On March 27th, 2023 a group called Privacy Is Your Right appeared seemingly out of nowhere to promote a legal challenge at the Divisional Court of Ontario. There was a press conference held over Zoom. They were to appear on the 30th. The thing was: there was also a lot of begging going on for money. They were already talking about going to the Ontario Court of Appeal if this didn’t work out.

The cause seemed worthwhile enough: patients and a Dr. Sonja Kustka were taking the CPSO to Court in order to prevent them from looking at medical records during an investigation. How did things transpire?

The case was thrown out on the spot, with the reasons coming a few weeks later.

This raises some eyebrows in light of recent events.

Another site, https://fre4justice.ca/, was completely shut down shortly after the attention it received from here. Perhaps there was backlash after pointing out that it would be just a rehash of the other “bad beyond argument” Federal case.

Now, the privacy site hasn’t completely disappeared, at least not yet. However, the site isn’t working, and none of the original links seem to either. It’s been that way for at least a few weeks.

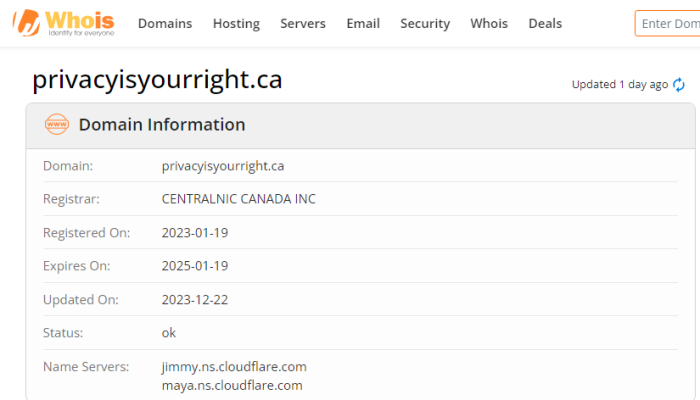

A check on the site https://privacyisyourright.ca/ shows that it was created January 19th, 2023, and that 2 years was paid for. Apparently, the last time the site was updated (in any capacity), was December 22nd, 2023.

The main site, Motion Record, and Factum are only available now via the Wayback Machine, unless they’ve been saved elsewhere. The last time it appears to have been functional — while saved — was January 19th, 2024.

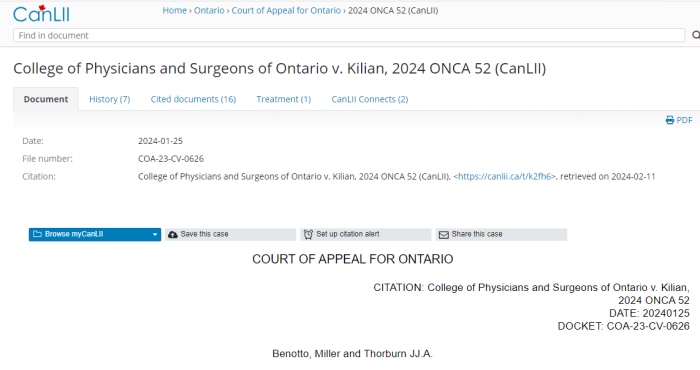

Now, why was it so odd that this group was asking for money, even though they openly conceded they’d probably be appealing it? Turns out that this case, the Kustka, case, was almost identical to the Dr. Rochagné Kilian case which had been rejected for the same reasons. At the time of this fundraising, the Ontario Superior Court had already refused patients standing. See the procedural history, and this review for more information.

That’s right. The big case (Kustka) that Privacy Is Your Right was soliciting money for was a clone of the earlier (Kilian) one.

However, that wasn’t disclosed at the virtual press conference. Going through the website, or at least the archived pages of it, there’s no mention of Dr. Kilian either.

Note: This isn’t to justify what the CPSO has been doing in recent years, but to point out the futility that was obvious from the start.

How many donors would have refused to hand over any money if there had been transparency about this? Probably most of them.

Looking at the ruling, it’s obvious. The Kustka case was a complete rehash of the Kilian case, with only superficial differences. This should have been made apparent prior to soliciting donations.

[10] The issue of public and private interest standing was recently examined in detail by this Court in Kilian v. College of Physicians and Surgeons, 2022 ONSC 5931 (Div. Ct.). The Patient Applicants’ applications for judicial review in this case are analogous to the patients’ applications for judicial review in Kilian. We see no basis to depart from this court’s decision in Kilian, which we find to be persuasive.

[13] In Kilian, at para. 44, this Court confirmed that patients have no private interest standing in the circumstances where the CPSO has initiated an investigation into a member’s conduct, stating as follows:

.

The Patient Applicants do not have a personal legal interest in the ICRC’s decisions to authorize an investigation of Dr. Kilian’s conduct or to place restrictions on her certificate. They have concerns that their medical records will be disclosed to College investigators, but that does not justify a grant of private interest standing, given the purpose of the regulatory regime and the subject matter of the judicial review proceeding.

[14] In Kilian, at para. 45, this Court held that a finding of private interest standing would be contrary to the statutory purpose, which is to regulate physicians’ conduct in the public interest. A finding of private interest standing would “disrupt” professional regulation because it would entitle thousands of patients to standing at the investigation stage: Kilian, at para. 47. This Court also noted that the Code grants patients standing in certain limited circumstances, further demonstrating the legislature’s intention to circumscribe patient participation in the regulatory process.

[15] Moreover, in Kilian, this Court went on to find that the patients have no direct interest in the decisions under review, which involve the regulator and the member. Similarly, the restrictions on the physician’s certificate in that case did not affect the patients’ legal interests: Kilian, at paras. 49-50. We see no reason to depart from the thorough and persuasive analysis conducted by this Court in Kilian.

[16] The Patient Applicants distinguish their applications for judicial review from those brought by the patients in Kilian on the basis that in this case, they seek to challenge s. 76 of the Code, while Kilian was limited to considering an investigation under s. 75 of the Code. In our view, this is a distinction without a difference. In Kilian, the CPSO had brought a parallel application in the Superior Court pursuant to s. 87 of the Code to compel the production of records under s. 76. While, in the circumstances, this Court did not specifically address s. 76, the underlying factual scenario was the same as in this case. The patients in Kilian argued that they had standing to bring an application for judicial review because their private medical records would be disclosed to CPSO investigators.

[17] The production of private medical records pursuant to s. 87 was subsequently addressed by Chalmers J. of the Superior Court in Kilian v. College of Physicians and Surgeons of Ontario, 2023 ONSC 1654 (Sup. Ct.) [Kilian SCJ]. In that case, Chalmers J., relying on College of Physicians and Surgeons of British Columbia v. Bishop (1989), 1989 CanLII 2674 (BC SC), 34 B.C.L.R. (2d) 175, held that the expectation of privacy in medical records is subject to the higher need to maintain appropriate standards in the profession: at para. 34. In addition, patient records are protected by the requirement that the CPSO maintain their confidentiality under s. 36 of the RHPA. As a result, courts have rejected the argument that patient-physician privilege precludes an order requiring the production of patient records: Kilian SCJ, at paras. 36 and 51.

The Court denied the patients private standing. Later in the ruling, they are denied public interest standing, again, for the same reasons outlined in the Kilian case.

Again, the group asking for money never disclosed this.

The follow up on the Dr. Kilian case isn’t encouraging either. July 2023, Court of Appeal for Ontario handed down a $16,000 cost award against Dr. Kilian, stating that adding the patient intervenors was a ploy designed to stall the original investigation.

May 8th, 2023, Dr. Kilian was finally ordered to produce the medical records the CPSO demanded. That was upheld by the Court of Appeal in January 2024. Absent a challenge to the Supreme Court of Canada, this case appears to be over.

So, why did Privacy Is Your Right gut their website? One possibility is that they’ve milked the donations for all they can. Now that the ruling is out — and everyone can see that it’s just a rehash — that one will dry up as well.

But just like those anti-lockdown and union cases, the CPSO ones are recycled as well.