The World Bank tries to portray itself as an organization devoted to the welfare of humankind globally. However, the organization is involved in many bond schemes that most people are completely unaware of. It’s quite the lucrative side operation.

1. More On The International Banking Cartel

For more on the banking cartel, check this page. The Canadian Government, like so many others, has sold out the independence and sovereignty of its monetary system to foreign interests. BIS, like its central banks, exceed their agenda and try to influence other social agendas. See who is really controlling things, and the common lies that politicians and media figures tell. The bankers work with the climate mafia and pandemic pushers to promote mutual goals of control and debt slavery.

2. Important Links

5 Organizations Make Up The World Bank

World Bank Launches “Blockchain Bond” In 2018

Second Round Of Blockchain Bonds In 2019

Video Explaining Blockchain Implementation In New Bonds

Seychelles Launches Blue Bonds In 2018

Blue Bonds Partially Financed By Rockefeller Foundation

Video Explaining Blue (Water) Bonds Concept

Rockefeller Foundation Financing Green Bonds

Founders And Partners Of Climate Bonds

“Pandemic Bonds” Started in 2017 By World Bank Group

Pandemic Emergency Financing Facility

World Bank Won’t Pay Out Pandemic Bonds

Video Explaining Pandemic Bonds Concept

World Bank Launching Social Impact Bonds

Lukashenko Claims IMF & World Bank Offered Bribe

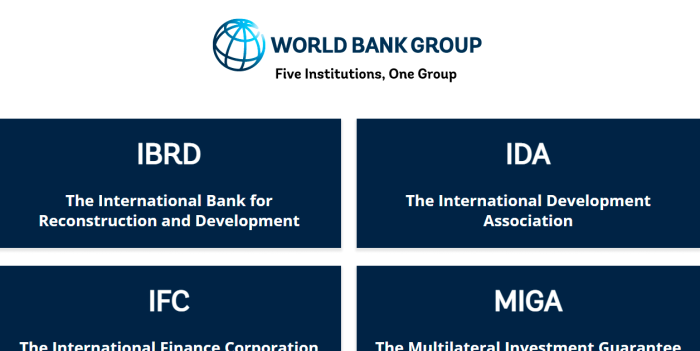

3. About The World Bank Group

- IBRD, The International Bank for Reconstruction and Development

- IDA, The International Development Association

- IFC, The International Finance Corporation

- MIGA, The Multilateral Investment Guarantee Agency

- ICSID, The International Centre for Settlement of Investment Dispute

Partnering With Governments

Together, IBRD and IDA form the World Bank, which provides financing, policy advice, and technical assistance to governments of developing countries. IDA focuses on the world’s poorest countries, while IBRD assists middle-income and creditworthy poorer countries.

.

Partnering With The Private Sector

IFC, MIGA, and ICSID focus on strengthening the private sector in developing countries. Through these institutions, the World Bank Group provides financing, technical assistance, political risk insurance, and settlement of disputes to private enterprises, including financial institutions.

.

One World Bank Group

While our five institutions have their own country membership, governing boards, and articles of agreement, we work as one to serve our partner countries. Today’s development challenges can only be met if the private sector is part of the solution. But the public sector sets the groundwork to enable private investment and allow it to thrive. The complementary roles of our institutions give the World Bank Group a unique ability to connect global financial resources, knowledge, and innovative solutions to the needs of developing countries.

Most people don’t know this, but the World Bank is actually the partnership of 5 organizations. Strangely, an outside search of them reveals nothing about them, other than being part of the World Bank Group. A deep dive is needed into the inner workings of the World Bank, and is coming in a future article.

4. Types Of Bonds World Bank Involved With

Here are some of the programs the World Bank has been mixed up in. It’s quite the varied and lucrative enterprise. People can become very wealthy with these schemes, although, it’s dependent on others playing along.

- Blockchain Bonds

- Blue (Water) Bonds

- Green Bonds

- Pandemic Bonds

- Social Bonds

- Vaccine Bonds

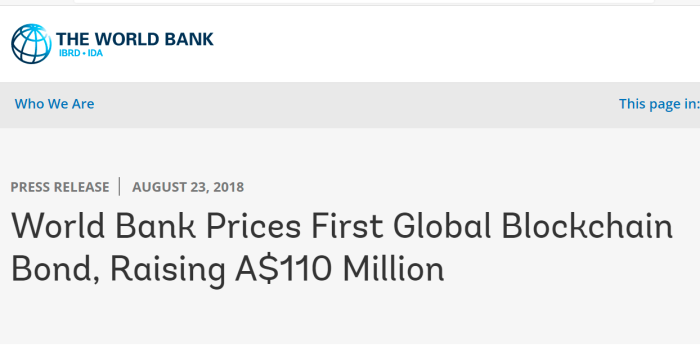

5. World Bank & Blockchain Bonds

WASHINGTON/SYDNEY, August 23/24, 2018 – The World Bank launched bond-i (blockchain operated new debt instrument), the world’s first bond to be created, allocated, transferred and managed through its life cycle using distributed ledger technology. The two-year bond raised $110 million, marking the first time that investors have supported the World Bank’s development activities in a transaction that is fully managed using the blockchain technology.

The World Bank mandated Commonwealth Bank of Australia (CBA) as arranger for the bond on August 10. The announcement was followed by a two-week consultation period with the market, with key investors indicating strong support for the issuance.

Investors in the bond include CBA, First State Super, NSW Treasury Corporation, Northern Trust, QBE, SAFA, and Treasury Corporation of Victoria. CBA and the World Bank will continue to welcome investor interest in the bond throughout its life cycle, and inquiries from other market participants in relation to the platform.

The bond is part of a broader strategic focus of the World Bank to harness the potential of disruptive technologies for development. In June 2017, the World Bank launched a Blockchain Innovation Lab to understand the impact of blockchain and other disruptive technologies in areas such as land administration, supply chain management, health, education, cross-border payments, and carbon market trading.

The World Bank Group started “blockchain bonds” in 2018. Rather than the more traditional methods, this would, as the name implies, use Blockchain technology as an alternative. The next round of bonds came in 2019.

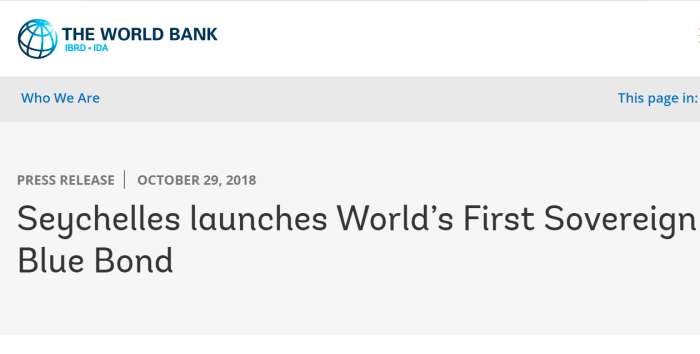

6. World Bank & Blue (Water) Bonds

The Republic of Seychelles start the first sovereign “blue bond” in 2018. The Rockefeller Foundation, Standard Chartered Bank and Bank of New York Mellon helped with payments. The bonds themselves were placed with the private investors: Nuveen, Prudential and Calvert Impact Capital.

7. World Bank & Green/Climate Bonds

Climate Bonds, or “Green Bonds“, is yet another growing industry that the Rockefellers and other environmental groups are trying to pump up. This is an industry that is potentially worth $100 trillion or more. However, the money likely won’t be going where people think it will.

8. World Bank, PEFF & Pandemic Bonds

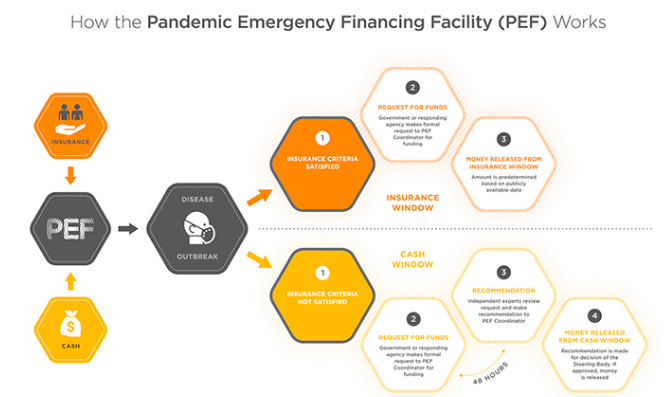

Washington, DC, June 28, 2017 – The World Bank (International Bank for Reconstruction and Development) today launched specialized bonds aimed at providing financial support to the Pandemic Emergency Financing Facility (PEF), a facility created by the World Bank to channel surge funding to developing countries facing the risk of a pandemic.

This marks the first time that World Bank bonds are being used to finance efforts against infectious diseases, and the first time that pandemic risk in low-income countries is being transferred to the financial markets.

The PEF will provide more than $500 million to cover developing countries against the risk of pandemic outbreaks over the next five years, through a combination of bonds and derivatives priced today, a cash window, and future commitments from donor countries for additional coverage.

The transaction, that enables PEF to potentially save millions of lives, was oversubscribed by 200% reflecting an overwhelmingly positive reception from investors and a high level of confidence in the new World Bank sponsored instrument. With such strong demand, the World Bank was able to price the transaction well below the original guidance from the market. The total amount of risk transferred to the market through the bonds and derivatives is $425 million.

In June 2017, the World Bank started up “Pandemic Bonds“, which would be a sort of insurance policy against infectious diseases. Of course, one has to wonder how far ahead they saw in starting this.

The PEFF, or Pandemic Emergency Financing Facility, will determine if there is a pandemic, according to certain criteria. But early in 2020, the World Bank was accused of “waiting for people to die”, by refusing to pay out this money.

9. World Bank & Social Impact Bonds

In February 2019 “Social Impact Bonds” were started up. They are marketed as a sort of social investment driver, to improve the quality of live for people in the 3rd World, particularly women. They are also supposed to help with the financing of the UNSDA, or United Nations Sustainable Development Agenda.

10. World Bank, IFFM & Vaccine Bonds

This was addressed in the Planned-emic series. Instead of giving money directly to GAVI, there is a convoluted scheme that involves making pledges to IFFIm, the International Finance Facility for Immunizations. Those pledges are then used to generate bonds which are sold to the World Bank. The World Bank then re-sells those bonds on the open market. The money from sales goes to GAVI, who uses it to finance their vaccine agenda.

Note: IFFIm is actually financed by GAVI (who is financed by Gates), so there isn’t really any independence here.

Of course, these means that donor pledges end up costing much more than originally told, or it means only a portion of that money is put to use.

11. Some Thoughts On These Bonds

In early 2020, the President of Belarus claimed that the IMF (International Monetary Fund), and World Bank, offered him a bribe of almost $1 billion if he would impose pandemic measures on his country. He refused. While that seemed like an absurd conspiracy theory at the time, more and more questions need to be answered.

What are the IMF and World Bank up to, and are these bonds connected to their push for drastic (and forced) social changes?

While all of these projects have nice enough sounding names, a question keeps coming up: why is it necessary to use these bonds at all? Instead of selling, and reselling bonds, shouldn’t the money go directly to the people who will be impacted? After all, the average person doesn’t benefit from increased bond values, only the bond holders do.

It’s interesting that the Rockefeller Foundation is so supportive of all of this. After all, they drafted the Lockstep Narrative in 2010. They lay out in broad strokes how to force social change under the false pretense of a global health crisis.

Of course, companies that don’t play along with the agenda, such as “non-green” industries, will soon be forced out of business. The threats have been openly made for a long time now.