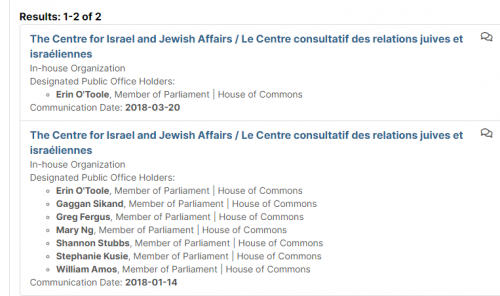

So who is Erin O’Toole, the Leader of the Conservative Party of Canada? What does he believe, and what does he stand for? Turns out, the answers are pretty bad. The CPC is just a parody of an opposition party (6uild 6ack 6etter is now 6uild 6ack “stronger“).

1. Important Links

https://twitter.com/erinotoole/status/1351658366406438914

https://www.conservative.ca/cpc/build-back-stronger/

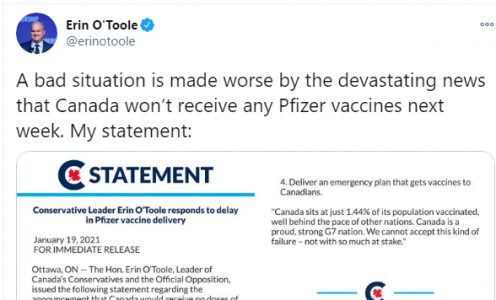

O’Toole Supports Even More Draconian Measures

Walied Soliman, Sick Kids Toronto Director

Walied Soliman Wins Global Citizen Of The Year Award

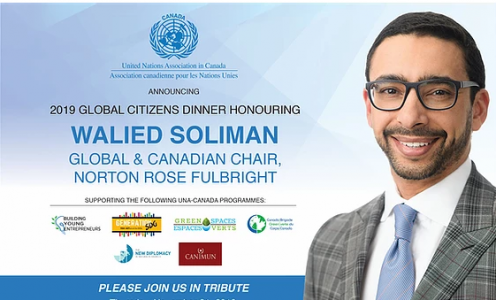

O’Toole Lobbied By NCCM, Anti-Free Speech

O’Toole Lobbied By CIJA, Anti-Free Speech

Jeff Ballingall, Canada Proud

Erin O’Toole Pushing FIPA In House Of Commons

Full Text Of FIPA With China

CANZUK International Website

James Skinner’s LinkedIn Page

CPC On The Climate Change Agenda

O’Toole, Private Member’s Bill C-405

Lobbying By SNC Lavalin For Deferred Pros. Agreement

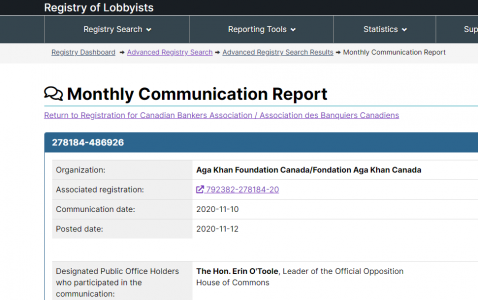

Aga Khan Lobbies O’Toole For Funding

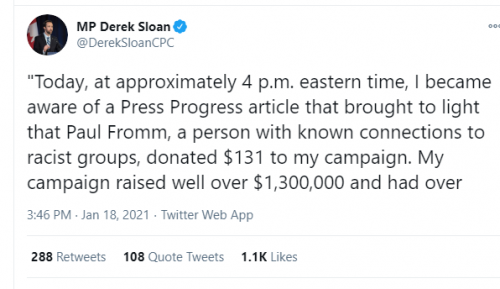

https://twitter.com/DerekSloanCPC/status/1351314995133501443

Derek Sloan’s Petition e-2961

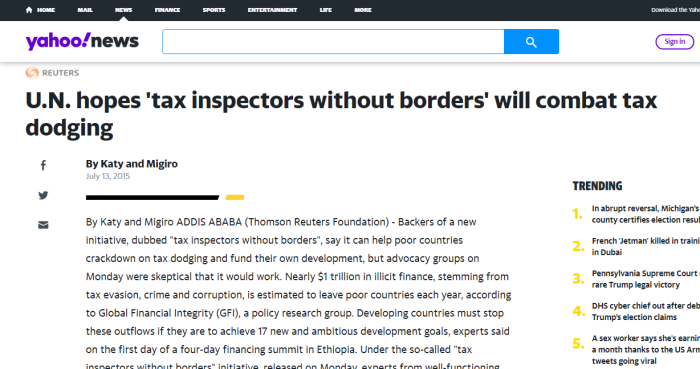

2. O’Toole Chief Of Staff Walied Soliman

Walied Soliman, O’Toole’s Chief of Staff, has been a Director of Sick Kids Hospital Toronto since 2012. Sick Kids is heavily funded by the Bill & Melinda Gates Foundation. One has to wonder if that is why O’Toole is so supportive of restrictive measures and lockdowns in general.

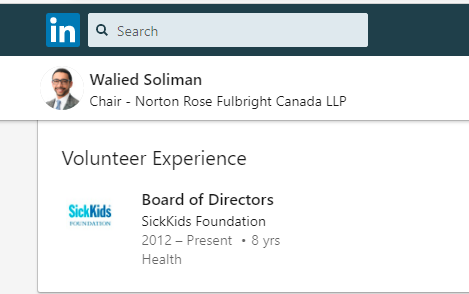

Soliman was awarded “Global Citizen Of the Year” in 2019. He’s also part of the National Council of Canadian Muslims, which is pushing hate speech laws in Canada.

3. Ties To Anti-Free Speech Lobby

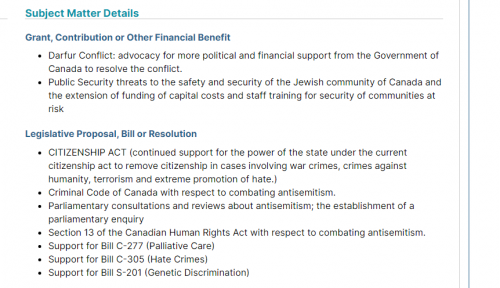

The National Council of Canadian Muslims, (NCCM) and the Centre for Israel and Jewish Affairs, (CIJA), are just 2 groups working to rewrite the laws in Canada on hate speech. While this is marketed in a harmless manner, the devil’s in the details about what may be included.

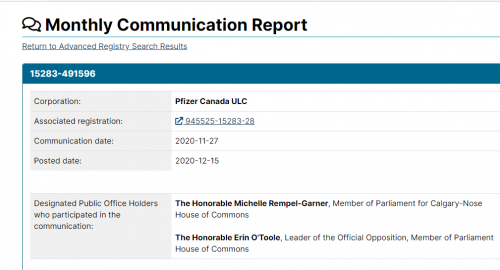

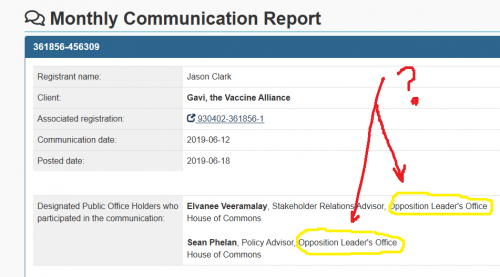

4. Ties To Vaccine/Pandemic Industry

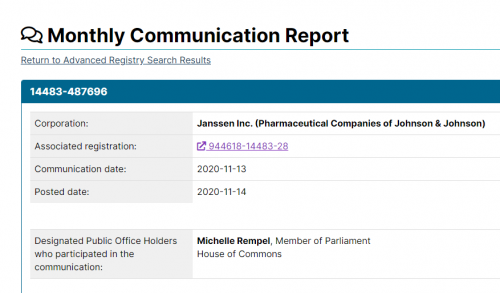

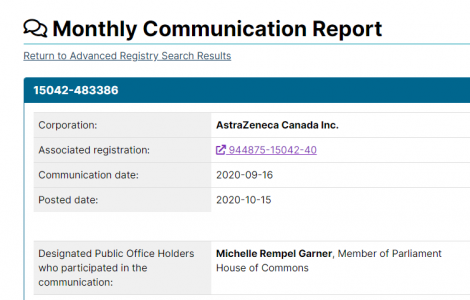

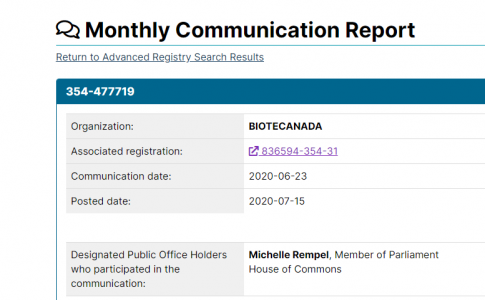

Why is O’Toole so vaccination happy? It could be the rampant pharmaceutical lobbying that has been going on, of all major parties. To the lay observer, it looks like he is fulfilling the wishes of special interests, instead of those of Canadians.

This is true with GAVI as well, which is also Gates funded. GAVI and Crestview Strategy lobbied the Office of the Official Opposition as well. At the time, this was Andrew Scheer. However, it seems doubtful that O’Toole’s stance will be any different.

(a) https://canucklaw.ca/cv-5-crestview-strategy-the-lobbying-firm-advocating-for-gavis-vaxx-agenda/

(b) https://canucklaw.ca/lobbyist-for-glaxosmithkline-astrazeneca-maker-sits-on-conservative-partys-national-council/

(c) https://canucklaw.ca/bill-c-11-cpc-national-secretary-lobbied-for-big-pharma-to-get-easier-access-to-your-medical-data/

(d) https://canucklaw.ca/pfizer-lobbyists-claim-responsibility-for-installing-ford-and-otoole-into-current-positions/

(e) https://canucklaw.ca/president-of-cpc-national-council-robert-batherson-starts-up-own-lobbying-firm/

O’Toole’s associates are also pharma lobbyists. But that wouldn’t have anything to do with his current positions.

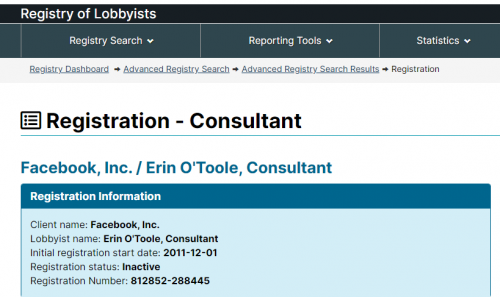

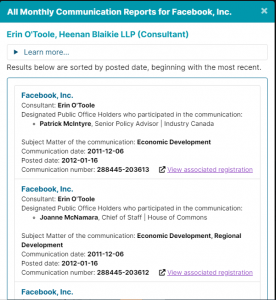

5. Heenan Blaikie, Desmarais, Facebook

Before getting into Parliament, O’Toole worked for the law firm Heenan Blaikie (which is now defunct). It’s the same firm that Jean Chretien and Pierre Trudeau worked for. The Desmarais Family also had connections the the company.

In his duties, O’Toole also acted as a lobbyist for Facebook, trying to influence the Government of Stephen Harper — which he later became part of.

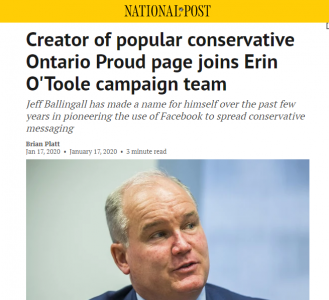

6. Jeff Ballingall, Canada Proud

O’Toole’s campaign was aided by Jeff Ballingall, and a group called Canada Proud. This is an NGO that tries to promote “conservative” politicians and movements. There are Provincial efforts as well, including Ontario Proud, which helped install Doug Ford into power. O’Toole was helped along by social media pros who got him more attention.

Side note: Ballingall works for The Post Millennial, which is owned by Matthew Azrieli. He is the grandson of the late David Azrieli, media mogul and billionaire.

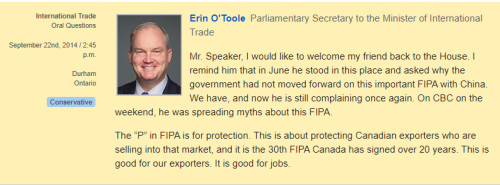

7. FIPA, Selling Out Canada To China

Upon entering the House of Commons, O’Toole worked as a Parliamentary Secretary for the Minister of International Trade. His first major gig was pushing FIPA, an agreement which sold Canadian sovereignty to China for a minimum of 31 years. Even after all this time, there’s no indication O’Toole regrets his involvement. See this earlier review on FIPA.

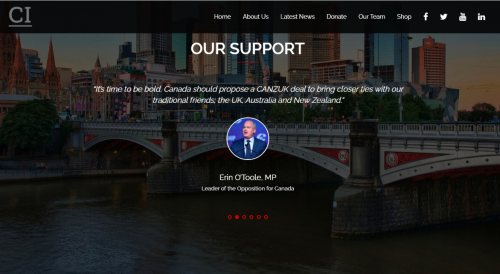

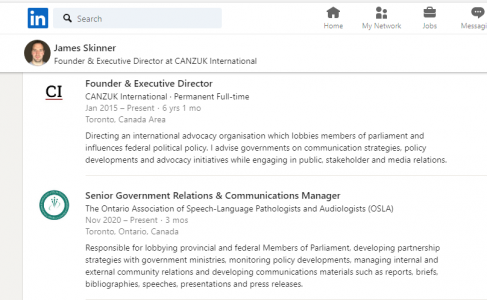

8. CANZUK, Open Borders Agreement

CANZUK is an acronym (Canada, Australia, New Zealand, and United Kingdom). The group, CANZUK International, is in a compaign for a treaty that would open borders between those countries. More countries could eventually be added. James Skinner, the head of the group, also worked for the CPC, and it looks like CANZUK is in fact their creation.

O’Toole is on record supporting CANZUK, and future expansion as well. He gives a variety of reasons, depending on what the circumstances are.

9. Open Borders Immigration Agenda

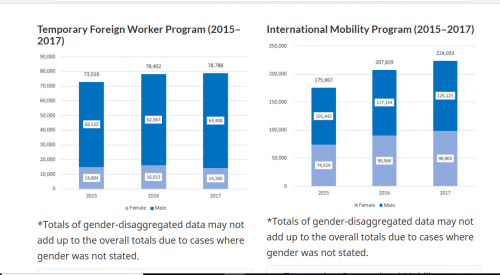

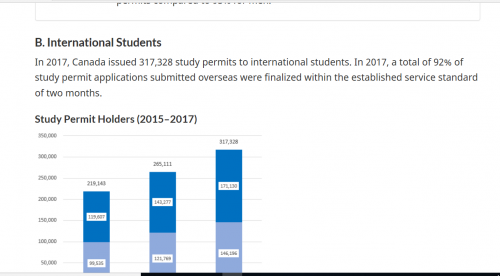

Would O’Toole and the Conservatives reduce the hordes of people entering Canada each year? Would they do something about the large numbers of students and temporary workers who have pathways to extend? It seems most unlikely.

The true scale of immigration into Canada has been covered extensively on this site, so no need to rehash it here. But fair to say that O’Toole either lowballs it, or has no clue whatsoever.

10. Supporting Climate Change Agenda

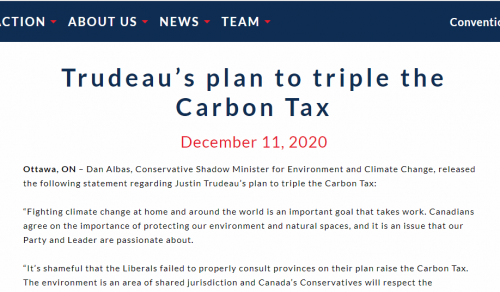

Ottawa, ON – Dan Albas, Conservative Shadow Minister for Environment and Climate Change, released the following statement regarding Justin Trudeau’s plan to triple the Carbon Tax:

“Fighting climate change at home and around the world is an important goal that takes work. Canadians agree on the importance of protecting our environment and natural spaces, and it is an issue that our Party and Leader are passionate about.

“It’s shameful that the Liberals failed to properly consult provinces on their plan raise the Carbon Tax. The environment is an area of shared jurisdiction and Canada’s Conservatives will respect the jurisdiction of the provinces and territories by scrapping Trudeau’s Carbon Tax. If provinces want to use market mechanisms, other forms of carbon pricing, or regulatory measures, that is up to them.

“This week, Conservatives put forward a motion to stop the Liberals from raising taxes during the pandemic. Not only did the Liberals vote against our motion, but they are now raising the Carbon Tax even higher. This increase will mean that Canadians will pay more for groceries, home heating, and add up to 37.57 cents per litre to the cost of gas.

A moment of clarification here: O’Toole and the CPC don’t actually take issue with the climate change agenda itself. Instead, they limit their criticisms specifically to Carbon taxes.

The disingenuous nature of the Provinces “challenging” the Carbon taxes, while supporting the climate change agenda has also been covered here.

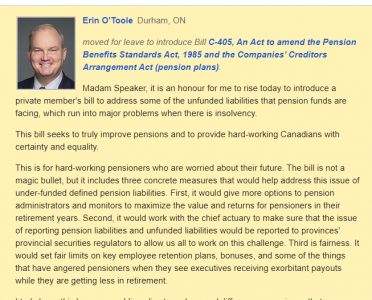

11. Weakening Protections On Worker Pensions

Although it ultimately went nowhere, O’Toole previously introduced Private Member’s Bill C-405, which would make it easier for bankrupt companies to transfer employee pensions instead of paying them out. Wonder where he got that idea from.

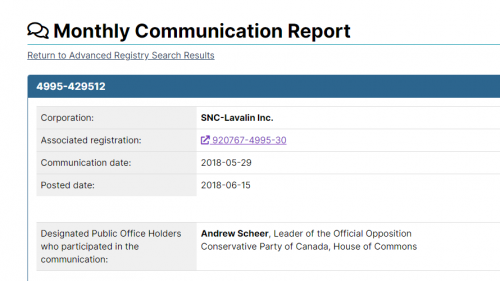

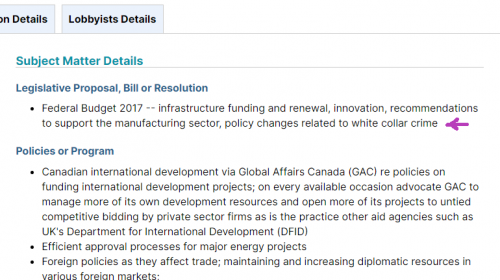

12. SNC Lavalin, Deferred Prosecution

Ever wonder why Conservatives were so tepid on SNC Lavalin getting their deferred prosecution agreement? Could be because they were also lobbied for it. Seems that “tough on crime” has its limits.

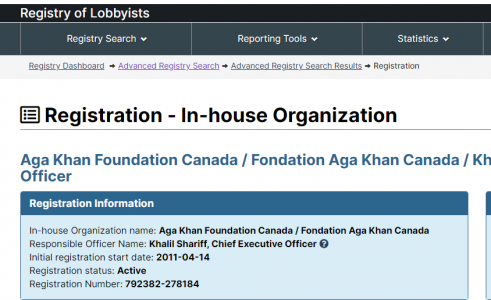

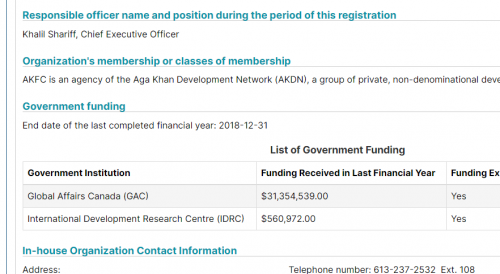

13. Aga Khan Foundation Canada

Aga Khan Foundation Canada (AKFC) is a registered charity that supports social development programs in Asia and Africa. As a member of the Aga Khan Development Network, AKFC works to address the root causes of poverty: finding and sharing effective and lasting solutions that help improve the quality of life for poor communities. Our programs focus on four core areas: health, education, rural development and building the capacity of non-governmental organizations.

In the year 2018, the Aga Khan Foundation received roughly $32 million from Canadian taxpayers. It’s a little disturbing to see Conservatives lobbied by this group as well, especially considering the grief they gave Trudeau over his winter vacation.

14. O’Toole Never Mentions Central Banking

From time to time, O’Toole will make noises about how Conservatives are better managers of money than Liberals. However, he never talks about private central banking, which is probably the biggest scam in history. He was in Parliament during the Bank of Canada case (so he presumably is familiar with the issue). But he will never talk about it openly.

15. Why Throw Derek Sloan Under The Bus?

Derek Sloan, a CPC MP, faces expulsion from his party for accepting a donation of $131 from a so-called “white supremacist”. Is that the real reason for this, or was O’Toole pressured by his pharma handlers after Sloan sponsored? Petition e-2961 referred to these vaccines as “human experimentation”.

Obviously O’Toole knows for sure, but the claim of a “racist donation” seems like a thinly veiled attempt to dump a politician who is actually critical of the vaccination agenda.

So who’s pulling Erin O’Toole’s strings? It seems everyone except the Canadian public.