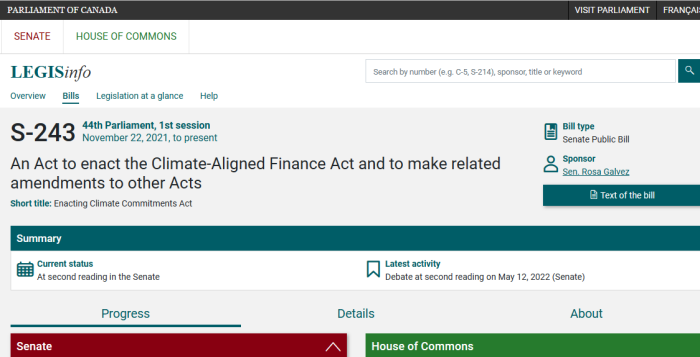

This is Senate Bill S-243. It was introduced by Rosa Galvez to enact the “Climate-Aligned Finance Act”, and to permanently alter banking in this country. Few people outside Ottawa have heard of this, making it all the more frightening.

Keep in mind, Senators in Canada are not elected. They aren’t accountable to the public, and it’s virtually impossible to get them removed prior to the retirement age of 75. Heck, Patrick Brazeau, Mike Duffy and Pamela Wallin only got suspensions for taking advantage of their Senate accounts.

According to Wikipedia, Galvez was born in Peru in 1961, and worked for the Peruvian Government in the Ministry of Housing, before coming to Canada in 1986. Not only is Galvez not beholden to any electorate, but she’s a foreign national who worked for another country.

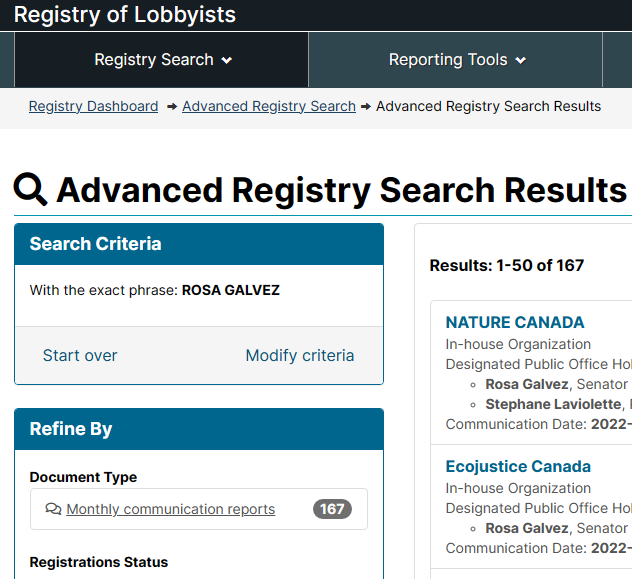

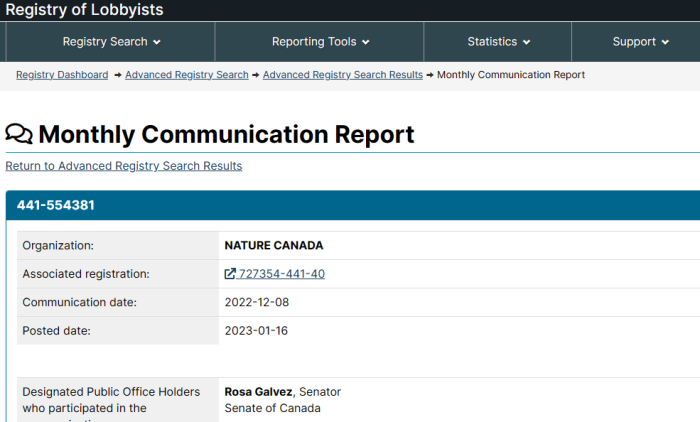

Going through the Federal Lobbying Registry, there are even more red flags. Galvez has been in contact with various N.G.O.s who have financial interests in seeing this pass. More on those connections later.

Now, what is this all about?

Climate-Aligned Finance Act

Enactment of Act

Enactment

2 The Climate-Aligned Finance Act is enacted as follows:An Act to require certain financial and other federally regulated entities to mitigate and adapt to the impacts of climate change

Whereas there is a broad scientific consensus and high confidence that anthropogenic greenhouse gas emissions cause global climate change and present an unprecedented risk to the environment — including its biological diversity — to human health and safety, to economic prosperity and to the stability of the Canadian financial system;

Whereas the impacts of climate change — such as coastal erosion, thawing permafrost, increases in heat waves, droughts and flooding — and related risks to critical infrastructure and food security are being felt throughout Canada and are impacting Canadians and disproportionately affecting Indigenous peoples, low-income citizens and northern, coastal and remote communities;

Whereas the Parliament of Canada recognizes that it is the responsibility of the present generation to minimize the impacts of climate change on future generations;

Whereas the United Nations, Parliament and the scientific community have identified climate change as an issue of international concern that is unconstrained by geographic boundaries;

Whereas Canada has ratified the United Nations Framework Convention on Climate Change, done in New York on May 9, 1992, and in force as of 1994, and the objective of that Convention is the stabilization of greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system;

Whereas Canada has ratified the Paris Agreement, done in Paris on December 12, 2015, and in force as of 2016, and the aims of that Agreement include holding the increase in the global average temperature to well below 2 degrees Celsius (2°C) above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5 degrees Celsius (1.5°C) above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change;

This would embed Treaties from the United Nations — including the Paris Agreement — into the financial sector. In it’s most blunt form, “climate change” could be used as an excuse to harm or cripple people or organizations that don’t play along.

Of course, this is one of those Bills that does not stand on its own. Instead, it will change other existing legislation in order to more broadly demand compliance. S-243 also amends:

- Bank of Canada Act

- Export Development Act

- Financial Administration Act

- Public Sector Pension Investment Board Act

- Canada Infrastructure Bank Act

- Net-Zero Emissions Accountability Act

Bank of Canada Act

3 The preamble to the Bank of Canada Act is amended by adding the following after the first paragraph:

.

And whereas the Bank of Canada must act in alignment with climate commitments;

.

4 The Act is amended by adding the following after section 18:

Alignment with climate commitments

18.01 The Bank may only exercise its powers under this Act in a way that permits it to be an entity that is in alignment with climate commitments as described in section 4 of the Climate-Aligned Finance Act.

Canada Infrastructure Bank Act

13 Section 7 of the Canada Infrastructure Bank Act is amended by adding the following after subsection (2):

Climate commitments

.

(3) The Board may only exercise its powers in a way that enables it and the Bank to each be an entity that is in alignment with climate commitments as described in section 4 of the Climate-Aligned Finance Act.

If passed in this form, the Climate-Aligned Finance Act would permeate all throughout the banking and finance sectors in Canada. In short, the financial sector would be subordinate to whatever the climate cartel demanded, at any given time.

Now, who’s pulling Rosa Galvez’s strings?

A quick search of the Federal Registry flags 167 hits for Rosa Galvez. Many of the them are climate related. Consequently, it’s fair to assume that these groups have had at least some influence in S-243.

- Nature Canada lobbies for: United Nations Framework Convention on Climate Change-Kyoto protocol The Government of Canada is required to: prepare a Climate Change Plan; prepare a statement on GHG emissions; and ensure that Canada meets its obligations under the Kyoto Protocol

- Ecojustice Canada lobbies for: A Biodiversity Accountability Act, and for a Canadian climate change accountability framework

- Greenpeace Canada lobbies for: Policies to encourage Canadian financial institutions, including banks, to divest from fossil fuel, and Canada to move forward with a comprehensive plan to meet or exceed the Paris Accord Climate targets

- Environmental Defence Canada lobbies for: Strengthening current government climate change plan, increasing resources for renewable energy and conservation and enacting regulations to reduce GHG from industry in Canada

Mark Carney, former head of the Bank of Canada, infamously said a few years ago that businesses that ignore climate change will go bankrupt. It wasn’t taken as the threat that it really is.

And from the looks of things, it will apply to the investments that pension plans make as well. Good to know that people’s retirements are tied up in all of this.

Now, we have an unelected Senator from Peru bringing in legislation that would considerably help make that threat a reality. Remember, even if this Bill doesn’t pass, it may one day be merged with a larger piece. How is any of this democratic?

(1) https://www.parl.ca/legisinfo/en/bills?chamber=2

(2) https://www.parl.ca/legisinfo/en/bill/44-1/s-243

(3) https://sencanada.ca/en/senators/galvez-rosa/

(4) https://www.parl.ca/DocumentViewer/en/44-1/bill/S-243/first-reading

(5) https://en.wikipedia.org/wiki/Rosa_Galvez

(6) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/advSrch

(7) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=441®Id=930717&blnk=1

(8) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=222662®Id=929510&blnk=1

(9) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=61®Id=924380&blnk=1

(10) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=13022®Id=924930&blnk=1

(11) https://www.theguardian.com/environment/2019/oct/13/firms-ignoring-climate-crisis-bankrupt-mark-carney-bank-england-governor

All roads lead back to the UN.