So-called “fiscal conservatives” will talk about the problem of debt, but never the predatory banking system that causes it. Similarly, they will pretend to oppose Carbon taxes, but not address where this money ends up. They don’t want supporters grasping what really happens.

Politicians want people focused on the symptoms (debt, carbon taxes), and not on the diseases (banking and climate cartels). See the bigger picture.

1. Debunking The Climate Change Scam

The entire climate change industry, (and yes, it is an industry) is a hoax perpetrated by the people in power. See the other articles on the scam, the propaganda machine in action, and some of the court documents in Canada. It’s a much bigger picture than what is presented by the mainstream media, or even the alternative media.

But as we will see, so called “conservatives” do nothing to halt this scheme, and act as gatekeepers.

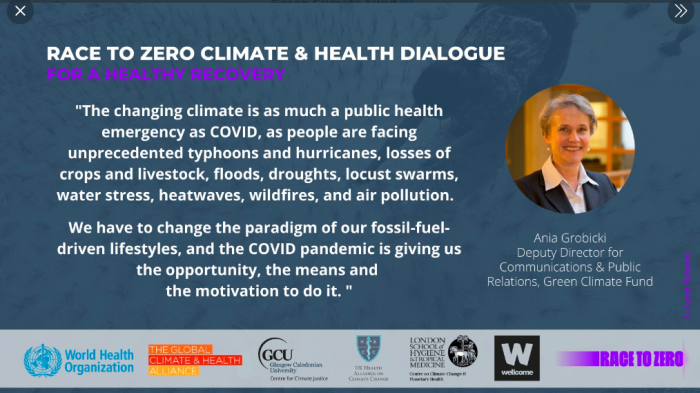

2. Alliance Between Climate, Banking Cartels

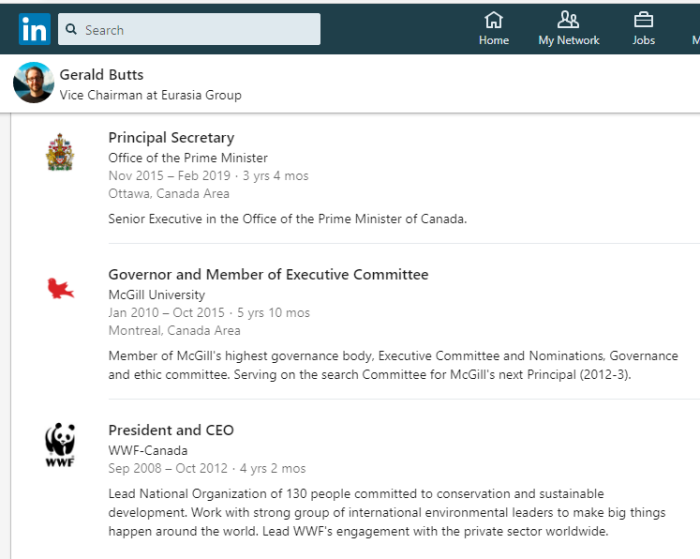

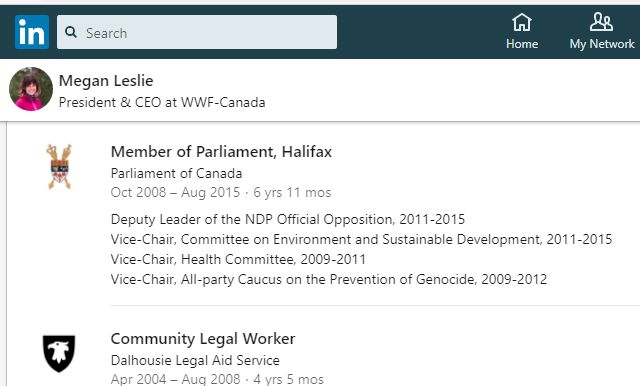

This may seem odd, but the banking cartel works with the climate cartel. They share a goal, which is to bleed wealth out of nations, and to the detriment of the citizens. Whether it is cloaked as “fiscal policy”, or as “stopping climate change”, the result is much the same. In fact, pushing climate bonds, the green agenda, green bonds, or heritage sites, seem to be a way to advance their agendas.

3. Climate Bonds A Growth Industry

Climate bonds are a growth industry, expected to top $100 trillion in value over the next several years. Granted, this does nothing to elimiate climate change, or make the air cleaner, but why should that be an excuse not to pay your taxes.

Incidently, the climate bonds are pushed by: Rockefeller Foundation, European Climate Foundation, and Climate Works Foundation (among others).

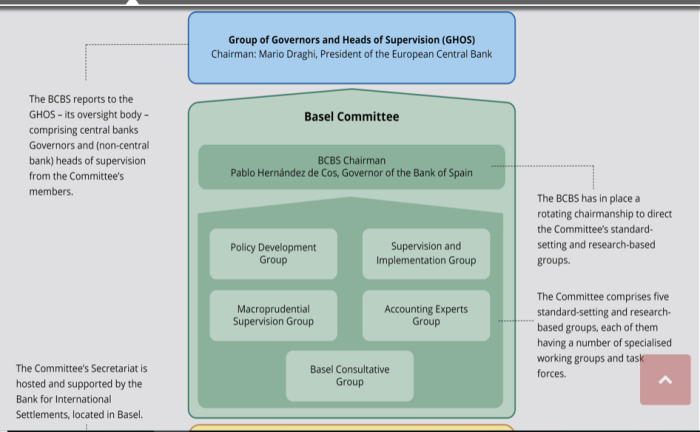

4. Central Banks Support Climate Hoax

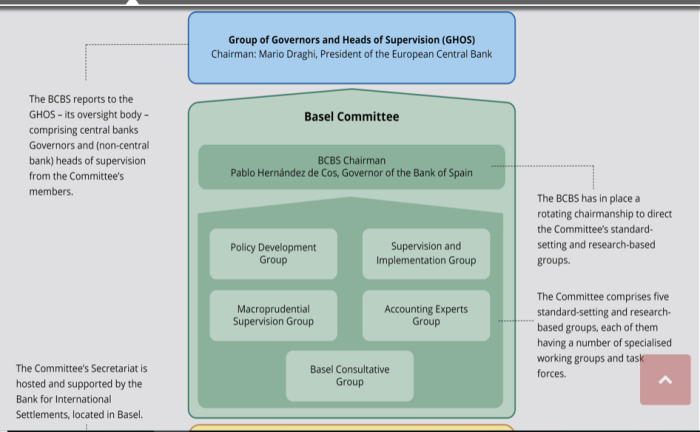

The Bank for International Settlements fully supports the climate change industry. See here and here. They claim stopping climate change is essential to financial stability, but offer no specifics on how this is, or on how these bonds help. Check out the BIS site for more.

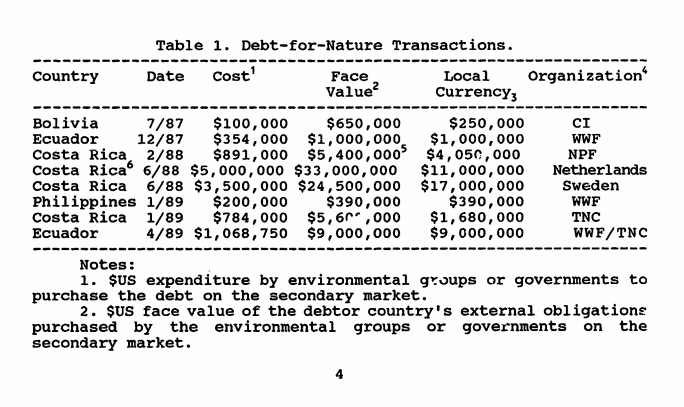

5. Carbon Taxes Finance Int’l Debt Swaps

UN.new.development.financing.2012.178pages

The UN laid out years ago where a lot of the money would be going. One of the big areas (besides climate bonds), is using various taxation methods making predatory loans to the 3rd World, then forcing them into debt-for-land swaps when they can’t afford to pay it back.

The kicker is that this money Canada (and other countries) give, is that it is borrowed to begin with. Canada borrows money (from private sources), to hand over to the UN, who then lends it out to other nations who can never pay it back.

But all conservatives will complain about is that a Carbon tax is ineffective. They miss the bigger picture.

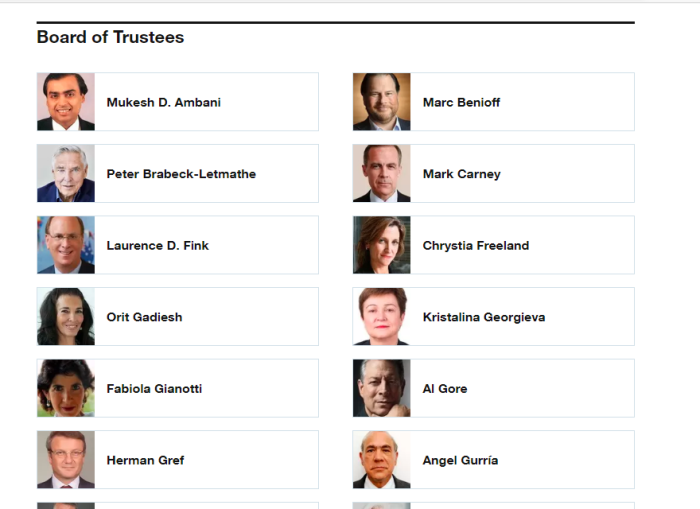

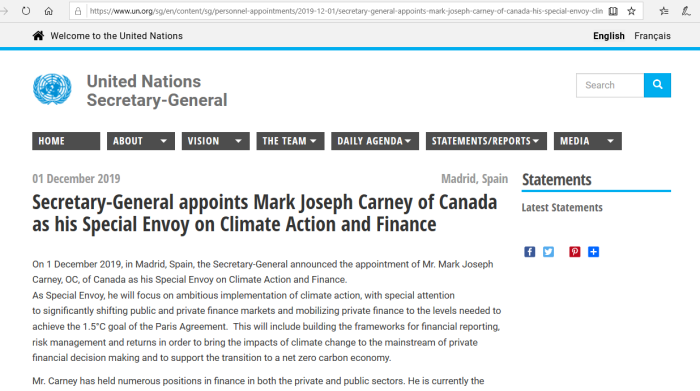

6. Mark Carney (Ex-BoC), UN Climate Mobster

In the old days, the mafia would burn down your business if you didn’t pay your taxes. Now, people like Mark Carney (former head of Bank of Canada and Bank of England), are threatening to legally wipe out your business if you don’t play along with the climate mob. Interesting that a banker now leads the climate cartel enforcement.

Carney was actually touted as a possible successor to Paul Martin years ago. Now, do conservatives have anything to say about this threat to free enterprise? Nope.

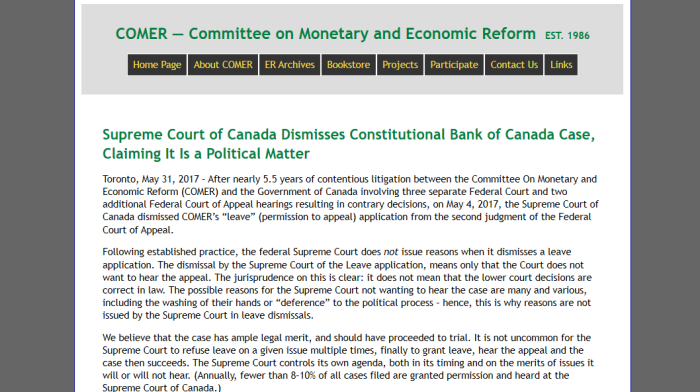

7. Harper, Conservatives Defend Banking Cartel

Although a few parties are willing to talk openly about the International Banking Cartel, most are not. This happens even when politicians know about the scam, but choose to remain quiet. From 2011 to 2017, both Liberals and Conservatives fought in Federal Court to keep the usurious system intact.

8. Carbon Tax Court Challenges Are Rigged

This was addressed here and here. Provincial Premiers (and the Federal Conservatives) all claim to be against the Federal Carbon tax. However, a look through their court submissions shows that they don’t have any issue with the climate industry itself. Nor do they rule out their own Provincial taxes. This is all just a dog and pony show. Court documents are here.

9. Garnett Genuis Defends Paris Accord

This is a clip from Rebel News, in 2017. Here, CPC MP Garnett Genuis went on the air and publicly defended voting in a motion to support the Paris Accord. Although Genuis insisted this was the right decision, he couldn’t offer anything but the flimsiest of justifications. He also refused to admit that the vote was whipped.

As for abiding by the Paris Accord without taxes: read the agreement, starting with Article #9.

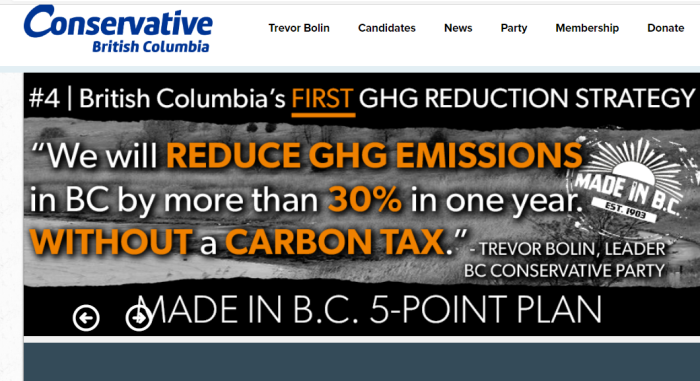

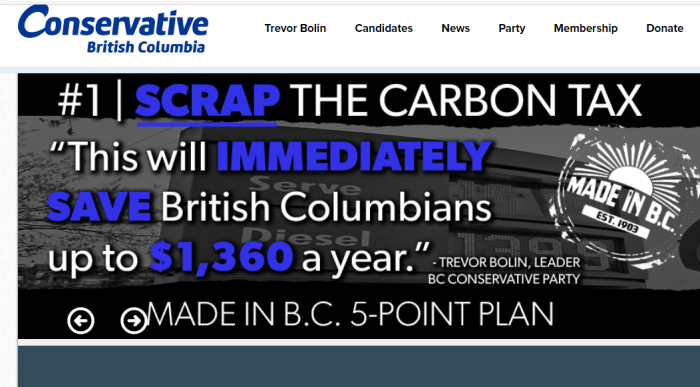

10. British Columbia Conservative Party

The BC Conservatives claim that greenhouses gases are an issue to be dealt with. They fully support the hoax, although claim to oppose a Carbon tax. There is no mention whatsoever of central banking.

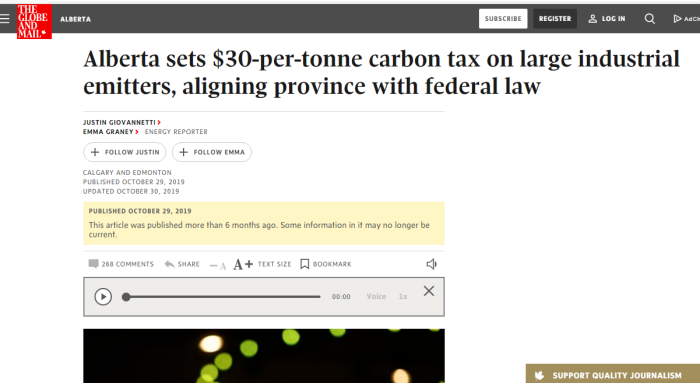

11. United Conservative Party (Alberta)

Jason Kenney, prior to his 2019 election win, claimed to oppose the Federal (yes, the Federal) Carbon tax, but still plays along with the climate change hoax.

[1] Calls to action to save the planet we all share evoke strong emotions. And properly so. The dangers of climate change are undoubted as are the risks flowing from failure to meet the essential challenge. Equally, it is undisputed that greenhouse gas emissions caused by people (GHG emissions) are a cause of climate change. None of these forces have passed judges by. The question the Lieutenant Governor in Council referred to this Court though – is the Greenhouse Gas Pollution Pricing Act, SC 2018, c 12 (Act) unconstitutional in whole or in part – is not a referendum on the phenomenon of climate change. Nor is it about the undisputed need for governments throughout the world to move quickly to reduce GHG emissions, including through changes in societal behaviour. The federal government is not the only government in this country committed to immediate action to meet this compelling need. Without exception, every provincial government is too.

[2] Nor is this Reference about which level of government might be better suited to address climate change or GHG emissions. Or whether a uniform approach is desirable. Or who has the best policies. Or what are the best policies. Or who could do more to reduce GHG emissions in the world. This Court cannot compare causes with causes, means with means, provinces with provinces or nations with nations in the global struggle against climate change. But what it can do is offer our opinion on the constitutionality of the Act under Canada’s federal state.

[3] Greenhouse gases (GHGs) in quantity have been part of our atmosphere since the dawn of mankind. Every human and animal activity is a source of GHGs. GHG emissions have picked up pace since the industrial revolution and the rapid increases in the world’s population. GHG emissions result from virtually every aspect of individuals’ daily lives, work, social and personal, from how many children they have to what they eat and how much they consume; what car they drive and how far they travel for work and pleasure; how large their home is and what temperature they choose to live at; what kind of furnace, appliances and lighting they have; and on and on.

Jason Kenney never told the Alberta public that his government openly took the position that climate change was a threat to humanity. The challenge surprisingly succeeded, although there’s no legal impact to the ruling.

“Fighting” the carbon tax apparently also includes introducing one of your own, as Alberta did in late 2019.

12. Conservatives In Saskatchewan

Scott Moe criticizes the Carbon tax. But like most conservatives, he speaks out both sides of his mouth. He fully supports the climate change scam, but only argues on one small point.

[4] The factual record presented to the Court confirms that climate change caused by anthropogenic greenhouse gas [GHG] emissions is one of the great existential issues of our time. The pressing importance of limiting such emissions is accepted by all of the participants in these proceedings.

[5] The Act seeks to ensure there is a minimum national price on GHG emissions in order to encourage their mitigation. Part 1 of the Act imposes a charge on GHG-producing fuels and combustible waste. Part 2 puts in place an output-based performance system for large industrial facilities. Such facilities are obliged to pay compensation if their GHG emissions exceed applicable limits. Significantly, the Act operates as no more than a backstop. It applies only those provinces or areas where the Governor in Council concludes GHG emissions are not priced at an appropriate level.

[6] The sole issue before the Court is whether Parliament has the constitutional authority to enact the Act. The issue is not whether GHG pricing should or should not be adopted or whether the Act is effective or fair. Those are questions to be answered by Parliament and by provincial legislatures, not by courts.

The Saskatchewan Government argued at the Court of Appeals, and still argues at the Supreme Court of Canada, that climate change must be dealt with. Any wonder why they lost?

Oh, and not a single mention of central banking and the endless debt it creates.

13. Conservatives In Manitoba

The Manitoba government will go to court over Ottawa’s imposition of a carbon tax.

Premier Brian Pallister revealed Wednesday his government will launch a legal challenge against the federal government, which imposed its new levy as promised on Manitoba, along with three other provinces, Monday.

“We’re going to court, sadly, to challenge the Ottawa carbon tax because Ottawa cannot impose a carbon tax on a province that has a credible greenhouse gas-reduction plan of its own, and we do,” he told reporters.

Manitoba’s Premier Brian Pallister, who also self-identifies as a “Conservative”, doesn’t challenge the history of valid predictions or climate models. Instead, his position (like the others), is solely that Ottawa doesn’t have the authority to impose a Carbon tax on the Provinces. Hear Pallister’s own words on this. He opposes OTTAWA imposing a Carbon tax, not the principle of a Carbon tax.

14. Conservatives In Ontario

6. Ontario agrees with Canada that climate change is real and that human activities are a major cause. Ontario also acknowledges that climate change is already having a disruptive effect across Canada, and that, left unchecked, its potential impact will be even more severe. Ontario agrees that proactive action to address climate change is required. That is why Ontario has put forward for consultation a made-in-Ontario plan to protect the environment, reduce greenhouse gas emissions, and fight climate change.

11. Ontario released its climate change plan, as part of its overall environment plan, for a 60-day period of public consultation on November 29, 2018. The plan will be finalized following consideration of input from that consultation. Ontario’s plan will tackle climate change in a balanced and responsible way, without placing additional burdens on Ontario families and businesses

12. “[Greenhouse gas] emissions come from virtually all aspects of Ontario’s society and economy.” There are seven primary sectors in Ontario that produce greenhouse gas emissions: transportation; industry; buildings; land use, land use change and forestry; electricity; waste; and agriculture. All but the last (which is an area of concurrent federal/provincial jurisdiction) will be discussed in turn.

13. Canada itself has publicly acknowledged the wide range of activities that can generate greenhouse gas emissions – activities as varied as homes and buildings, transport, industry, forestry, agriculture, waste, and electricity.

In its “challenge“, before the Ontario Court of Appeals, the Ford Government argued that climate change was a danger, in full agreement with Trudeau. They repeat the same thing to the Supreme Court of Canada. These “conservatives” don’t oppose the climate change hoax, nor do they talk about the banking cartel which contributes to their Provincial debt.

What’s the point of these challenges if you don’t oppose the climate change scam? Is it just for show?

15. Conservatives In Quebec

The Quebec government is intervening before the Supreme Court in Saskatchewan’s challenge to the federal carbon tax.

Quebec Premier François Legault said his government is in favour of carbon pricing, but it must be exclusively a provincial responsibility.

“For us, it is important to protect provincial jurisdiction,” he said.

“I have been clear with the premiers of other provinces who are opposed for other reasons to this [federal] encroachment. We want to protect provincial jurisdiction to fight climate change.”

Currently, the federal carbon tax applies only to New Brunswick, Ontario, Manitoba and Saskatchewan. In Alberta the tax would come into effect as of Jan. 1.

Quebec is not affected by the federal government’s decision since it joined a carbon exchange with California several years ago.

The “conservative” Quebec Premier says he will challenge the Federal carbon tax, but only on grounds that it should be the Provinces getting the money instead.

16. Conservatives In New Brunswick

1. The Intervenor, Attorney General of New Brunswick (“New Brunswick”) agrees with the factum of the Attorney General of Ontario (“Ontario”) regarding the nature of this reference and agrees with Ontario’s conclusions in every respect. New Brunswick also agrees with the climate data submitted by the Attorney General of Canada (“Canada”). This reference should not be a forum for those who deny climate change; nor should it be a showcase about the risks posed by greenhouse gas emissions (“GHG emissions”). The supporting data is relevant only to the extent that it is meaningfully connected to the constitutional question at issue.

2. The foundational climate change data provided by Canada, generally intended to portray the anticipated impacts of climate change in Canada, as well as the many references to international accord and commitments, leave an unquestionable impression of Canada’s a deep resolve to see the nation’s environmental footprint diminished. New Brunswick does not take issue with Canada’s commitment or with the importance of the overall subject matter.

3. What New Brunswick disputes is the way in which the federal Parliament has apportioned its resolve to diminish GHG emissions by imposing “backstop legislation”.

New Brunswick acted as an intervenor in the Ontario Court of Appeals case and submitted their own Factum. Above are some of the quotes. Higgs makes it clear he doesn’t actually oppose the agenda itself.

New Brunswick Premier Blaine Higgs is yet another “conservative” who is fighting the Carbon tax by introducing one of his own.

17. Elsewhere In The Maritimes

There doesn’t seem to be any real opposition (or mention) of the carbon tax by conservatives in Nova Scotia, PEI, and Newfoundland & Labrador. They don’t talk about the 1974 changes that Trudeau Sr. made to the banking system, either.

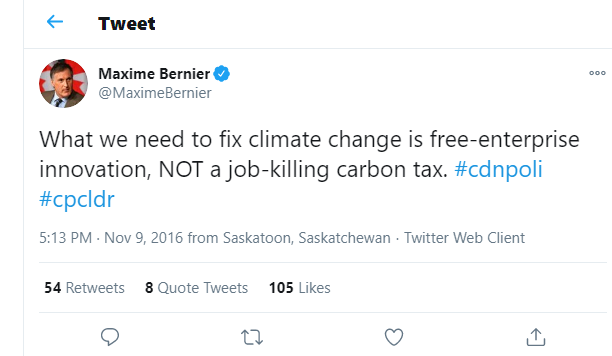

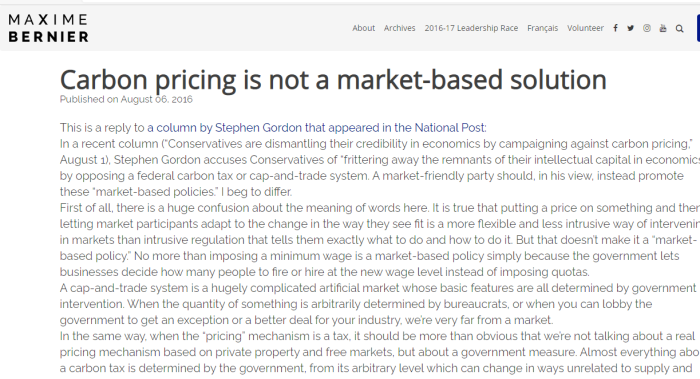

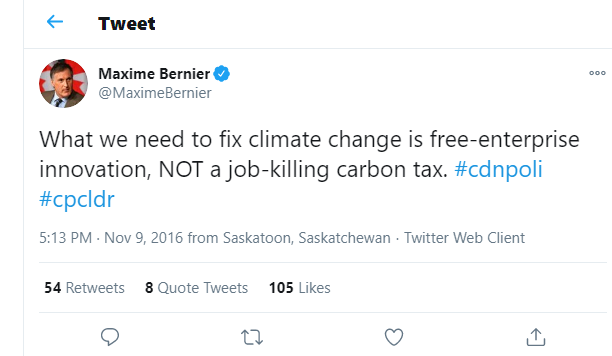

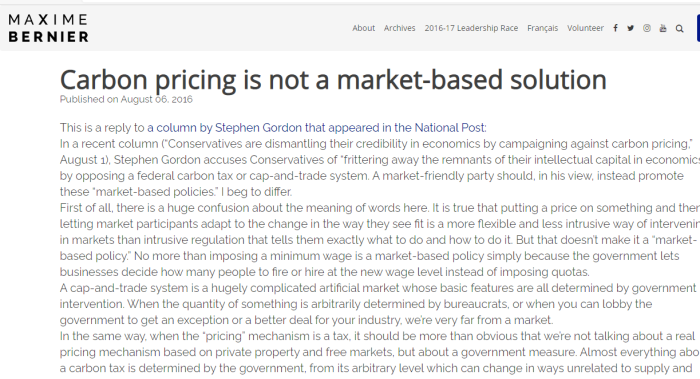

18. Fake Populist (Fake Party) Maxime Bernier

Even when running for the CPC leadership, Bernier played along with the climate change scam. His only opposition was to a tax itself. However, since losing in 2017, he finally admitted (somewhat), that it’s all a hoax.

Bernier talks a lot about the milk mafia, but doesn’t have much to say about the banking or climate mafias. Bernier was also in cabinet from 2011 to 2015 during the COMER case in Federal Court. Bernier claims to support balanced budgets, but never talks about the biggest obstacle.

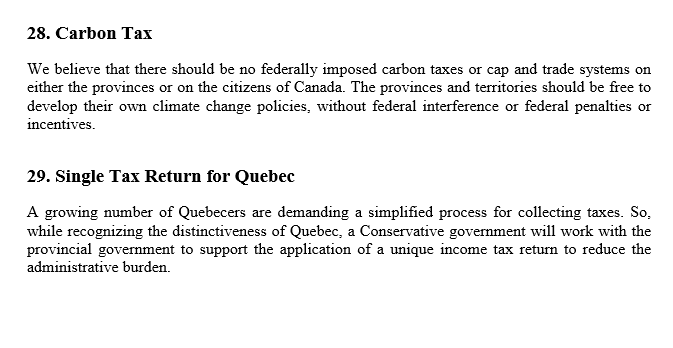

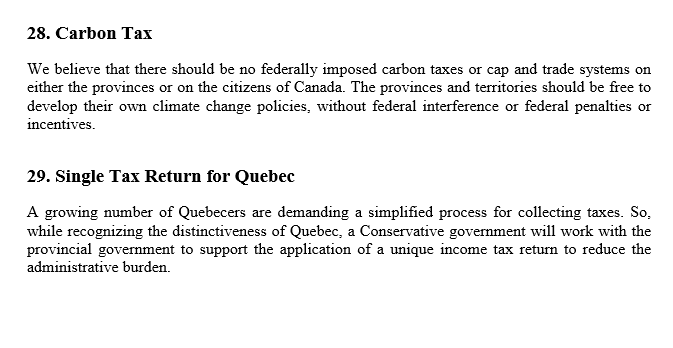

19. Conservative Party Of Canada

While claiming to oppose a Carbon tax, the CPC still plays along with the climate change agenda. It does this to offer the illusion of choice in voting options. Harper signed Agenda 2030 in September 2015. Erin O’Toole supports the Paris Accord, as does Andrew Scheer.

Also worth pointing out, while Conservatives “pretend” to care about debt in opposition, they do little when in power. They also had a majority government in 2011 to 2015 when COMER attempted to dismantle Canada’s participation in the International Banking Cartel. The CPC fought the court challenge for years.

20. Leslyn Lewis’ Pro-UN/PA Dissertation

Leslyn Lewis PhD Dissertation, Paris Accord

As many readers will be aware, Leslyn Lewis recently ran for the leadership of the Conservative Party of Canada, and came 3rd overall. But what many supporters don’t know is her thesis, published in 2019, was very pro-UN, and pro-Paris Accord. This isn’t some ancient paper she wrote at age 19 or 20. It was her PhD dissertation, published at the age of 48.

This “social conservative” was also a Director at Women’s LEAF, a pro-death lobbyist and legal group. But that’s another story.

21. The Controlled Opposition Conservatives

(Originally featured as “the Resistance” in Maclean’s), these so-called leaders pretend to oppose the Carbon tax levied by Trudeau. But the devil is in the details. They actually ENDORSE the climate change industry overall, and don’t rule out Carbon taxes Provincially. Nor do they discuss where the money even goes. They only criticize Trudeau imposing a FEDERAL tax.

Nor do the “Resistance” seem to have any problem with the international banking cartel bleeding Canada dry through usury and private loans. They focus on a symptom (the debt), but never the disease (the banking system). The goal is to ensure the public never sees the big picture.

While climate change and central banking seem unrelated, there is a connection: so-called “opposition” politicians never come clean as to what is going on. Both are scams meant to bankrupt and enslave the people.

22. Documents On The Climate Change Scam

(A.1) SK COA Ruling On Carbon Tax

http://archive.is/tNe2k

(B.1) ONCA Ruling On Carbon Tax

http://archive.is/tbMTC

(B.2) ONCA Reference Documents

(B.3) ONCA, Ontario Factum, GGPPA

(B.4) ONCA, BC Factum, GGPPA

(B.5) ONCA, NB Factum, GGPPA

(B.6) ONCA, United Conservative Assoc

(B.7) ONCA, CDN Taxpayers Federation

(C.1) ABCA Ruling On Carbon Tax

http://archive.is/guxXF

(C.2) Jason Kenney Repeals Carbon Tax

http://archive.is/Q1gGb

(C.3) Kenney Supports New Carbon Tax

http://archive.is/wTYoE

(C.4) Kenney To Hike New Carbon Tax

http://archive.is/jbLjN

(D.1) SCC, Ontario Factum

(D.2) SCC, Sask Factum, GGPPA

Leslyn Lewis’s 2019 PhD Dissertation On Climate Change

Like this:

Like Loading...