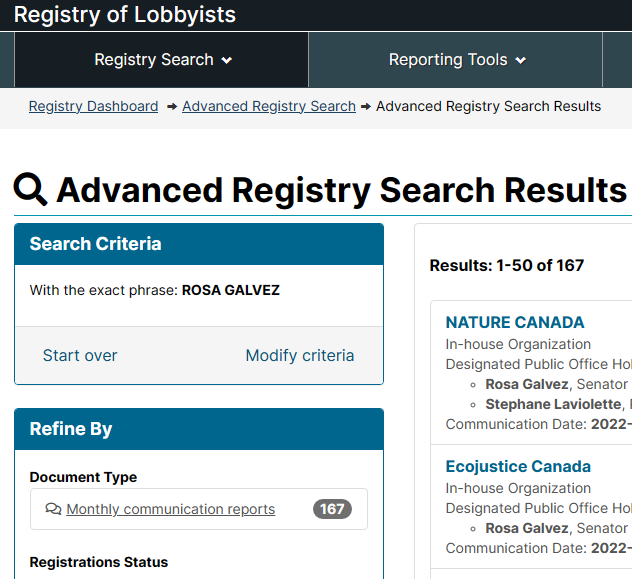

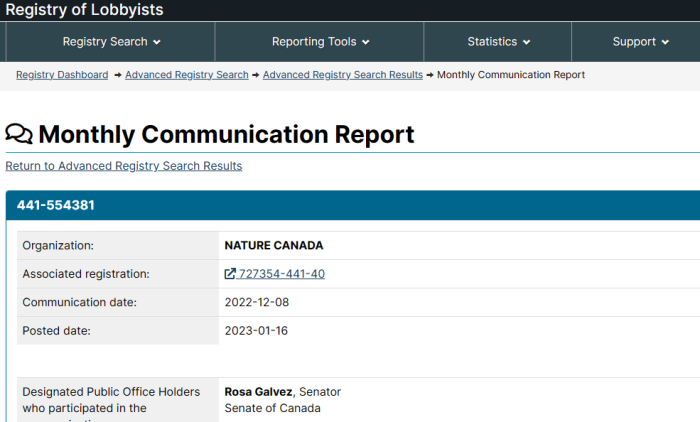

Yes, the Supreme Court of Canada recently declared the Carbon tax to be constitutional. But who exactly were the NGOs pushing for this to be accepted?

1. Debunking The Climate Change Scam

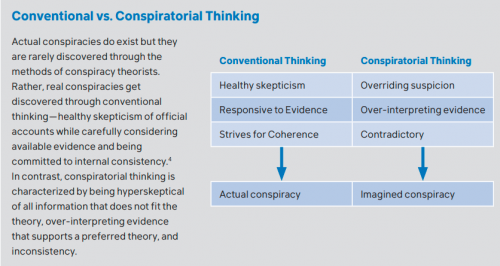

The entire climate change industry, (and yes, it is an industry) is a hoax perpetrated by the people in power. See the other articles on the scam, the propaganda machine in action, and some of the court documents in Canada. Carbon taxes are just a small part of the picture, and conservatives are intentionally sabotaging their court cases.

2. Important Links

https://decisions.scc-csc.ca/scc-csc/scc-csc/en/item/18781/index.do

https://scc-csc.ca/case-dossier/info/af-ma-eng.aspx?cas=39116

Diverge Media On Major Judicial Conflict In Case

Canada Ecofiscal Commission – Main Page

https://www.linkedin.com/in/christopher-ragan-7a595631/

https://rightsofchildren.ca/our-work/

https://www.progressalberta.ca/about

https://www.linkedin.com/in/jimstorrie/

https://institute.smartprosperity.ca/content/green-bonds-canada

https://institute.smartprosperity.ca/about

https://www.youthclimatelab.org/

https://www.youthclimatelab.org/our-board

https://www.youthclimatelab.org/toolbox

3. Diverge Media On Chief Justice Wagner

Diverge Media just reported that Chief Justice Richard Wagner was the opening speaker at the Centre For International Sustainable Development Law (CISDL) in 2020. That certainly sheds things in a new light. Check out their article for much more information.

4. NGOs Intervening In Court Challenges

- Assembly of First Nations

- Athabasca Chipewyan First Nation

- Canada’s Ecofiscal Commission

- Canadian Public Health Association

- Canadian Taxpayers Federation

- Climate Justice et al

- David Suzuki Foundation

- Generation Squeeze et al

- Generation Squeeze

- Public Health Association of BC

- Saskatchewan Public Health Association

- Canadian Associations of Physicians for the Environment

- Canadian Coalition for the Rights of the Child

- Youth Climate Lab

- International Emissions Trading Association

- Oceans North Conservation Society

- Progress Alberta Communications Limited

- Saskatchewan Power Corporation & Saskenergy Inc.

- Smart Prosperity Institute

- Thunderchild First Nation

The list of both the Governments and NGOs participating in the Supreme Court challenge are available to all. Likewise, the arguments they submit are all posted publicly. While it’s too extensive to cover everything, let’s dig down anyway.

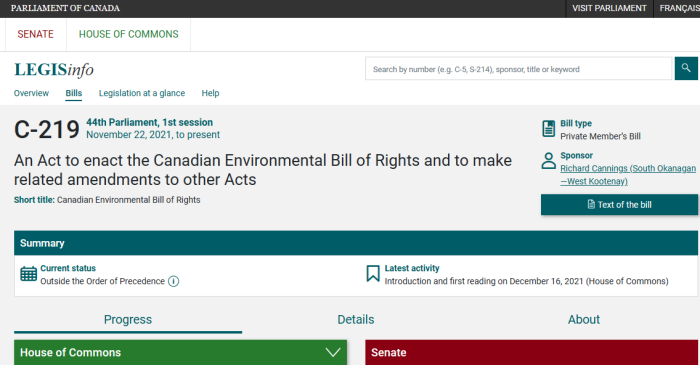

5. Canada’s Ecofiscal Commission

Canada Ecofiscal Commission recommends raising Canada’s Carbon tax to $210/tonne, and are fully behind the climate agenda. But who exactly is involved with this organization? Who is calling the shots?

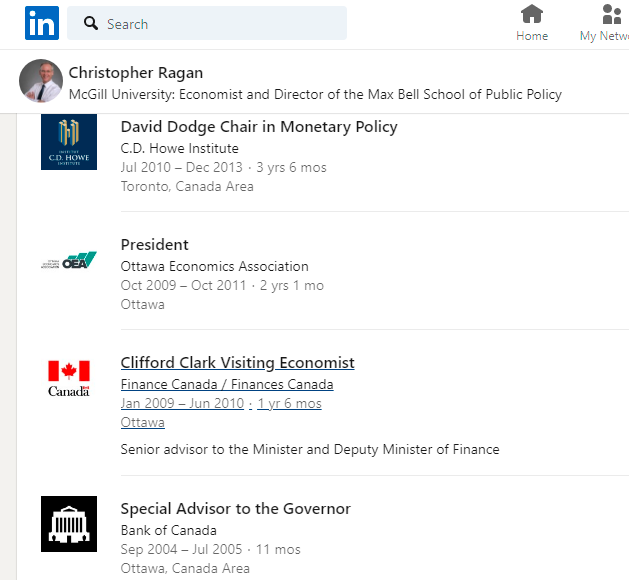

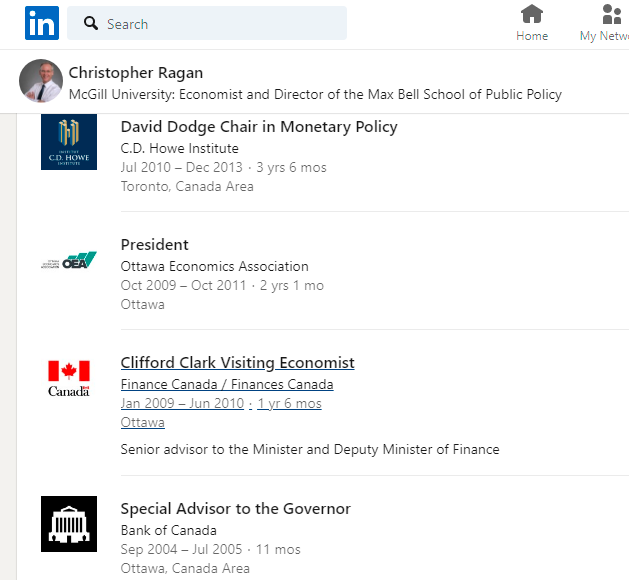

Chris Ragan is the Chair of the Canada Ecofiscal Commission. Prior to that, he was: Advisor to the Governor of the Bank of Canada; Advisor to the Finance Minister of Canada; and worked for the C.D. Howe Institute.

Glen Hodgson‘s history includes: Conference Board of Canada, where he was Senior Vice-President and Chief Economist for twelve years; the International Monetary Fund (IMF) in Washington D.C.; Export Development Canada (EDC); and the Canadian Department of Finance. His affiliations include: Senior Fellow at the C.D. Howe Institute; Chief Economist with International Financial Consulting Ltd (IFCL)

Jason Dion was a project manager and economist at the International Institute for Sustainable Development (IISD), where his work focused on climate change mitigation and adaptation, green public procurement, and sustainable infrastructure. Jason is the author of numerous publications, including environmental fiscal reform studies for the governments of Mauritius and Mozambique, funded by the United Nations Environment Programme (UNEP).

Steven Williams is the CEO of Suncor, and is also on the McKinsey & Company Advisory Committee. In 2005 he was appointed to the National Roundtable on the Environment and the Economy by the Prime Minister, then Paul Martin. He was also part of COP21 in Paris in 2015.

The advisory Board includes:

- Michael Harcourt, former Vancouver Mayor

- Gordon Campbell, former Vancouver Mayor, former BC Premier

- Jean Charest, former Quebec Premier

- Paul Martin, former Prime Minister

There are more of course, but a lot of interesting connections to the political world. And perhaps a coincidence, but McGill and Simon Fraser Universities keep coming up in their biographies.

6. Canadian Coalition For Rights Of The Child

Our Work

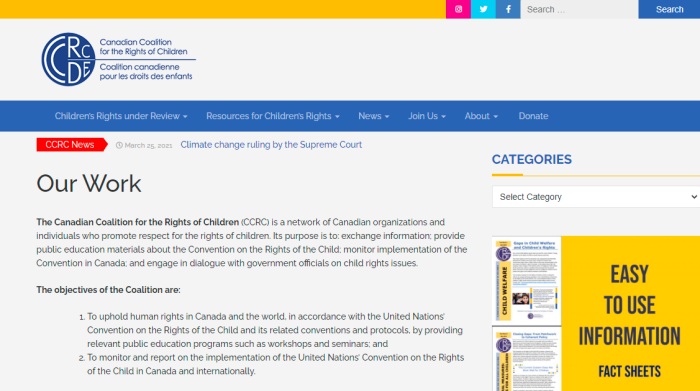

The Canadian Coalition for the Rights of Children (CCRC) is a network of Canadian organizations and individuals who promote respect for the rights of children. Its purpose is to: exchange information; provide public education materials about the Convention on the Rights of the Child; monitor implementation of the Convention in Canada; and engage in dialogue with government officials on child rights issues.

The objectives of the Coalition are:

-To uphold human rights in Canada and the world, in accordance with the United Nations’ Convention on the Rights of the Child and its related conventions and protocols, by providing relevant public education programs such as workshops and seminars; and

-To monitor and report on the implementation of the United Nations’ Convention on the Rights of the Child in Canada and internationally.

What We Do

The Convention on the Rights of the Child is the guiding framework for all activities of the coalition. Those activities include:

-Monitoring and promoting the implementation of children’s rights in Canada, in both domestic policies and international relations.

-Establishing national, provincial, and local links between groups concerned about the well-being of children, to share information and co-operate in the advancement of children’s rights.

-Fostering education and awareness in Canada about the rights of children, especially among young Canadians.

-Promoting Canada’s role in international bodies that foster children’s rights and engaging Canadians in international initiatives to advance respect for children’s rights.

How We Do It

Children’s Rights Monitoring

-The CCRC brings together Canadian children and civil society organizations to participate in the regular five-year reviews of Canada’s implementation of the CRC before the UN Committee on the Rights of the Child.

-The CCRC makes submissions on policy proposals before parliament from the perspective of children’s rights.

-The Coalition provides a child-rights analysis of the federal budget and other national policies.

-The CCRC helps children from all parts of Canada participate in consultations on matters that affect them, with the support of coalition members. Canadian children have participated in the World Summit for Children, the Earth Summit, the UN Special Session for Children, and other national and international events.

-The CCRC provided policy recommendations for Canada’s participation in the UN Special Session for Children, and for Canada’s Action Plan, entitled “A Canada Fit for Children.”

Presumably, wanting carbon dioxide gone is a children’s rights issue. This group openly admits that its major goals involve seeing through the implementation of a child’s right treaty.

- Kate Butler, Child Protection Advisor, Save the Children Canada – Chair

- Hala Mreiwed, Post-doctoral Student, Children’s Rights and Education, McGill University – Secretary

- Emily Chan, Lawyer, Justice for Children and Youth – Treasurer

- Robyn Aaron, Child Rights Specialist

- Daniella Bendo, PhD Candidate in Children’s Rights, Carleton University

- Terence Hamilton, Child Rights Policy Analyst, UNICEF Canada

- Helesia Luke, Communications and Development Coordinator, First Call BC Child and Youth Advocacy Coalition

- Laura Wright, Child Rights Consultant and PhD Candidate in Children’s Rights

- Candace Blake-Amarante, PhD., Playwright and Children’s Author

- Michael Saini, Ph.D., M.S.W., R.S.W., Associate Professor, Factor-Inwentash Chair in Law and Social Work. University of Toronto

- Ashley Vandermorris, MC, FRCPC, Staff Physician, Division of Adolescent Medicine, Sick Kids Hospital. Associate Professor, Department of Paediatrics, University of Toronto

- Tara Black, PhD, Assistant Professor, Factor-Inwentash Faculty of Social Work, University of Toronto

It’s list of Directors is pretty impressive, but this seemingly has nothing to do with the climate change agenda. Nonetheless, they have been granted Intervenor status with the Supreme Court of Canada, along with Generation Squeeze

7. David Suzuki Foundation

This was addressed in considerable detail in another article. Take a deeper look into what exactly is going on, and what their interests really are. It’s a very well funded organization. There’s also details provided on the International Emissions Trading Association, (IETA).

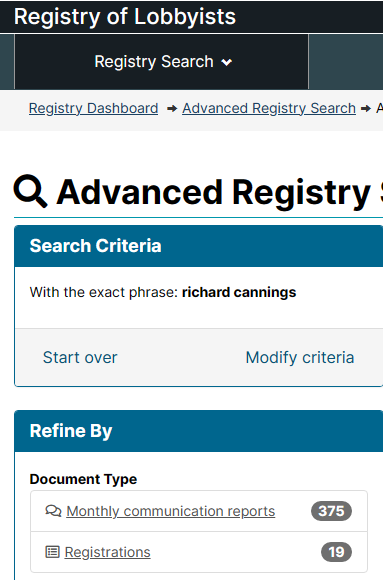

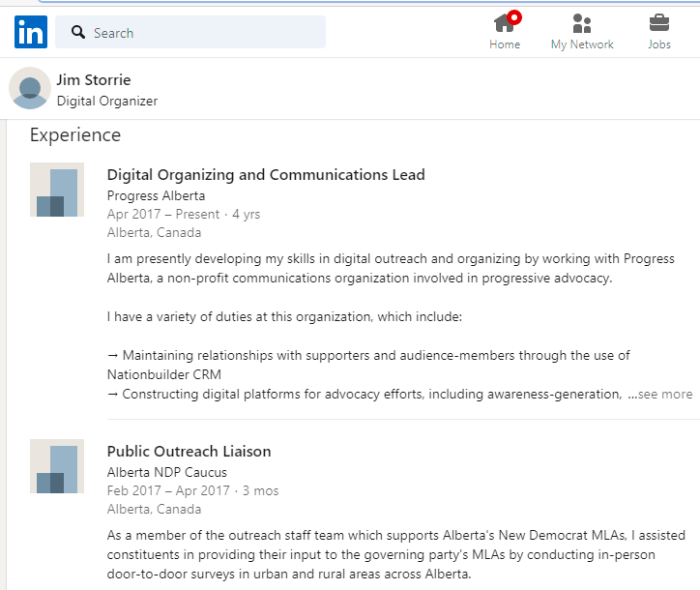

8. Progress Alberta

Progress Alberta describes itself as a progressive leaning advocacy group. To their credit, they don’t claim to be neutral in the policies they call for. One of their members, Jim Storrie, recently worked for the Alberta NDP, which is interesting. There is little information about who their donors actually are.

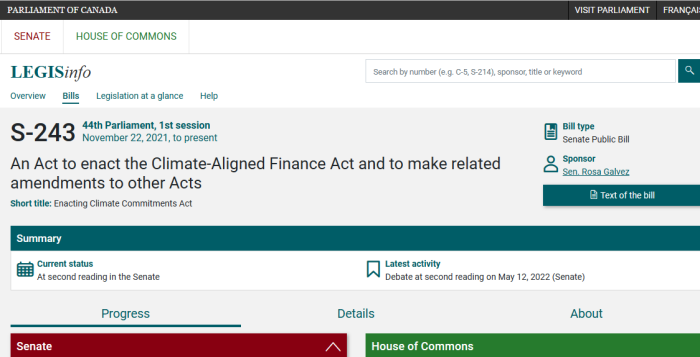

9. Smart Prosperity Institute, Green Bonds

Smart Prosperity Institute’s annual “Green Bonds – State of the Market in Canada” reports provide unique insight on the role of green bonds in funding environment and climate-related projects in Canada. The annual report is a special supplement to the Bonds and Climate Change: The State of the Market global report and is prepared collaboratively with Climate Bonds Initiative. Commissioned by HSBC, the report marks specific highlights from the current year, emerging trends, and identifies specific opportunities for market development of green bonds in Canada.

The Smart Prosperity Institute is heavily in selling “climate bonds“, and partners with HSBC and the Climate Bonds Initiative. Their financial interest in this enterprise heavily depends on there being continued growth in the bond market.

The Climate Bonds Initiative publicly posts that the market for their climate bonds may eventually top $1 trillion in value. But this can only happen if Governments everywhere continue to push the narrative that climate change is about to cause a worldwide disaster.

Green Bonds have infiltrated Ontario and Quebec, and elsewhere. More and more public money is being sunk into these ventures.

- uOttawa

- Social Sciences and Humanities Research Council of Canada

- The Ontario Ministry of the Environment and Climate Change

- Fulbright Canada

- Natural Resources Canada

- The Jarislowsky Foundation

- Atkinson Foundation

- Alberta Real Estate Foundation

- Environment and Climate Change Canada

- Société de développement économique de la Colombie-Britannique (SDECB)

- Tides Canada

- CDEM

- Echo Foundation

- The Greenbelt Foundation

- The Real Estate Foundation of BC

- The J.W. McConnell Family Foundation

- Conseil de développement économique de l’Alberta

- The Salamander Foundation

- Canadian Water Network

- Suncor Energy Foundation

- Vancity

- Conseil Économique et Coopératif de la Saskatchewan

Steven Williams, CEO of Suncor, is also part of Canada’s Ecofiscal Commission, another Intervenor trying to keep the Carbon tax intact. The Tides Foundation gets some funding from George Soros, head of Open Society. Various branches of Government — relying on taxpayer money — also fund this group. The McConnell Foundation also contributes to Youth Climate Lab.

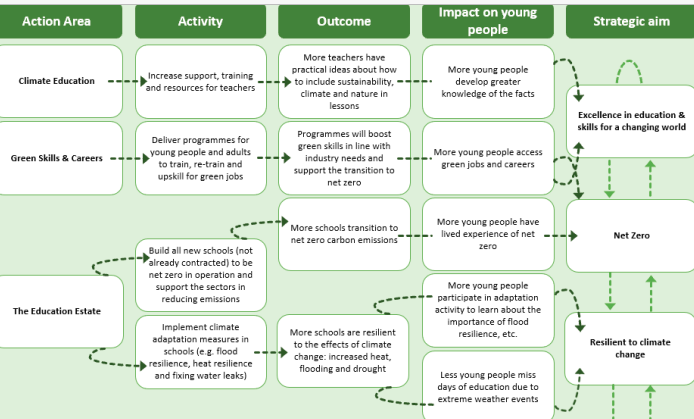

10. Youth Climate Lab, Infiltration Manual

Dominique Souris, the co-Founder and Executive Director of Youth Climate Lab, is also a member of the World Economic Forum. Both groups are ideologically aligned with the climate change agenda.

Ronny Jumeau was appointed Seychelles’ Permanent Representative to the United Nations and Ambassador to the United States for the first time. He was also Ambassador to Canada, Brazil, Cuba and several Caribbean islands until 2012 when he became his country’s New York-based roving Ambassador for Climate Change and Small Island Developing State Issues. He is the Member of the Board of the Green Climate Fund (GCF), representing Small Island Developing States(SIDS) and a Member of the Executive Council of SIDS DOCK, the global sustainable energy initiative for Small Island Developing States (SIDS). He is also a Director at Youth Climate Lab

Youth Climate Lab — Infiltration Manual

Youth Climate Lab produces an “infiltration manual“, (their words, not mine), to give people step by step instruction on how to insert the climate change agenda into local politics. They are partnered with the climate caucus, and funded by the McConnell Foundation.

11. What Does All This Mean To Canada?

Various Provincial Premiers intentionally sabotaged their court challenges by playing along with the climate change scam. Now, it seems that several NGOs acting as Intervenors had their own agenda in making submissions. Even groups like the Canadian Taxpayers’ Federation only opposed it on groups it was wasteful.

It’s also interesting, that piece by Diverge Media, which lists Canada’s Supreme Court Chief Justice speaking at an eco-conference. That alone raises questions about how impartial he is.

In the end, it’s the Canadian public that gets hurt by this politically driven Carbon tax. There wasn’t anyone fighting for the public during those proceedings.

Like this:

Like Loading...