One way to “persuade” people to get vaccinated is to simply strip them of their rights. Sure, the Government won’t tie you down to get it, but good luck enjoying your life otherwise. This is David Williams, the Chief Medical Officer of Ontario.

A point of clarification: the research into “vaccine hesitancy” isn’t about CREATING safe vaccines. Instead, it’s about CONVINCING people that they already are. Big difference.

1. Other Articles On CV “Planned-emic”

The rest of the series is here. Many lies, lobbying, conflicts of interest, and various globalist agendas operating behind the scenes, obscuring the vile agenda called the “Great Reset“. The Gates Foundation finances: the WHO, the US CDC, GAVI, ID2020, John Hopkins University, Imperial College London, the Pirbright Institute, the BBC, and individual pharmaceutical companies. Also: there is little to no science behind what our officials are doing; they promote degenerate behaviour; and the International Health Regulations are legally binding. See here, here, and here. The media is paid off, and our democracy compromised, shown: here, here, here, and here.

2. Important Links

Ontario Medical Officer David Williams: Boot To Neck

Health Canada On Addressing Vaccine Hesitancy

Canada On Improving Vaccination Rates

Canadian Family Physician Publication

Vaccine Hesitancy Clinic

CBC Smearing Skeptics Of Masks/Vaccines

May 2019 Statement On Canada And Vaccine Hesitancy

Vaccine Hesitancy: Part A; Part B; Part C

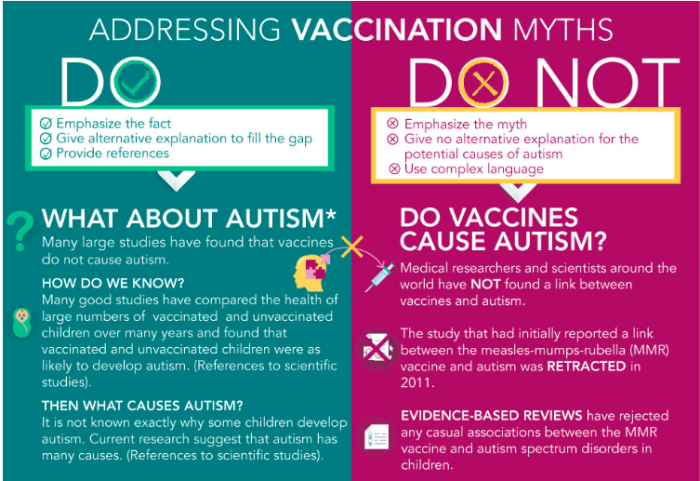

3. Be Vague, Avoid Giving Specifics

This infographic uses autism as an example. The trick is to be conclusive (but vague), in stating that there are no harmful effects. It recommends not saying anything meaningful or specific, in order to make it harder to pin down.

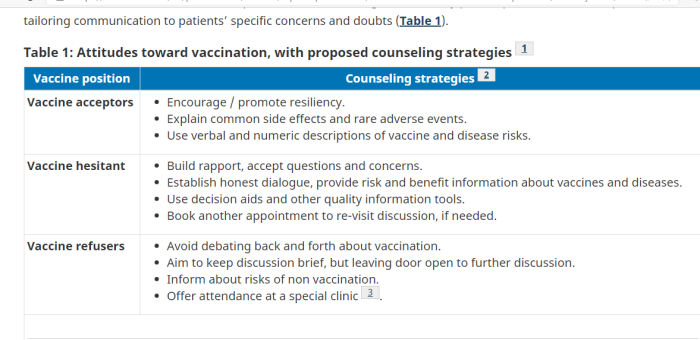

4. Only Be “Honest” With Vaccine Accepters

This chart gives different techniques depending how willing to the person is to accept vaccines at all. It suggests being somewhat open about the risks, but emphasizing that they are rare. For the reluctant people, the guidelines say to focus on “building rapport” to get them to take it, but doesn’t specify to list what’s actually in the vaccines. As for the “refusers”, the recommendation is a mild form of gaslighting. Avoid giving direct answers, and focus on the risks of not being vaccinated.

5. Have A Script/Technique Already Prepared

Start early:

Take advantage of prenatal appointments and the first few postnatal appointments. A mixed-methods study showed that parents who delayed or refused vaccines were twice as likely to start thinking about vaccines before their children’s births. A randomized controlled trial showed that adherence to the immunization schedule improved with a single prenatal education session, and another showed benefit from stepwise education interventions prenatally, postnatally, and 1 month after birth. At these appointments, parents can be provided with opportunities to ask questions and with credible take-home materials, websites, or tools.

Present vaccination as the default approach:

The Centers for Disease Control and Prevention recommends a presumptive approach to discussions about vaccinations and restating the recommendation after addressing parents’ concerns. A cross-sectional study found that parents were significantly more likely to resist vaccine recommendations if the provider used a participatory rather than a presumptive initiation format (odds ratio of 17.5, 95% CI 1.2 to 253.5) and that when providers pursued the original recommendations, almost half of initially resistant parents subsequently accepted the recommendations. While a follow-up cross-sectional study showed that the presumptive initiation format had a lower-rated visit experience, it was still associated with higher parental vaccine acceptance at the end of the visit.

Be honest about side effects when asked, and reassure parents of a robust vaccine safety system:

A 2014 systematic review showed that serious adverse events associated with vaccines are extremely rare. Perceived risk might be lowered by acknowledging that vaccines might result in mild side effects and very rarely serious adverse events. The Canadian vaccine safety system has 8 components, including an evidence-based approval process, manufacturer regulations, independent recommendations for vaccine use, and ongoing monitoring of adverse events. It has been shown in a randomized controlled trial that providing general information on the adverse event reporting system might increase trust and vaccine acceptance among adults. However, no similar study was found for childhood immunization.

Tell stories in addition to providing scientific facts:

According to a survey of primary care physicians in the United States, the most common communication practices deemed very effective for convincing skeptical parents were personal statements by physicians about what they would do for their own children and about their personal experiences with vaccine safety among their patients. Stories and images highlighting the effects of VPDs improved attitudes toward vaccination according to a randomized controlled trial, especially for individuals who had lower confidence in vaccines. However, another randomized controlled trial showed that dramatic narratives and images resulted in no significant change in intention to vaccinate and even decreased intention among those who had the least favourable perception. However, this study tested Web-based messages only. Although more evidence is needed on the topic, storytelling, which has commonly been used by the antivaccine movement, has been proposed as a possible messaging technique to supplement evidence-based information.

Build trust with parents:

A recent review found that parental trust in a provider helps ensure vaccine compliance. A qualitative study reported that a mother’s trust is obtained when a provider spends time discussing vaccines, does not deride her concerns, is knowledgeable, and provides satisfactory answers. Other qualitative studies identified respect, empathy, and tailored information as aspects of communication competence.

Address pain:

Pain associated with vaccination is a concern for many parents and children. Evidence-based clinical practice guidelines have been developed to reduce vaccination-associated.

Focus on protection for the child and community:

Necessity of vaccines is the top concern from Canadian parents, and a study conducted in Quebec found that one of the strongest factors associated with parental vaccine hesitancy was the belief that VPDs were not serious. A study conducted in the United States had similar findings. To highlight the importance of individual protection, the use of motivational interviewing could be considered. A recent Canadian randomized controlled trial showed that motivational interviewing on maternity wards increased the intention to vaccinate by 20% and the likelihood of complete vaccination status by 9%. A systematic review concluded that there might be some parental willingness to vaccinate children for the benefit of others; however, its relative importance as a motivating tool is uncertain.

Note that throughout this, there is no suggestion that the doctor have a frank and open discussion about what is actually in vaccines, the gaps in knowledge, or the long term effects. The recommendation is to build trust, so that the patient will not ask difficult questions and just take it. The entire approach can be described as “shut up and trust me”. Again, doctors are guided to be vague when answering questions.

6. Set Up Actual Vaccine Hesitancy Clinic

Again, the focus is on “building trust” and “forming a relationship”, but never a focus on educating the patient on what is in the vaccines, and the long term effects. Also, guilt trip the people by implying that it’s necessary in order for life to return to normal.

7. Social Media Manipulation, Censorship

There are many ways to “put one’s thumb on the scale” to ensure that the right, pro-vaccination messages are what is seen and heard online. Some techniques include:

(a) Flood social media with pro-vaxx content

(b) Automatically direct people to Government sites

(c) Take down sites which contradict the Government

(d) Get certain accounts demonetized

(e) Manipulate search algorithms

8. Deliberate Gaslighting Of Critics, Skeptics

There is the option of intentionally smearing people as emotional and bigoted for asking legitimate questions about masks and vaccines. While this CBC video explicitly claims to oppose shaming and humiliation, it’s tone seems to support exactly that.

9. Not Limited To Current “Pandemic”

No, this situation isn’t unique to 2020. Governments and NGOs have for many years been looking at ways to get more people vaccinated.

10. Patients Not Provided Real Information

Much of the research involves techniques of “building a relationship”, or of “building a rapport”, or of “being sympathetic”. This does nothing to address the litany of legitimate concerns and questions that many have about the chemicals being injected into their bodies.

Even more disturbingly, there aren’t recommendations that physicians and nurses take the time and effort to research and understand exactly what the chemicals are.

In fact, much of the published research explicitly recommends avoiding real discussion, especially with people who have done their homework — so called “vaccine refusers”. In effect, it encourages health care workers to betray their oath and obligations regarding informed consent.

If this is health care, then the entire system is broken beyond repair.

A telltale sign of deception is when a person is asked increasingly direct questions, but remains vague about the answers. That is exactly what is implied with these techniques to overcome “vaccine hesitancy”.