1. More On Pension Plans/Funding

CLICK HERE, for #1: CPPIB invests $2B in Mumbai, India.

CLICK HERE, for #2: CPP underfunded, money leaving Canada.

2. Important Links

CLICK HERE, for CPPIB Investing $2B In Mumbai, India.

CLICK HERE, for earlier piece on Canada Pension Plan.

CLICK HERE, for 2000 audit. $443B shortfall (Page 113)

CLICK HERE, for 2006 audit. $620B shortfall (Page 73). $67.9B added as of 2009.

CLICK HERE, for 2012 audit. $830B shortfall (Page 48)

CLICK HERE, for 2015 audit. $884B shortfall (Page 48)

CLICK HERE, for the 2019 CPPIB Annual Report.”

CLICK HERE, for getting your statement of earnings.

CLICK HERE, for CPP benefits for 2019 year.

CLICK HERE, for a generic investment calculator.

CLICK HERE, for a 2017 UN report on leveraging African pension funds for financing infrastructure development.

CLICK HERE, for 2019 report on development financing.

CLICK HERE, for closing infrastructure funding gap.

3. Obtain Your Statement Of Contributions

Any Service Canada should be able to help you apply for a copy of your statement of contributions. One tip is to do it after a tax assessment to get the most up to date information. You will need your social insurance number.

Also, you can request your statement by mail.

Contributor Client Services

Canada Pension Plan

Service Canada

PO Box 818 Station Main

Winnipeg MB R3C 2N4

Once you have received it, you will get a lot of new information you didn’t have before. Yes, I have mine from 2018, and am ordering a 2019 statement.

4. Information From Statement Of Contributions

A quote from the 2018 statement:

You and your employer each paid 4.95% of your earnings between the minimum of $3,500 and the maximum of $55,900 for 2018. These are called “pensionable earnings. Self employed individuals paid contributions of 9.9% on these amounts.

The maximum retirement pension at age 65 this year is $1,134.17 per month.

A few things to point out here:

You and your employer “both” paid 4.95% of your earnings between the minimum and maximum amounts. So if you made $25,000 then $21,500 of it would be taxable. Both you and your employer would have contributed $1,064.25 towards it. Combined is $2128.50.

Suppose you made over $55,900. Then $52,400 of it would have been taxable, and both you and the employer would have paid $2,593.80 into it. Combined is $5187.60.

Let address the elephant in the room. How much: (a) will CPP actually pay out for you; and (b) what would you make if you invested the CPP contributions yourself?

5. How Much Will CPP Pay Out For You?

Assuming retirement at age 65, and average life expectancy is 82. That gives 17 years, (204 months) of receiving pension contributions.

For the 2019 year, the maximum is listed as $1,154.58, and the average is $679.16. None of this covers Old Age Security (OAS) or Guaranteed Income Supplement (GIS). Those are separate and fall outside of CPP.

The average earner:

($679.16/month)X(17 year)X(12 month/year) = $138,540

The top earner:

($1,154.58/month)X(17 year)X(12 month/year) = $235,534

For simplicity, inflation is ignored, as is indexing of contributions.

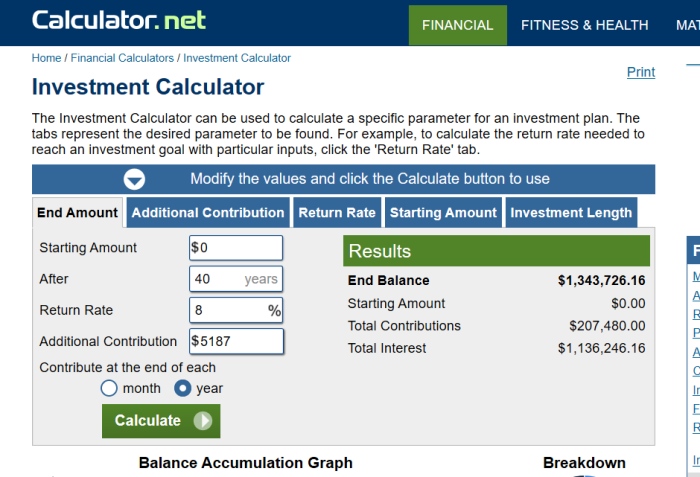

6. Invest Your Own CPP Contributions

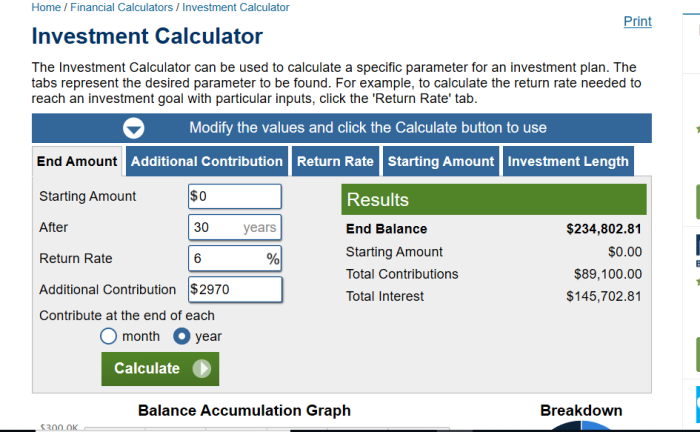

Yes, contributions and interest rates vary, but for simplicity, let’s keep them consistent.

For the top earner, let’s do this scenario:

(a) Worked for 40 years

(b) Contributed full amounts

(c) Invested at 8% annually.

Yes, the interest is absurd, but CPPIB claims that is what it is getting. In fact, CPPIB states that it gets 6.6-18% interest on its fun each year.

Over $1.3 million. That is what you would have after 40 years, making full contributions, assuming those contributions (both yours and the employer’s) were fully invested. A far cry from the $235,000 that you would make from 17 years of CPP payouts. Over a million more in fact.

Even just a 3% return — which is very doable — would net you $390,000 over those 4 years. Almost double what CPP would be paying out.

For an average earner, let’s try different numbers:

(a) Worked for 30 years

(b) Earned ~$30,000 annually contributed $2,970

(c) Invested at 6% annually.

$235,000 the person would have earned. This is about $100,000 more than simply taking the average payouts from Canada Pension Plan.

Why the different numbers? Perhaps the person took several years off for childcare. Perhaps there were years with low earnings. And 6% is a more realistic return, although good luck getting that from a bank. To repeat, CPPIB claims 6-18% returns (after costs) annually.

To be fair, people who go decades without working are unlikely to ever be able to save and invest the equivalent of what CPP is paying out.

For example, my own statement of contributions estimates if I were magically 65 today. With only a decade of work, I would be getting $317/month. Over the next 17 years that would pay out about $65,000, far more than I would have put in.

But long term and steadily employed workers get screwed.

7. Performance CPPIB Claims In Investments

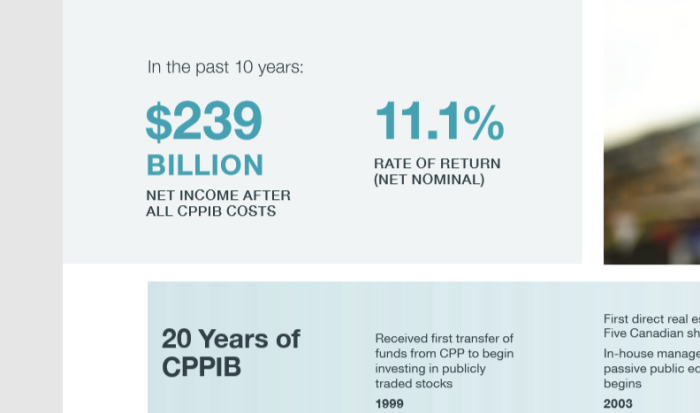

This was addressed in the previous piece. In the CPPIB Annual Reports, the Board claims to have staggering growth year after year. Of the years listed, the interest ranges from 6% to 18%.

| Year | Value of Fund | Inv Income | Rate of Return |

|---|---|---|---|

| 2010 | $127.6B | $22.1B | 14.9% |

| 2011 | $148.2B | $20.6B | 11.9% |

| 2012 | $161.6B | $9.9B | 6.6% |

| 2013 | $183.3B | $16.7B | 10.1% |

| 2014 | $219.1B | $30.1B | 16.5% |

| 2015 | $264.6B | $40.6B | 18.3% |

| 2016 | $278.9B | $9.1 | 6.8% |

| 2017 | $316.7B | $33.5B | 11.8% |

| 2018 | $356.B | $36.7B | 11.6% |

| 2019 | $392B | $32B | 8.9% |

Also, as outlined in the last article, the accounting method used also changes how your pension plan comes across. You can select your data, and paint a rosy picture. Or you can take ALL assets and liabilities into account.

When the Canada Pension Plan was properly audited in 2016, it was found to have $884.2 billion in unfunded liabilities. The 2019 Annual report lists $392 billion as the value of the fund. However, with over a trillion dollars in liabilities, that illusion came crashing down.

$239 billion in growth over the last decade, an 11% annual increase. But in spite of that, CPP is not paying out retirees anywhere near what they have put in.

Why? Where is the money going?

8. CPP Unfunded Liabilities Swept Under Rug

Here are quotes from some of the actuarial reports. Interesting how they go out of their way to gloss over the truth about the CPP. In 2 of the reports, the total unfunded liabilities are reduced to a mere footnote.

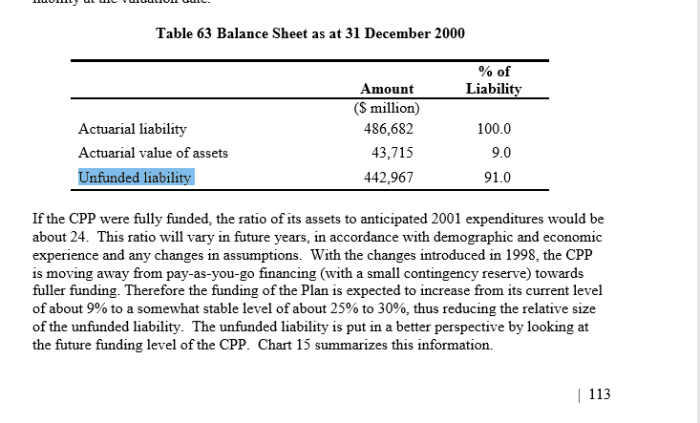

Page 113 in 2000 audit. Actuarial liability 486,682M Actuarial value of assets 43,715 or 9%, Unfunded liability 442,967M or 91% of total. That’s right, ten times as many liabilities as assets.

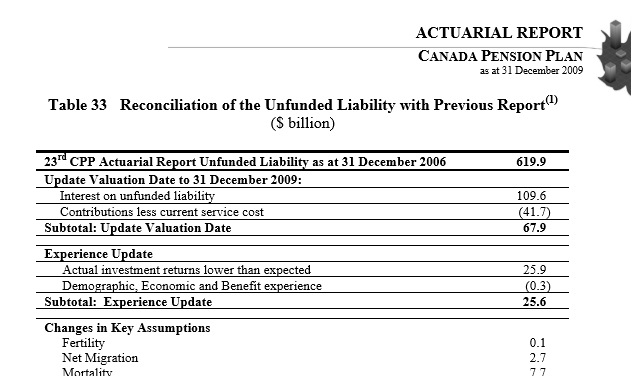

Page 73 in 2006 audit report. $619.9B in unfunded liabilities. Updated in 2009 to reflect another $67.9B on the interest (just the interest) of those unfunded liabilities.

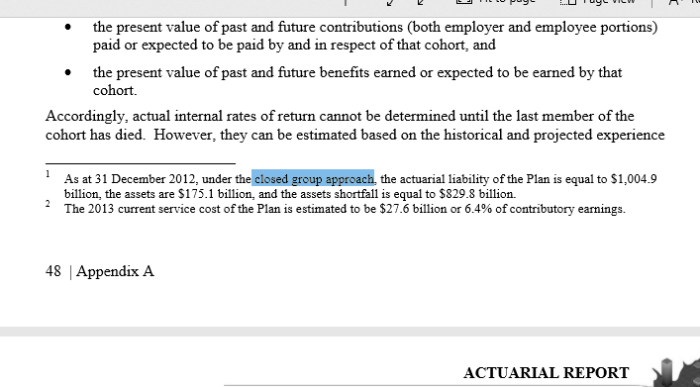

Footnote from 2012 audit. When the “closed-group approach” is used to audit the program, the assets are $175.1 billion, actuarial liability of the Plan is equal to $1,004.9 billion, and the assets shortfall is equal to $829.8 billion

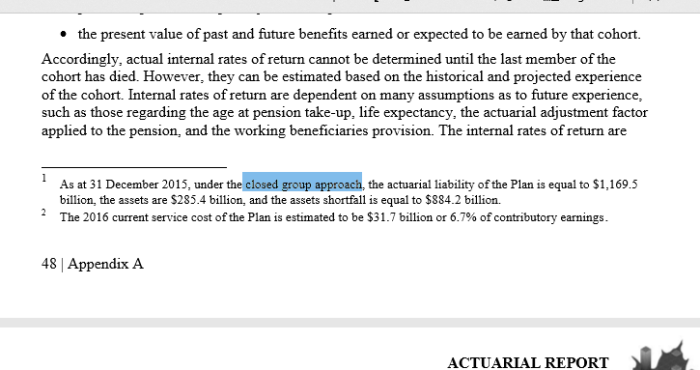

Footnote from 2015 audit. Using “closed-group approach” to audit, the actuarial liability of the Plan is equal to $1,169.5 billion, the assets are $285.4 billion, and the assets shortfall is equal to $884.2 billion

Despite the glowing reviews our politicians give, the Canada Pension Plan is not doing well. In fact, it has close to a trillion dollars in unfunded liabilities. This is not sustainable in the slightest.

Younger workers will be paying into a system they have no realistic hope of ever collecting on. Not a good social safety net.

By now you are probably wondering these things:

The CPP, for most people, will never actually pay out anywhere near the amount that the person contributes over their lifetime. This is on top of the nearly 1 trillion shortfall that the plan has. So if the plan won’t pay out fully, and yet is so broke, where is the money going?

Who is running the show?

9. Open-Group v.s. Closed-Group Valuation

The difference is this:

Open-group valuation principles mean that a pension is solvent and in good shape as long as it’s current assets and payouts are able to keep up with the demands of retirees at the moment. It doesn’t require that the pension plan be fully funded. The reasoning is there is a “social contract”, and that the Government can raise more money (tax more) to cover the shortfalls.

Closed-group valuation principles require that “all” liabilities be taken into account. The is a far more accurate method, as payments from all workers are considered, if those who won’t retire for decades. The rationale is that private companies could go bankrupt at any time, and need to take the actual amounts into account.

10. CPPIB Board Members Well Connected

Heather Munroe-Blum

- Principal and Vice Chancellor (President), McGill University

- Current Director of the Royal Bank of Canada

- Hydro One (Ontario)

- Trilateral Commission

Ashleigh Everett

- Former Director of The Bank of Nova Scotia

- Premier’s Enterprise Team for the Province of Manitoba

William ‘Mark’ Evans

- Former member of the Management Committee at Goldman Sachs

- Co-founded TrustBridge Partners in China (2006)

- Kindred Capital in Europe (2016)

Mary Phibbs

- Standard Chartered Bank plc

- ANZ Banking Group

- National Australia Bank

- Commonwealth Bank of Australia

- Allied Irish Banks plc

- Morgan Stanley Bank International Ltd

- The Charity Bank Ltd

Tahira Hassan

Kathleen Taylor

- Chair of the Board of the Royal Bank of Canada

- Director of Air Canada since May 2016

- Chair since April 2019 of Altas Partners

Karen Sheriff

- United Airlines

- Director of WestJet Airlines

Jo Mark Zurel

Not proof of any wrongdoing, but the board is certainly connected to other institutions.

11. CPPIB Holdings (Foreign & Domestic)

Here are CPPIB’s Canadian holdings.

Here are CPPIB’s foreign holdings.

$44M in from Power Corporation (Desmarais)

$17M in Hydro One Ltd (Heather Munroe-Blum is former board member)

$555M in RBC (Heather Munroe-Blum is board member)

$292M in Scotia Bank (Sylvia Chrominska is former chair)

In fairness, there are hundreds of companies CPPIB invests in. But always keeping an eye out for potential conflicts of interest.

But having all of these assets (both within Canada and abroad), doesn’t really explain the trillion dollar shortfall. There has to be something else that the CPPIB is wasting Canadian pensioners’ retirement savings on.

12. Pensions Sent For UN Development Projects?

Yes, this sounds absurd, but consider this report from the UN about using pensions to leverage development projects. True, this report refers to African pension funds. But it is entirely possible that Canada could get involved (or already be involved) in some similar scheme.

III. PENSION FUNDS DIRECT INVESTMENT IN INFRASTRUCTURE

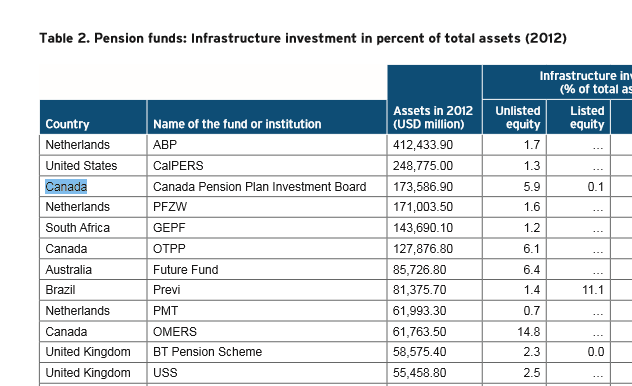

International experience At 36.6 percent of GDP, assets of the pension funds in OECD countries are relatively large. As of end-2013, pension-fund assets were even in excess of 100 percent in countries such as the Netherlands, Iceland, Switzerland, Australia, and the United Kingdom (Figure 1). In absolute terms, pension funds in OECD countries held $10.4 trillion of assets.25 While large pension funds (LPFs) held about $3.9 trillion of assets, assets in public and private sector and public pension reserves (PPRFs) stood at $6.5 trillion.

Individual pension funds can be relatively large in some countries such as the Netherlands (ABP at $445.3 billion and PFZW at $189.0 billion) and the U.S. (CalPERS at $238.5 billion, CalSTRS at $166.3 billion, and the New York City Combined Retirement System at $150.9 billion). Similarly, PPRFs are relatively large in the U.S. (United States Social Security Trust Fund at $2.8 trillion) and Japan (Government Pension Investment Fund at $1.2 trillion). Among emerging markets, South Africa (Government Employees Pension Fund (GEPF) at $133.4 billion) and Brazil (Previ at $72 billion) have the largest funds in Africa and Latin America, respectively.

Pension funds can dedicate a share of their assets specifically to infrastructure. Such direct investment in infrastructure is implemented through equity investment in unlisted infrastructure projects (through direct investment in the project or through a private equity fund). Such investment can also take the form of debt investment in project and infrastructure bonds or asset-backed security. In contrast, pension funds can allocate a share of their funds indirectly to infrastructure through investment in market-traded equity and bonds. Listed equity investment can take the form of shares issued by corporations and infrastructure project funds while debt investment is often in the form of corporate market-traded bonds.

As is plain from the text, (Page 10), the UN views pensions as a potential investment vehicle for their agendas. And is clear from the pages in the reports, the UN has been sizing up pension funds from all over the world.

This is more than just an academic exercise

IV. OBSTACLES TO PENSION FUNDS INVESTMENT IN INFRASTRUCTURE

The extent to which pension funds can invest in infrastructure depends on the availability of assets in the pension system. Asset availability, in turn, is driven by a number of factors including the pension system’s environment, design, and performance. Even in a well-performing pension system with ample assets available for investments, the governance, regulation, and supervision of pension funds can restrict those funds’ ability to actually invest in infrastructure. If such constraints are lifted, then pension funds need to consider the risks of infrastructure projects and demand a fair, transparent, clear, and predictable policy framework to invest in infrastructure assets. Once this hurdle is overcome, pension funds will need adequate financial and capital market instruments to implement their investment decisions.

Simple enough (page 13). Lift the regulations, and the pension money will be free to flow to UN development projects. And after all, who knows better about spending other people’s money?

The endless foreign aid gestures that our government engages in: is that really our pension money being sent abroad?

We can see from Table 2 (Page 16) that the UN has been sizing up:

- Canada Pension Plan ($173B in assets)

- Ontario Municipal Employees ($62B in assets)

- Ontario Teachers’ Pension Plan ($128B in assets)

- Quebec Pension Plan ($39B in assets)

The recent OECD policy guidance for investment in clean energy, which is based on the PFI illustrates how policymakers can identify ways to mobilize private investment in infrastructure (OECD, 2015c). The policy guidance focuses on electricity generation from renewable energy sources and improved energy efficiency in the electricity sector, and provides a list of issues and questions on five areas of the PFI (investment policy, investment promotion and facilitation, competition policy, financial market policy, and public governance).

(Page 31) Clearly the UN is pushing its enviro agenda and suggesting that public pensions be used to finance at least part of it.

13. So Why Is CPP So Underfunded?

A number of factors most likely.

(A) Most pension plans are ponzi-style. In order to stay funded, it requires an ever growing number of contributors in order to pay off older contributors. Rather than having members who can sustain themselves, this is dependent on infinite growth.

(B) Although a person contributing to a pension in their career would “theoretically” be self-sufficient, it is clear the interest and gains are not what CPPIB pretends. If the fund was growing at 10%+ year over year, it would be different. We are not getting the full story.

(C) Public sector pensions are not sustainable either. So, very likely that some CPP money is being diverted to help cover the shortfalls.

(D) Due to political pressure, the powers that be find it more convenient to downplay the serious shortfalls rather than meaningfully address it. No political will to ask the hard questions.

(E) There has to be money going to outside projects, such as the UN plot to use pensions to fund their development agenda. The UN is a money pit, and the waste is probably enormous.

To repeat from the last post:

We are screwed.