Does anyone remember the hype in alternative media circles about Vaccine Choice Canada taking on Justin Trudeau and Doug Ford over martial law measures? It seemed to be the beginning of something grand. This would be the big case to stop the New World Order.

But in the end, nothing ever came of it. The case sat idly for years, even as more donations were solicited. The quality of the pleadings themselves was very questionable. There weren’t even service addresses for most Defendants, despite them being freely available. No attempt was made to push the case forward, or to obtain Default Judgement. Critics who publicly asked questions were threatened, and some sued.

Now, the other shoe drops. The case is being discontinued, and will never make it to Trial. Heck, it won’t even make it to the scheduled Motion to Strike.

The litigants themselves will never see their day in Court. Given the 2 year Statute of Limitations, they probably don’t have recourse with another lawyer. Donors who paid money in good faith were ripped off.

How long before the many interviews from the Summer of 2020 get scrubbed from the internet?

Thanks for the money, suckers!

Vaccine Choice Canada’s Email To Supporters

Dear Vaccine Choice Canada Community and Donors,

After much consultation and deliberation the Board of Directors of Vaccine Choice Canada have decided to file a ‘Notice of Discontinuance’ with regards to the legal action filed on July 6, 2020 (Court File No. CV-20-00643451-0000). Discontinuance means that a party, for its own reasons, has chosen not to continue the litigation. The decision to discontinue does not take away from the importance or merit of the case.

It is the position of the Board of Directors of Vaccine Choice Canada that to continue this legal matter at this time is not advisable. Our confidence in the independence and integrity of our Courts, and their willingness to properly consider the available facts and scientific evidence has been seriously eroded, past repair or hope. We are of the opinion that to participate in a fraudulent and illegitimate process is to give legitimacy to that process.

Our decision is based on the following considerations:

1. The Courts have clearly demonstrated their unwillingness to properly consider the facts as they relate to COVID-19, the evidence and lack thereof of a pandemic; the extent of harm caused by the so called “vaccine”; the extent of harm caused by measures and mandates imposed by governments including masking, social distancing, lockdowns, injection of a genetic material; lack of proper safety testing; the violation of our Charter Rights and Freedoms, and other matters related to the government’s response to the COVID-19 event.

2. The Courts have clearly demonstrated their unwillingness to consider expert testimony that challenges the claims of Health Canada, the CDC, and statements made by various government officials, officers and agencies.

3. The Courts have clearly demonstrated a deference, not to facts, the scientific method, and scientific evidence, but rather to government authorities, regardless of the inability of such authorities to justify their measures and mandates.

4. The Courts have utilized “judicial notice”, “mootness”, and “motion to strike” as instruments to deny full debate and disclosure of the available evidence.

5. The Courts have clearly demonstrated that they are not impartial with regards to the matter of the appropriate response to COVID, as is evidenced by their requirement that those attending court be compelled to wear a face covering, despite compelling evidence of the ineffectiveness of coverings in preventing transmission, and the harm from prolonged use of face coverings.

6. The Courts have clearly demonstrated that they are not impartial with regards to the matter of COVID and the appropriate response to COVID, as is evidenced by the Supreme Court judges publicly declaring their compliance with vaccine mandates that violate bodily sovereignty and informed consent.

7. The Courts have clearly demonstrated that they are not impartial with regards to the matter of COVID and the appropriate response to COVID, as is evidenced by the Supreme Court refusing to consider the appeal of lower court decisions that violate our fundamental rights and freedoms.

8. Our Courts are no longer committed to “justice” as understood by Canadians. Rather, our Courts have become politicized such that they serve those in power rather than justice. Our Courts have become instruments of control and coercion rather than safeguards to ensure the upholding of the rule of law and our Charter rights and freedoms.

9. We are also fully aware that the Courts have used the legal process to delay, defer and unnecessarily increase the cost of seeking justice. We are fully aware of the punitive costs awarded to those seeking justice which punishes those seeking justice and discourages future efforts to seek justice.

10. Our Courts have failed to uphold the Charter of Rights and Freedoms, despite it being the highest law of the land. They have refused to demand that governments “demonstrably justify” their clear and undisputed violations of our Charter rights and freedoms as required under Section 1.

Given our current lack of confidence in the independence and commitment of the Courts to justice and to protecting our rights and freedoms as guaranteed under the Canadian Charter of Rights and Freedoms, we are of the opinion that to proceed under these circumstances would cause more harm than good, jeopardize future legal action by adding to defective case law, and further erode confidence in the integrity of our judicial system and government agents. (A brief summary of the failure of the Canadians courts to uphold our Charter rights and established rule of law is available here:

We are also of the opinion that given the number of defendants included in this action, in the event of an unjust ruling where the plaintiffs are ordered to pay costs, this could present a significant financial burden. The awarding of punitive court costs would undoubtedly impair the ability of VCC to serve our mission with respect to defending informed consent, bodily sovereignty, and the right, responsibility and authority of parents to protect their children from harm.

In initiating this legal action, the first of its kind in Canada, we consciously and intentionally drafted, with the guidance of our legal counsel, an unusually detailed Statement of Claim to ensure that those involved in this well planned and globally orchestrated event were named, and their actions exposed. By this measure, we believe we have achieved our purpose and brought awareness to a global conspiracy that is undeniable in the harm it has caused. For those who may not be aware of what we exposed in July 2020, the Statement of Claim can be viewed here:

We are confident that were the available facts to be properly considered, and the laws of Canada and the Charter of Rights and Freedoms upheld, that our proceeding would have been successful. The failure of our law enforcement and Canadian judicial systems to properly respond to the harms caused by government measures and mandates, including permanent injury and death, and to the violation of fundamental rights and freedoms is deeply disturbing and reveals a significant betrayal that needs to be rectified if justice is to be served in Canada.

Vaccine Choice Canada will continue to inform and defend our right to informed consent, bodily sovereignty, and the right and responsibility of parents to make medical decisions for their children. Forced and coerced vaccination, and other purported medical treatments, have no place in an ethical medical system, and a free and democratic Nation. Given the present threats to our fundamental and inherent rights and freedoms, the work of Vaccine Choice Canada was never more important.

We know that justice will eventually be served, however, it would appear that this is not the time.

Sincerely,

Ted Kuntz, President

Board of Directors Vaccine Choice Canada

VaccineChoiceCanada.com

June 13, 2024

That appears to be it. 4 years later, Vaccine Choice is dropping their case, after making no effort whatsoever to push it through the Courts. Donors should be receiving refunds, at a bare minimum.

Vaccine Choice Lawsuit A Giant Bait-And-Switch

Re-read this passage from Kuntz’ email.

In initiating this legal action, the first of its kind in Canada, we consciously and intentionally drafted, with the guidance of our legal counsel, an unusually detailed Statement of Claim to ensure that those involved in this well planned and globally orchestrated event were named, and their actions exposed. By this measure, we believe we have achieved our purpose and brought awareness to a global conspiracy that is undeniable in the harm it has caused. For those who may not be aware of what we exposed in July 2020, the Statement of Claim can be viewed here:

Kuntz states that the Statement of Claim was written to “ensure that [people] were named, and their actions exposed”. He states that “we believe we have achieved our purpose”.

Why does this matter? Because he doesn’t say that going to Trial and having the Court hold people accountable would have achieved the purpose. In other words, this was for publicity. It was never about getting any sort of a ruling or decision.

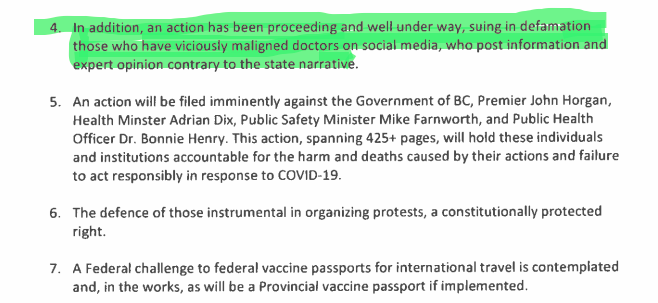

Consider this quote from a July 13, 2022 livestream. Fuller video here.

“Most people measure the effectiveness of a Court submission based upon what a Judge decides. And what you’ve helped us to understand is that there’s more to educating the impact of your legal proceeding than simply what happens within the Court. It’s also how the Defendants respond, and how the public responds…. We brought awareness to a dynamic that had been hidden from the public. And I would suggest that maybe, this was the most important impact we’ve had to date.”

It’s actually illegal to commence proceedings like this. You can’t sue somebody to “make a point”, or to “fire a shot across the bow”, or any similar justification. The Courts refer to this sort of thing as bringing a suit “for improper purposes”. The only permitted reason is that the Plaintiff(s) believes that he or she has a strong case.

Does this sort of thing happen? Yes it does. But few are retarded enough to openly admit it on a public livestream. Anyone can be listening in. This alone would be grounds to throw the case out.

So, What Happened Over The Course Of 4 Years?

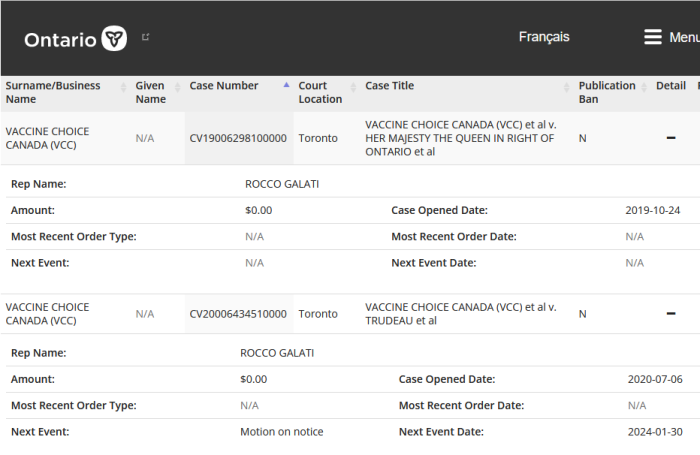

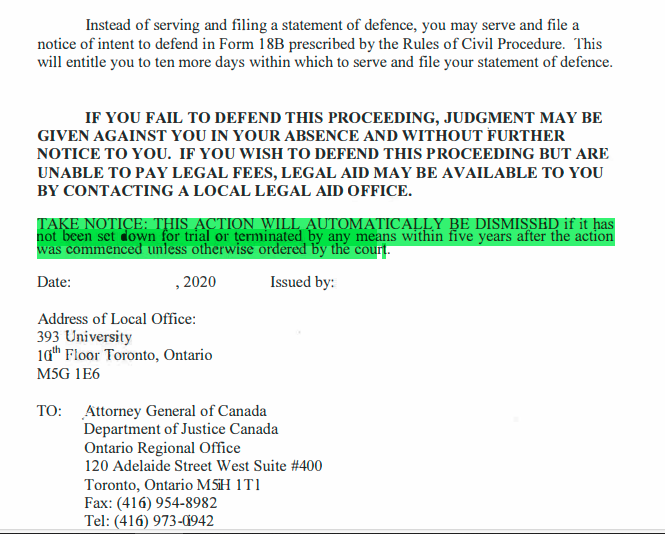

July 6th, 2020: Vaccine Choice Canada files a 191 page Statement of Claim in Ontario Superior Court in Toronto. In addition to its length, the Claim was incoherent, and failed to follow even the basics of Civil Procedure.

Summer 2020: There was a media blitz online soliciting donations for this lawsuit. It was supposed to be the great challenge to medical martial law in Canada. However, no one seems to be asking the important questions, such as what activity is going on.

September 2020: Counsel for Vaccine Choice Canada tells Rebel Media that he will do everything he can to ensure an Application for a mask injunction is heard before Christmas (2020). However, that never happens. To be clear, no Application is ever filed with the Court. It simply does not exist.

In fact, no activity whatsoever will happen with this case for a long time to come. But what does happen is lawfare directed against critics and ideological opponents.

December 2020: 23 people and organizations are sued for defamation by Kulvinder Gill and Ashvinder Lamba, primarily over Twitter comments. It would be thrown out under anti-SLAPP laws.

January 2021: CSASPP, the Canadian Society for the Advancement of Science in Public Policy, is threatened with a defamation suit for an email to Dan Dicks (Press For Truth) from their Treasurer. The email tries to redirect attention and money to their case, and calls into question the abilities of counsel for Action4Canada and Vaccine Choice.

March 2021: Kulvinder Gill files another defamation lawsuit, this time against Amir Attaran and the University of Ottawa. She demands $7,000,000 because he called her an “idiot” online. An anti-SLAPP Motion will be heard later this year.

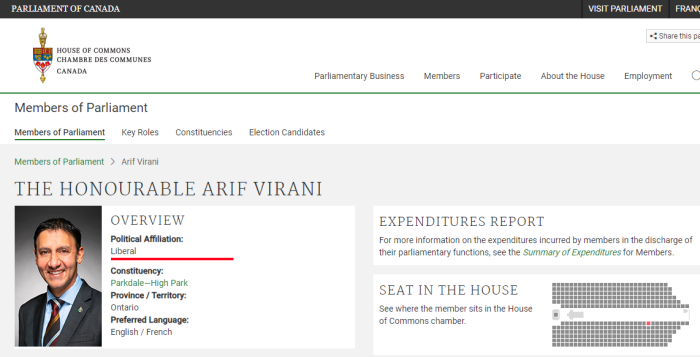

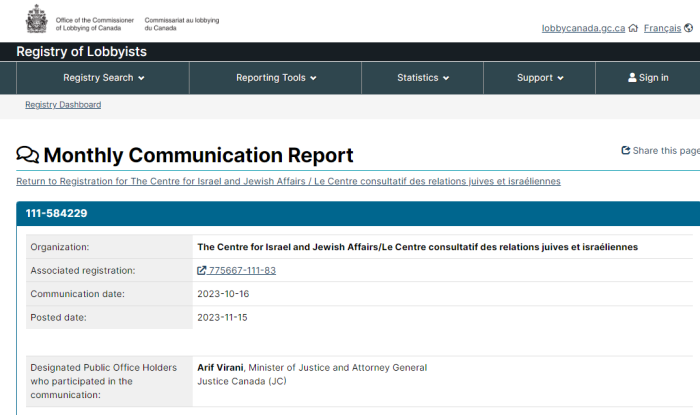

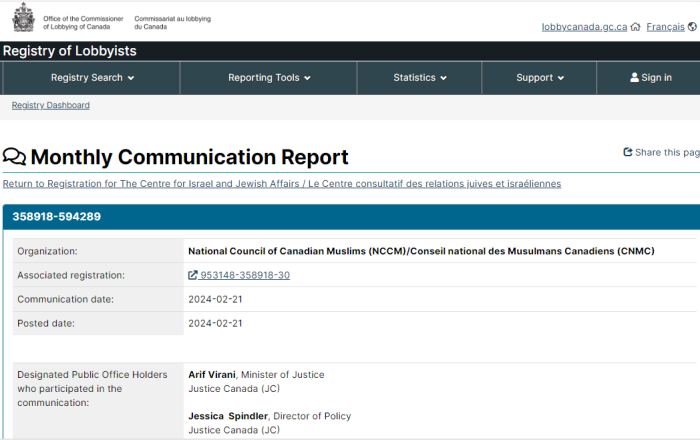

Ted Kuntz later admitted that Vaccine Choice financed (or at a minimum, coordinated) the Gill defamation cases. See paragraph 20 in the main text, and Exhibit “C”, starting on page 20.

From that, it’s reasonable to suspect VCC funded other defamation lawsuits.

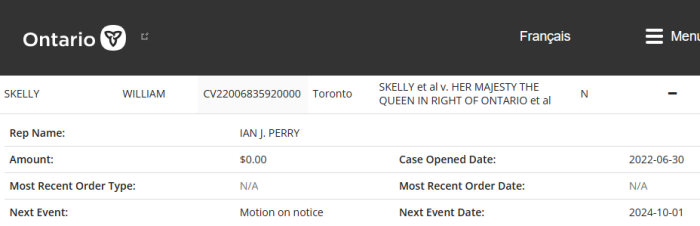

September 2021: This website is sued in large part for publicly questioning the horrible quality of the VCC and A4C pleadings, and for pointing out the lack of progress in any of these cases. Currently, there’s an open anti-SLAPP Motion pending.

June 2022: CSASPP is sued for the email mentioned above, and an FAQ that’s critical (in part) of the VCC case. The suit also goes after a woman named Donna Toews. She dared to contact the Law Society of Ontario, LSO, asking about money she had donated to Vaccine Choice and Action4Canada. It was thrown out under anti-SLAPP laws.

July 2022: The Law Society of Ontario (LSO) is sued for $500,000. The primary motivation appears to be an attempt to derail the complaint from Donna Toews, and to make sure it cannot be investigated. It was struck for failing to state a Cause of Action (a grievance the Court can theoretically remedy), and the incoherent pleadings.

Note: The LSO would be sued again in 2023, a virtual clone of the last one. The probable reason was to keep the Court activity going, in order to sabotage their investigative abilities.

July 2022: A Notice of Discontinuance is filed regarding the CBC, which removes them as a Defendant. Previously, the organization had threatened to file an anti-SLAPP Motion if the case against them wasn’t dropped. See cover letter.

August, 2022: A single Statement of Defence is filed, more than 2 years after the Claim is originally brought. It suggests a Motion to Strike will be coming.

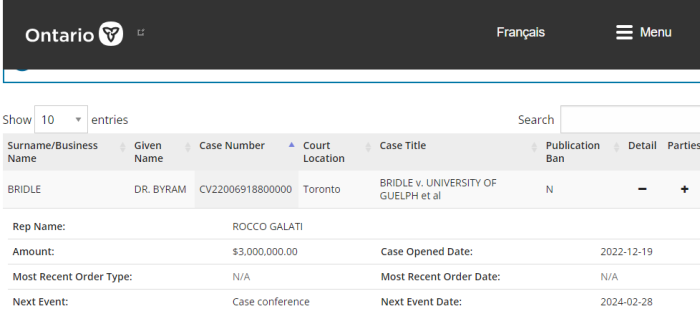

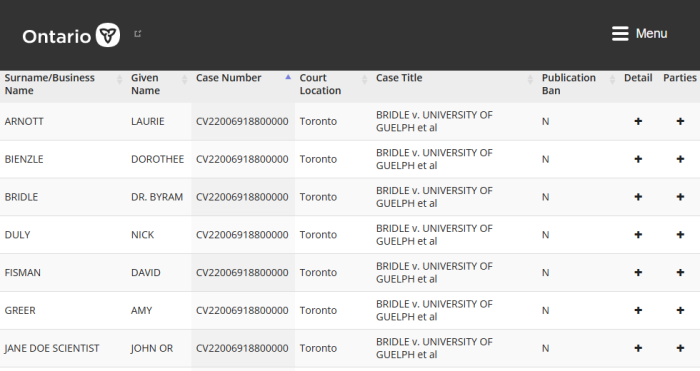

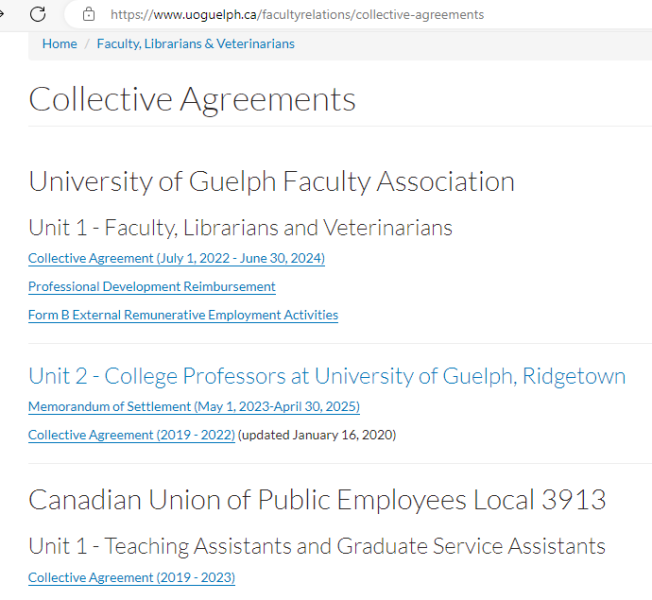

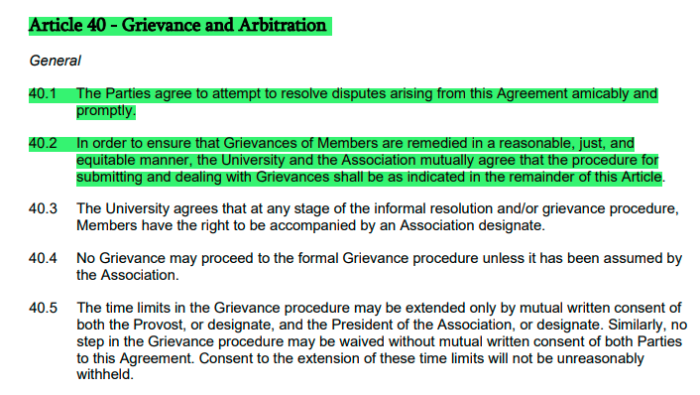

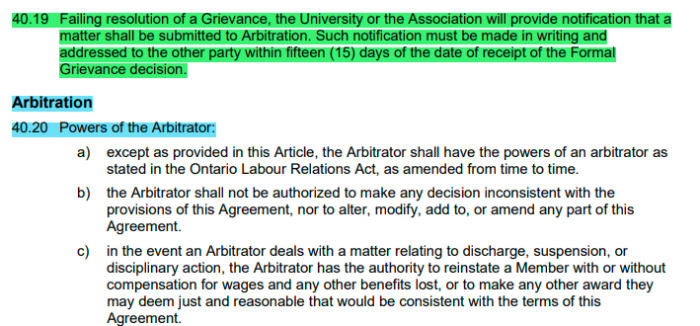

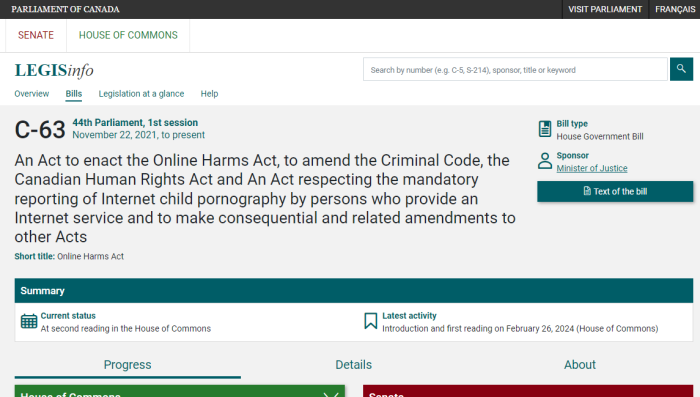

December 2022: Lawsuit from Byram Bridle filed against the University of Guelph, employees, and non-employees. Currently on hold while 2 separate anti-SLAPP Motions are pending.

***You’ll notice in this list so far that there’s no mention of Court activity, such as motions, hearings, witnesses testifying, or evidence being sworn. That’s because none ever took place. This case is a “paper challenge”, not going anywhere.***

January 2023: Vaccine Choice Canada had its first Court appearance. Yes, that is the correct date. It took 2 1/2 years for even this. And it was just a CPC (Civil Practice Court) session. Simply put, these are 5-10 minute hearings with a fairly full docket. What happened was that dates were set down for the Defendants to bring Motions to strike (throw out) the case.

- June 30th, 2023 – Moving Party Motion Record

- July 28th, 2023 – Responding Motion Record

- October 31th, 2023 – Cross Examinations (if Affidavits submitted)

- November 17th, 2023 – Moving Party Factum (arguments)

- December 8th, 2023 – Responding Factum

- December 22nd, 2023 – Reply Factum

- January 30th, February 1st, 2024 – 2 day Hearing

March 2023: For his work creating the article and video called “Nothing Burger Lawsuits”, Rick Thomas is threatened with a lawsuit. None have been filed yet, but anti-SLAPP laws exist for a reason.

January 2024: The hearing briefly starts, headed by Justice Dow. However, he immediately recuses himself and adjourns the case. The reason being that he’s a former co-worker and personal friend of Health Minister Christine Elliott. This conflict of interest makes him unavailable to adjudicate the Motion. The hearing is rebooked — with a new Judge — for May 1st and 2nd of 2025.

February 2024: Ted Kuntz (VCC) and Tanya Gaw (A4C) host a livestream to “expose” people they call “paid agitators”. Basically, it’s just a hit piece on their critics.

June 2024: Vaccine Choice Canada announces that they’re dropping the case.

So much for being the ground-breaking challenge.

What About VCC’s 2019 Challenge For Vaxxing Students?

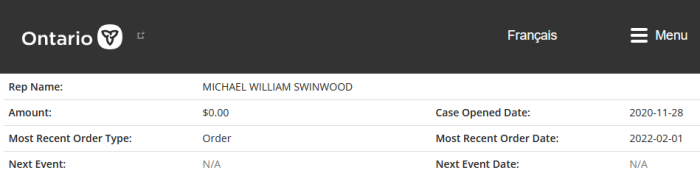

Few will remember this, but Vaccine Choice filed a challenge in October 2019 against Ontario’s policy of immunizing children as a requirement of attending class. In over 4 1/2 years, that case hasn’t gone past the pleadings.

Keep in mind — and this is written into the Statement of Claim forms — that a case will be dismissed for delay if it’s not resolved or set down for Trial within 5 years. Sure, it can be extended, but the Court will need to be convinced that there’s activity.

Should donors expect a refund for this case?

What About Those Thousands Of Pages Of Expert Evidence?

Once of the mantras endlessly repeated is that counsel for Vaccine Choice and Action4Canada has the best evidence from the top experts in the world.

We’ve all seen pictures or videos where all these expert reports are bandied about, attached as Affidavit evidence. Supposedly, it amounts to tens of thousands of pages. Problem is, they’ve never been filed in any Court. Any if these reports do exist, why delay cases with convoluted pleadings?

It seems more likely no such Affidavits exist, and that these are just images of stacks of blank paper. Or, they could just be random items printed from the internet. One explanation might be that it’s to divert attention from the lack of activity in the Courts. This would be done for the purpose of duping and deceiving donors and potential donors.

Why spend (presumably) hundreds of thousands of dollars, or millions, on expert reports if there was never any intention to push the case forward?

It these thousands of pages of expert reports do exist, which seems unlikely, then a competent lawyer should have been responsible for drafting the pleadings.

Growing List Of Anti-Lockdown Cases Not Pursued

The Vaccine Choice cases don’t exist in isolation. Consider these:

- Struck as “bad beyond argument” – Action4Canada (August 2021)

- Upheld as “bad beyond argument” – Action4Canada (by B.C. Court of Appeal)

- Struck as “bad beyond argument” – Adelberg, Federal injection pass case (May 2022)

- Upheld as “bad beyond argument” – Adelberg (by Federal Court of Appeal)

- Non-Existent?! – Federal workers vaccine injury lawsuit

- Abandoned?! – Vaccine Choice Canada (October 2019)

- Discontinued – Vaccine Choice Canada (July 2020)

- Discontinued – Sgt. Julie Evans (April 2021), fundraised by Police On Guard

- Discontinued – Children’s Health Defense Canada (April 2021), of which counsel was, at the time, a Director of the organization

- Discontinued? – Take Action Canada (March 2023) is in an awkward spot. While it faces Motions to throw out the case as “bad beyond argument”, the group is openly considering dropping the case. More money is demanded. If only someone could have warned Sandy and Vincent that this was a bad idea

It’s worth mentioning that Action4Canada can probably be classified as “abandoned” at this point. 4 months after their nonsense Appeal was thrown out, there’s still no amended Notice of Civil Claim (NOCC).

Seriously: Is this a track record of good results?

Sadly, many of the “truther” media accounts promote these cases as if they’re legitimate, despite the abundance of information available. Liberty Talk is an obvious example, but hardly the only one.

Does it make sense why this website would spend so much time and effort tracking these bogus cases, and the endless money-pits that they’ve become? Does it make sense to question why millions of dollars have been funneled into this litigation? Shouldn’t everyone be held to account?

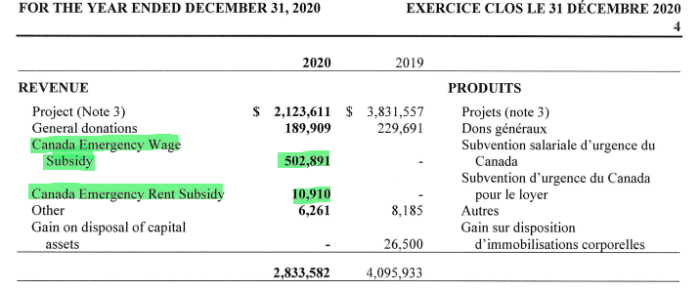

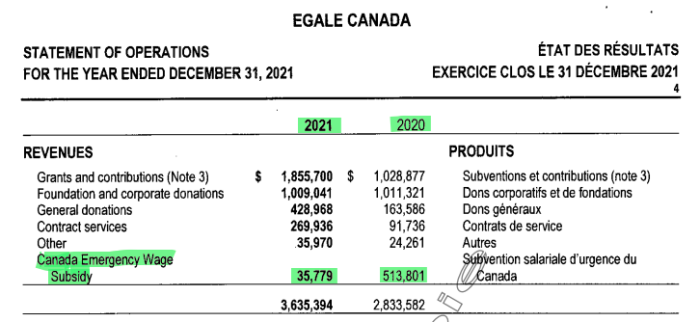

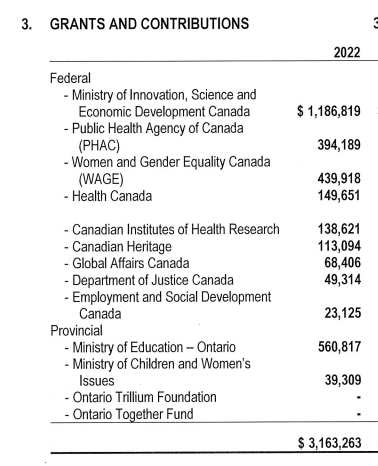

How much money has been raised? Here’s a starting point.

Okay, So What’s YOUR Solution?

A common thread most detractors have here is that the content is too negative. It’s too divisive. It needlessly weakens the Freedom Movement. No solutions are ever offered, despite endless criticism.

Well, there is a simple solution for donors at least. Demand full refunds, preferably with interest. If they say there’s no money available (since it was all spent on lawyers), start suing VCC for refunds. They’ll capitulate rather than face hundreds or thousands of angry people. Small Claims Court is dirt cheap, for example.

Deceit and/or misrepresentation would surely void any “no refunds” policy.

What About Potential Cost Consequences?

One question worth asking is how much VCC would be forced to pay for dropping the case. After all, the (successful) Defendants could ask for costs to offset the expenses incurred so far. True, the Motion to Strike wasn’t actually heard, but it had to be prepared.

This is certainly a valid point.

However, after thinking it over, it’s probably not a big deal. Government lawyers often agree to waive costs (or minimize them) if lawsuits are discontinued. This could have happened here. Or, the Defendants could have agreed to accept nominal costs (small amounts) as a symbolic victory.

Using Action4Canada as a reference, they paid out approximately $13,000 in costs after their Notice of Civil Claim was struck as “bad beyond argument”. True, Ontario has higher tariffs, but $50,000 or less would have been a reasonable order from a Judge against VCC. In any event, it would be a drop in the bucket considering the money that was fundraised.

Now that the Claim has been dropped, Kuntz, VCC, and their counsel are presumably free to spend the rest as they wish. There doesn’t appear to be a refund policy.

How long until Action4Canada announces they’re discontinuing their case?

As Trudeau would say: “Thank you for your donation.”

VACCINE CHOICE CANADA DOCUMENTS (2019 CLAIM):

(1) VCC – Statement Of Claim, October 2019 Lawsuit

(2) VCC – Statement Of Defence, October 2019 Lawsuit

(3) VCC – October 2019 Press Release

VACCINE CHOICE CANADA DOCUMENTS (2020 CLAIM):

(1) VCC – Statement Of Claim Unredacted

(2) VCC – Discontinuance Against CBC

(3) VCC – Discontinuance Against CBC With Cover Letter

(4) VCC – Mercer Statement Of Defense

(5) VCC – Mercer Affidavit Of Service

(6) VCC – Requisition For CPC Motion To Strike

(7) VCC – Notice Of Motion To Strike

(8) VCC – Factum WEC Wajid Ahmed

(9) VCC – Factum Nicola Mercer

(10) VCC – Factum Federal Defendants

(11) VCC – Factum Of Respondent Plaintiffs