This topic isn’t revolutionary. However, it’s interesting how different pieces of legislation (supposedly brought for completely different areas of life) can serve much the same purpose. Laws that seemingly have no connection to each other can end up having very similar results.

Let’s look at a few of them.

For emergency and disaster management:

-U.N. Sustainable Development Agenda (Agenda 21) signed in 1992

–Yokohama Strategy for a Safer World signed in 1994

–Hyogo Framework for Action signed, goes from 2005 to 2015

-U.N. Sustainable Development Agenda (Agenda 2030) signed in 2015

–Sendai Framework signed, goes from 2015 to 2030.

For public health management:

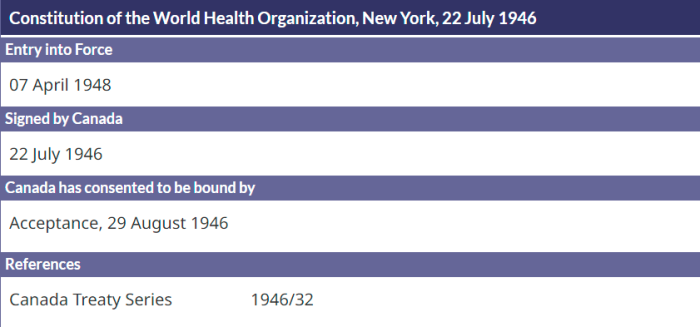

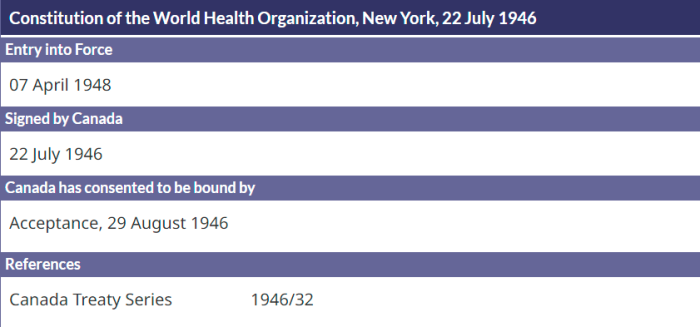

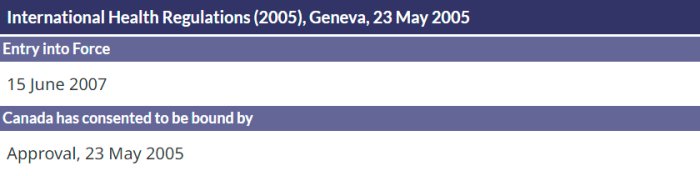

–W.H.O. Constitution signed in 1946

-W.H.O. International Sanitary Regulations signed in 1951

-W.H.O. International Health Regulations (First Edition) signed in 1969

-W.H.O. International Health Regulations (Second Edition) signed in 1995

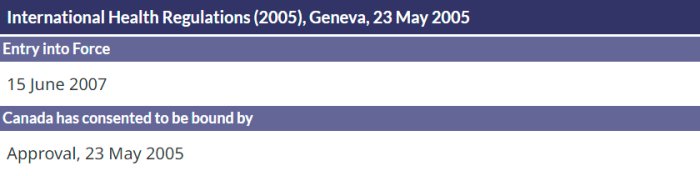

–W.H.O. International Health Regulations (Third Edition) signed in 2005

Now, what can these things have in common? Quite simply, they are pretexts for removing rights and property from people, under the cloak of being an emergency. True, the nature of it will vary, but the results are the same.

1. Parallels Between Sendai Framework And WHO-IHR

While not identical, there are many connections and similarities between enacting emergency management laws, and the public health laws. Using B.C. as an example:

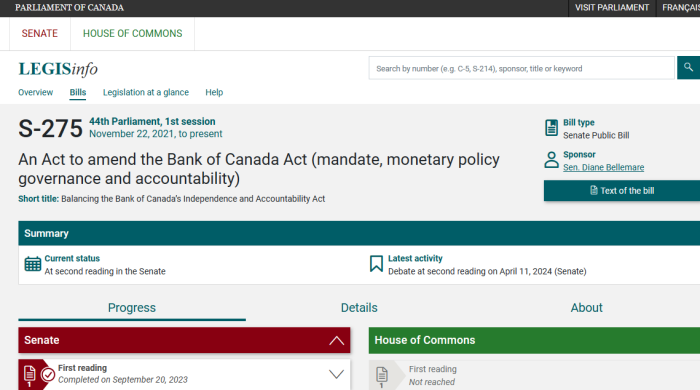

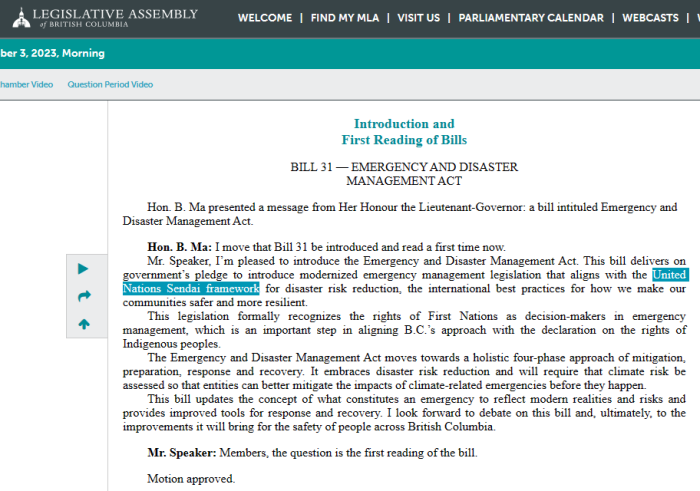

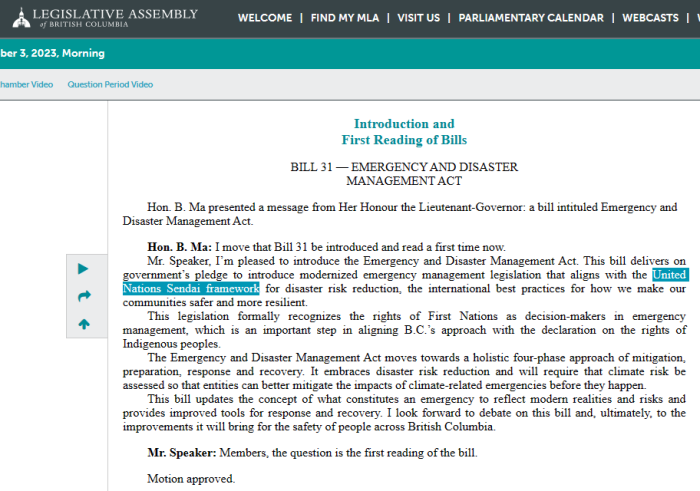

(a) Bill 31 was derived from the Sendai Framework, which itself is part of the United Nations Sustainable Development Agenda. There are many aspects to this ideology

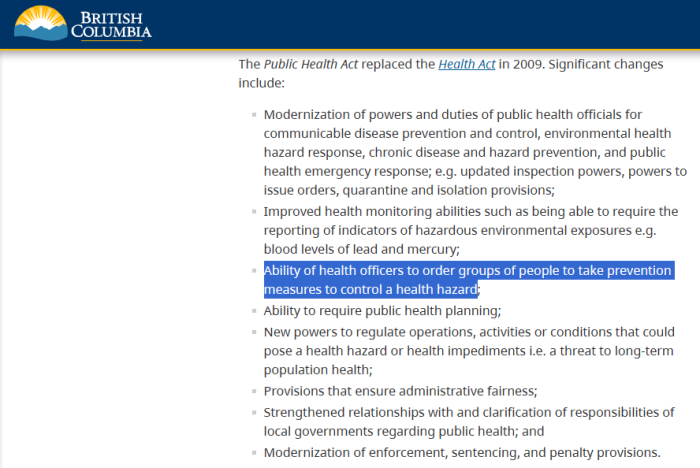

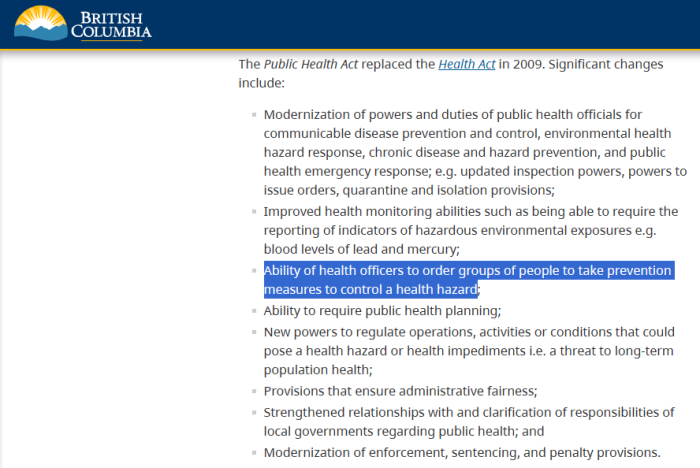

(b) The Provincial Public Health Acts are the result of the 2005 Quarantine Act, which itself is derived from the 3rd Edition of the WHO’s International Health Regulations. Also, the WHO’s Constitution is well worth a read, as it dates back to the 1940s.

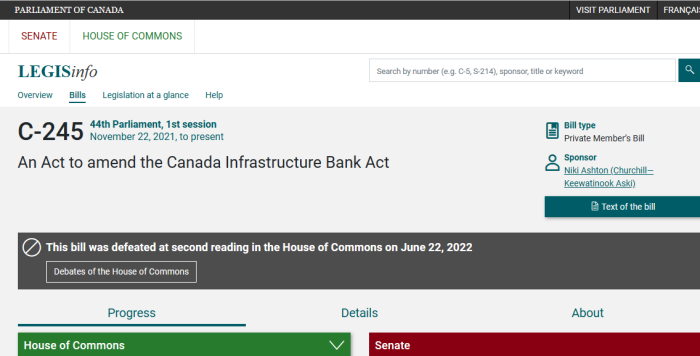

While laws are being enacted that greatly impact the lives of Canadians, the reality is that these — and many laws — are derived from international agreements that the public has no say in.

(a) Bill 31 is framed as “disaster reduction measures”, which presumably means natural disasters. As for speculation about “climate lockdowns”, this type of legislation is laying the ground work.

(b) Provincial Health Acts are framed as “preventing communicable diseases”, and we saw plenty of that in the last few years.

And reading through both, it’s clear that both are intended — among other things — to strip away large parts of individual rights, including property rights. These things are presented as necessary for the greater good.

Additionally, both sets of laws allows near dictatorial powers when it comes to issuing orders. A Cabinet Minister could do it for the Emergency & Disaster Management Act. A Minister, or Public Health Officer, can give orders concerning regulations within the Public Health Act

2. B.C. Bill 31, Emergency & Disaster Management Act

This is still going through the Legislature, but parts of it are certainly worth looking at. They’re ripe for abuse in the wrong hands.

Essential matters

75 (1) The minister may, by order, do one or more of the following:

(a) identify supplies, equipment or other items, services, property or facilities, or a class of any of these, as essential;

(b) for things identified under paragraph (a) as essential,

(i) establish or restrain increases in prices or rents for them,

(ii) ration or otherwise provide for their distribution or use,

(iii) provide for their restoration, and

(iv) prohibit or limit seizures of them or evictions from them;

(c) authorize a person to provide a service or give assistance of a type that the person is qualified to provide or give;

(d) require a person to provide a service or give assistance of a type that the person is qualified to provide or give;

(e) provide for, maintain and coordinate the provision and maintenance of necessities.

(2) Subsection (1) (b) (i) and (iv) applies despite any enactment governing tenancies or the recovery of property.

(3) Subsection (1) (c) and (d) applies despite any contract, including a collective agreement.

Land and other property

76 (1) The minister may, by order, do one or more of the following:

(a) appropriate, use or control the use of any personal property;

(b) use or control the use of any land;

(c) authorize the entry without warrant into any structure or onto any land by any person for the purpose of taking emergency measures;

(d) prohibit the entry into any structure or onto any land by any person;

(e) authorize or require the alteration, removal or demolition of any trees, crops, structures or landscapes;

(f) authorize or require the construction, alteration, removal or demolition of works;

(g) require the owner of a structure to

(i) have any damage to the structure assessed, and

(ii) give the results of the assessment to the minister or a person in a class of persons specified by the minister.

(2) The power under subsection (1) (b) to use or control the use of land does not apply to specified land.

General restrictions

78 (1) The minister may, by order, control or prohibit one or more of the following:

(a) travel to or from any area;

(b) the carrying on of a business or a type of business;

(c) an event or a type of event.

(2) The minister may, by order, do one or more of the following:

(a) require a person to stop doing an activity, including an activity that a person is licensed, permitted or otherwise authorized to do under an enactment;

(b) put limits or conditions on doing an activity, including limits or conditions that have the effect of modifying a licence, permit or other authorization issued under an enactment.

Clearly, the Bill is much longer than this. But what do these sections include?

- Establish price controls of “essential goods”

- Establish rationing of “essential goods”

- Require (force) people to provide certain services

- Appropriate or control someone’s private land

- Allow warrantless searches

- Prohibit people from entering their property

- Prevent travel

- Prohibit certain types of businesses

- Prohibit or restrict activities

Sound familiar? It should. These things were implemented throughout British Columbia through 2020 to 2022, but under the pretense of “disease prevention”. All that’s missing are the injection passports and the mask mandates.

3. B.C. Public Health Act (2009), Derivative Of WHO-IHR

People will no doubt remember the years of endless (and seemingly arbitrary) dictates from BCPHO Bonnie Henry, and Health Minister Adrian Dix. But what allowed them to do this?

General powers respecting health hazards and contraventions

31 (1)If the circumstances described in section 30 [when orders respecting health hazards and contraventions may be made] apply, a health officer may order a person to do anything that the health officer reasonably believes is necessary for any of the following purposes:

(a) to determine whether a health hazard exists;

(b) to prevent or stop a health hazard, or mitigate the harm or prevent further harm from a health hazard;

(c) to bring the person into compliance with the Act or a regulation made under it;

(d) to bring the person into compliance with a term or condition of a licence or permit held by that person under this Act.

(2) A health officer may issue an order under subsection (1) to any of the following persons:

(a) a person whose action or omission

(i) is causing or has caused a health hazard, or

(ii) is not in compliance with the Act or a regulation made under it, or a term or condition of the person’s licence or permit;

(b) a person who has custody or control of a thing, or control of a condition, that

(i) is a health hazard or is causing or has caused a health hazard, or

(ii) is not in compliance with the Act or a regulation made under it, or a term or condition of the person’s licence or permit;

(c) the owner or occupier of a place where

(i) a health hazard is located, or

(ii) an activity is occurring that is not in compliance with the Act or a regulation made under it, or a term or condition of the licence or permit of the person doing the activity.

Specific powers respecting health hazards and contraventions

32(1) An order may be made under this section only

(a) if the circumstances described in section 30 [when orders respecting health hazards and contraventions may be made] apply, and

(b) for the purposes set out in section 31 (1) [general powers respecting health hazards and contraventions].

32(2) Without limiting section 31, a health officer may order a person to do one or more of the following:

(a) have a thing examined, disinfected, decontaminated, altered or destroyed, including

(i) by a specified person, or under the supervision or instructions of a specified person,

(ii) moving the thing to a specified place, and

(iii) taking samples of the thing, or permitting samples of the thing to be taken;

(b) in respect of a place,

(i) leave the place,

(ii) not enter the place,

(iii) do specific work, including removing or altering things found in the place, and altering or locking the place to restrict or prevent entry to the place,

(iv) neither deal with a thing in or on the place nor dispose of a thing from the place, or deal with or dispose of the thing only in accordance with a specified procedure, and

(v) if the person has control of the place, assist in evacuating the place or examining persons found in the place, or taking preventive measures in respect of the place or persons found in the place;

(c) stop operating, or not operate, a thing;

(d) keep a thing in a specified place or in accordance with a specified procedure;

(e) prevent persons from accessing a thing;

(f) not dispose of, alter or destroy a thing, or dispose of, alter or destroy a thing only in accordance with a specified procedure;

(g) provide to the health officer or a specified person information, records, samples or other matters relevant to a thing’s possible infection with an infectious agent or contamination with a hazardous agent, including information respecting persons who may have been exposed to an infectious agent or hazardous agent by the thing;

(h) wear a type of clothing or personal protective equipment, or change, remove or alter clothing or personal protective equipment, to protect the health and safety of persons;

(i) use a type of equipment or implement a process, or remove equipment or alter equipment or processes, to protect the health and safety of persons;

(j) provide evidence of complying with the order, including

(i) getting a certificate of compliance from a medical practitioner, nurse practitioner or specified person, and

(ii) providing to a health officer any relevant record;

(k) take a prescribed action.

(3) If a health officer orders a thing to be destroyed, the health officer must give the person having custody or control of the thing reasonable time to request reconsideration and review of the order under sections 43 and 44 unless

(a) the person consents in writing to the destruction of the thing, or

(b) Part 5 [Emergency Powers] applies.

While not identical, the B.C. Public Health Act provides many of the same restrictions that Bill 31 would (if enacted). Primarily, property and personal rights can be suspended in an open ended manner, under the excuse of an emergency.

It’s also worth mentioning the the “Public Officials” involved in issuing orders are exempt from legal liability, and cannot be sued. It’s written right into the legislation.

SENDAI FRAMEWORK, B.C. BILL 31

(1) https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/42nd-parliament/4th-session/bills/bills-with-hansard-debate

(2) https://www.leg.bc.ca/documents-data/debate-transcripts/42nd-parliament/4th-session/20231003am-Hansard-n331#bill31-1R

(3) https://www.preventionweb.net/publication/sendai-framework-disaster-risk-reduction-2015-2030

(4) https://www.preventionweb.net/files/43291_sendaiframeworkfordrren.pdf

(5) https://www.preventionweb.net/files/44983_sendaiframeworkchart.pdf

(6) Sendai Framework 2015 Full Text English

(7) https://en.wikipedia.org/wiki/World_Conference_on_Disaster_Risk_Reduction

(8) https://www.unisdr.org/files/8241_doc6841contenido1.pdf

(9) https://www.unisdr.org/2005/wcdr/intergover/official-doc/L-docs/Hyogo-framework-for-action-english.pdf

WHO TREATIES, INTERNATIONAL HEALTH REGULATIONS

(1) https://canucklaw.ca/wp-content/uploads/WHO-Constitution-Full-Document.pdf

(2) https://www.who.int/about/governance/constitution

(3) https://apps.who.int/gb/bd/

(4) https://apps.who.int/gb/bd/pdf_files/BD_49th-en.pdf#page=6

(5) https://www.treaty-accord.gc.ca/

(6) https://www.treaty-accord.gc.ca/index.aspx

(7) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=103984&t=637793587893732877

(8) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=103986&t=637862410289812632

(9) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=103990&t=637793587893576566

(10) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=103994&t=637862410289656362

(11) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=103997&t=637793622744842730

(12) https://www.treaty-accord.gc.ca/details.aspx?lang=eng&id=105025&t=637793622744842730

(13) https://canucklaw.ca/provincial-health-acts-are-really-just-who-ihr-domestically-implemented/

(14) https://canucklaw.ca/the-other-provincial-health-acts-written-by-who-ihr/

(15) WHO International Health Regulations, 3rd Edition 2005

Like this:

Like Loading...