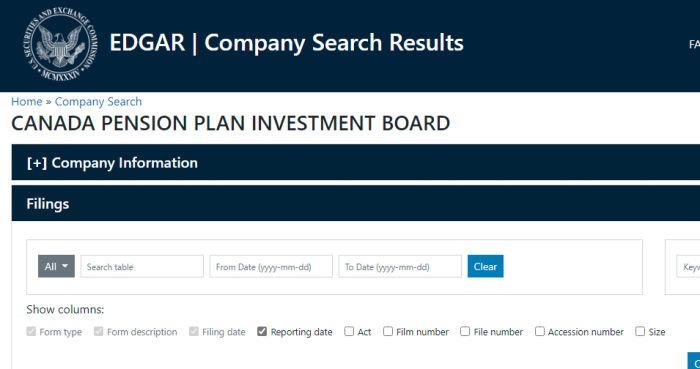

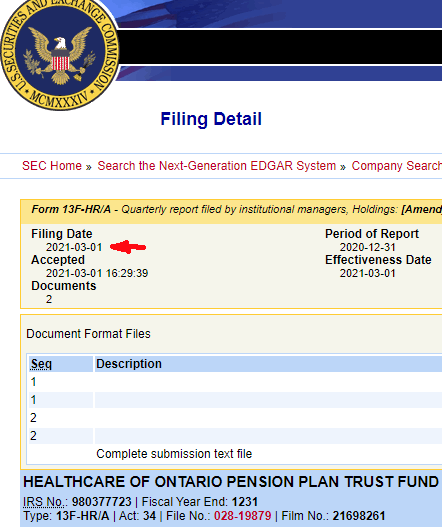

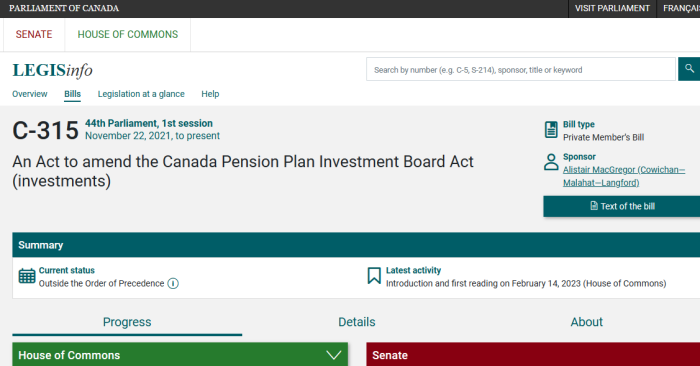

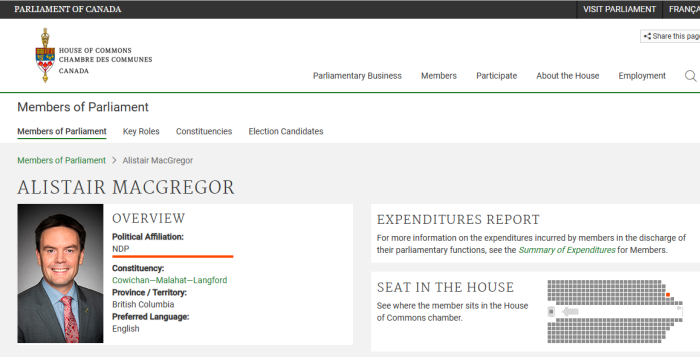

New Democrat Member of Parliament Alistair MacGregor recently introduced Bill C-315, to amend the Canada Pension Plan Investment Board Act. At least, his name is on it. It’s unclear if he actually wrote this legislation.

On the surface, this is a Bill to get Canada’s national pension plan to move away from certain activities, at least as far as investing is concerned. To the novice reader, there’s nothing objectionable. It’s short, and (apparently) straight to the point.

But, at its core, this is a form of economic warfare against certain industries. Companies (or sectors)

Preamble

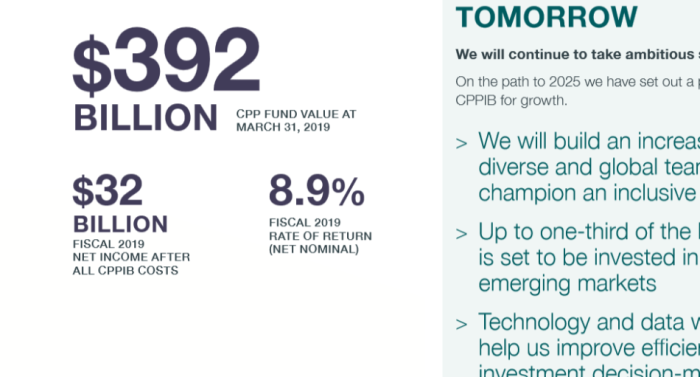

Whereas the Canada Pension Plan is a major pillar of Canada’s retirement income system and the Canada Pension Plan fund is one of the largest sovereign wealth funds in the world;

.

Whereas capital markets can have a tremendous impact and influence on environmental and social outcomes;

.

And whereas Canada, having a long history as a defender of human rights and freedoms, is committed to promoting responsible business practices and holding to account those who violate human, labour and environmental rights;

1 Section 35 of the Canada Pension Plan Investment Board Act is renumbered as subsection 35(1) and is amended by adding the following:

Considerations

(2) The investment policies, standards and procedures, in order to take into account environmental, social and governance factors, shall provide that no investment may be made or held in an entity if there are reasons to believe that the entity has, in performing acts or carrying out work,

(a) committed human, labour or environmental rights violations;

(b) produced arms, ammunition, implements or munitions of war prohibited under international law; or

(c) ordered, controlled or otherwise directed acts of corruption under any of sections 119 to 121 of the Criminal Code or sections 3 or 4 of the Corruption of Foreign Public Officials Act.

In fairness, it’s nice that this is transparent about its intent. The CPPIB Act is to be amended to use its financial power to influence social change.

Admittedly, this Bill isn’t entirely bad. It does make sense not to do business with companies that are engaged in arms manufacturing if they may be a threat to Canada.

However, some of the more subjective areas leave opportunities for double standards to take place. Who decides if “environmental rights” have been violated? Considering vaccine passports were a recent issue, what qualifies as “human rights” violations? What about “labour rights”? Would it be illegal to bring in replacement workers? Since none of this is clearly defined, how could any sort of consistency be applied?

This is a common problem in these kinds of bills. Since key terms are undefined, then everything becomes subjective, and impossible to enforce in any uniform matter. Politicians may vote on them, but then it is up to unelected bureaucrats to work out the details.

Sources:

(1) https://www.parl.ca/legisinfo/en/overview

(2) https://www.ourcommons.ca/Members/en/alistair-macgregor(89269)

(3) https://www.parl.ca/DocumentViewer/en/44-1/bill/C-315/

(4) https://www.parl.ca/DocumentViewer/en/44-1/bill/C-315/first-reading

Private Member Bills In Current Session:

(A) Bill C-207: Creating The “Right” To Affordable Housing

(B) Bill C-219: Creating Environmental Bill Of Rights

(C) Bill C-226: Creating A Strategy For Environmental Racism/Justice

(D) Bill C-229: Banning Symbols Of Hate, Without Defining Them

(E) Bill C-235: Building Of A Green Economy In The Prairies

(F) Bill C-250: Imposing Prison Time For Holocaust Denial

(G) Bill C-261: Red Flag Laws For “Hate Speech”

(H) Bill C-293: Domestic Implementation Of Int’l Pandemic Treaty

(I) Bill C-312: Development Of National Renewable Energy Strategy

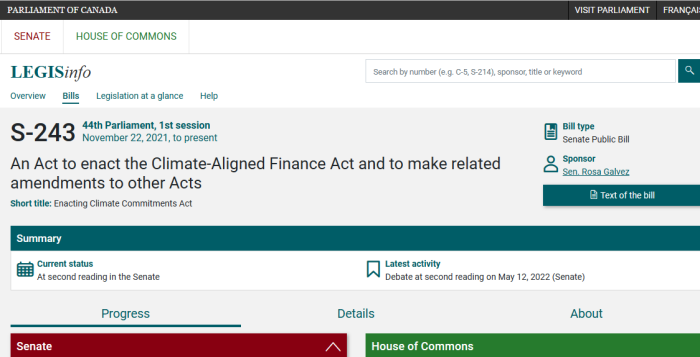

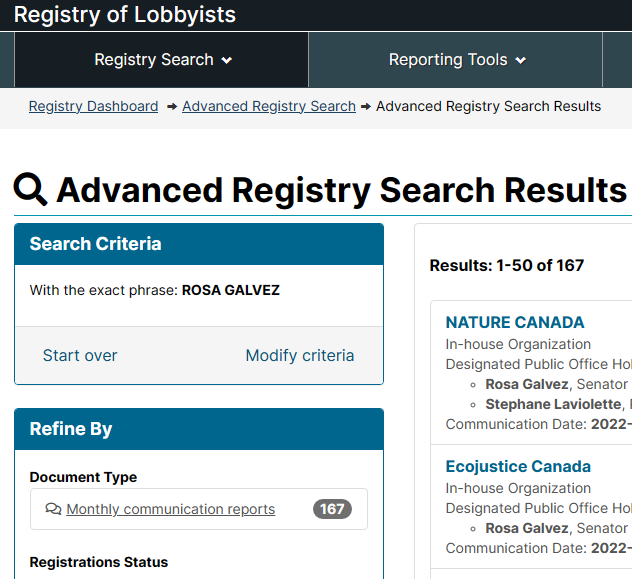

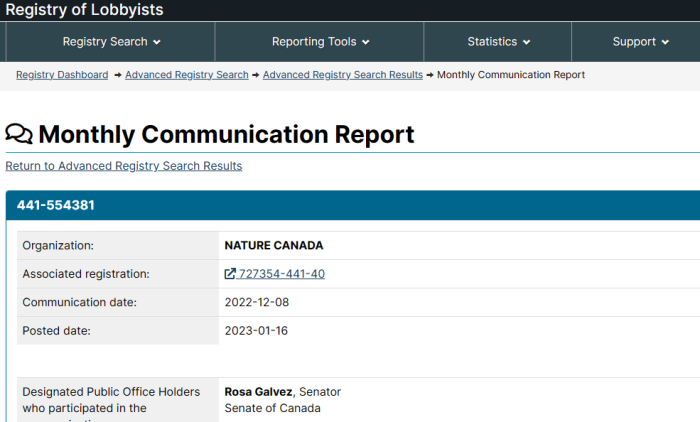

(J) Bill S-243: Climate Related Finance Act, Banking Acts

(K) Bill S-248: Removing Final Consent For Euthanasia

(L) Bill S-257: Protecting Political Belief Or Activity As Human Rights