1. Important Links

(1) https://www.snclavalin.com/en

(2) https://www.snclavalin.com/en/about/leadership-and-governance/board-of-directors

(3) http://www.trudeaufoundation.ca/en/community/jacques-bougie

(4) https://pressprogress.ca/more-than-half-of-the-canada-infrastructure-banks-board-of-directors-have-liberal-connections/

(5) https://buffalochronicle.com/2019/03/22/bmos-kevin-lynch-threatened-job-losses-in-call-to-wernick/

(6) https://canucklaw.ca/canadian-infrastructure-bank-and-cib-act/

(7) https://laws.justice.gc.ca/eng/acts/C-6.18/FullText.html

(8) https://canucklaw.ca/canadas-bill-c-74-deferred-prosecution-agreementand-oecd-anti-bribery-agreementand-oecd-anti-bribery-agreement/

(9) https://www.budget.gc.ca/fes-eea/2018/docs/statement-enonce/fes-eea-2018-eng.pdf (Pgs 37-42)

(10) https://canucklaw.ca/unifor-interview-denies-crawling-into-bed-with-government/

(11) https://www.canada.ca/en/employment-social-development/programs/social-innovation-social-finance/steering-group/member-biographies.html

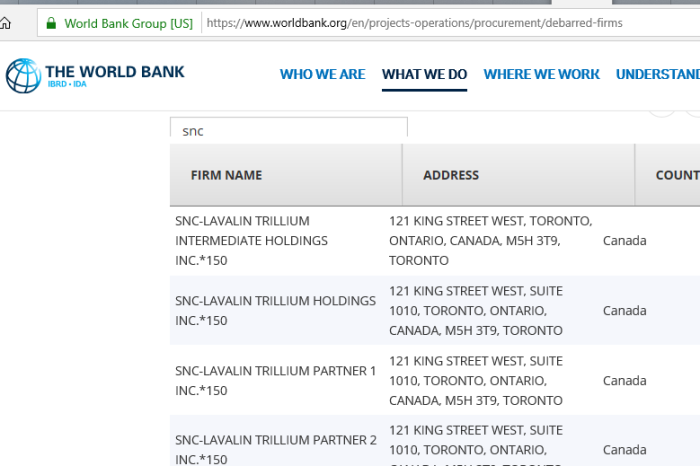

(12) https://www.worldbank.org/en/projects-operations/procurement/debarred-firms

(13) https://laws-lois.justice.gc.ca/eng/acts/d-2.5/page-1.html

(14) https://lobbycanada.gc.ca/eic/site/012.nsf/eng/h_00000.html

(15) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/clntSmmry?clientOrgCorpNumber=359826&sMdKy=1562758127214

(16) https://www.elections.ca/WPAPPS/WPF/EN/CCS/C

(17) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=359914®Id=890581

(18) https://business.financialpost.com/news/rcmp-charges-snc-lavalin-with-fraud-and-corruption-linked-to-libyan-projects

2. Who Are The Board Members Of SNC-Lavalin?

- Ian L. Edwards is the interim President and CEO. Prior to joining Lavalin, he worked at Leighton Asia, which had its own corruption scandal.

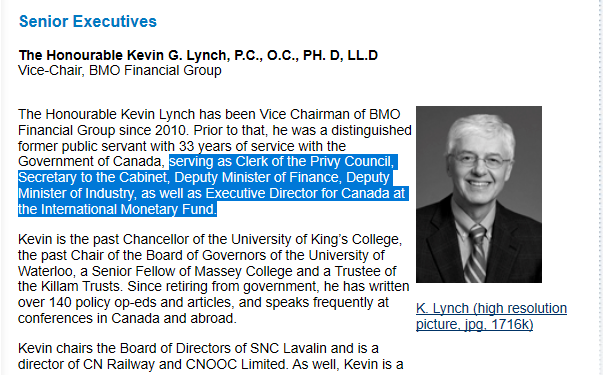

- Kevin Lynch is the Chairman of SNC-Lavalin, but he has also held other interesting roles:

(1) former Clerk of Privy Council;

(2) former Secretary to the Cabinet;

(3) former Deputy Minister of Finance;

(4) former Deputy Minister of Industry;

(5) former Executive Director for Canada at the IMF;

(6) current Vice-Chairman of BMO Financial Group - Jacques Bougie, O.C., is member of Governance & Ethics Committee, with some connections of his own:

(1) Director of CSL Group Inc.;

(2) Director at McCain Foods Limited;

(3) former Board member at RBC;

(4) former Board Member at Bell Canada;

(5) former member of Trilateral Commission;

(6) Member of Trudeau Foundation - Isabelle Courville, Chair of the Human Resources Committee

(1) Chair of the board of directors of the Laurentian Bank of Canada;

(2) President of Bell Canada’s Enterprise segment from 2003 to 2006;

(3) Director of Canadian Pacific Railway Limited;

(4) director of the Institute for Governance of Private and Public Organizations;

(5) former member of APEC Business Advisory Council - Catherine J. Hughes, Member of the Audit Committee

- Steven L. Newman, Chair of the Governance and Ethics Committee

(1) non-executive director of Tidewater, Inc.;

(2) Dril-Quip, Inc.;

(3) Rubicon Oilfield International Holdings GP Ltd;

(4) limited partner of Rubicon Oilfield International Holdings - Jean Raby, Member of the Audit Committee

(1) former adviser to the CFO of Nokia;

(2) member of the board of Fiera Capital Corporation;

(3) Co-CEO of Goldman Sachs (France, then Russia);

(4) Chief Financial and Legal Officer of Alcatel-Lucent S.A - Alain Rhéaume, Member of the Audit Committee

(1) Ministry of Finance of the Québec Government, 1974 to 1996;

(2) former public director of the Canadian Public Accountability Board;

(3) former Executive Vice-President of Rogers Wireless - Eric D. Siegel, ICD.D, Member of the Audit Committee

(1) former President and CEO of Export Development Canada (EDC);

(2) Director of Citibank Canada - Zin Smati,, Chair of the Safety, Workplace and Project Risk Committee

- Benita M. Warmbold, Chair of the Audit Committee, has been in finance for decades. Here are some of her connections.

(1) Senior VP and COO of CPPIB from 2008 to 2013;

(2) Senior Managing Director and CFO of CPPIB from 2013-2017;

(3) Director at Bank of Nova Scotia;

(4) former CFO for Northwater Capital Management Inc

Kevin Lynch is Vice-Chairman of BMO Financial Group.

Jacques Bougie is a former Board Member at RBC.

Benita M. Warmbold is a former Director at Scotia Bank.

Eric D. Siegel is Director at Citibank Canada.

Isabelle Courville is Chair of BOD at Laurentian Bank.

Jean Raby is former Co-CEO of Goldman Sachs.

Alain Rhéaume is former Executive VP of Rogers.

Jean Raby is former advisor to CFP of Nokia.

Jacques Bougie is a former Director at Bell.

3. Access To Privy Council Via Kevin Lynch

(Kevin Lynch, Chairman of SNC Lavalin, among other roles, was Clerk of the Privy Council. He clearly still has access to the Council. Taken from his BMO profile.)

From the Buffalo Chronicle article:

SNC Lavalin Chairman Kevin G. Lynch, who also serves as Bank of Montreal‘s Vice Chairman, placed a call on October 15th to Michael Wernick, during which he repeatedly threatened the Clerk of the Privy Council of a potential loss of 9,000 Canadian jobs — ominously suggesting that the decision was to be made at a looming board meeting. Lynch feared that his firm could be implicated in the widespread bribery of First Nations officials in British Columbia.

Wernick, who holds a bachelors degree in economics from the University of Toronto, did not apply scrutiny to that assertion, despite his training, before repeating the threat to Prime Minister Justin Trudeau and others in the PMO.

Although Lynch had left the Privy Council a decade ago, he clearly still has some clout. A single phone call was enough to get Michael Wernick to attempt to get SNC Lavalin off the hook via the DPA (deferred prosecution agreement). Wernick doesn’t seem to see problem with SNC-L having such easy access to the Privy Council. However, the majority of Canadians do.

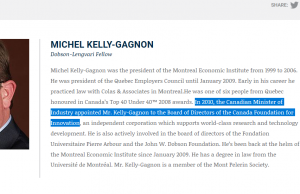

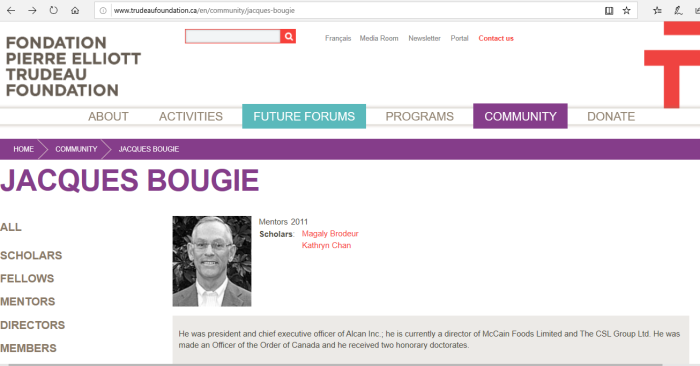

4. Jacques Bougie Sits On Trudeau Foundation

(Jacques Bougie, Member of the Governance and Ethics Committee for SNC Lavalin, also is part of the Trudeau Foundation)

Yet another obvious conflict of interest case. A board member of Lavalin also sitting on the board of the Trudeau foundation. Not that these two roles would ever get Goudie to lean on Trudeau for favourable treatment towards Lavalin.

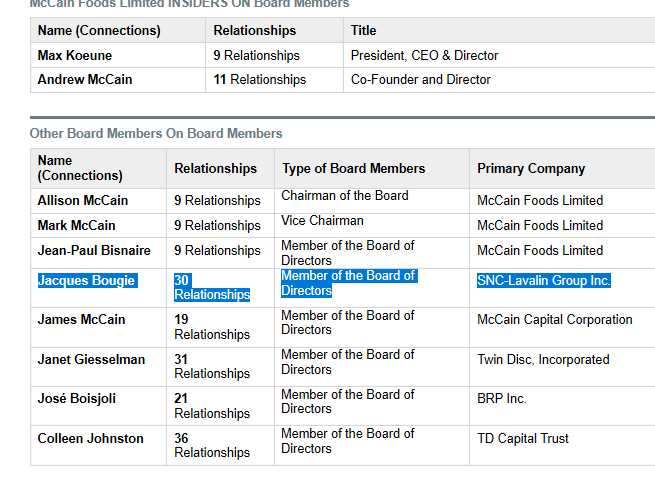

5. Jacques Bougie Also Sits On McCain’s B.O.D.

(Finance Minister Bill Morneau is married to Nancy McCain, heiress to McCain’s Food’s Ltd. Jacques Bougie from SNC-Lavalin “also” sits as a Director for McCain’s.)

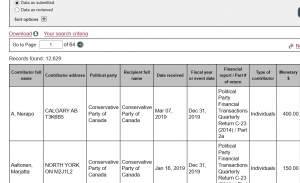

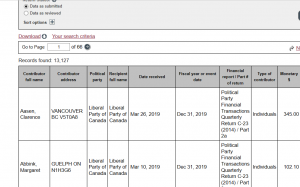

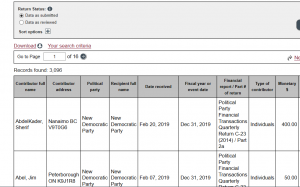

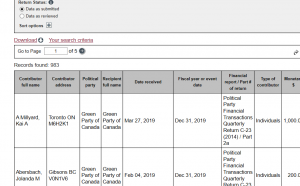

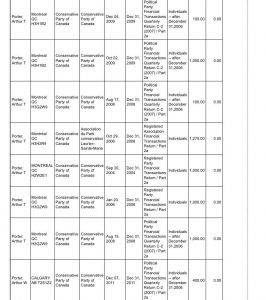

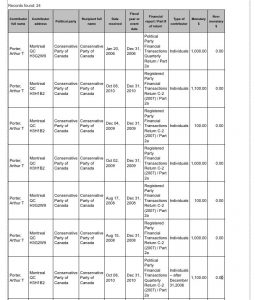

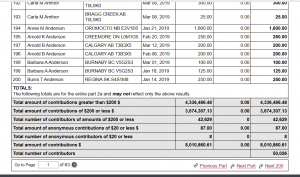

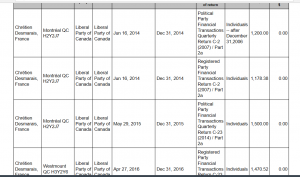

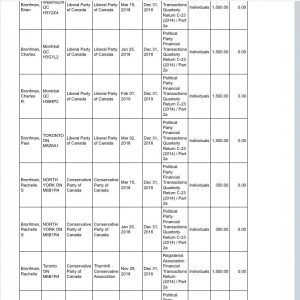

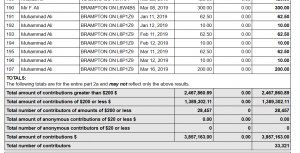

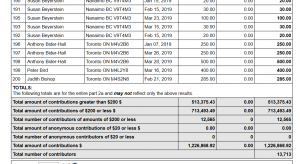

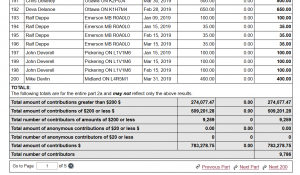

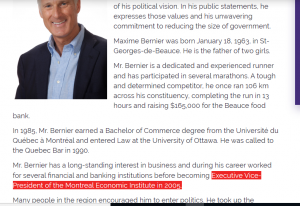

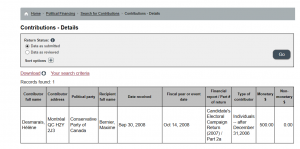

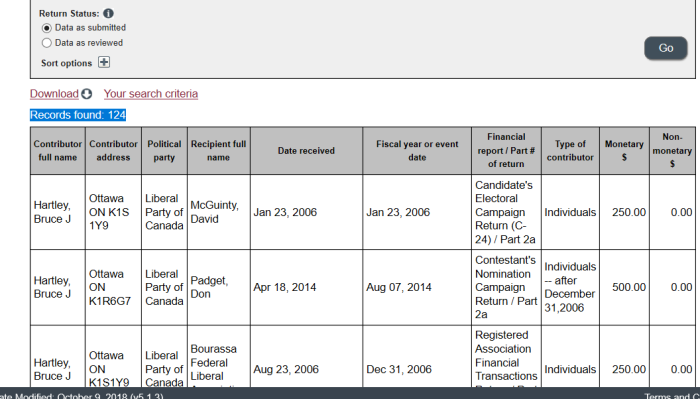

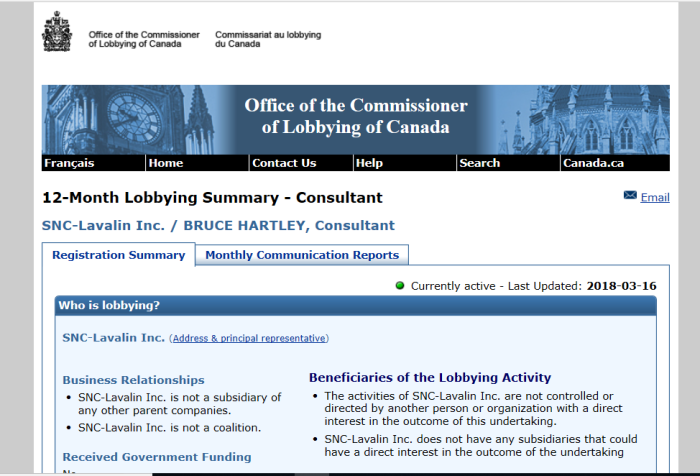

6. Bruce Hartley: SNC Lobbyist & Liberal Donor

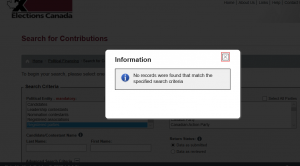

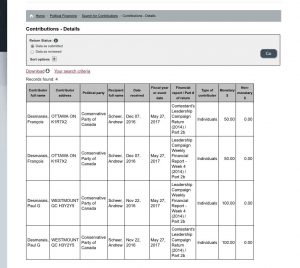

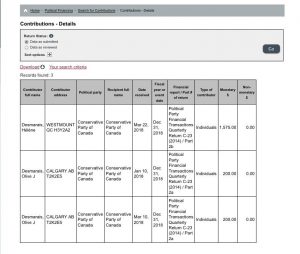

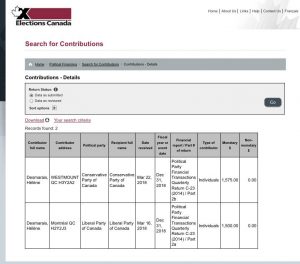

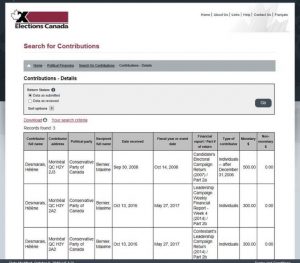

(Bruce Hartley is a regular Liberal donor, according to Elections Canada.)

(Hartley is also a registered lobbyist for SNC-Lavalin)

Bruce Hartley, now a lobbyist for SNC-Lavalin, has donated 124 times since 2005 to the Liberal Party and its members. But now that he acts as a lobbyist, he certainly won’t get the Liberals (whom he supports financially) to do anything nefarious, would he?

Actually, he did. Hartley, in his capacity as an SNC-Lavalin employee, lobbied the Federal Government to introduce the “Deferred Prosecution Agreement” (or DPA). This DPA would allow companies like Lavalin to avoid a 10 year ban on receiving government contracts if found guilty of criminal activity

That’s right. A long time Liberal supporter gets a job as a lobbyist. He then turns around and uses that position to get the law changed to allow his new employer to get off the hook for what would have been a 10 year ban on Canadian contracts.

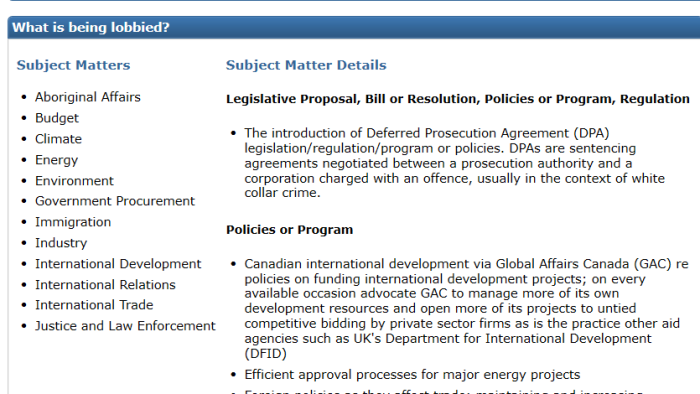

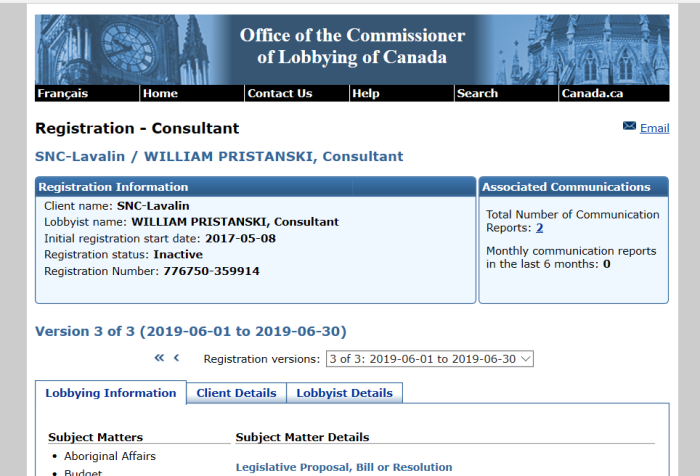

And here is another lobbyist, William Pristanski, who also lobbied to get the deferred prosecution agreement (DPA) for Lavalin.

Reading through his profile with the Lobbying Commissioner of Canada, it seems Pristanski’s role was basically the same as Hartley’s.

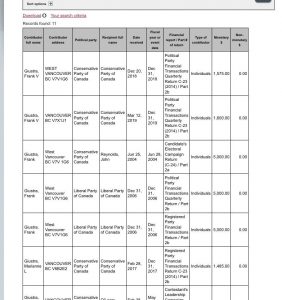

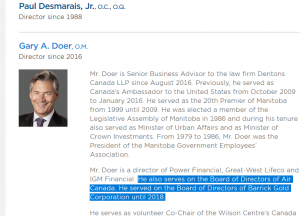

7. SNC Lobbied Current Attorney General David Lametti

(then Parliamentary Secretary to Minister for ISED, David Lametti, met with SNC Lavalin President Neil Bruce)

(McGill University Law Professor, David Lametti, Who is on leave while he sits as the Attorney General of Canada)

(February 13, 2019, McGill University is “gifted” $200M)

(The people who “donated” $200M to McGill University were also caught “donating” almost $1M to Trudeau)

David Lametti is now the Attorney General of Canada, after Jody Wilson-Raybould resigned. Interesting to note that Wilson-Raybould thought that SNC-Lavalin “didn’t” deserve the deferred prosecution. Her successor, Lametti did. Could it be because of Lavalin lobbying him?

Within days of Lametti deciding that SNC-Lavalin was not worth prosecuting, McGill University (where Lametti teaches law), received a $200M “gift” from European Climate Founder McCall MacBain.

Note: Trudeau had also received 2 donations from them.

- $500,000 in 2015 as a candidate

- $428,000 IN 2016 as sitting Prime Minister

8. Lavalin & Libya Connections

The case against SNC and two of its subsidiaries stems from the company’s dealings in Libya between 2001 and 2011, when a senior executive established close ties with Saadi Gaddafi, son of dictator Muammar Gaddafi.

Court documents allege the company offered bribes worth $47.7 million “to one or several public officials of the ‘Great Socialist People’s Libyan Arab Jamahiriya,’” as Gaddafi called the nation he ruled until he was overthrown and killed in 2011.

SNC and its subsidiaries SNC-Lavalin Construction Inc. and SNC-Lavalin International Inc. are also alleged to have defrauded various Libyan public agencies of approximately $129.8 million.

“Corruption of foreign officials undermines good governance and sustainable economic development,” RCMP Assistant Commissioner Gilles Michaud said Thursday. “The charges laid today demonstrate how the RCMP continues to support Canada’s international commitments and safeguard its integrity and reputation.”

(See source.)

Lavalin denies all the allegations, but interesting to see just how deep this runs. There are also allegations that Canadian taxpayers are on the hook for $30,000 for prostitution services for Saadi Gaddafi. He is the son of former dictator Mummar Gaddafi.

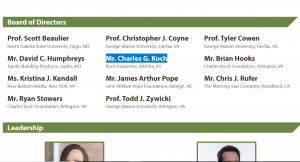

9. Fall 2018 Economic Update Social Finance Fund, A Potential Slush Fund?

While the $595 million media bailout received much attention in the media, far less was paid to the slush fund that was also announced to the Social Finance Program that was also launched.

In June 2017, the Government created a Social Innovation and Social Finance Strategy Co-Creation Steering Group, primarily comprised of experts from the charitable and non-profit sector, to provide recommendations on the development of a social innovation and social finance strategy. The Steering Group delivered its final report, Inclusive innovation: New Ideas and New Partnerships for Stronger Communities, in August 2018. One of the report’s key recommendations was to create a Social Finance Fund to help close the capital financing gap faced by organizations that deliver positive social outcomes, and to help accelerate the growth of the existing social finance market in Canada.

To help charitable, non-profit and other social purpose organizations access new financing, and to help connect them with private investors looking to invest in projects that will drive positive social change, the Government proposes to make available up to $755 million on a cash basis over the next 10 years to establish a Social Finance Fund. Additionally, the Government proposes to invest $50 million over two years in an Investment and Readiness stream, for social purpose organizations to improve their ability to successfully participate in the social finance market. It is expected that a Social Finance Fund like the one the Government is proposing could generate up to $2 billion in economic activity, and help create and maintain as many as 100,000 jobs over the next decade.

The Steering Committee consists of 16 members, who will doll out the cash.

10. Last thoughts on Lavalin

Will SNC Lavalin be getting any of this cash? Hard to say, but there are two things to point out:

(1) Lavalin is know to be corrupt and is losing business. One such example is getting debarred from the World Bank for corrupt business practices.

(2) The other item is that the connections between Lavalin and the Government are immense.

- Director of Lavalin also a former Privy Council Clerk

- Director of Lavalin also Director of Trudeau Foundation on

- Director of Lavalin also a Director or McCain Foods

- Lobbyist for Lavalin also frequent Liberal donor

- President of Lavalin lobbied current Attorney General

Yes, this is entirely speculative. However, I wouldn’t be at all surprised if grants flowed to Lavalin from this social fund.

After all, if you are connected enough to have laws written to excuse your criminal conduct, this should be no problem.

By no means is this a complete listing of the tentacles that SNC Lavalin has. Rather, it should show some of the obvious connections to Government officials.