This is from a few years ago, but worth addressing again: the central banks are fully on board with the climate change agenda, and with the green bonds agenda.

The Bank for International Settlements in Switzerland is supposed to concern itself with fiscal policies. However, it has branched off into the climate change agenda and green bonds. This has nothing to do with its stated mandate, and is therefore, an important topic. Not a lot of evidence this even works, but who cares?

1. Green Bonds First Launched By World Bank

10 years ago, The World Bank issued the first-ever green bond then laid out the first blueprint for sustainable fixed income investing, transforming development finance and sparking a sustainability revolution in the capital markets. Green bonds have become a strategic priority for The World Bank as they support all Sustainable Development Goals. Watch this video to learn about the investors, evaluator, and Treasury behind the first green bond and how it turned into a $12 billion World Bank program 10 years later.

The green bonds industry was the first organized by the World Bank. It has expanded greatly over the last decade.

2. Green Bonds Potentially $100T Industry

In the Summer of 2019, the International Economic Forum of the Americas was held in Montreal. Several speakers discussed the rapid growth of the climate bonds, or green bonds industry. One predicted to be eventually become a $100 trillion industry.

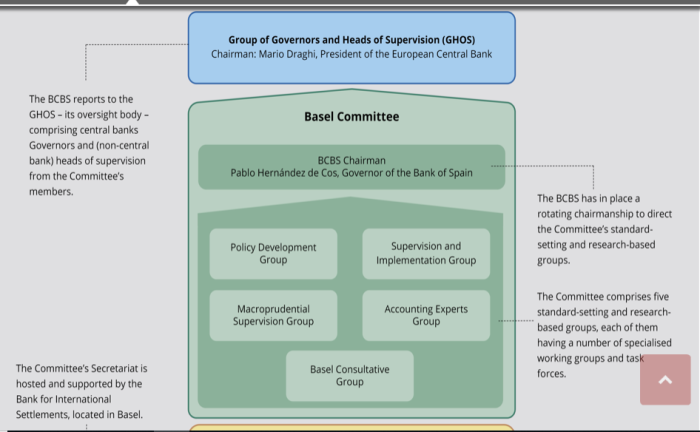

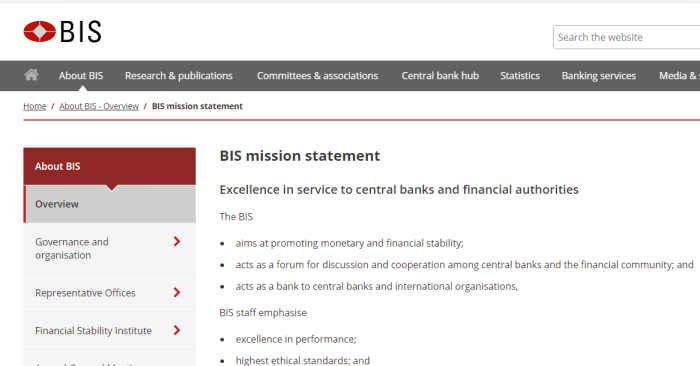

3. BIS Mission Statement Excludes Green Agenda

BIS mission statement

Excellence in service to central banks and financial authorities

.

The BIS

.

-aims at promoting monetary and financial stability;

-acts as a forum for discussion and cooperation among central banks and the financial community; and

-acts as a bank to central banks and international organisations,

Strange, there seems to be no mention of using its power and influence to enact social change, and to facilitate the climate change agenda. Perhaps an oversight.

4. Green Bonds Already 3.5% Of Bond Market

Interest in green bonds and green finance – commonly defined as the financing of investments that provide environmental benefits (G20 GFSG (2016)) – has been increasing rapidly. Financial instruments that contribute to environmental sustainability have become a priority for many issuers, asset managers and governments alike. In particular, the market for green bonds has been growing fast. Global issuance surpassed $250 billion in 2019 – about 3.5% of total global bond issuance ($7.15 trillion).

Private institutions have developed green bond certifications and standards that grant issuers a green label if individual projects are deemed sufficiently in line with the Green Bond Principles (GBPs) of the International Capital Market Association (ICMA), and the use of proceeds can be ascertained.

A key issue for both policymakers and investors is whether existing certifications and standards result in the desired environmental impact (The Economist (2020)). While the GBPs define a broader range of environmental benefits, this special feature focuses on one particular aim: low and decreasing carbon emissions.

According to the Bank for International Settlements, so-called green bonds are exploding in popularity, and already make up over $250 billion of the total bond market, or about 3.5% overall. It’s unclear how any of this actually contributes to a cleaner environment, or combats climate change.

It’s disturbing how much money can be generated (or lost) on this industry. This 3.5% share is only expected to grow.

5. BIS: Climate Change Threatens Finances

Climate change poses new challenges to central banks, regulators and supervisors. This book reviews ways of addressing these new risks within central banks’ financial stability mandate. However, integrating climate-related risk analysis into financial stability monitoring is particularly challenging because of the radical uncertainty associated with a physical, social and economic phenomenon that is constantly changing and involves complex dynamics and chain reactions. Traditional backward-looking risk assessments and existing climate-economic models cannot anticipate accurately enough the form that climate-related risks will take. These include what we call “green swan” risks: potentially extremely financially disruptive events that could be behind the next systemic financial crisis. Central banks have a role to play in avoiding such an outcome, including by seeking to improve their understanding of climate-related risks through the development of forward-looking scenario-based analysis. But central banks alone cannot mitigate climate change. This complex collective action problem requires coordinating actions among many players including governments, the private sector, civil society and the international community. Central banks can therefore have an additional role to play in helping coordinate the measures to fight climate change. Those include climate mitigation policies such as carbon pricing, the integration of sustainability into financial practices and accounting frameworks, the search for appropriate policy mixes, and the development of new financial mechanisms at the international level. All these actions will be complex to coordinate and could have significant redistributive consequences that should be adequately handled, yet they are essential to preserve long-term financial (and price) stability in the age of climate change.

In a nutshell, this is BIS’ official reason for getting involved in the climate change industry, and into gree bonds: it threatens fiscal stability. But they have certainly found a profitable way to “stave off” this oncoming disaster. Very convenient.

6. Scaling Up: The Green/Banking Marriage

The four recommendations addressed to central banks and supervisors are:

.

(1) Integrating climate-related risks into financial stability monitoring and micro-supervision. This includes assessing climate-related risks in the financial system and integrating them into prudential supervision.

(2) Integrating sustainability factors into own portfolio management. The NGFS encourages central banks to lead by example in their own operations.

(3) Bridging data gaps. Public authorities are asked to share data relevant to Climate Risk Assessment and make these data publicly available.

(4) Building awareness and intellectual capacity and encouraging technical assistance and knowledge-sharing. The NGFS encourages all financial institutions to build in-house capacity and to collaborate to improve their understanding of how climate-related factors translate into financial risks and opportunities.

What is suggested here is nothing short of a full fledged marriage of the banking cartel and the climate cartel. Elements of the green agenda are to be embedded in every aspect of fiscal policies. This (shouldn’t) be what banks and bankers are involved with.

7. Bonds Are An “Investment” With No Real Product

It was interesting to see this “explanation” of climate bonds, which included vague references to “green industries”. No concrete examples were provided, nor was there any mention of the industries that would be lost as a result of this agenda.

This bonds scheme (like a Ponzi Scheme) only works as long as it is able to continuously get new funding. That won’t work, as eventually people realize this is a scam, and pulls their funds.

At 9:50, there is the not so subtle threat: change your business model, or go out of business. Former Bank of Canada Head Mark Carney (currently doing UN Climate Finance), said exactly the same thing. This isn’t opportunity, but the FORCED transition or shut down of many industries.

8. Green Bonds Already In Canada A While

If you thought this nonsense would never become a reality in Canada, you would be mistaken. Ontario has been issuing green bonds for several years, and it has continued under “populist” Doug Ford. It’s been happening Federally since at least 2014, when “conservative” Stephen Harper ran Canada. TD Canada appears to also have gotten in on the action.

Ontario and Canada aren’t doing anything revolutionary. They are just implementing what the World Bank started, and what the Bank for International Settlements is upscaling.

9. Bonds To Stabilize Financial System?

Although the idea of Green Bonds is not specifically mentioned in this BIS video, read between the lines. They talk about “alternative means” to stabilize economies after the 2008 collapse. BIS also refers to Green Bonds as necessary for fiscal stability. Two problems, one solution?

Cartel Marriage Shouldn’t Happen

The Bank for International Settlements offers the flimsiest of rationales for getting involved in the climate change and green bonds agendas.

While the idea that this aids fiscal stability, BIS never explains “how” exactly that is. It doesn’t delve into any of the many climate questions that need answered, nor does it explain how these bonds prevent climate change. BIS also won’t discuss how enriching a very few leads to overall equality.

It comes across as an attempt to (further) monetize the climate agenda, and to embed elements of it within national banking policies. As if national finances weren’t corrupt enough.

Canadians, and others, need to wake up to the collusion that continues to erode sovereignty. Do some research. The information presented above is just the tip of the iceberg.