(UN Promotes replacement migration)

(Hungary proposes making it more affordable for Hungarian women to have children)

1. Previous Solutions Offered

A response that frequently comes up is for people to ask what to do about it. Instead of just constantly pointing out what is wrong, some constructive suggestions should be offered. This section contains a list of proposals that, if implemented, would benefit society. While the details may be difficult to implement, at least they are a starting point.

2. Population Replacement Agenda

CLICK HERE, for the topic of “REPLACEMENT MIGRATION”.

CLICK HERE, for March 2000 Report.

NEW REPORT ON REPLACEMENT MIGRATION ISSUED BY UN POPULATION DIVISION

20000317NEW YORK, 17 March (DESA) — The Population Division of the Department of Economic and Social Affairs (DESA) has released a new report titled Replacement Migration: Is it a Solution to Declining and Ageing Populations?. Replacement migration refers to the international migration that a country would need to prevent population decline and population ageing resulting from low fertility and mortality rates.

United Nations projections indicate that between 1995 and 2050, the population of Japan and virtually all countries of Europe will most likely decline. In a number of cases, including Estonia, Bulgaria and Italy, countries would lose between one quarter and one third of their population. Population ageing will be pervasive, bringing the median age of population to historically unprecedented high levels. For instance, in Italy, the median age will rise from 41 years in 2000 to 53 years in 2050. The potential support ratio — i.e., the number of persons of working age (15-64 years) per older person — will often be halved, from 4 or 5 to 2.

Focusing on these two striking and critical trends, the report examines in detail the case of eight low-fertility countries (France, Germany, Italy, Japan, Republic of Korea, Russian Federation, United Kingdom and United States) and two regions (Europe and the European Union). In each case, alternative scenarios for the period 1995-2050 are considered, highlighting the impact that various levels of immigration would have on population size and population ageing.Major findings of this report include:

— In the next 50 years, the populations of most developed countries are projected to become smaller and older as a result of low fertility and increased longevity. In contrast, the population of the United States is projected to increase by almost a quarter. Among the countries studied in the report, Italy is projected to register the largest population decline in relative terms, losing 28 per cent of its population between 1995 and 2050, according to the United Nations medium variant projections. The population of the European Union, which in 1995 was larger than that of the United States by 105 million, in 2050, will become smaller by 18 million.— Population decline is inevitable in the absence of replacement migration. Fertility may rebound in the coming decades, but few believe that it will recover sufficiently in most countries to reach replacement level in the foreseeable future.

– 2 – Press Release DEV/2234 POP/735 17 March 2000

— Some immigration is needed to prevent population decline in all countries and regions examined in the report. However, the level of immigration in relation to past experience varies greatly. For the European Union, a continuation of the immigration levels observed in the 1990s would roughly suffice to prevent total population from declining, while for Europe as a whole, immigration would need to double. The Republic of Korea would need a relatively modest net inflow of migrants — a major change, however, for a country which has been a net sender until now. Italy and Japan would need to register notable increases in net immigration. In contrast, France, the United Kingdom and the United States would be able to maintain their total population with fewer immigrants than observed in recent years.

— The numbers of immigrants needed to prevent the decline of the total population are considerably larger than those envisioned by the United Nations projections. The only exception is the United States.

— The numbers of immigrants needed to prevent declines in the working- age population are larger than those needed to prevent declines in total population. In some cases, such as the Republic of Korea, France, the United Kingdom or the United States, they are several times larger. If such flows were to occur, post-1995 immigrants and their descendants would represent a strikingly large share of the total population in 2050 — between 30 and 39 per cent in the case of Japan, Germany and Italy.

— Relative to their population size, Italy and Germany would need the largest number of migrants to maintain the size of their working-age populations. Italy would require 6,500 migrants per million inhabitants annually and Germany, 6,000. The United States would require the smallest number — 1,300 migrants per million inhabitants per year.

— The levels of migration needed to prevent population ageing are many times larger than the migration streams needed to prevent population decline. Maintaining potential support ratios would in all cases entail volumes of immigration entirely out of line with both past experience and reasonable expectations.

— In the absence of immigration, the potential support ratios could be maintained at current levels by increasing the upper limit of the working-age population to roughly 75 years of age.

— The new challenges of declining and ageing populations will require a comprehensive reassessment of many established policies and programmes, with a long-term perspective. Critical issues that need to be addressed include: (a) the appropriate ages for retirement; (b) the levels, types and nature of retirement and health care benefits for the elderly; (c) labour force participation; (d) the assessed amounts of contributions from workers and employers to support retirement and health care benefits for the elderly population; and (e) policies and programmes relating to international migration,

– 3 – Press Release DEV/2234 POP/735 17 March 2000

in particular, replacement migration and the integration of large numbers of recent migrants and their descendants.

The report may be accessed on the internet site of the Population Division (http://www.un.org/esa/population/unpop.htm). Further information may be obtained from the office of Joseph Chamie, Director, Population Division, United Nations, New York, NY, 10017, USA; tel. 1-212-963-3179; fax 1-212-963-2147.

3. The Hungarian Alternative

Far better than “importing” replacement populations, Hungary has decided to make it more affordable to have their own children. Recently, Prime Minister Victor Orban announced a policy that women who have 4 children or more will no longer pay income tax. The goal is to encourage women to have more children, and reverse falling birth rates.

By growing your own population, you don’t have to worry about “multiculturalism”. You don’t have to hope that a group assimilates and adopts your values. There isn’t language and culture clash, like their is with mass migration.

Mostly importantly, you don’t have to worry about cultures (like Islam) INTENTIONALLY REFUSING to assimilate and replace your way of life with their way of life.

Note: in small amounts, immigration “can” benefit a nation. But mass migration to “replace” the dwindling old-stock simply leads to the disappearance of the host culture and people.

4. Conservatism & Libertarianism Fail

In order to preserve a nation, unity and common bonds are far more important than merely “keeping the numbers up”. There is more to a nation than number of people, GDP, and economic growth. Nationalists understand this. Conservatives and Libertarians do not.

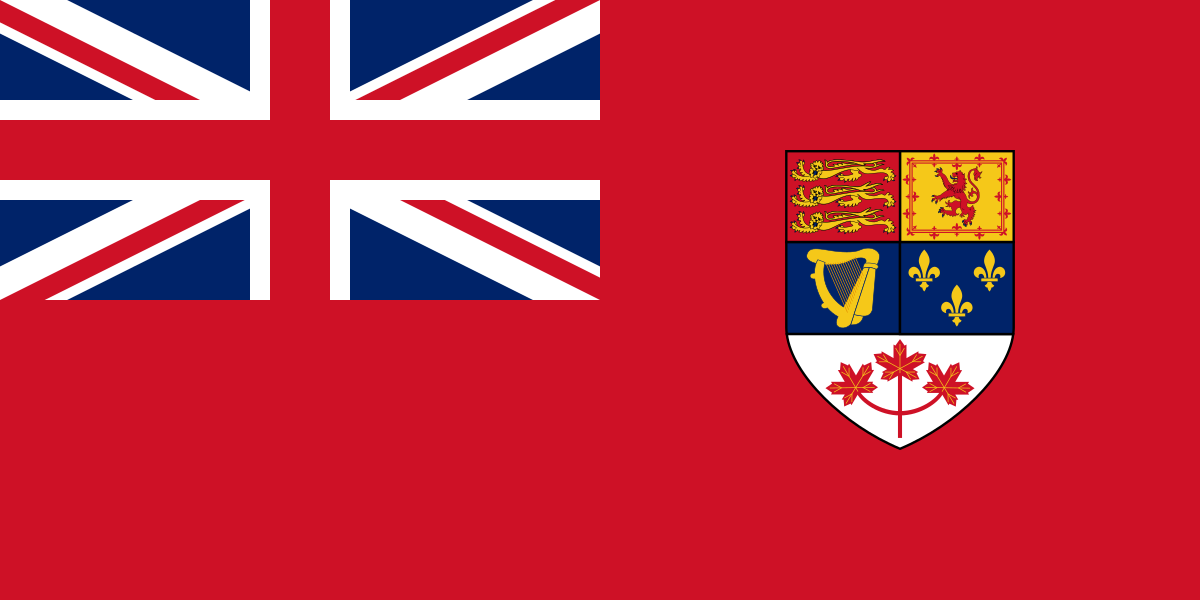

Canada — and all nations — wanting to grow, should follow the Hungarian lead of boosting its own population. Forget about using replacement migration as a solution.