“The Minister may make an interim order that contains any provision that may be contained in a regulation made under this Act if the Minister believes that immediate action is required to deal with a significant risk, direct or indirect, to health, safety or the environment.” Section 30.1(1) of the Food and Drugs Act. Sure, there are standards, but they can be bypassed if needed.

1. Other Articles On CV “Planned-emic”

The rest of the series is here. Many lies, lobbying, conflicts of interest, and various globalist agendas operating behind the scenes, obscuring the vile agenda called the “Great Reset“. The Gates Foundation finances: the WHO, the US CDC, GAVI, ID2020, John Hopkins University, Imperial College London, the Pirbright Institute, the BBC, and individual pharmaceutical companies. Also: there is little to no science behind what our officials are doing; they promote degenerate behaviour; the Australian Department of Health admits the PCR tests don’t work; the US CDC admits testing is heavily flawed; and The International Health Regulations are legally binding. See here, here, and here. The media is paid off, and our democracy compromised, shown: here, here, here, and here.

2. Important Links

Imperial College London Modelling H1N1

https://archive.is/KLgV2

Imperial College London’s Findings On Swine Flu (H1N1)

https://archive.is/gj4R6

CDC Approves PCR Tests For H1N1 Detection

Interim Order Allowing H1N1 Vaccine

[A] Q&A About Vaccine Arepanrix H1N1 Approval

[A] Information About Research Performed

https://archive.is/WskgA

[B] Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine

https://archive.is/wip/q1Z79

Food & Drug Act Of Canada

Adam v. GlaxoSmithKline Inc., 2019 ONSC 7066 (CanLII)

2010 Film: Outbreak, Anatomy Of A Plague

Rockefeller.Foundation.lockstep.2010

Order In Council: 2009-1769

Order In Council: 2009-1857

3. Neil Ferguson’s Shoddy Modelling

Neil Ferguson and Imperial College London were also involved in modelling H1N1 (Swine Flu), over a decade ago. His models are about as off the mark then as they are now.

Imperial College London has financial ties to the Bill & Melinda Gates Foundation. Gates himself shows interest in many of ICL’s activities.

Professor Neil Ferguson, the corresponding author of the new research from the MRC Centre for Outbreak Analysis and Modelling at Imperial College London, said: “Our study shows that this virus is spreading just as we would expect for the early stages of a flu pandemic. So far, it has been following a very similar pattern to the flu pandemic in 1957, in terms of the proportion of people who are becoming infected and the percentage of potentially fatal cases that we are seeing.

“What we’re seeing is not the same as seasonal flu and there is still cause for concern – we would expect this pandemic to at least double the burden on our healthcare systems. However, this initial modelling suggests that the H1N1 virus is not as easily transmitted or as lethal as that found in the flu pandemic in 1918,” added Professor Ferguson.

Even back in 2009 (and in fact earlier), Ferguson was quite willing to push the panic button based on very incomplete information. It must be noted that models are not proof or evidence, they are merely predictions. These predictions are subjected to the same limitations and biases of the people conducting them.

Ferguson’s “models” predicted some 65,000 deaths in the U.K. as a result of Swine Flu. A total of 457 materialized in the end. And it’s just one of the times he’s grossly overshot the mark.

4. PCR Tests Used For Swine Flu Detection

This guidance was revised to clarify that the current rRT-PCR developed by CDC to detect novel influenza A ( H1N1) is authorized by the FDA. The FDA authorization, also termed Emergency Use Authorization or EUA, is not equivalent to FDA cleared, which was incorrectly stated in the previous version of the guidance.

Those PCR tests (which don’t detect Covid-19), were also approved for use in diagnosing H1N1 by the Center for Disease Control in the U.S. The technology wasn’t suited then, and isn’t now.

5. Inadequate Clinical Trials: (Arepanrix H1N1)

4. What evidence was used to support the authorization of Arepanrix™ H1N1?

A prototype or “mock” vaccine was developed in the pre-pandemic period using another strain of influenza virus, the H5N1 strain. During this period Health Canada inspected the vaccine manufacturing facilities, validated the vaccine production process, and reviewed results from both animal and human studies with the mock vaccine. In addition, the safety and effectiveness of the adjuvant to be used with the vaccine was assessed by Health Canada. Once the H1N1 virus emerged as the pandemic virus, the manufacturer initiated vaccine production using the strain recommended by the WHO.

5. What are the benefits and potential risks associated with Arepanrix™ H1N1?

Criteria have been established to assess the immunogenicity of vaccines. Clinical trial results indicate that Arepanrix meets all of these criteria, which means that the vaccine produces an adequate level of protection against the H1N1 pandemic virus.

.

As with all medicinal products, there may be side effects or adverse events associated with the use of the product. Some of the very common adverse events that have been observed in clinical trials with the pandemic vaccine include pain at the injection site, fatigue, headache, swollen glands in the neck, joint pain, and muscle ache. Refer to the product leaflet for additional information on adverse events.

6. How was Arepanrix™ H1N1 authorized?

Arepanrix™ H1N1 was approved because it was shown that the benefits of the vaccine outweigh any risks. The time frame between vaccine manufacturing and the need to use the vaccine in time to provide the public with protection against the virus is very short. As a result, it has not been possible for the manufacturer to collect the usual full information necessary for a Notice of Compliance to be issued under the Food and Drug Regulations. For this reason, an Interim Order was used to provide an alternate pathway to allow for the authorization for sale of the vaccine. Under the Interim Order, the manufacturer is required to continue submitting data on the safety and effectiveness of the vaccine. Health Canada and the Public Health Agency of Canada will review this information as it becomes available.

This vaccine was rushed out for use in the general population. This was despite the testing not being complete. The Minister of Health signed an interim Order allowing it to be dispensed anyway.

It’s worth pointing out that initial trials were not even conducted on the H1N1 influenza strain, but on another one. Fair to ask how valid that initial research would be.

Elderly (>60 years):

There are limited data available from clinical studies with Pandemrix™ (H1N1) and with Arepanrix™ H1N1 vaccine in adults aged over 60 years.

.

The recommended dosage for this age group is one dose of 0.5mL.

.

Immunogenicity data obtained at 3 weeks after administration of Pandemrix (H1N1) or Arepanrix™ H1N1 in clinical studies in this age group suggest that a single dose may be sufficient.

.

If a second dose is administered, it should be given after an interval of at least three weeks. See section Pharmacodynamics.

Children and adolescents aged 10-17 years:

No clinical data are available for Arepanrix™ H1N1 in this age group. There are limited data available from a clinical study with Pandemrix™ (H1N1) in this age group.

.

The recommended dosage for this age group is in accordance with recommendations for adults.

Children aged from 6 months to 9 years:

One dose of 0.25mL (i.e. half of the adult dose) at an elected date.

Preliminary immunogenicity data obtained in a limited number of children aged 6-35 months who received two doses of 0.25 mL of Pandemrix™ (H1N1) containing 1.9 µg HA derived from A/California/7/2009 (H1N1) and a limited number of children aged 3-9 years who received one dose of 0.5 mL of Pandemrix™ (H1N1) show that a good immune response is elicited after the first dose, but there is a further immune response to a second dose of 0.25 mL administered to children aged 6-35 months after an interval of three weeks.

Extremely limited studies were done prior to getting interim approval from the Minister of Health. In some cases, they were using different vaccines and working with different strains. Not really an apples to apples comparison.

6. Inadequate Trials: (Monovalent Vaccine)

Elderly (>60 years):

No clinical data are available for Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine (Without Adjuvant) in this age group. One dose of 0.5mL may be administered at an elected date.

Children and adolescents aged 10-17 years:

No clinical data are available for the Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine (Without Adjuvant) in this age group. One dose of 0.5mL may be administered at an elected date.

Children aged 3-9 years:

No clinical data are available for the Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine (Without Adjuvant) in this age group. The use of this vaccine should be considered in light of PHAC recommendations for the A/California/7/2009(H1N1)v-like vaccination. Preliminary data with other similar unadjuvanted vaccines suggest that if used in this age group, a 2-dose regimen (0.5mL with an interval of at least 21 days between doses) is recommended.

Children aged from 6-35 months:

No clinical data are available for the Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine (Without Adjuvant) in this age group. The use of this vaccine should be considered in light of PHAC recommendations for the A/California/7/2009(H1N1)v-like vaccination. Preliminary data with other similar unadjuvanted vaccines suggest that for this age group, unadjuvanted vaccine may not be suitable against this pandemic strain.

Children aged less than 6 months:

Vaccination is not currently recommended in this age group.

For further information, see section Pharmacodynamics.

This isn’t selective editing or anything of the sort. Health Canada approved the use of this drug for children between 6 months and 17 years, and over the age of 60, without there being clinical data to support that it worked. This is chilling to read.

7. Approval Of Experimental Drugs

“The Minister may make an interim order that contains any provision that may be contained in a regulation made under this Act if the Minister believes that immediate action is required to deal with a significant risk, direct or indirect, to health, safety or the environment.” [from the Food and Drugs Act]

That is Section 30.1(1) of the Food and Drug Act of Canada. It was used to approve 2 vaccines without full and complete trials. They were:

[1] Arepanrix™ H1N1 (AS03-Adjuvanted H1N1 Pandemic Influenza Vaccine)

[2] Influenza A (H1N1) 2009 Pandemic Monovalent Vaccine (Without Adjuvant)

The Minister has the discretion to do this. And it happened, despite there not being adequate testing done. Could the same thing happen with Covid-19?

8. Indemnification From The Courts

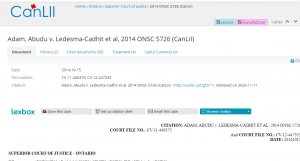

Adam, Abudu v. Ledesma-Cadhit et al, 2014 ONSC 5726 (CanLII)

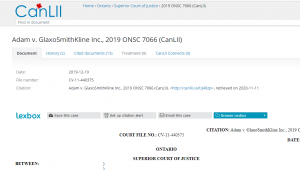

Adam v. GlaxoSmithKline Inc., 2019 ONSC 7066 (CanLII)

There are actually 2 different rulings based on vaccine injury from GlaxoSmithKline. Here are quotes from the later ruling.

[15] In early 2009, the WHO became aware of the development of a new strain of influenza virus: H1N1, commonly known as swine flu. It had not been seen in human populations before, as a result of which humans had no built up immunity. The WHO declared H1N1 to be a pandemic.

[16] On June 11, 2009, the WHO declared a phase 6 pandemic. This is the final and most serious stage of a pandemic. It marks sustained human-to-human transmission of the virus in more than one region of the world. By early July there had been 94,512 reported cases and approximately 429 recorded deaths attributable to H1N1.

[17] In the summer of 2009, the WHO called for manufacturers to begin clinical trials for a vaccine to combat H1N1.

[18] GSK developed two vaccines to combat H1N1: Arepanrix and Pandemrix. Both are substantially similar. Pandemrix was manufactured and distributed in Europe. Arepanrix was manufactured and distributed in Canada. Clinical trials for Arepanrix began in 2008 but had not been completed when the pandemic was declared.

[19] The federal Minister of Health authorized the sale of the Arepanrix vaccine pursuant to an interim order dated October 13, 2009. Human trials of the vaccine were still underway. The Minister of Health is empowered to make interim orders if immediate action is required because of a danger to health, safety or the environment. In issuing the interim order, Health Canada deemed the risk profile of Arepanrix to be favourable for an interim order. The authorization was based on the risk caused by the current pandemic threat and its danger to human health. As part of the interim order process, Health Canada agreed to indemnify GSK for any claims brought against it in relation to the administration of the Arepanrix vaccine.

[20] Although human trials of Arepanrix were not finished by the time Health Canada authorized its use, the vaccine was not without clinical history.

[34] The plaintiffs’ principal allegation with respect to the standard of care is that GSK failed to make adequate disclosure of the risks involved with Arepanrix.

[35] The plaintiffs began their challenge about disclosure with the evidence of Ms. Hyacenth who testified that she was not told that: (i) the vaccine had not been tested through the usual route, (ii) the vaccine had been subject to a hastened approval process by Health Canada, (iii) adjuvants had never been used in children, (iv) the Government of Canada was indemnifying the vaccine manufacturer; and (v) some countries refused to make the vaccine available because of safety concerns. Ms. Hyacenth says that had she been told about these things she would not have risked having her children vaccinated.

[36] Part of the challenge of the plaintiffs’ inadequate disclosure case is that Ms. Hyacenth was not the direct purchaser of the vaccine. Vaccines are administered through a “learned intermediary,” in this case, her family physician. The issue is significant because any disclosures GSK makes are made in product monographs or inserts that accompany each vial of vaccine. The patient getting the vaccine does not receive the box containing the vaccine and whatever disclosure document it contains. It is the physician who receives this.

[37] GSK did disclose in its Product Information Leaflet for the Arepanrix vaccine and in its product monograph that Health Canada had authorized the sale of the vaccine based on only limited clinical testing and no clinical experience at all with children. Dr. Ledesma-Cadhit believes she knew this from the Health Canada website. She was also aware that Arepanrix was authorized through a special process because of the pandemic.

[38] The product monograph for Arepanrix disclosed that there was limited clinical experience with an investigational formulation of another adjuvanted vaccine but no clinical experience with children. In addition, the product information leaflet and product monograph disclosed a number of risks.

In short, Health Canada approved, or rather authorized, a vaccine that in which trials were still ongoing. The doctor, despite reading the lengthy disclaimer, injected it, and this comes in spite of there being no trials on children.

The Canadian Government had agreed to indemnify the manufacturer, GSK, ahead of time. Moreover, the victims didn’t buy the product from the manufacturer, but from the doctor, a “learned intermediary”. In short, GlaxoSmithKline was legally off the hook for what it sold to the public.

Can we expect the same sort of thing here with Covid-19? Will the Government approve a vaccine (or multiple vaccines), that haven’t properly been tested, and indemnify the manufacturers? After all, the patients aren’t buying directly from the manufacturer, but are getting it from their doctors.

Moreover, doctors are largely immune from action against them if they are following approved practices. In this case, it would be administering drugs that Health Canada approved.

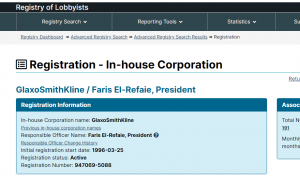

GSK has been registered as lobbying the Federal Government since 1996, and there are hundreds of communications reports. But getting an indemnification agreement was probably just a coincidence.

9. Strange Events Happened In 2010

The next year, Tam would go on to have an appearance in the movie “Outbreak: Anatomy Of A Plague”. She advocated locking people up and putting tracking bracelets on them. Quite the bit of predictive programming.

Rockefeller.Foundation.lockstep.2010

The infamous “Lockstep Narrative” was also written in 2010. That was just one scenario laid out in the infamous paper, but it largely parallels what’s happening today.

10. History Repeating Itself In 2020?

This may seem a bit hyperbolic, but what is going on in 2009 with Swine Flu closely parallels what is happening Covid-19. Main points include:

-Neil Ferguson and Imperial College London

-Useless PCR tests to detect viral infection

-Vaccines not fully tested

-Health Canada approves despite incomplete tests

-Vaccine manufacturers are indemnified

There are some differences though. The World Economic Forum wasn’t touting the “Great Reset”, and communist movements weren’t nearly as overt as today. Or perhaps that was all just setting it in motion.