Expect your bank accounts to be at risk if you hold the wrong opinions, or have contributed to the wrong causes. Any pretense of due process has gone out the window.

Many of us wondered when the shoe would drop, and it finally has. Ottawa has invoked the Emergencies Act, and is not even pretending to care about the public’s concerns anymore.

Perhaps the most chilling is from Chrystia Freeland. These “convoys” have provided an excuse for the Federal Government to encroach even further into the personal and financial lives of Canadians. Moreover, banks are now required to comply with some measures, and strongly encouraged on others.

In case you find Freeland too cringey to listen to, here’s a summary of the measures that were announced regarding banking and finance.

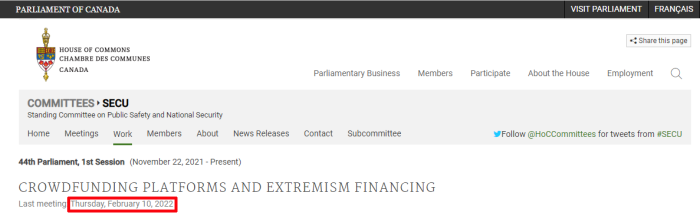

- Anti-money laundering/terrorist financing laws to include crowd-funding platforms

- Payment processers to be responsible as well

- Digital assets (and cryptocurrencies) subjected to disclosure laws

- All crowd funding platforms must register with FinTrac Canada

- All “large and suspicious” transactions must be reported

- Reports used as intelligence gathering for law enforcement

- Legislation will be brought to make these measures permanent

- Financial institutions can cease services (personal or corporate) based on suspicions

- Financial institutions “urged to review relationships” with anyone involved in blockades

- Financial institutions urged to report suspicions to RCMP or CSIS

- Accounts can be SUSPENDED OR FROZEN without a court order

- Banks freezing accounts protected from civil liability if done in good faith

- Federal Government has new authority to share “information” with financial institutions

- Corporate bank accounts to be frozen if trucks are used in blockades

- Insurance will be suspended if trucks are used in blockades

Not only is there much more leeway given to freeze or suspend services based on suspicions, but Ottawa intends to “provide information” to financial institutions, and ask them to review relationships. Reading between the lines a bit, it comes across as an attempt to bankrupt, or at least greatly inconvenience.

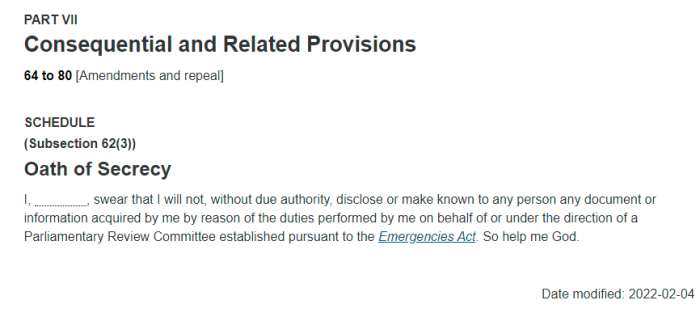

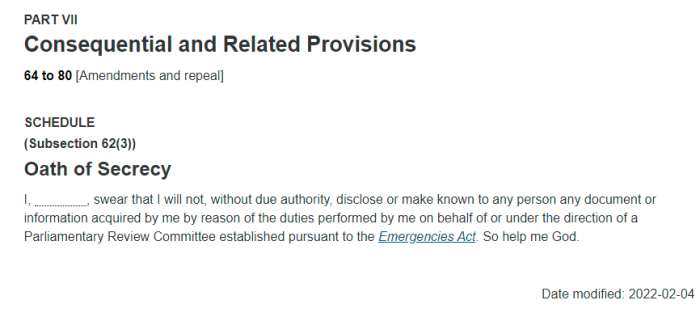

While there is supposedly Parliamentary oversight, it doesn’t help when everyone is sworn to secrecy. Therefore, the public will likely never know what’s really going on.

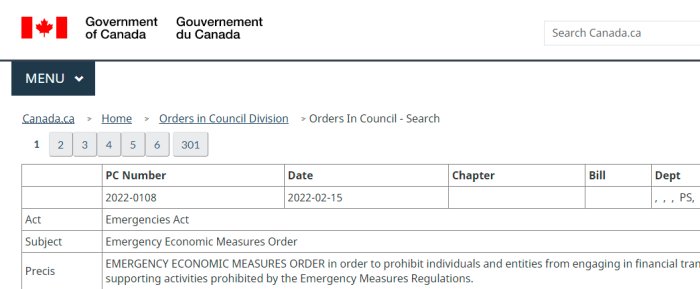

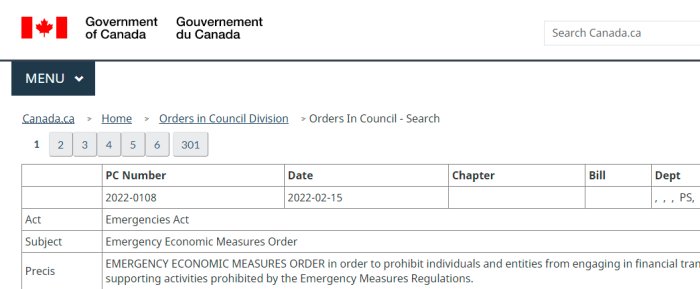

Orders and regulations

.

8 (1) While a declaration of a public welfare emergency is in effect, the Governor in Council may make such orders or regulations with respect to the following matters as the Governor in Council believes, on reasonable grounds, are necessary for dealing with the emergency:

.

(a) the regulation or prohibition of travel to, from or within any specified area, where necessary for the protection of the health or safety of individuals;

.

(b) the evacuation of persons and the removal of personal property from any specified area and the making of arrangements for the adequate care and protection of the persons and property;

.

(c) the requisition, use or disposition of property;

.

(d) the authorization of or direction to any person, or any person of a class of persons, to render essential services of a type that that person, or a person of that class, is competent to provide and the provision of reasonable compensation in respect of services so rendered;

.

(e) the regulation of the distribution and availability of essential goods, services and resources;

.

(f) the authorization and making of emergency payments;

.

(g) the establishment of emergency shelters and hospitals;

.

(h) the assessment of damage to any works or undertakings and the repair, replacement or restoration thereof;

.

(i) the assessment of damage to the environment and the elimination or alleviation of the damage; and

.

(j) the imposition

(i) on summary conviction, of a fine not exceeding five hundred dollars or imprisonment not exceeding six months or both that fine and imprisonment, or

(ii) on indictment, of a fine not exceeding five thousand dollars or imprisonment not exceeding five years or both that fine and imprisonment,

.

for contravention of any order or regulation made under this section.

Most interesting: a violation under this order can result in a criminal charge and up to 5 years in jail. Perhaps those isolation centres will come in handy after all.

And by “directing essential services” the Government can effectively override free will and choice by declaring their trades or fields to be essential. Also, say goodbye to property rights, as this Act allows for property to be seized or disposed of.

Liability

Marginal note: Protection from personal liability

.

47 (1) No action or other proceeding for damages lies or shall be instituted against a Minister, servant or agent of the Crown, including any person providing services pursuant to an order or regulation made under subsection 8(1), 19(1), 30(1) or 40(1), for or in respect of any thing done or omitted to be done, or purported to be done or omitted to be done, in good faith under any of Parts I to IV or any proclamation, order or regulation issued or made thereunder.

What a shocker: people are immune from civil liability for the damages they cause under this Act, as long as they claim it’s being done in good faith.

David Lametti, (the Attorney General), tries to convince the public that this is a temporary and limited measure. Keep in mind, medical martial law has already been in effect for 2 years. So it seems disingenuous that this is the real aim. Expect it to be renewed many times.

Things are about to get ugly.

This trucker protest is being used as an excuse to further erode rights and freedoms.

Trudeau, Freeland and Lametti weren’t kidding. They absolutely did order that assets must be frozen, and business relations cut off, for people not following this dictate. Moreover, no business can be sued as long as this was done “in good faith.

As for using public health as a means to control the population, check out the earlier pieces on Health Canada and PHAC. These entities are never what they appear to be, and few bother to check deep enough into it.

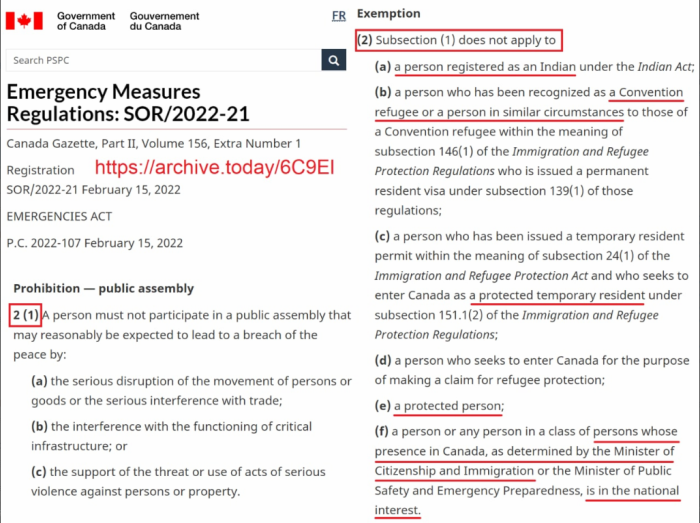

If things weren’t bad enough, there are now double standards as to who can legally participate in so-called illegal gathering. Certain classes of people are allowed to protest, while others aren’t

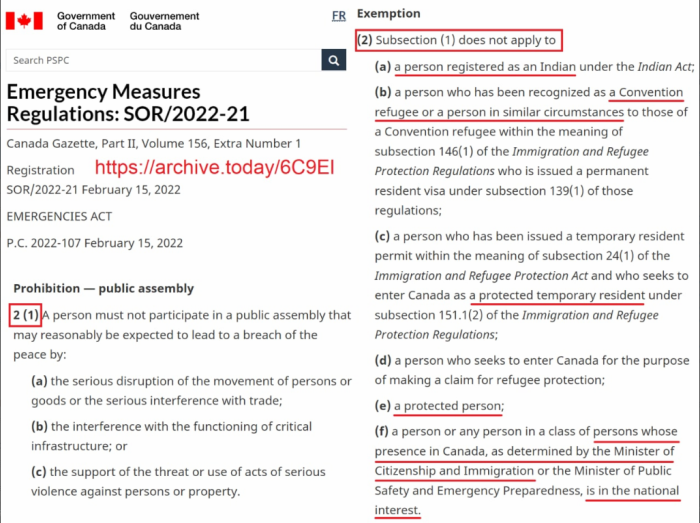

Prohibition — public assembly

2 (1) A person must not participate in a public assembly that may reasonably be expected to lead to a breach of the peace by:

(a) the serious disruption of the movement of persons or goods or the serious interference with trade;

(b) the interference with the functioning of critical infrastructure; or

(c) the support of the threat or use of acts of serious violence against persons or property.

.

Minor

(2) A person must not cause a person under the age of eighteen years to participate in an assembly referred to in subsection (1).

Prohibition — entry to Canada — foreign national

3 (1) A foreign national must not enter Canada with the intent to participate in or facilitate an assembly referred to in subsection 2(1).

Exemption

(2) Subsection (1) does not apply to

(a) a person registered as an Indian under the Indian Act;

(b) a person who has been recognized as a Convention refugee or a person in similar circumstances to those of a Convention refugee within the meaning of subsection 146(1) of the Immigration and Refugee Protection Regulations who is issued a permanent resident visa under subsection 139(1) of those regulations;

(c) a person who has been issued a temporary resident permit within the meaning of subsection 24(1) of the Immigration and Refugee Protection Act and who seeks to enter Canada as a protected temporary resident under subsection 151.1(2) of the Immigration and Refugee Protection Regulations;

(d) a person who seeks to enter Canada for the purpose of making a claim for refugee protection;

(e) a protected person;

(f) a person or any person in a class of persons whose presence in Canada, as determined by the Minister of Citizenship and Immigration or the Minister of Public Safety and Emergency Preparedness, is in the national interest

Now, many people will not be familiar with IRPA, the Immigration and Refugee Protection Act. Those rules give foreigners all kinds of rights, even for people in the country illegally. Here are those new exemptions that are referred to in the Canada Gazette:

Temporary resident permit

.

24 (1) A foreign national who, in the opinion of an officer, is inadmissible or does not meet the requirements of this Act becomes a temporary resident if an officer is of the opinion that it is justified in the circumstances and issues a temporary resident permit, which may be cancelled at any time.

Humanitarian and compassionate considerations — request of foreign national

.

25 (1) Subject to subsection (1.2), the Minister must, on request of a foreign national in Canada who applies for permanent resident status and who is inadmissible — other than under section 34, 35 or 37 — or who does not meet the requirements of this Act, and may, on request of a foreign national outside Canada — other than a foreign national who is inadmissible under section 34, 35 or 37 — who applies for a permanent resident visa, examine the circumstances concerning the foreign national and may grant the foreign national permanent resident status or an exemption from any applicable criteria or obligations of this Act if the Minister is of the opinion that it is justified by humanitarian and compassionate considerations relating to the foreign national, taking into account the best interests of a child directly affected.

Section 24(1) of IRPA allows for people who have been deemed inadmissible to Canada, for many reasons, to enter the country anyway. Reasons listed include criminal offenses, serious criminal offenses, misrepresentation, and human rights violations.

As for part (f) in the recent order, that references Section 25(1) of IRPA, which allows for threats to national security to enter — and be given permanent residence, if a Minister deems it to be in the public interest. So people banned from Canada (initially), and threats to national security, are allowed to take part in gatherings that would otherwise be considered illegal. Interesting.

“Protected people” also seems to encompass family members when dealing with those entering Canada for refugee or other related reasons

The regulations against protesting also don’t apply to Indians, or to people coming to Canada to apply to be a refugee. Perhaps blockading railroad tracks is okay, depending on the skin colour.

Foreign nationals supposedly aren’t supposed to enter for the purpose of illegal public assemblies…. except if you ignore the exceptions.

Freezing bank accounts is allegedly to cut down on violence and terrorist activity. However, terrorists and felons are exempt from the restrictions on gatherings.

So who isn’t protected from being arrested for “unlawful gatherings”? Actual Canadians. Threats to national security, and “inadmissibles” let in anyway are allowed to get away with it. So are people coming to Canada to claim asylum — even if it’s from the United States.

Canadians can have their assets frozen, and have their free speech rights limited. However, there are several categories of people who are subjected to different rules. Some emergency.

Is there Parliamentary oversight? In theory, yes, but it doesn’t help when everyone involved is sworn to secrecy. Even if we did, all parties are basically on the same page.

(1) https://twitter.com/i/events/1492674034143690753

(2) https://laws-lois.justice.gc.ca/eng/acts/E-4.5/FullText.html

(3) https://www.fintrac-canafe.gc.ca/intro-eng

(4) https://canucklaw.ca/canada-emergencies-act-tyranny-no-property-rights-indemnification-publication-exemption-parliamentary-secrecy/

(5) https://canucklaw.ca/health-canada-initially-created-for-population-control-measures/

(6) https://canucklaw.ca/cv-62g-public-health-agency-of-canada-created-as-branch-of-who-bill

(7) https://www.canadagazette.gc.ca/rp-pr/p2/2022/2022-02-15-x1/pdf/g2-156×1.pdf#page=5

(8) Emergencies Act Protesting Regulations

(9) https://laws.justice.gc.ca/eng/acts/I-2.5/page-4.html#h-274473

(10) https://orders-in-council.canada.ca/results.php?lang=en

(11) https://orders-in-council.canada.ca/results.php?lang=en

(12) https://www.canada.ca/en/immigration-refugees-citizenship/corporate/publications-manuals/operational-bulletins-manuals/permanent-residence/protected-persons/stage-1-eligibility.html

(13) https://canucklaw.ca/full-scale-of-inadmissibles-getting-residency-permits-what-global

Like this:

Like Loading...