(UN: Mark Carney to become Special Envoy for Climate Action & Finance, once he leaves post at Bank of England)

(Notice, from COP25 in Madrid, Spain)

(Carney: businesses ignoring climate change will go bankrupt)

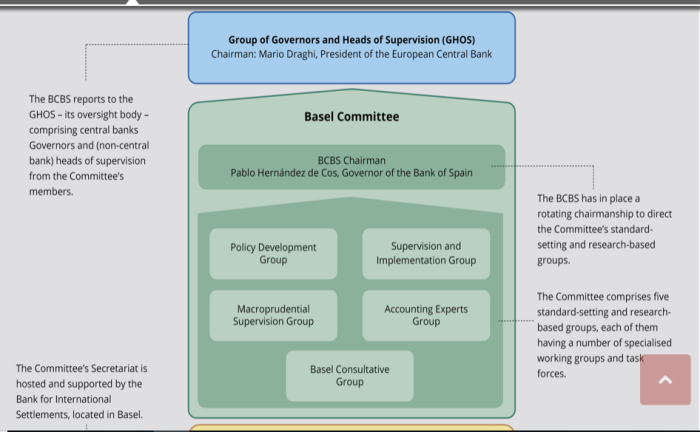

(Bank for International Settlements)

(Chicago Climate Exchange)

1. Context For This Piece

Mark Carney is the current head of the Bank of England, and is the former head of the Bank of Canada. After he leave the BoE, he will take on a UN position as the Special Envoy on Climate Action and Finance.

Carney will supposedly be working for a token $1/year, which means that money is not the motivation. Rather it is ideological. Okay, so why is he doing this? And why would the UN go an seek out a head of 2 Western central banks? Is there to become a “central bank” of carbon credits and emissions trading? Will nations who don’t cut Carbon Dioxide be hit with extra bank fees, or have their assets frozen or seized?

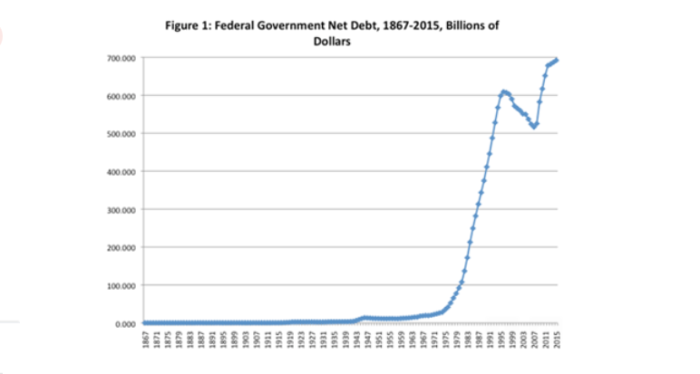

The Bank for International Settlements in Switzerland is sort of a central bank for central banks. Debt, credit, interest and monetary policy all come from the BIS. It’s an illusion that individual nations are sovereign. In fact, the Rothchild Family controls the banking for most nations on the planet. So it is extremely powerful. Now, why would a head of 2 central banks (England and Canada) be put in charge of climate action and finance?

Furthermore, Carbon Dioxide is not pollution, but a fundamental part of photosynthesis and respiration. An 8th grade science text book would confirm that. So the “science” is bogus, especially when the issue of solar activity is repeatedly ignored.

Also included is Chicago Climate exchange, which Wikipedia describes as “North America’s only voluntary, legally binding greenhouse gas (GHG) reduction and trading system for emission sources and offset projects in North America and Brazil”.

If these “carbon credits” are being bought, sold and traded just as another commodity, then one has to ask the obvious question: how much of this is about the environment, and how much is just a money-making gimmick?

2. Mark Carney, UN Climate Action/Finance

On 1 December 2019, in Madrid, Spain, the Secretary-General announced the appointment of Mr. Mark Joseph Carney, OC, of Canada as his Special Envoy on Climate Action and Finance. As Special Envoy, he will focus on ambitious implementation of climate action, with special attention to significantly shifting public and private finance markets and mobilizing private finance to the levels needed to achieve the 1.5°C goal of the Paris Agreement. This will include building the frameworks for financial reporting, risk management and returns in order to bring the impacts of climate change to the mainstream of private financial decision making and to support the transition to a net zero carbon economy.

We need unprecedented climate action on a global scale. And public and private financial systems must be transformed to provide the necessary finance to transition to low-emission and resilient systems and sectors. The Secretary-General will count on Mark Carney to galvanise climate action and transform climate finance as we build towards the 26th Conference of the Parties (COP) meeting in Glasgow in November 2020

Mr. Carney began his career at Goldman Sachs before joining the Canadian Department of Finance and later serving as the Governor of the Bank of Canada (2008-2013). He was born in Fort Smith, Northwest Territories, Canada in 1965. He received a bachelor’s degree in Economics from Harvard University in 1988. He went on to receive a master’s degree in Economics in 1993 and a doctorate in Economics in 1995, both from Oxford University.

Carney’s announcement sounds impressive, but let’s be clear: this is about wide scale wealth transfer. The claims about environmentalism and saving the planet are just pretexts for doing so.

It’s interesting to tap a former banker (heads of both Bank of Canada and Bank of England). Does he plan to use this “climate finance” agenda the same way that central banks control national finances?

Climate modelling over any length of time has never worked. Why? Because models are just guess, predictions. They aren’t proof of anything. And despite claims to the contrary, the people doing the estimating know so little about the environment that such precise predictions aren’t realistic. Also, scientific research is frequently politically driven.

3. Announcement From COP25 In Madrid

The UN Secretary-General has outlined the “increased ambition and commitment” that the world needs from governments during the coming days of the COP25 UN climate change conference which opens in Madrid on Monday, calling for “accountability, responsibility and leadership” to end the global climate crisis.

The “social dimension” of climate change must also be paramount, so that national commitments include “a just transition for people whose jobs and livelihoods are affected as we move from the grey to the green economy.”

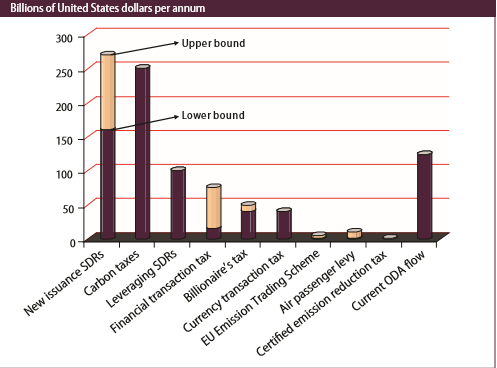

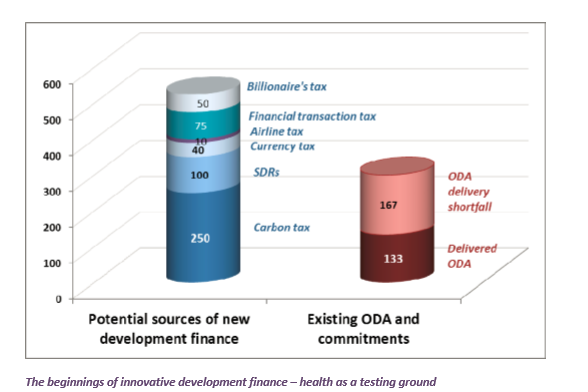

Mr. Guterres said at least $100 billion dollars must be made available to developing countries for mitigation and adaptation and to take into account their “legitimate expectations to have the resources necessary to build resilience and for disaster response and recovery.”

A statement from the Spokespersons’ office said his tasks would include “building the frameworks for financial reporting, risk management and returns in order to bring the impacts of climate change to the mainstream of private financial decision making and to support the transition to a net zero carbon economy.”

The Bank of England Governor has held numerous positions in finance in both the private and public sectors and will become a member of UN staff at the point at which he ceases to work for the Bank. He also served, from 2011 to 2018, as Chair of the Financial Stability Board and Governor of the Bank of Canada from 2008-2013.

“The Secretary-General will count on Mark Carney to galvanise climate action and transform climate finance”, as the UN looks to next year’s 26th Conference of the Parties (COP26), due to take place in Glasgow, Scotland.

COP25 in Madrid. Pardon the sarcasm, but these questions need to be asked: if climate change is such a pressing matter, why have they not accomplished their goals in 25 annual conferences? Why do we finish one conference and immediately schedule another? If burning fossil fuels is so harmful, then why do tens of thousands of people have to fly across the world? Why not video conference?

Guterres admits that at least $100 billion needs to be raised. Okay, very expensive agenda.

It’s also admitted that a lot of this money won’t be used for “climate change”. Instead, it will be used to pay off people whose livelihoods have been destroyed.

Carney is a former central bank head (UK and Canada), Is he in this role to remake the climate change scam this way? Is the UN going to establish a sort of “UN central bank” to regulate and control carbon taxes?

4. Is This Just A Protection Racket?

From a piece by YourNews.com:

LONDON (Reuters) – Businesses that fail to adapt to climate change will go bust, Bank of England Governor Mark Carney said on Wednesday, but others will be able to profit handsomely from funding green investment.

“Companies that don’t adapt – including companies in the financial system – will go bankrupt without question. (But) there will be great fortunes made along this path aligned with what society wants,” Carney told Channel 4 News.

From the Guardian:

Companies and industries that are not moving towards zero-carbon emissions will be punished by investors and go bankrupt, the governor of the Bank of England has warned.

Mark Carney also told the Guardian it was possible that the global transition needed to tackle the climate crisis could result in an abrupt financial collapse. He said the longer action to reverse emissions was delayed, the more the risk of collapse would grow.

From a piece by Reuters:

LONDON (Reuters) – Businesses that fail to adapt to climate change will go bust, Bank of England Governor Mark Carney said on Wednesday, but others will be able to profit handsomely from funding green investment.

“Companies that don’t adapt – including companies in the financial system – will go bankrupt without question. (But) there will be great fortunes made along this path aligned with what society wants,” Carney told Channel 4 News.

There are many more articles on the subject, but the above describes it bluntly. Carney, in his new role, is making it clear that businesses that don’t adapt will go bankrupt. In fairness, this could simply be grandstanding to make headlines. However, Carney could actually be sincere about it.

Now, this “could” be interpreted to mean that they will simply not be able to keep up with changing conditions. But a more likely meaning is that companies who do not play along will be shut down — one way or another.

If this is the latter case, then this is nothing more than an elaborate protection racket. Play along, pay your fees, jump through the hoops, etc… Or else, you won’t be doing business here (or anywhere) anymore. More sophisticated than mafia thugs who simply burn down your business, but the basic idea is much the same.

5. A New Form Of Central Banking?

For background information, please review the CENTRAL BANKING articles posted previously on this site. Lots of important detail is given in these other postings.

An interesting article by Christians For Truth suggests that Rothschilds’ central banking cartel is behind the move to force climate action. It quotes the Guardian article and then concludes:

The Rothschilds founded the Bank of England right after the Jews were readmitted to England after having been expelled for 300 years by King Edward I for usury and ritual murder. The BoE was the first central bank to issue money as unpayable debt, the world’s greatest Ponzi Scheme, and it has been the model of all central banks, including the Federal Reserve, since then.

And if you want to understand why the global warming or “climate change” propaganda is pushed 24/7 by the jewish-controlled media, now you know: the Rothschilds are using it as a way of keeping their ever-expanding Ponzi Scheme afloat, and they clearly intend to threaten and punish any businesses that won’t play ball.

While it seems easy to dismiss the article as conspiracy theory nonsense, it is worth a look. Does the Bank for International Settlements engage in this climate finance agenda? Are they getting in on the United Nations’ climate change scam?

And absolutely, BIS does involve itself in the climate change scam. A quick search of “climate finance” yields 1276 results. Search “climate finance Mark Carney” and 76 hits comes up. So it is not at all a conspiracy theory to see cooperation between the banking cartel and the climate cartel. It looks like they are cooperating to screw us over.

Let’s look at some of these articles.

https://www.bis.org/review/r191008a.htm

Mark Carney: TCFD – strengthening the foundations of sustainable finance

https://www.bis.org/review/r160523b.htm

Mark Carney: The Sustainable Development Goal imperative

https://www.bis.org/review/r120622c.pdf

Mark Carney: Financing the global transition

https://www.bis.org/review/r151130f.pdf

Klaas Knot: The role of central banks; the Netherlands Bank and sustainable finance

https://www.bis.org/review/r191029a.htm

Jens Weidmann: Climate change and central banks

https://www.bis.org/review/r190206b.pdf

Climate Change and the Irish Financial System

https://www.bis.org/fsi/publ/insights20.pdf

Turning up the heat – climate risk assessment in the insurance sector

https://www.bis.org/review/r181122b.pdf

Remarks at the Accounting for Sustainability Summit 2018

The above is just a small sample of what is on the Bank for International Settlements’ website. Again, just searching “climate finance” gets 1276 hits. So they are very active on this topic, and have been for years. It’s not at all a stretch to think that the BIS and the UN will collaborate to control Carbon taxes, and climate finance.

Of course, it’s not clear — yet — how exactly the BIS will be involved in running this scheme. But it’s disturbing, putting one of their operatives at head of the UN “climate finance action”.

6. Chicago Climate Exchange

We started out in 2000 with the idea of transforming the energy markets by creating an electronic marketplace that removed barriers and drove transparency and access.

By staying close to customers, we saw the demand for the efficiency that technology brings and expanded our electronic trading platform into new markets. At the same time we understood that along with liquidity, trust and integrity are central to the effective operation of markets and began investing to build and acquire clearing houses.

As our electronic markets and demand for clearing grew, access to new sources of information became central to our customers and data has increasingly become the lifeblood of markets. We saw this evolution and consistently we advanced our capabilities, building a data business which is complementary to every part of our solution.

Despite the word salad this is an organization that tries to effectively run a climate bond trading market. Setting aside the bogus science, this is an industry that can only survive as long as people keep buying into the scam. Sooner or later, it will collapse.

If we follow the time line on where Obama was during the funding of the Chicago Climate Exchange, he was still a lecturer at the University of Chicago Law School teaching constitutional law, with his law license becoming inactive a year later in 2002.

It may be interesting to note that the Chicago Climate Exchange in spite of its hype, is a veritable rat’s nest of cronyism. The largest shareholder in the Exchange is Goldman Sachs. Chicago Mayor Richard M. Daley is its honorary chairman, The Joyce Foundation, which funded the Exchange also funded money for John Ayers’ Chicago School Initiatives. John is the brother of William Ayers.

This Canada Free Press article, see archive, gives a damning critique of the operation. It also raises point that the biggest shareholder was Goldman Sachs. This is important as Mark Carney worked for Goldman Sachs, and in fact was their managing director of investment banking.

Read the Britannia piece for more information on Carney’s background, but the conflict of interest here is plainly visible.

(1) Carney was a Director for Goldman Sachs.

(2) Goldman Sachs was largest shareholder of Chicago Climate Exchange.

(3) CCE’s existence was based on the climate bonds industry.

(4) Carney is former head of Bank of Canada.

(5) Carney is current head of Bank of England.

(6) Carney used positions at BoC and BoE to promote climate change agenda

(7) Carney promotes climate change with Bank for International Settlements.

(8) Carney gets a UN post to push climate finance agenda.

Mark Carney has been going on about the dangers of climate change for years. Now, is he doing so as a concerned head of the Bank of Canada or Bank of England? Or is he doing so as a Director for Goldman Sachs, and part owner of the Chicago Climate Exchange? Pretty hard to tell, isn’t it?

7. Where Does This Lead?

Hard to say for sure. But it looks like the banking cartel and the climate change cartel are effectively working together. Perhaps this is just a way of centralizing and controlling the scheme more efficiently.

However, it is nonsense to think that paying taxes to the UN, or the Bank for International Settlements (or anyone) will make the climate better. It is a money grab, and junk science. Again, Carbon Dioxide, the most commonly cited “greenhouse gas”, is not pollution. It is necessary in order to sustain life.

Even if these taxes were to be avoided, the only way to do so would be to collapse the economy, and get rid of most (or all) of industrialization. If that is the goal, then it’s one that will effectively end Western civilization.

At what point can we call these people traitors?

(1) https://www.un.org/sg/en/content/sg/personnel-appointments/2019-12-01/secretary-general-appoints-mark-joseph-carney-of-canada-his-special-envoy-climate-action-and-finance

(2) https://news.un.org/en/story/2019/12/1052491

(3) https://www.britannica.com/biography/Mark-Carney

(4) https://yournews.com/2019/07/31/1120477/boes-carney-warns-of-bankruptcy-for-firms-that-ignore-climate/

(5) https://www.theguardian.com/environment/2019/oct/13/firms-ignoring-climate-crisis-bankrupt-mark-carney-bank-england-governor

(6) https://www.reuters.com/article/us-britain-boe-carney-idUSKCN1UQ28K

(7) https://money.usnews.com/investing/news/articles/2019-07-31/boes-carney-warns-of-bankruptcy-for-firms-that-ignore-climate-change

(8) https://www.theice.com/index

(9) https://en.wikipedia.org/wiki/Chicago_Climate_Exchange

(10) https://canadafreepress.com/article/obamas-involvement-in-chicago-climate-exchange-the-rest-of-the-story