(Originally featured in Maclean’s as “The Resistance”)

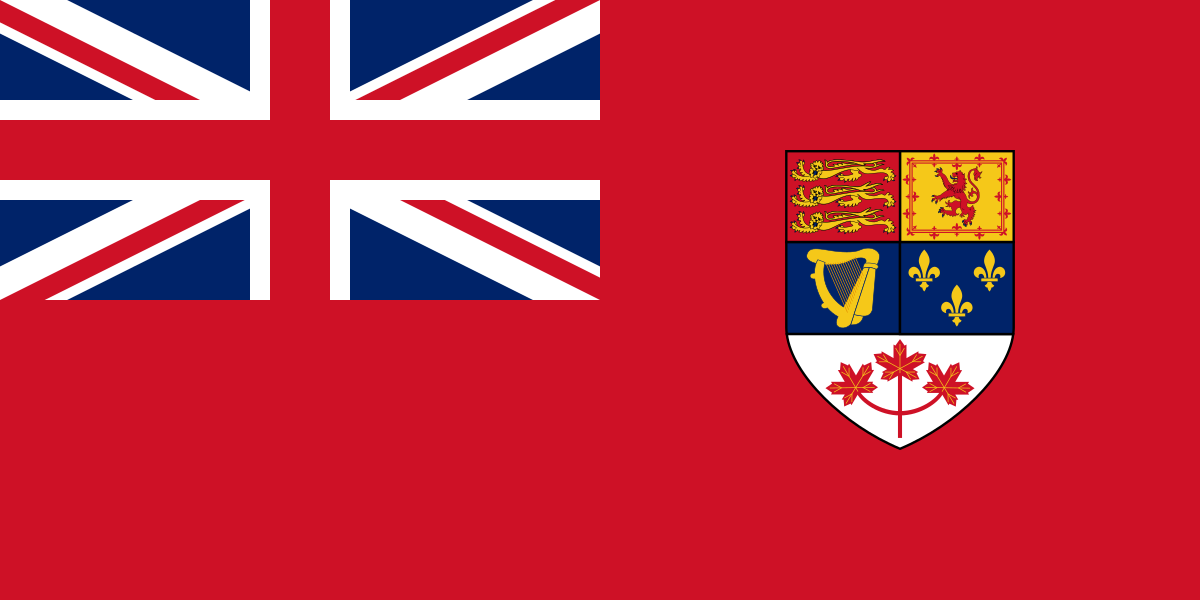

(Saskatchewan Premier Scott Moe. Read between the lines.)

1. Debunking The Climate Change Scam

CLICK HERE, for #1: major lies that the climate frauds tell.

CLICK HERE, for #2: review of the Paris Accord.

CLICK HERE, for #3: Bill C-97, the GHG Pollution Pricing Act.

CLICK HERE, for #4: in 3-2 decision, Sask. COA allows carbon tax.

CLICK HERE, for #5: controlled opposition to carbon tax.

2. Important Links

Supreme Court Of Canada To Hear Challenge

SCC Attorney General Of Ontario

SCC Attorney General Of Canada

SCC Attorney General Of Saskatchewan

SCC Attorney General Of Alberta

SCC Attorney General Of Quebec

SCC Attorney General Of New Brunswick

SCC Attorney General Of Manitoba

SCC Attorney General Of British Columbia

SCC Amnesty International

SCC Canadian Labour Congress

SCC David Suzuki Foundation

SCC Intergenerational Climate Committee

SCC International Emissions Trading Association

SCC Smart Prosperity Institute

SCC Attorney General Of Ontario Reply

SCC Attorney General Of Canada Reply

CLICK HERE, for Saskatchewan Court of Appeal ruling.

CLICK HERE, for Ontario Court of Appeal ruling.

CLICK HERE, for Alberta Court of Appeal ruling.

CLICK HERE, for Supreme Court of Canada constitutional challenge.

Alberta Situation

CLICK HERE, for Jason Kenney Repeals Carbon Tax.

CLICK HERE, for Kenney Supports New Carbon Tax.

CLICK HERE, for Kenney To Hike New Carbon Tax.

CLICK HERE, for New Brunswick creating its own Carbon tax.

3. Reading Between The Lines

Throughout this interview, and any interview, Scott Moe never tells anyone that Carbon Dioxide is not pollution, and that it is used in photosynthesis. He never tells his interviewers that removing CO2 from the atmosphere will kill off plant-life, and by extension, ourselves. Moe never goes into any of the bogus junk science.

Why does this matter? Because Scott Moe, like Doug Ford in Ontario, Jason Kenney in Alberta, Blaine Higgs in New Brunswick, and Brian Pallister in Manitoba all claim to oppose the Carbon tax, but endorse the climate change scam itself.

Read through the filings throughout this article. These so-called “conservatives” thoroughly and completely endorse the UN IPCC warnings that catastrophe is imminent. They all agree that climate change will cause damage long term. They don’t (really) even oppose a Carbon tax. The issue is over who shall implement a “solution”, the Federal Government of the Provinces.

They cannot effectively oppose an agenda that they support in principle. All of these self-identified “conservative” Premiers are on board with the climate change scam.

4. Supreme Court Of Canada Filings

Let’s start with the pleadings filed by the Ontario Government, currently under the rule of Doug Ford. What does Ontario have to say about this?

The Ontario challenge previously, and this subsequent appeal, are limited to 2 very narrow and technical questions over taxation. There is nothing in either the ONCA challenge, nor this appeal, that suggest the Government takes any issue with the climate change agenda.

In fact, in the Court of Appeal challenge, the Ontario Government fully accepted the UNIPCC claims about climate change, and the need to act urgently on it. So, really, what is the point of doing these challenges in the first place?

Now let’s turn to Saskatchewan, which has joined as an intervenor in this case. Essentially, they are supporting Ontario’s challenge. What do they have to say about all of this.

Similar to Ontario, Saskatchewan does not challenge the climate change agenda in any way, shape or form. Instead, there are 2 extremely limited and technical questions put forward for the court to consider.

This is the state of opposition to Trudeau in Canada. Admit all of the major facts. Instead, argue over minor details, and insist this is a Provincial matter. Very petty.

(from the Ontario submissions)

1. This case is not about whether action needs to be taken to reduce greenhouse gas emissions or the relative effectiveness of particular policy alternatives. It is about (1) whether the federal Greenhouse Gas Pollution Pricing Act (the “Act”) can be supported under the national concern branch of the POGG power; and (2) whether the “charges” imposed by the Act

are valid as regulatory charges or as taxes. The answer to both questions should be no.

(from the Saskatchewan submissions)

2. This appeal does not concern whether global climate change is real and concerning or if the provinces are taking sufficient action to reduce GHG emissions. All parties agree that global climate change is a significant societal problem and all provinces have and continue to take action to reduce GHG emissions. In the Courts below, many submissions, including those of the Attorney General of Canada, focused on the nature of climate change and the importance of carbon pricing as an effective method of reducing GHG emissions. However, the efficacy of carbon pricing is not relevant to the constitutionality of the GGPPA, which must be derived from whether it is within the legislative competence of the federal government.

This entire façade is limited to technical questions over taxation. Nothing about the fake science behind these dire predictions.

And no, this is not limited to the Supreme Court of Canada. These players pulled the exact same stunt in their respective Provincial challenges.

5. Ontario Court Of Appeal Ruling

At the ONCA, the Province lost in a split decision to the Federal Government. The arguments were very similar to what happened in the Saskatchewan case. So what went wrong? Well, admitting that climate change is a threat to the world might not have helped.

Yes, in their own court challenge, Ontario agreed that climate change is a serious problem, and that real action has to be taken to prevent it from getting worse. So from that perspective, the court essentially had a case where the facts were all agreed to.

Don’t worry. It’s about to get much worse. Ontario was joined by several “intervenors” who were essentially there to reinforce their case. And they did just that.

Ontario was joined by New Brunswick. Not only did they endorse Ontario’s view that climate change is real and a threat, they said that this court forum should not be used by anyone who would deny climate change. So much for allowing different perspectives.

British Columbia also joins as an intervenor in the case. BC reiterates that climate change is real, and greenhouse gases are to blame. But instead of rejecting a Carbon tax, it touts its own as a model to emulate.

However, it is not just other Provincial or local Governments that were allowed to enter submissions for this hearing. Other groups were as well. Let’s take a look at a few.

The United Conservative Association entered the case, claiming that they agreed with the Attorney General of Ontario’s submissions. Thing is, the AG submitted that climate change was a threat to everyone and that action had to be taken. In essence, all of the facts were admitted once again. The only opposition was to prevent backlash and a unity crisis over the taxation.

The Canadian Taxpayers Federation also joined in the Ontario matter. They argued that given their agenda, not wasting the money of taxpayers was a real concern. While true, they never addressed the elephant in the room: namely that the whole Carbon tax was predicated on lies.

Now, with every one of these parties saying that climate change is real and that human are responsible (or at least ignoring the issue), it should be no surprise how the court ruled. The ONCA said that yes, the Federal Government had the right to levy this tax.

Greenhouse Gas Emissions and Climate Change

[6] Climate change was described in the Paris Agreement of 2015 as “an urgent and potentially irreversible threat to human societies and the planet”. It added that this “requires the widest possible cooperation by all countries, and their participation in an effective and appropriate international response”.

[7] There is no dispute that global climate change is taking place and that human activities are the primary cause. The combustion of fossil fuels, like coal, natural gas and oil and its derivatives, releases GHGs into the atmosphere. When incoming radiation from the Sun reaches Earth’s surface, it is absorbed and converted into heat. GHGs act like the glass roof of a greenhouse, trapping some of this heat as it radiates back into the atmosphere, causing surface temperatures to increase. Carbon dioxide (“CO2”) is the most prevalent GHG emitted by human activities. This is why pricing for GHG emissions is referred to as carbon pricing, and why GHG emissions are typically referred to on a CO2 equivalent basis. Other common GHGs include methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, sulfur hexafluoride, and nitrogen trifluoride.

[8] At appropriate levels, GHGs are beneficial. They surround the planet like a blanket, keeping temperatures within limits at which humans, animals, plants and marine life can live in balance. The level of GHGs in the atmosphere was relatively stable for several million years. However, since the beginning of the industrial revolution in the 18th century, and more particularly since the 1950s, the level of GHGs in the atmosphere has been increasing at an alarming rate. Atmospheric concentrations of CO2 are now more than 400 parts per million, a level not reached since the mid-Pliocene epoch, approximately 3-5 million years ago. Concentrations of other GHGs have also increased dramatically.

Quite predictably, Ontario lost their challenge at the Court of Appeals. Pretty hard to win when you admit all of the other side’s “facts” regardless of how absurd they are.

6. Saskatchewan Court Of Appeal

II. OVERVIEW

[4] The factual record presented to the Court confirms that climate change caused by anthropogenic greenhouse gas [GHG] emissions is one of the great existential issues of our time. The pressing importance of limiting such emissions is accepted by all of the participants in these proceedings.

[5] The Act seeks to ensure there is a minimum national price on GHG emissions in order to encourage their mitigation. Part 1 of the Act imposes a charge on GHG-producing fuels and combustible waste. Part 2 puts in place an output-based performance system for large industrial facilities. Such facilities are obliged to pay compensation if their GHG emissions exceed applicable limits. Significantly, the Act operates as no more than a backstop. It applies only in those provinces or areas where the Governor in Council concludes GHG emissions are not priced at an appropriate level.

[6] The sole issue before the Court is whether Parliament has the constitutional authority to enact the Act. The issue is not whether GHG pricing should or should not be adopted or whether the Act is effective or fair. Those are questions to be answered by Parliament and by provincial legislatures, not by courts.

[7] The Constitution Act, 1867 distributes legislative authority between Parliament and the provincial legislatures. Broadly speaking, a statute is valid if its essential character falls within a subject matter allocated to the legislative body that put the statute in place. Neither level of government has exclusive authority over the environment. As a result, Parliament can legislate in relation to issues such as GHGs so long as it stays within the four corners of its prescribed subject matters and the provinces can do the same so long as they stay within their prescribed areas of authority.

Quite inexplicably, Saskatchewan admitted, that climate change was a serious problem, and that real action had to be taken. Basically, they admitted that all of the Federal Government’s claims were true. All that the SKCOA had to do was answer some technical questions about whether this taxation format was legal.

Like Doug Ford, Scott Moe sabotaged his Provincial Reference Question by ceding to the pseudo-science that the UNIPCC puts out. Had he challenged it, it is quite likely that the Carbon taxes would have been gone by now.

7. Capitulation By “The Resistance”

The industry tax is being set at a higher level per tonne than Mr. Kenney promised during the spring election, $30 instead of $20, in a move to ensure that the provincial government’s plan is in compliance with the federal climate law. Due to the size of Alberta’s industrial base, especially the province’s large oil and gas industry, the expected reductions in greenhouse gas emissions from the plan will contribute significantly to meeting national targets.

Speaking with reporters on Tuesday before he tabled the legislation, Environment Minister Jason Nixon said industries across Alberta were close to unanimous that they wanted the province to set the tax at a level where the federal government would not take over and regulate their emissions.

The minister added that he will consult on future increases to the provincial tax. The federal carbon price for industry is set to increase by $10 annually until it reaches $50-per-tonne in 2022. If Alberta’s tax were to fall below the federal threshold, Ottawa would likely impose a higher tax under a provision in the federal law known as the backstop.

This is a strange version of fighting for your constituents: surrender and gouge them yourselves, so that Ottawa won’t be the one doing the gouging.

8. Federal Conservatives Not Any Better

The CPC policy declaration, Article 28 does explicitly state no Carbon tax. That said, it tacitly endorses the climate change scam by suggesting that Provinces should develop their own plan. In other words, the CPC supports it, but would not impose this one specific measure.

9. Elephant In The Room: Junk Science

Carbon Dioxide, CO2, is touted as a “greenhouse gas” which contributes to all kinds of environmental disasters.

”Global warming” is a term not used as much anymore, since “climate change” is more vague, and can be more easily adapted.

However, carbon dioxide occurs naturally, just from breathing.

The human body converts carbohydrates, fatty acids, and proteins into smaller “waste products” such as water and carbon dioxide in order to extract energy from them.

Carbon dioxide is not a “waste product” to be eliminated. It is a necessary resource plants use for photosynthesis

6 CO2 (carbon dioxide) + 6 H20 (water) + sunlight ===> C6H1206 (sugar) + 6 02 (oxygen)

While only plants engage in photosynthesis, both plants and animals respire

C6H1206 (sugar) + 6 02 (oxygen) ===> 6 CO2 (carbon dioxide) + 6 H20 (water) + usable energy

The photosynthesis and respiration cycles are not some big mystery. They have been taught in grade schools for many years.