Some background information on how this process works (in theory at least). See here and here. Does it matter that many countries are unable to repay their loans? To the creditors, not really, as there is always another way.

These “swaps” involve selling a country’s debt (at a discount) to a 3rd party, but one who has its own agenda.

1. More On The International Banking Cartel

For more on the banking cartel, check this page. The Canadian Government, like so many others, has sold out the independence and sovereignty of its monetary system to foreign interests. BIS, like its central banks, exceed their agenda and try to influence other social agendas. See who is really controlling things, and the common lies that politicians and media figures tell. And check out the climate change hoax as well, as the 2 now seem intertwined.

New Development Financing, a bait-and-switch.

2. Important Links

UN New Development Finance Paper

UN.new.development.financing.2012.178pages

UNDP Explaining Debt-For-Nature Swaps

CLICK HERE, for World Economic Forum, debt swap support.

https://archive.is/LTw1r

World Bank Working Paper, March 1990

CLICK HERE, for World Wildlife Fund Climate fund page.

https://archive.is/43sHz

3. Debt Used As A Weapon Against Nations

This cannot be emphasized enough. Countries take foreign loans in times when they are desperate, and often are unable to meet the terms to pay them back. This is a form of predatory lending. What may end up happening is that those debts are sold to people and organizations who have their own agenda.

And where do these loans originate in the first place? Many are (debt financed) by countries like Canada, the U.S., and in Europe. Western nations — who use private parties to borrow money from — borrow money which is then handed over as loans to the 3rd World. Those loans are distributed to countries who can’t pay them back. They are then forced into options like debt-for-nature.

4. World Economic Forum & Climate Swaps

Debt swaps can be one solution to tackle both challenges at once. Traditionally, these instruments represent an exchange of the existing debt contract with a new one, where the previous contract is normally “written down”, or discounted. Usually, this action is associated with specific conditions for investments, agreed both by the creditor and the debtor. In the past, such instruments have also been used to achieve climate-related objectives.

The idea of a “debt-for-climate” swap was first conceived during the 1980s by the then Deputy Vice President of the World Wildlife Fund, Thomas Lovejoy, in the wake of the Latin American debt crisis. The idea was simple: an NGO would act as a donor, purchasing debt from commercial banks at its face value on the secondary market, hence providing a level of relief on the debt’s value. The title of the debt would then be transferred to the debtor country in exchange for a specific commitment to environmental or conservation goals, performed through a national environmental fund.

In 2018, the Seychelles government worked with The Nature Conservancy, Global Environment Facility (GEF), and the United Nations Development Programme (UNDP) to develop a debt-for-nature swap for $27 million of official debt, to set up vast areas of protected marine parks for climate resilience, fishery management, biodiversity conservation and ecotourism.

This came out just the other day. The World Economic Forum, which pushed for a declaration of a pandemic also goes on about how this can be used to advance the green agenda. But don’t worry, it’s not preplanned or anything.

5. UNDP Explains Risks And Consequences

Cons

.

-DNS have only resulted in relatively small amounts of debt relief, limiting their impact in reducing developing countries’ debt burden;

–Transaction costs might be high compared to other financing instruments; negotiations can be time-consuming, spanning several years and might result in limited debt reduction or discount rates. The length of the design and negotiation phase of a DNS can span one to three years, mostly depending on the willingness of the parties and the complexity of the deal.

Risks

.

-Lengthy negotiations. Disagreement between the creditor and debtor country on conservation goals or other details of the agreement can increase the costs of the operation.

–Currency exchange risks, the impact of which (and the response strategy) is dependent on the financial structure of the DNS. The currency risk can be mitigated, for example, by making payments in local currency at the spot rate on the day payments are due. In the latter case the risk is lower for the entity managing the DNS cash flow.

–Inflation risks, the value of future payments in local currencies might be highly by inflation. Mitigation strategies to inflation risks are similar to the ones for currency exchange risks.

-The DNS might prevent the possibility of negotiating a more comprehensive and favourable debt treatment (debt relief and restructuring).

-The debtor-country might not be able or willing to respect its commitments. Fiscal and liquidity crises can undermine the capacity of the debtor-government to meet its obligations.

-Management risks related to the capacity of the fund selected to administer grants from the DNS proceeds, including mismanagement, corruption and failures in the identification of good projects to be financed.

-While rarely reported, it is possible that the projects financed might create discontent in local communities (e.g. removal of access to resources by local communities).

-ODA substitution (no additionality). While a DNS is an option for increasing ODA, it might just substitute for other committed flows.

-The debtor-country may lose sovereignty in deciding about the spending of public resources. Grants may be disbursed according to donors’ preferences, which in turn might or might not better mirror local conservation needs. In most DNS the debtor-government decides in agreement with the creditor(s) about the modalities of funds’ disbursements, both participating in the boards of the trust fund responsible for grant-making.

-Debt swaps may be tied to the purchase of goods or services for the creditor(s).

There are an awful lot of drawbacks to getting involved with this sort of loan. Specifically, countries cede their sovereignty, are forced into conditions they don’t like, and it may not even result in much of a debt reduction.

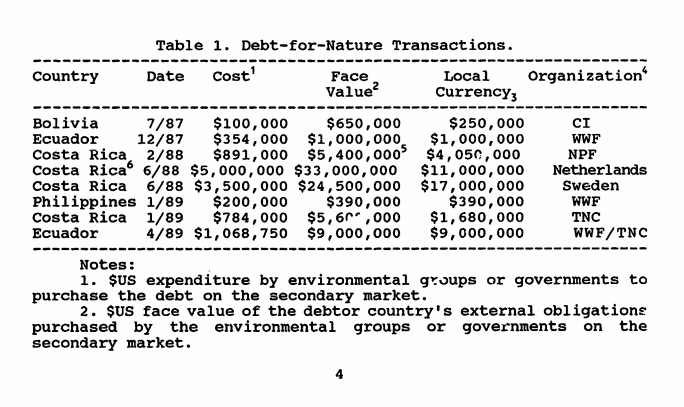

6. World Bank 1990 Working Paper On Swaps

The first debt-for-nature agreement (Bolivia) was the only one in which land was set aside, and development restrictions adopted, as a result of the agreement. This deal was extremely controversial at first, as many Bolivians thought that the country had relinquished sovereignty to the international environmental group. There is, however, no transfer of land ownership, and development decisions are not based on agreements between the local environmental groups, the government, and the regional population. The Bolivian government has been slow in dispersing the local currency funds, and controversies have arisen over the development use of the buffer areas.

Finally, prior to the debt-for-nature concept, environmental groups had little or no direct contact with either commercial banks or debt countries’ finance ministers. Debt-for-nature swaps, however, have entailed intense negotiations between all three groups, leading to a network of relationships that may prove valuable to international environmental groups beyond simply debt-for-nature agreements.

Much of the interest in using official debt for debt-for-development swaps first began as a result of the 1988 Toronto Economic Summit, in which the G-7 countries established guidelines that allowed Paris Club Creditors to forgive debt to the poorest of the Sub-Saharan countries. One of three options given to Paris Club creditors was to forgive up to one-third of the debt of the developing country (with the other two being extended maturities and lower interest rates). France has generally chosen the first option, while the United States (until July 1989) has been reluctant to forgive debt.

World Bank Working Paper, March 1990

This scheme has been going back many decades. The basic principle is that countries are loaned money they cannot realistically afford to pay back. Loans are then forgiven — or reduced — but with strings attached. One such arrangement is the debt-for nature swaps.

Although the land isn’t officially ceded, for all practical purposes it is.

7. Leonardo DiCaprio Foundation, Seychelles

In 2017, the Leonardo DiCaprio Foundation helped finance a debt-for-nature swap with the Republic of Seychelles to set aside some 400,000 square kilometers of water for conservation.

8. World Wildlife Fund Conservation Finance

Debt-for-Nature Swaps

WWF has worked with the U.S., French, German, Dutch, and other creditor countries to structure foreign debt-for-nature swaps, including the first one in Ecuador in 1987. Since 2001, WWF has helped design several debt-for-nature swap agreements under the Tropical Forest Conservation Act (and previously under the Enterprise for the Americas Initiative). Both mechanisms were formed to relieve the debt burden of developing countries owed to the U.S. government, while generating funds in local currency to support tropical forest conservation activities. Capital raised through debt-for-nature swaps can be applied through trust funds or foundations specifically set up to channel funding to local biodiversity conservation.

Carbon Finance

WWF believes that carbon finance, if used appropriately, will play a critical role in reducing global greenhouse gas emissions, contributing to biodiversity conservation, and promoting a range of local economic and social values. WWF is developing pilot carbon projects in Peru, Brazil, Central Africa, Indonesia and Nepal to capitalize on the rapidly growing potential for carbon finance. We contribute to these efforts by securing private and public financing for carbon projects and providing technical support to implement carbon finance mechanisms.

The World Wildlife Fund is quite involved in financing the nature-for-debt swaps. Should make Canadians wonder what is the real reason Trudeau and Butts present themselves as eco-warriors.

9. Gerald Butts, Megan Leslie Head(s) of WWF

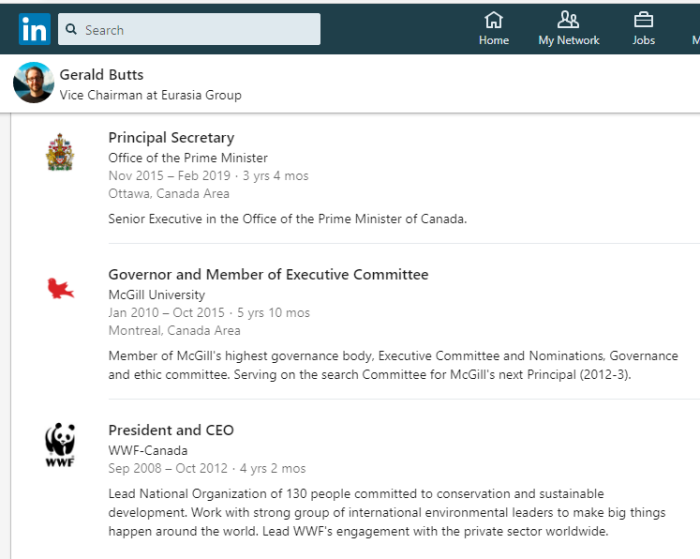

It shouldn’t surprise anyone that Gerald Butts was once the President and CEO of World Wildlife Fund Canada. This conflict of interest isn’t limited to the Liberals though.

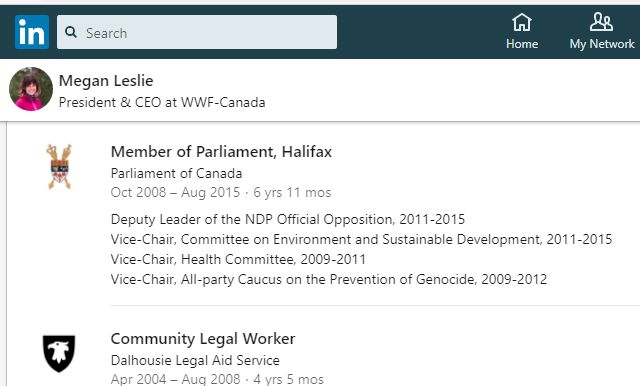

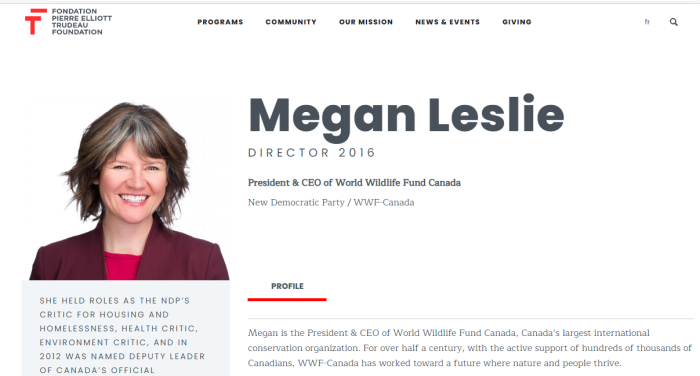

Megan Leslie used to be the Deputy NDP Leader, and was Deputy Opposition Leader for a time. Now, this Trudeau Foundation Director is also the head of the World Wildlife Fund.

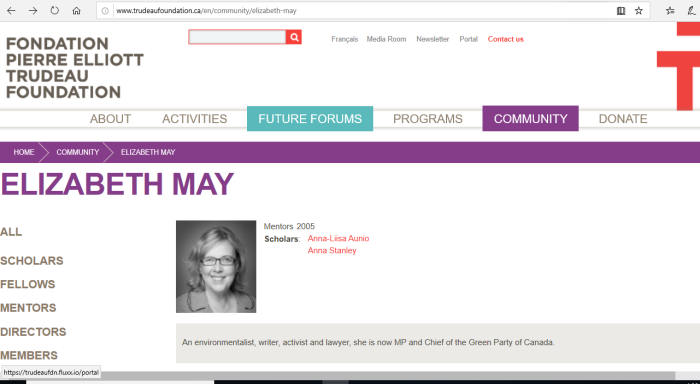

It’s also worth a mention that Elizabeth May, the former Green Party Leader is also with the Trudeau Foundation. She was, at a time, Head of Sierra Club Canada. At least 3 of the major Federal parties are compromised, and in bed with the eco-lobby.

10. Mockingbird Foundation Of Canada

To see a little deeper just how many tentacles the Trudeau Foundation has, see these connections between the House of Commons, the Senate, the Courts and the media. Truly disgusting.

11. Usury Disguised As Humanitarianism

Despite what is said publicly, there is nothing compassionate about what is happening. Countries are taking loans they can’t pay back, and are forced to cede sovereignty in order to “service the debt”. Not at all what we are led to believe.