissions Trading Association

(A.10) SKCA United Conservative Association

(B.1) ONCA Ruling On Carbon Tax

http://archive.is/tbMTC

(B.2) ONCA Reference Documents

(B.3) ONCA Attorney General Of Ontario

(B.4) ONCA Attorney General Of Canada

(B.5) ONCA Attorney General Of Saskatchewan

(B.6) ONCA Attorney General Of New Brunswick

(B.7) ONCA David Suzuki Foundation

(B.8) ONCA Intergenerational Climate Coalition

(B.9) ONCA International Emissions Trading Association

(B.10) ONCA Attorney General Of Ontario Reply

(B.11) ONCA Attorney General Of Canada Reply

(C.1) ABCA Ruling On Carbon Tax

http://archive.is/guxXF

(C.2) Alberta Court Of Appeal Reference Question

(C.3) ABCA Attorney General Of Alberta

(C.4) ABCA Attorney General Of Canada

(C.5) ABCA Attorney General Of Ontario

(C.6) ABCA Attorney General Of Saskatchewan

(C.7) ABCA Attorney General Of New Brunswick

(C.8) ABCA Attorney General Of British Columbia

(C.9) ABCA International Emissions Trading Association

(C.10) ABCA Attorney General Of Alberta Reply

(C.11) ABCA Attorney General Of Canada Reply

(C.12) Jason Kenney Repeals Carbon Tax

http://archive.is/Q1gGb

(C.13) Kenney Supports New Carbon Tax

http://archive.is/wTYoE

(C.14) Kenney To Hike New Carbon Tax

http://archive.is/jbLjN

(D.2) Supreme Court Of Canada To Hear Challenge

(D.3) SCC Attorney General Of Ontario

(D.4) SCC Attorney General Of Canada

(D.5) SCC Attorney General Of Saskatchewan

(D.6) SCC Attorney General Of Alberta

(D.7) SCC Attorney General Of New Brunswick

(D.8) SCC Attorney General Of Manitoba

(D.9) SCC Attorney General Of British Columbia

(D.10) SCC Amnesty International

(D.11) SCC Canadian Labour Congress

(D.12) SCC David Suzuki Foundation

(D.13) SCC Intergenerational Climate Committee

(D.14) SCC International Emissions Trading Association

(D.15) SCC Smart Prosperity Institute

(D.16) SCC Attorney General Of Ontario Reply

(D.17) SCC Attorney General Of Canada Reply

One common thread throughout these challenges is that all parties agree climate change is a threat to humanity. This includes parties challenging the Carbon taxes.