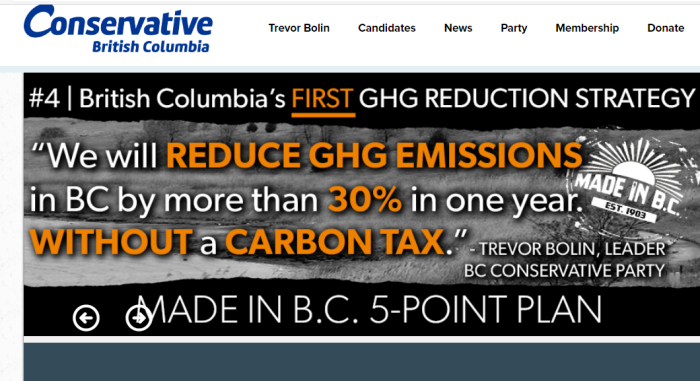

Originally featured as the resistance, this group is going through the motions of pretending to oppose a Carbon tax, and the globalist agenda as a whole. Now the Supreme Court of Canada is about to weigh in.

1. Debunking The Climate Change Scam

The entire climate change industry, (and yes, it is an industry) is a hoax perpetrated by the people in power. See the other articles on the scam, the propaganda machine in action, and some of the court documents in Canada. Carbon taxes are just a small part of the picture, and conservatives are intentionally sabotaging their court cases.

2. Important Links

CLICK HERE, for Saskatchewan Court of Appeal ruling.

CLICK HERE, for Saskatchewan Courts, info for users.

CLICK HERE, for Ontario Court of Appeal ruling.

CLICK HERE, for ONCA challenge documents, pleadings.

CLICK HERE, for Alberta Court of Appeal ruling.

CLICK HERE, for ABCA challenge documents, pleadings.

CLICK HERE, for Supreme Court of Canada constitutional challenge.

SCC Attorney General Of Ontario

SCC Attorney General Of Canada

SCC Attorney General Of Saskatchewan

SCC Attorney General Of Alberta

SCC Attorney General Of New Brunswick

SCC Attorney General Of Manitoba

SCC Attorney General Of Quebec

SCC Attorney General Of British Columbia

SCC Amnesty International

SCC Canadian Labour Congress

SCC David Suzuki Foundation

SCC Intergenerational Climate Committee

SCC International Emissions Trading Association

SCC Smart Prosperity Institute

SCC Attorney General Of Ontario Reply

SCC Attorney General Of Canada Reply

Listings Of Documents Filed With Court

3. Saskatchewan Court Of Appeal (May, 2019)

II. OVERVIEW

[4] The factual record presented to the Court confirms that climate change caused by anthropogenic greenhouse gas [GHG] emissions is one of the great existential issues of our time. The pressing importance of limiting such emissions is accepted by all of the participants in these proceedings.

[5] The Act seeks to ensure there is a minimum national price on GHG emissions in order to encourage their mitigation. Part 1 of the Act imposes a charge on GHG-producing fuels and combustible waste. Part 2 puts in place an output-based performance system for large industrial facilities. Such facilities are obliged to pay compensation if their GHG emissions exceed applicable limits. Significantly, the Act operates as no more than a backstop. It applies only in those provinces or areas where the Governor in Council concludes GHG emissions are not priced at an appropriate level.

[6] The sole issue before the Court is whether Parliament has the constitutional authority to enact the Act. The issue is not whether GHG pricing should or should not be adopted or whether the Act is effective or fair. Those are questions to be answered by Parliament and by provincial legislatures, not by courts.

From the Saskatchewan Court of Appeal ruling. All parties, including those of Scott Moe, and his “conservative” allies, all admitted that climate change was a dire threat. The case was only over very narrow technical arguments. The junk science behind the Carbon tax was never questioned.

4. Ontario Court Of Appeal (June, 2019)

Greenhouse Gas Emissions and Climate Change

[6] Climate change was described in the Paris Agreement of 2015 as “an urgent and potentially irreversible threat to human societies and the planet”. It added that this “requires the widest possible cooperation by all countries, and their participation in an effective and appropriate international response”.

[7] There is no dispute that global climate change is taking place and that human activities are the primary cause. The combustion of fossil fuels, like coal, natural gas and oil and its derivatives, releases GHGs into the atmosphere. When incoming radiation from the Sun reaches Earth’s surface, it is absorbed and converted into heat. GHGs act like the glass roof of a greenhouse, trapping some of this heat as it radiates back into the atmosphere, causing surface temperatures to increase. Carbon dioxide (“CO2”) is the most prevalent GHG emitted by human activities. This is why pricing for GHG emissions is referred to as carbon pricing, and why GHG emissions are typically referred to on a CO2 equivalent basis. Other common GHGs include methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, sulfur hexafluoride, and nitrogen trifluoride.

[8] At appropriate levels, GHGs are beneficial. They surround the planet like a blanket, keeping temperatures within limits at which humans, animals, plants and marine life can live in balance. The level of GHGs in the atmosphere was relatively stable for several million years. However, since the beginning of the industrial revolution in the 18th century, and more particularly since the 1950s, the level of GHGs in the atmosphere has been increasing at an alarming rate. Atmospheric concentrations of CO2 are now more than 400 parts per million, a level not reached since the mid-Pliocene epoch, approximately 3-5 million years ago. Concentrations of other GHGs have also increased dramatically.

[29] On December 9, 2016, eight provinces, including Ontario, and the three territories adopted the Pan-Canadian Framework on Clean Growth and Climate Change (the “Pan-Canadian Framework”), which explicitly incorporated the Benchmark. At that time, British Columbia, Alberta and Québec already had carbon pricing mechanisms, and Ontario had announced its intention to join the Québec/California cap-and-trade system. Manitoba subsequently adopted the Pan-Canadian Framework on February 23, 2018. Saskatchewan did not adopt it. The Pan-Canadian Framework emphasized the significant risks posed by climate change to human health, security and economic growth and recognized carbon pricing as “one of the most effective, transparent, and efficient policy approaches to reduce GHG emissions”, promote innovation and encourage individuals and industries to pollute less.

[55] Ontario agrees that climate change is real, is caused by human activities producing GHG emissions, is having serious effects, particularly in the north, and requires proactive measures to address it. Ontario does not agree, however, that what it labels a “carbon tax” is the right way to do so. It says that Ontario will continue to take its own approach to meet the challenge of reducing GHG emissions.

[56] Ontario points to the success of its own efforts to reduce GHG emissions, the most significant of which has been the closure of all five of Ontario’s coal-fired electricity generation plants, which has reduced Ontario’s annual GHG emissions by approximately 22 percent below 2005 levels as of 2016.

[57] Ontario’s environmental plan (“Preserving and Protecting our Environment for Future Generations: A Made-in-Ontario Environment Plan”), released in November 2018, proposes to find ways to “slow down climate change and build more resilient communities to prepare for its effects”, but it will do this in a “balanced and responsible” way, without placing additional burdens on Ontario families and businesses.

[58] Ontario has committed to reducing its emissions by 30 percent below 2005 levels by 2030, which aligns with Canada’s target under the Paris Agreement. It will do so, for example, by updating its Building Code, O. Reg. 332/12, increasing the renewable content of gasoline, establishing emissions standards for large emitters, and reducing food waste and organic waste.

From the Ontario Court of Appeal ruling. The Ford Government does not question the climate change agenda in any way, shape or form. Nor do his partners. In fact, there is a lot of bragging that Ontario is already doing a great job combatting climate change.

5. Alberta Court Of Appeal (February, 2020)

I. Introduction

[1] Calls to action to save the planet we all share evoke strong emotions. And properly so. The dangers of climate change are undoubted as are the risks flowing from failure to meet the essential challenge. Equally, it is undisputed that greenhouse gas emissions caused by people (GHG emissions) are a cause of climate change. None of these forces have passed judges by. The question the Lieutenant Governor in Council referred to this Court though – is the Greenhouse Gas Pollution Pricing Act, SC 2018, c 12 (Act) unconstitutional in whole or in part – is not a referendum on the phenomenon of climate change.[1] Nor is it about the undisputed need for governments throughout the world to move quickly to reduce GHG emissions, including through changes in societal behaviour. The federal government is not the only government in this country committed to immediate action to meet this compelling need. Without exception, every provincial government is too.[2]

[2] Nor is this Reference about which level of government might be better suited to address climate change or GHG emissions. Or whether a uniform approach is desirable. Or who has the best policies. Or what are the best policies. Or who could do more to reduce GHG emissions in the world. This Court cannot compare causes with causes, means with means, provinces with provinces or nations with nations in the global struggle against climate change. But what it can do is offer our opinion on the constitutionality of the Act under Canada’s federal state.

[460] Alberta, according to Robert Savage, who has worked primarily in the climate change field for Alberta since 2004 and is now Alberta’s assistant deputy minister of the Climate Change Division of Alberta Environmental and Parks, “has long accepted the scientific consensus that human activity, in particular the production of … [greenhouse gases is] … a significant contributory factor to climate change, and that if action is not taken to reduce global … [greenhouse gas] emissions, the potential impacts of climate change will be more severe”.[346]

[461] Mr. Savage, with justification, asserts that “Alberta has been a pioneer in Canada and North America with respect to climate change initiatives, with a long history of innovative policies, regulatory schemes, and investments in technology targeted at reducing GHGs”.[347]

[462] He also claims that Alberta was one of the first Canadian jurisdictions to adopt “a comprehensive action plan to reduce GHG emissions”.[348]

[463] The 2002 Albertans & Climate Change: Taking Action plan dealt with better emissions management, enhanced technology to control industrial emissions, enhanced energy efficiency and the development of renewable energy sources.[349]

[464] The 2002 climate change plan contained ambitious components. It targeted a fifty percent reduction of 2002 emissions by 2020 per unit of gross domestic product. It directed large emitters to measure and report to government emissions data. It emphasized the need to manage carbon dioxide emissions and develop biological sinks. It encouraged Albertans to consume less energy.

From the Alberta Court of Appeal ruling. Once again, none of these “conservative” parties oppose the climate change agenda in any way. Instead, they argue for the right to implement their own programs. Now it may be poor wording, but this doesn’t exclude PROVINCIAL Carbon taxes at some point.

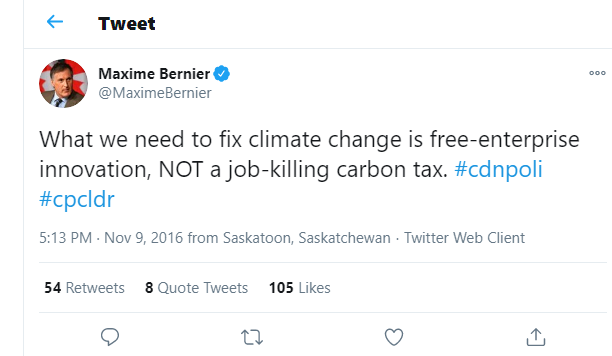

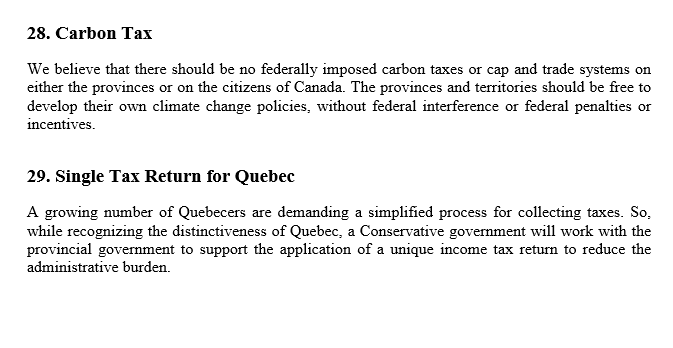

6. Federal Conservatives Support Climate Hoax

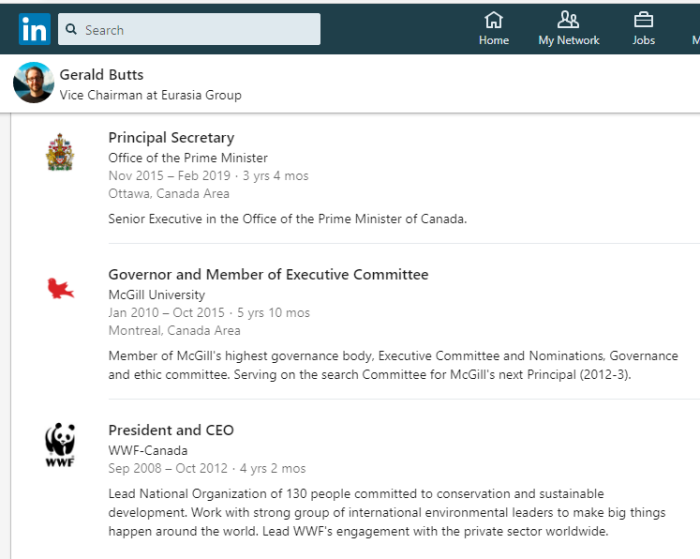

This interview clip with Alberta MP Garnett Genuis is from 2017. Then Leader Andrew Scheer whipped his caucus into voting for a motion to support the Paris Accord. Now Genuis tries to defend it, and fails.

However, the CPC would likely have still supported it if they were in power. Stephen Harper signed Agenda 2030 in September 2015, and there’s no reason to indicate he wouldn’t have signed the Paris Accord as well. Either Conservatives are unaware of the deeper globalist agenda, or they don’t care.

7. Supreme Court Of Canada: Ontario (Appellant)

PART I – OVERVIEW AND FACTS

1. This case is not about whether action needs to be taken to reduce greenhouse gas emissions or the relative effectiveness of particular policy alternatives. It is about (1) whether the federal Greenhouse Gas Pollution Pricing Act (the “Act”) can be supported under the national concern branch of the POGG power; and (2) whether the “charges” imposed by the Act are valid as regulatory charges or as taxes. The answer to both questions should be no.

2. The provinces are fully capable of regulating greenhouse gas emissions themselves, have already done so, and continue to do so. Ontario has already decreased its greenhouse gas emissions by 22% below 2005 levels and has committed to a 30% reduction below 2005 levels by 2030 – the same target to which Canada has committed itself in the Paris Agreement.

14. Internationally, while there is broad consensus about the importance of urgently addressing climate change, parties to the Paris Agreement are not required to implement carbon pricing as part of their efforts to reduce greenhouse gas emissions. Article 6.8 of the Paris Agreement specifies that the Parties “recognize the importance of integrated, holistic and balanced non-market approaches being available to the Parties.” The Act therefore imposes standards that are more stringent than the requirements of the Paris Agreement.

C. Ontario Has Taken and Will Continue to Take Strong Actions Across Its Economy and Society to Address Greenhouse Gas Emissions

.

15. Ontario agrees with Canada that climate change is real and needs to be addressed. That is why Ontario has taken steps to implement a made-in-Ontario plan to protect the environment, reduce greenhouse gas emissions, and fight climate change. Ontario has set itself the goal of reducing Ontario’s emissions by 30% below 2005 levels by 2030.

Ontario’s Factum (as the Appellant). Although other parties are joining in as Intervenors, Ontario is officially the party that is appealing.

8. Supreme Court: Manitoba (Intervenor)

PART I – OVERVIEW AND STATEMENT OF FACTS

1. This appeal strikes at the heart of federalism. It provides this Court with an opportunity to further delineate the parameters of the test for the national concern branch of peace, order and good government (POGG), as set out in Crown Zellerbach over 30 years ago.

2. No one disputes that climate change and the reduction of greenhouse gas (GHG) emissions are of paramount importance. The issue is whether Parliament has exclusive jurisdiction to impose its preferred policy choice on the provinces. Manitoba agrees with the Appellants’ submissions that reducing GHG emissions lacks the singleness, distinctiveness and indivisibility necessary to support an exercise of the POGG power. If Parliament were to have jurisdiction under POGG to impose national standards to reduce GHG emissions as a matter of national concern, there would be virtually no limit to Parliament’s ability to legislate in areas of provincial jurisdiction, given the breadth of activities that create GHG emissions. This would substantially disrupt the balance of federalism.

6. Manitoba is fully committed to reduce GHG emissions and agrees that all governments must play a role and work cooperatively to implement effective solutions to combat and mitigate climate change. Climate change is one of the main pillars of Manitoba’s Climate and Green Plan, 2017 (Climate Plan), which aims to reduce GHG emissions, invest in clean energy and adapt to the impacts of climate change.

7. When first introduced, Manitoba’s Climate Plan included carbon pricing as one among many tools to help reduce GHG emissions. It recognized that free-market forces could be used together with smart regulation to tackle climate change and make meaningful emission reductions. In addition to other measures, Manitoba proposed to introduce a flat $25 per tonne carbon tax. The proposed carbon tax would start at more than double the initial federal price of $10 per tonne, and would remain constant at $25 from 2018 to 2022.

Manitoba has decided to enter the case as an Intervenor for Ontario. The “conservative” Brian Pallister supports the climate change agenda fully, but only objects to this specific tax. Ideologically, he is fully on board.

9. Supreme Court: Saskatchewan (Intervenor)

PART I – OVERVIEW AND FACTS

A. Introduction

1. This appeal concerns whether federal legislation that regulates provincial greenhouse gas (GHG) emission sources is constitutional. What is specifically at stake is whether the federal government has jurisdiction to unilaterally impose its chosen policy to regulate sources of GHG emissions on the provinces. The Greenhouse Gas Pollution Pricing Act (the “GGPPA” or “Act”) functions as if the federal government is legislating in place of a province itself. It is supervisory, and its legislative machinery reveals that what the federal government is truly doing is passing provincial legislation in those provinces it feels have inadequately adopted the federal policy.

2. This appeal does not concern whether global climate change is real and concerning or if the provinces are taking sufficient action to reduce GHG emissions. All parties agree that global climate change is a significant societal problem and all provinces have and continue to take action to reduce GHG emissions. In the Courts below, many submissions, including those of the Attorney General of Canada, focused on the nature of climate change and the importance of carbon pricing as an effective method of reducing GHG emissions. However, the efficacy of carbon pricing is not relevant to the constitutionality of the GGPPA, which must be derived from whether it is within the legislative competence of the federal government.

That was from the submissions of the Attorney General of Saskatchewan, acting as an Intervenor in the Ontario appeal to the Supreme Court. Again, Scott Moe confirms that climate change is a threat to humanity, but that this particular tax is unconstitutional on technical grounds.

10. Supreme Court: Alberta (Intervenor)

A. Overview

1. In a case like this with profound implications for the division of powers, the court’s overriding concern must be maintaining the structure of our federal system of government.

2. The court cannot and should not base its decision on what it considers necessary to address a global problem such as climate change or what it believes are the best policy solutions for reducing greenhouse gas (“GHG”) emissions, particularly in light of genuine and reasonable policy disputes as to what approaches strike the right balance in particular contexts.

3. With respect, this was lost sight of in the majority decisions of the Courts of Appeal below. The majority judges in these cases appeared to conclude that the importance of addressing climate change justified the federal government controlling how the provinces exercise their jurisdiction over the regulation of GHG emissions under the national concern branch of the Peace, Order and Good Government (“POGG”) power.

As before, Alberta doesn’t actually challenge the climate change agenda in any way. The argument (as in all cases), is that Provinces should be left alone to come up with their own solutions. With everyone saying that climate change is a serious threat, the Court will never consider just how corrupt and fraudulent it really is.

11. Supreme Court: BC (Intervenor)

PART I: OVERVIEW OF POSITION AND STATEMENT OF FACTS

1. The troubling question raised by these references is whether our system of federalism is an obstacle to addressing the existential threat of global climate change. Are we the only major emitting country in the world whose constitution renders it impossible to make national commitments to reduce greenhouse gases? Or can national targets be met using means compatible with the unity-in-diversity that characterizes Canada’s federal structure?

2. In British Columbia, the “future” of a climate transformed by human greenhouse gas emissions is here now. A major industry has already been devastated: people have already been forced out of their homes. The province has experienced an average temperature increase of 1.4°C since 1900 – the limit of what scientists tell us would destabilize biological and social systems globally. A succession of relatively warm winters in the 1990s led to the mountain pine beetle epidemic and, as a direct consequence, the loss of most of the merchantable pine volume in interior British Columbia by 2012. The worst forest fire seasons on record occurred back-to back in 2017 and 2018. The elevated risk is because of climate change. In coming decades, British Columbia can expect wildfires like California’s today. Melting permafrost will damage infrastructure in Northern British Columbia, especially for remote communities and Indigenous peoples. Sea level rise poses risk of unquantifiable flooding losses for coastal British Columbia, particularly Prince Rupert and the Fraser River delta, where 100 square kilometres of land are currently within one metre of sea level. This includes the City of Richmond, home to 220,000 people

The NDP Government of British Columbia openly supports the climate change agenda, as do so-called “conservatives”. But at least the NDP is up from about this.

That said, the part about forest fires needs to be addressed. The RCMP has stated — at least for the 2018 fires — that the bulk of them were intentionally set (arson).

Even if conservatives were in power, they seem to support the agenda.

12. Supreme Court: Quebec (Intervenor)

PARTIE III. EXPOSÉ DES ARGUMENTS

Introduction

8. La PGQ ne conteste pas que la protection de l’environnement constitue un enjeu fondamental qui nécessite une action de la part des deux ordres de gouvernement, comme la Cour l’a reconnu dans l’arrêt Hydro-Québec. La Cour a défini la protection de l’environnement comme étant une matière « diffuse », non expressément attribuée de manière exclusive à un ordre de gouvernement plutôt qu’à un autre Affirmant au premier chef la compétence de l’Assemblée

nationale de légiférer sur la protection de l’environnement, la PGQ ne remet pas en cause la compétence législative du Parlement fédéral à l’égard de cette même matière. La PGQ est d’avis que la protection de l’environnement requiert d’ailleurs une collaboration de la part de tous les acteurs concernés

PART III. STATEMENT OF ARGUMENTS

Introduction

8. The PGQ does not dispute that environmental protection is an issue fundamental that requires action from both levels of government, such as the Court recognized this in the Hydro-Québec decision. The Court defined the protection of the environment as being a “diffuse” matter, not expressly attributed exclusively to an order of government rather than another. Primarily affirming the competence of the Assembly to legislate on the protection of the environment, the QMP does not call into question the legislative competence of the federal Parliament with regard to the same matter. The PGQ is of opinion that the protection of the environment requires collaboration on the part of all actors involved

Francois Legault, the Premier of Quebec, is another “conservative” that does not actually oppose the climate change agenda. In fact, Legault seems content with Premiers imposing PROVINCIAL Carbon taxes everywhere.

13. Supreme Court: New Brunswick (Intervenor)

PART I – INTRODUCTION

1. The Intervenor, Attorney General of New Brunswick (“New Brunswick”) supports the position of the Attorney General of Alberta (“Alberta”) and adopts the arguments in Alberta’s factum. New Brunswick is also in general agreement with the climate data submitted by the Attorney General of Canada (“Canada”). Consistent with the previous references of the Attorney General of Saskatchewan (“Saskatchewan”) and the Attorney General of Ontario (“Ontario”) in their respective Courts of Appeal, this should not be a platform on which to debate climate change however real the threat may be. Climate data and warnings regarding the consequences of greenhouse gas emissions (“GHG emissions”) are relevant to the extent that such information dispassionately informs the constitutional question. Objectivity is paramount.

2. Much of Canada’s record and arguments support a resolve to deal with a looming existential threat; but it also provokes an emotional response – the natural result of contemplating any dire

circumstance. When imbued with the weight and gravitas it deserves, equally weighty solutions feel appropriate. In turn, it may feel appropriate to a layperson that the regulation of GHG emissions should be controlled by Parliament. Such may seem both harmless and practical. When a central control over the matter is cast in supervisory terms and is fixated on minimum standards, the layperson could believe that a benign form of federalism has been accomplished. But those conclusions would ignore the constitutional division of powers.

New Brunswick avoids the issue of climate change in the Supreme Court filings, but had this to say elsewhere: These hearings should not be used as a forum to question the science. Similar submissions were made in Ontario as well.

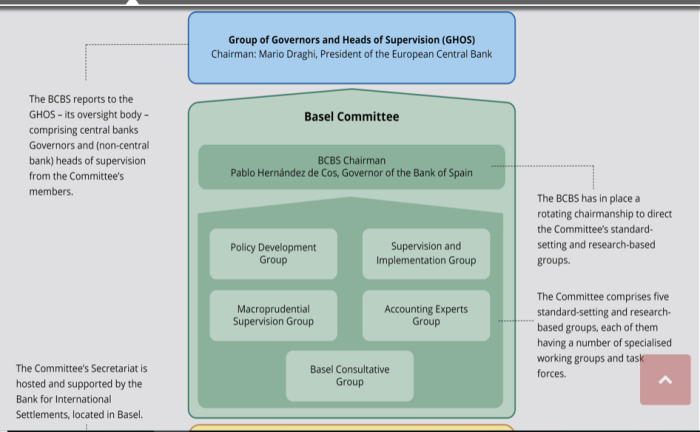

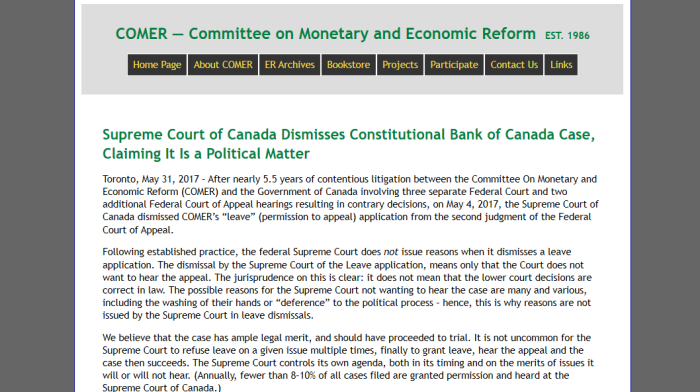

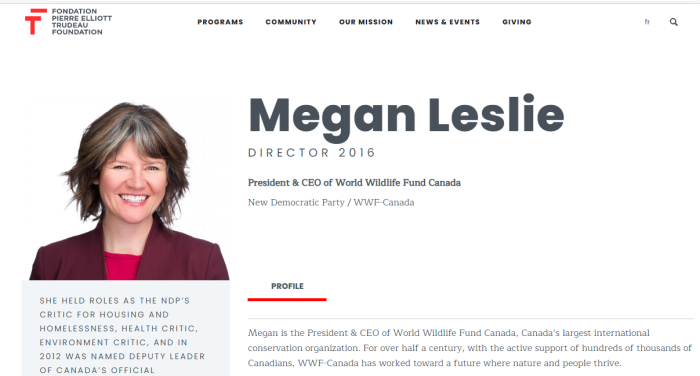

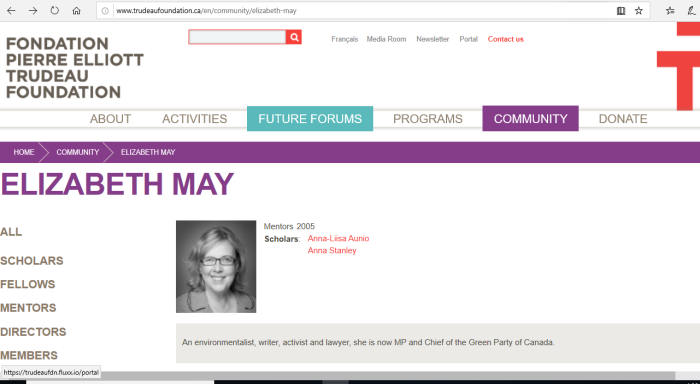

14. NGOs Meddling In Court Affairs

This was covered in the last article. There are several non-government organizations who are acting as Intervenors for their own reasons. It’s not just the Provinces and Ottawa involved.

15. SCC Challenges Are Designed To Fail

It’s difficult to see the Supreme Court of Canada ruling against the Carbon tax, though it’s possible in theory. Alberta was successful, although their courts are more tilted that way. There’s no real opposition to the theft being done under the guise of environmentalism.

What is even the point of doing this? Well, it’s not about stopping the public from being fleeced. It’s about APPEARING to stop the public from being fleeced, (or at least trying to). All parties support this hoax. As such, Canadians are being deceived.

One final thought: even if this challenge is ultimately successful, who’s to say that Provinces won’t start implementing their own Carbon taxes? Or who’s to say Erin O’Toole would actually drop the Federal tax if he became Prime Minister?