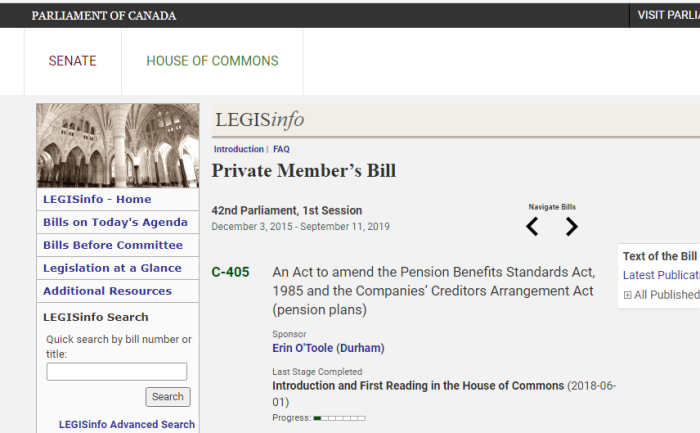

In 2018, the CPC MP for Durham, Erin O’Toole, introduced C-405, a Private Member’s Bill to make changes regarding employee pension plans. While touted as some great overhaul for workers, things are not what they appear to be.

1. Pensions, Benefits, Worker Entitlements

The public is often unaware of what is happening with their pensions and other social benefits. Often, changes are made with little to no input from the people who are directly impacted by it. Unfortunate, but we need to constantly be on top of these things.

2. Important Links

Private Member’s Bill C-405 Introduced By Erin O’Toole

Text Of Bill C-405 (First Reading)

Pension Benefits Standards Act, 1985

Companies’ Creditors Arrangement Act

Open Parliament: Announcement From Erin O’Toole

Open Parliament: Debate On Bill C-405

3. Bill C-405 Introduced In June 2018

Bill for Private Members rarely get far in the House of Commons, let alone pass. Often, they are just a way to signal to the sponsor that efforts are being made. O’Toole’s Bill didn’t get anywhere in Parliament, but it’s unclear how serious he was about pushing it.

4. Pension Benefits Standards Act

Termination and Winding-up of Pension Plans

Marginal note:Deemed termination

.

29 (1) The revocation of registration of a pension plan shall be deemed to constitute termination of the plan.

Effect of termination on assets

.

(8) On the termination of the whole of a pension plan, all assets of the plan that are to be used for the purpose of providing pension benefits or other benefits continue to be subject to this Act.

The language of section 29(8) of the Pension Benefits Standards Act is quite clear. Once a pension plan is terminated, the funds must be dispersed to those who have contributed to the plan. Here is part of what O’Toole wanted to add.

Amendment — liquidation, assignment or bankruptcy of the employer

(8.1) If an employer is the subject of proceedings under the Companies’ Creditors Arrangement Act or Part III of the Bankruptcy and Insolvency Act and the amount required to permit a pension plan to satisfy all obligations with respect to pension benefits and other benefits to be provided under the plan is greater than the assets of the plan, the administrator may

.

(a) despite subsection 10.1(2) and the terms of the plan, amend the plan to change the nature or form of the pension benefits and other benefits to be provided under the plan; or

.

(b) apply to the Superintendent for permission to transfer or permit the transfer of any part of the assets or liabilities of the pension plan to another pension plan.

Consent to amendment

.

(8.2) Before a pension plan may be amended or part of its assets or liabilities transferred in accordance with subsection (8.1),

.

(a) the administrator must provide any prescribed information, in the prescribed manner, to the members or former members, to any other persons entitled to pension benefits and to the representatives of the members or former members and of any other persons entitled to pension benefits; and

.

(b) the amendment or transfer must be approved by more than one third of the members or former members and of any other persons entitled to pension benefits or by the representatives of more than one third of the members or former members and of any other persons entitled to pension benefits.

.

No action against administrator

(8.3) No action lies against any administrator for amending a plan or for transferring or permitting the transfer of any part of the assets or liabilities of a pension plan to another pension plan in compliance with subsections (8.1) and (8.2).

Bill C-405 would have allowed employers to transfer the pension funds rather than pay out if the company were in serious financial difficulties.

As for the consent, that is an extremely low threshold. Forget a super majority, or even a simple majority. Only 1/3 would have to approve for this to happen. Even worse, the “representatives”, or people claiming to represent the workers could simply approve on their behalf. This seems ripe for abuse.

While transferring pension funds to another company may make that more solvent, the reality is, those employees did not sign up for it initially. An argument can be made that they should simply be allowed to collect on their entitlements, and walk away. If an opt-out were provided so individual members could cash out, it would nullify a lot of the criticism.

5. Companies’ Creditors Arrangement Act

Companies’ Creditors Arrangement Act

.

3 The Companies’ Creditors Arrangement Act is amended by adding the following after section 11.52:

.

Limitation — pension plans

11.53 No order may be made under this Part respecting the approval of a plan offering incentives to certain directors, officers or employees to remain in the employ of the debtor company for the period during which the company is expected to be subject to proceedings under this Act unless the court is satisfied

.

(a) if the debtor company participates in a prescribed pension plan for the benefit of its employees, that the relevant parties have entered into an agreement, approved by the relevant pension regulator, respecting the payment of the amounts referred to in subparagraphs 6(6)(a)(ii) and (iii);

.

(b) that the directors, officers or employees are necessary for the successful restructuring or liquidation of the debtor company or for the protection and the maximization of the value of the company’s property;

.

(c) that the directors, officers or employees have received a job offer from another person than the debtor company and the offering of the incentives is necessary for their retention in the employ of the debtor company; and

.

(d) that the amount of the incentive offer

.

(i) is not greater than ten times the amount of a similar incentive offer given to an employee of the debtor company for any purpose during the previous calendar year; or

.

(ii) if no incentive referred to in subparagraph (i) was offered, is not greater than an amount equal to 25% of the amount of any similar incentive given to a director or officer of the debtor company for any purpose during the previous calendar year.

Incentives and bonuses (primarily aimed at officers and directors), would still be allowed to be offered, and not be vulnerable to a court order. However, those incentives would be capped. Seems strange that heads of failing companies should be offered any type of incentives.

6. Does This Bill Benefit Workers?

If a company is failing, and going under, the right thing to do is to pay out its pension holdings to the people who have contributed to it. Transferring elsewhere, especially with such a low threshold, seems like shifting the goal posts. At a minimum, those who have contributed should be able to just take a pay out and leave.

People who run failing companies shouldn’t be getting bonuses, even if they are capped. This just rewards incompetence, often at the cost of other assets of the company.

The legislation was promoted as a way to protect pensions and to keep them going. However, such transfers (possible with just a minority of support), potentially remove all control from workers. And as with everything, the devil is in the details.

For now, it appears to be dead.

That is interesting eh? Imagine, crime: defrauding people; treason: misrepresenting, breach of trust, genocide : anti wealth legalized fraud, raid the pensions & bankrupt the company and kick the worker to the door…and also setup another company where all the new contracts go without the liabilities..

imagine pension funds protected from divorce, estate and inheritance tax, criminals, management, government, stock market manipulations and other electronic pick pockets, international money laundering…imagine power and control, freedom of choice, relevant options, what would that look and feel like? Eh?

the solution is simple, money in trust, a separate company or entity, business or statutory trust, it can be a private mutual fund, a co-operative association, even a private investment group, an enterprise co-operative, and certainly separate from the operational company, this can also have capital structure, and in this case, ownership, voting and control, in addition to decision making, which may also utilize or retain consultants, advisory or other services for investment transactions in both public and private securities,.

The plan is separate from the “pension entity” the plan can be changed by mutual agreement (change the plan, but don’t plan to fail, plan to succeed) and proportional, as in working share ownership, with an effective vote, not the typical union meeting where 10% show up 6 of the 10 vote effectively outvoting the 94 who did not, which includes voting machines fiascos controlled by the enemy, right?

The typical plan is sometimes even changed by the employer to another management investment pension firm or fund, poof, gone, you might not like the next plan or the next entity for one reason or another. They might re-organize it, sell it, amalgamate or consolidate it or whatever, and you might not like it! Where is the title to securities? Not to the investor? Ownership, voting, control, passive and active management? Hmmm

Look at the American example of enabling Pension funds to be gambled in the stock market. The financial hazard of ICE & CME Exchange Casinos (see https://intergalactic-securities.ca/Welcome/Investment.html) only add to the economic genocide and theft of wealth on an exponential scale, in addition to the drug, vaccine, microwave, true value & education genocide going on right now…oh yeah voting genocide…

In America, even in Canada, most people do not even know about the Public Banking Institute or the simple and powerful way to protect money and assets…

the most advanced solution in Canada and the USA are found at :

https://www.strategic-enterprise.ca/Welcome/Advanced_Civilisation_Projects.html for a good idea, and at : https://intergalactic-securities.ca/Intergalactic_Accounts/ISMC_PIM_Account.html which is light years ahead of anything else for obvious reasons.

What about self directed private pension funds? Why not pay off your own mortgage? Why not invest in the company you work for? This would take capital structure, shares with voting rights, protected in trust, with built in liability protection and Strategic Risk Management, this means class A, not class B, (Be nothing, own nothing, vote nothing, achieve nothing) or anything else but voting class…that would nuke many public securities, as they want your money but you have no say, no ownership, no real title, and electronic registry that can be wiped by an EMP to erase your assets and all evidence of the crimes…or sorry, rewind the time travel device…

What is it going to be? A kick ass ultra-nationalist real Canadian to protect your interests and assets and future…or, a mastermind criminal, traitor or sellout, with allegiance to someone else, somewhere else, with another flag that is definitely not Canadian;

someone tough on crime, fraud, treason and genocide or someone involved in some or all of that…

legit paper votes, ownership, voting, control and editing, or those who censor truth, knowledge, wealth and freedom, in addition to your future;

made in Canada or made somewhere else? Pensions for Made in Canada, or pensions to finance the enemy and put you out of business and there is nothing you can do about it, especially when you are defrauded and the company goes bankrupt…or bought out or liquidated by globalists and over regulated by governments who are anti free enterprise, and are actually into wealth redistribution which is a code word for government sponsored theft, fraud, crime, genocide, treason and war, along with a debt based money system of imbeciles…knowing full well that a government or at least some people in it are a front for a criminal organization, which means this is the best website about red-pilling, which is a little or lot different than the trauma based mind control super imposed by the bogus covid 19, however the 5G bio-weapon is not bogus, it is the invisible enemy of which discussion has been censored by “mass media big tech and liberal fascist agents engaged in globalism”

obviously I don’t talk or write like O’Toole, especially in question period, you will not have that warm fuzzy feeling or the rage that you might experience from some stupid insolent arrogant person who is engaged in total treason against you and Canada…who refuses to answer your question about anything…nothing like being vindicated, validated, exonerated, with some justice and real freedom of speech, compared to being vexed and victimized by the virus of crime, treason and genocide that will be happy to take all of your pension and experience zero grief, like a sociopath financial predator…so take your pick, freedom of choice, freedom, optimism and opportunity, health and wealth red pill rocketing to an awesome creative and productive future, or six feet under…in a blue pill coffin for ignorance, debt, sickness, loss opportunity, and all the things you don’t want…that you believe in all that is your present version of reality, kick it up a little, get some Made in Canada Boots, you will need them, with a good solid pension that is true north strong and free.