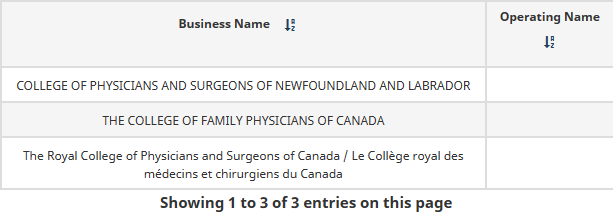

A topic that hasn’t been covered in quite some time is the long list of business and organizations that received bailout money from the CEWS Program. Of course, this is short for the Canada Emergency Wage Subsidy. There were a few colleges Of physicians & surgeons that got it.

- Royal College Of Physicians & Surgeons of Canada

- College of Family Physicians in Canada

- College of Physicians and Surgeons in Newfoundland and Labrador

Granted, the program did end over a year ago, but it doesn’t erase the fact that so many organizations received this money in the first place.

This can be easily verified by visiting the CEWS Registry (see new link).

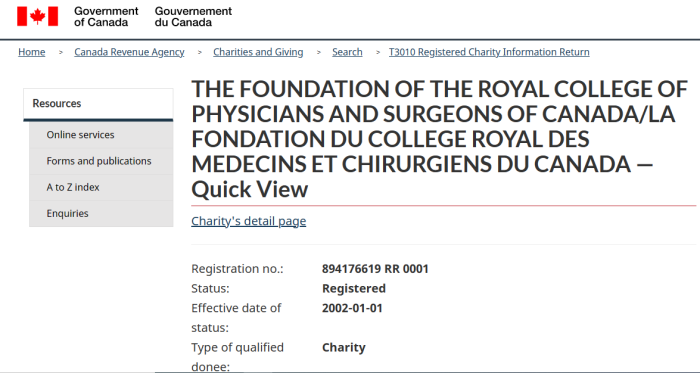

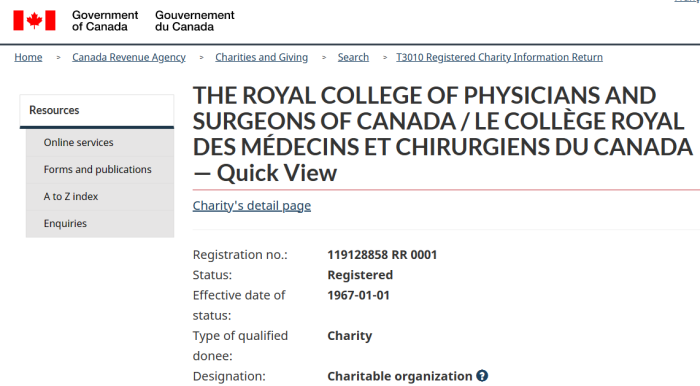

About the Royal College, there are 2 different charities: (a) The Royal College Of Physicians & Surgeons of Canada; and (b) Royal College Of Physicians & Surgeons of Canada Foundation.

It’s worth pointing out that registered charities also automatically were eligible for CERS, the Canada Emergency Rental Subsidy, and other lockdown grants.

Now, what does the Royal College describe as its functions?

CREATE AND CONDUCT SPECIALTY MEDICAL EXAMINATIONS FOR PHYSICIANS. ACCREDIT SPECIALTY TRAINING PROGRAMS AT CANADIAN UNIVERSITY MEDICAL SCHOOLS. ASSESSS RESIDENCY TRAINING TO ENSURE SPECIALTY SPECIFIC TRAINING REQUIREMENTS HAVE BEEN FULFILLED. PROVIDE A CONTINUING PROFESSIONAL DEVELOPMENT PROGRAM TO ENSURE FELLOWS ARE ENGAGED IN MAINTENANCE OF KNOWLEDGE. UNDERTAKE PUBLIC POLICY INITIATIVES TO PROMOTE LEADERSHIP IN SPECIALTY MEDICINE.

Looking at some tax information in recent years, we get this:

March 31, 2020

Receipted donations: $523,771.00 (0.78%)

Non-receipted donations: $0.00 (0.00%)

Gifts from other registered charities: $587,500.00 (0.88%)

Government funding: $35,672.00 (0.05%)

All other revenue: $65,682,187.00 (98.28%)

Total revenue: $66,829,130.00

Charitable programs: $38,896,568.00 (56.35%)

Management and administration: $25,033,055.00 (36.26%)

Fundraising: $0.00 (0.00%)

Gifts to other registered charities and qualified donees: $0.00 (0.00%)

Other: $5,098,798.00 (7.39%)

Total expenses: $69,028,421.00

Compensation

Total compensation for all positions: $27,934,692.00

Full-time employees: 327

Part-time employees: 164

Professional and consulting fees: $11,781,429.00

Compensated full-time positions:

$200,000 to $249,999: 2

$250,000 to $299,999: 2

$300,000 to $349,999: 3

$350,000 and over: 3

March 31, 2021

Receipted donations: $36,792.00 (0.05%)

Non-receipted donations: $0.00 (0.00%)

Gifts from other registered charities: $378,431.00 (0.55%)

Government funding: $4,267,623.00 (6.20%)

All other revenue: $64,139,221.00 (93.20%)

Total revenue: $68,822,067.00

Charitable programs: $32,720,809.00 (57.19%)

Management and administration: $24,492,552.00 (42.81%)

Fundraising: $0.00 (0.00%)

Gifts to other registered charities and qualified donees: $0.00 (0.00%)

Other: $0.00 (0.00%)

Total expenses: $57,213,361.00

Compensation

Total compensation for all positions: $35,971,607.00

Full-time employees: 270

Part-time employees: 62

Professional and consulting fees: $13,125,154.00

Compensated full-time positions:

$160,000 to $199,999: 3

$250,000 to $299,999: 2

$300,000 to $349,999: 3

$350,000 and over: 2

March 31, 2022

Receipted donations: $22,614.00 (0.03%)

Non-receipted donations: $0.00 (0.00%)

Gifts from other registered charities: $1,155,246.00 (1.67%)

Government funding: $892,245.00 (1.29%)

All other revenue: $66,959,192.00 (97.00%)

Total revenue: $69,029,297.00

Charitable programs: $39,197,885.00 (65.42%)

Management and administration: $20,477,992.00 (34.18%)

Fundraising: $0.00 (0.00%)

Gifts to other registered charities and qualified donees: $0.00 (0.00%)

Other: $238,261.00 (0.40%)

Total expenses: $59,914,138.00

Compensation

Total compensation for all positions: $35,073,801.00

Full-time employees: 327

Part-time employees: 57

Professional and consulting fees: $6,969,896.00

Compensated full-time positions:

$200,000 to $249,999: 1

$250,000 to $299,999: 1

$300,000 to $349,999: 4

$350,000 and over: 4

The Royal College Foundation, by contrast, is much, much smaller. It seems primarily geared towards bursaries and scholarship opportunities for medical students.

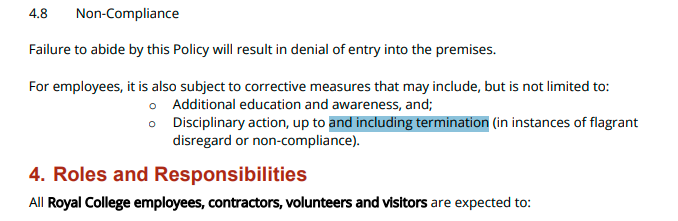

The Royal College announced in the Fall of 2021 that people who haven’t taken at least 2 shots would be prohibited from entering the premises. However, it appeared that taking tests within the last 3 days would be an alternative. Failure to comply meant possible termination from employment.

The requirement for entry would apply to:

- Employees

- Visitors

- Contractors

- Volunteers

- Members of the public

For employees, this would presumably mean tests at least twice per week. Never mind that no virus has ever been proven to exist. This is only the Royal College Of Physicians & Surgeons of Canada.

Why would they play along with this? One possibility is that they know how financially beneficial the bailouts and charity designations are.

The Royal College is also part of HEAL, a coalition of health groups that lobbies Ottawa on issues such as: “mental health, health care improvement, opioids, pharma care, seniors care and other priority health topics”.

The College of Family Physicians of Canada (which also got the CEWS bailout), is part of that Federal lobbying coalition.

It’s interesting that no organizations within HEAL did much to push back on the implementation of vaccine passports in late 2021. Have to wonder why.

(1) https://apps.cra-arc.gc.ca/ebci/hacc/cews/srch/pub/bscSrch

(2) https://apps.cra-arc.gc.ca/ebci/habs/cews/srch/pub/dsplyBscSrch?request_locale=en

(3) https://apps.cra-arc.gc.ca/ebci/hacc/srch/pub/dsplyRprtngPrd?q.srchNmFltr=college+physicians

(4) https://apps.cra-arc.gc.ca/ebci/hacc/srch/pub/dsplyRprtngPrd?q.srchNmFltr=college+physicians

(5) https://www.royalcollege.ca/

(6) https://www.royalcollege.ca/rcsite/search-e?Ntt=vaccination&Nty=1&op=Search

(7) Royal College Mandatory Vaccination Policy

(8) https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=371168®Id=931696

(A.1) Hotel, Restaurant Groups Getting Wage/Rental Subsidies

(A.2) Liberals, Conservatives, NDP All Getting Bailout Money

(A.3) Lawyers, Bar Associations Receiving CEWS Money

(A.4) Conflicting Out? Lawyers Getting More Than Just CEWS

(A.5) Churches Are Charities, Getting CEWS, Subsidies & Promoting Vaccines

(A.6) Trucking Alliance Grants Raising many Eyebrows

(A.7) Chambers Of Commerce Subsidized By Canadians, Want Open Borders

(A.8) Banks, Credit Unions, Media Outlets All Getting CEWS

(A.9) Publishing Industry Subsidized By Taxpayer Money

(A.10) Gyms And Fitness Centers Getting Subsidies To Push Vaxx Pass

(A.11) Sports Groups That Took CEWS To Push Pandemic Hoax

(A.12) Chapters-Indigo Getting Millions In Subsidies To Discriminate

(A.13) Toronto Region Board Of Trade Pushing Vaxx Passports

So tax payers, all of us essentially pay for the bribery of all the officials and extras to violate our rights ,basically bought our very own incentivized coercion ? When a government does this , first signs of such corrupt behaviour all involved should be strictly and immediately removed . We really need to tighten up our laws to contain big government and implement more choke holds and just pure punishment for such cretans! Getting more and more unsavoury by the minute