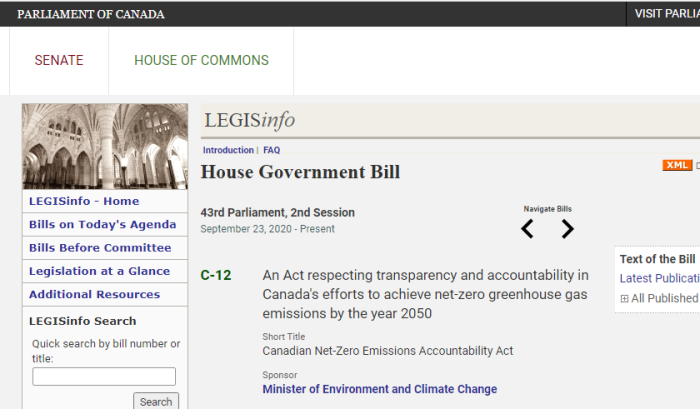

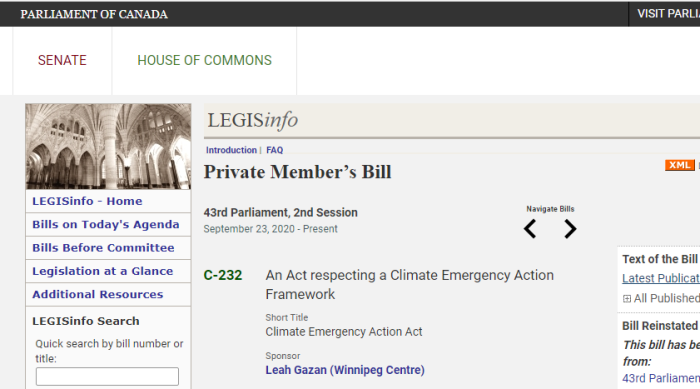

Bill C-12 has been introduced in the House of Commons. It is to force Canada to formally adopt the “Net Zero Emissions by 2050” environmental agenda. A lot more is going on than simply this legislation. Bill C-232 is a Private Member’s Bill concerning the “Climate Emergency Action Framework”.

1. What’s In Bills C-232/C-12?

Climate Emergency Action Framework

Climate emergency action framework

4 (1) The Minister must, in consultation with Indigenous peoples and civil society, develop and implement a climate emergency action framework to achieve the objectives of the Convention on Climate Change respecting the reduction of greenhouse gas emissions. The framework must include measures to

(a) ensure that Canada meets, at a minimum, the greenhouse gas emissions reduction targets set for 2030 under the Convention on Climate Change;

(b) ensure a transition towards a green economy by, among other means, increasing employment in green energy, infrastructure and housing; and

(c) ensure the economic well-being, public health and protection of the natural environment of Canada.

SUMMARY

This enactment requires that national targets for the reduction of greenhouse gas emissions in Canada be set, with the objective of attaining net-zero emissions by 2050. The targets are to be set by the Minister of the Environment for 2030, 2035, 2040 and 2045.

In order to promote transparency and accountability in relation to meeting those targets, the enactment also

(a) requires that an emissions reduction plan, a progress report and an assessment report with respect to each target be tabled in each House of Parliament;

(b) provides for public participation;

(c) establishes an advisory body to provide the Minister of the Environment with advice with respect to achieving net-zero emissions by 2050 and matters that are referred to it by the Minister;

(d) requires the Minister of Finance to prepare an annual report respecting key measures that the federal public administration has taken to manage its financial risks and opportunities related to climate change; and

(e) requires the Commissioner of the Environment and Sustainable Development to, at least once every 5 years, examine and report on the Government of Canada’s implementation of measures aimed at mitigating climate change.

Bill C-232, the Climate Emergency Action Framework, would entrench further Canada’s obligations to Agenda 2030, which was signed in 2015 by Stephen Harper. Wasn’t that supposed to be non-binding?

Bill C-12 is the so-called Net Zero by 2050. Not only will it shut down entire sectors of the economy, the Finance Minister will be required to consider the impacts of climate change in all future reports.

2. Conservatives Support Climate Change Hoax

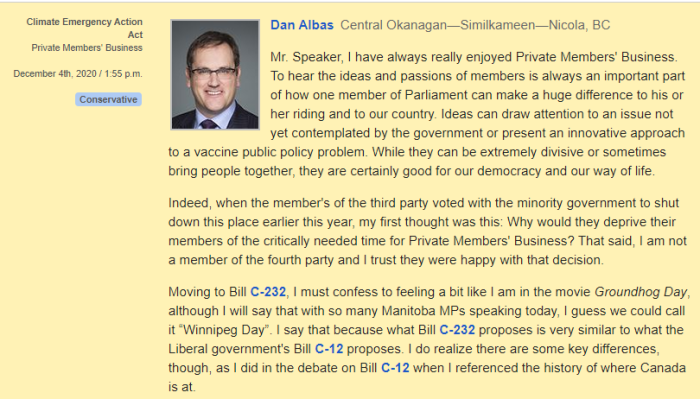

We know while in Paris, despite often criticizing the former Harper government, ultimately the Liberal government adopted those same targets it said would be a minimum. Of course, we all know today the Liberal government has massively failed to reach that so-called minimum. In fact, some reports suggest the Liberal government may be off the target by 123 million tonnes.

.

Obviously that is why we are here today debating this bill and why last week it was Bill C-12. Bill C-12 was quite fascinating from a political perspective. It literally kicks the can so far down the road that it will be up to future governments, and ultimately the government of the day in 2050, to deal with it. How do we get there? There is no road map, no solutions and no costs or penalties for failure. There is more of the same, more promises to do better down the road. They promise.

.

However, that is enough about Bill C-12.

.

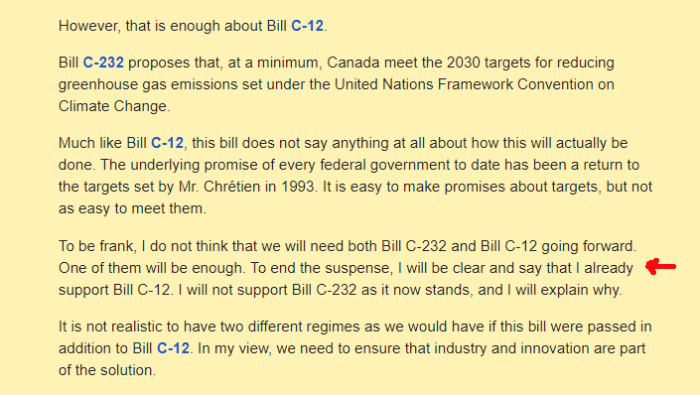

Bill C-232 proposes that, at a minimum, Canada meet the 2030 targets for reducing greenhouse gas emissions set under the United Nations Framework Convention on Climate Change.

.

Much like Bill C-12, this bill does not say anything at all about how this will actually be done. The underlying promise of every federal government to date has been a return to the targets set by Mr. Chrétien in 1993. It is easy to make promises about targets, but not as easy to meet them.

.

To be frank, I do not think that we will need both Bill C-232 and Bill C-12 going forward. One of them will be enough. To end the suspense, I will be clear and say that I already support Bill C-12. I will not support Bill C-232 as it now stands, and I will explain why.

This pattern is extremely common among “Conservative” politicians, both Federally and Provincially. They will argue ad nauseum of minor details of implementation, to give the illusion of opposition. They pretend to fight, although, in the end, they support the same policies.

Think that Conservatives will revive the oil & gas sector, if they ever regained power? Nope, they are fully committed to letting industries like that die off.

3. Ontario Teachers’ Pension Plan, Net Zero

January 21, 2021

.

TORONTO, ON – Building on over a decade of climate change efforts, Ontario Teachers’ Pension Plan Board (Ontario Teachers’) today announced its commitment to achieve net-zero greenhouse gas emissions by 2050. This is a meaningful decision that advances Ontario Teachers’ mission to deliver retirement security for its members, while creating a positive impact for its partners and the communities where it operates.

“As a global pension plan, we will leverage our scale and influence to transition to a low-carbon economy and create a sustainable climate future,” said Jo Taylor, President and CEO. “With coordinated action net zero by 2050 is an ambitious but achievable goal. We are committed to playing our part alongside other organizations and governments around the world to effect significant, positive change.”

Climate change is one of the greatest challenges faced by society and businesses today. The effects of global warming, from rising sea levels and devastating floods to disrupted weather patterns and destructive storms, are clear and wide-ranging.

“While the transition to the low-carbon economy presents many challenges, it also presents many opportunities to earn the returns we need to pay our members’ pensions while more broadly benefiting society and the environment,” said Ziad Hindo, Chief Investment Officer.

The OTTP, Ontario Teachers’ Pension Plan, announced a few days ago that it would be adopting the “Net Zero” initiative. Contributions will now be funneled through environmental causes that are virtuous. In short, this is a way to monetize the eco-push.

Not only will carbon taxes be funneled to various U.N. groups, but it seems that their pensions will be as well. It would be interesting to know if the members ever voted on this.

4. Investment Plans And Environmentalism

Kevin Uebelein

Chief Executive Officer

Alberta Investment Management Corporation

Gordon J. Fyfe

Chief Executive Officer

Chief Investment Officer

British Columbia Investment Management Corporation

Charles Emond

President and Chief Executive Officer

Caisse de dépôt et placement du Québec

Mark Machin

President and Chief Executive Offier

Canada Pension Plan Investment Board

Jeff Wendling

President and Chief Executive Officer

Chief Investment Officer

Healthcare of Ontario Pension Plan

Blake Hutcheson

President and CEO

Ontario Municipal Employees Retirement System

Jo Taylor

President and Chief Executive Officer

Ontario Teachers Pension Plan

Neil Cunningham

President and Chief Executive Officer

Public Sector Pension Investment Board

CEO-Statement-CEO-Signatures-EN-Nov25-2020

The heads of 8 asset management/pension funds have recently signed a pledge to insert the climate change agenda into their investment decisions.

5. Net Zero Asset Owner Alliance

23 September 2019: An alliance of the world’s largest pension funds and insurers committed to achieve carbon-neutral investment portfolios by 2050. Participating pension funds and insurers launched the UN-convened ‘Net-Zero Asset Owner Alliance’ at the UN Secretary-General’s Climate Action Summit.

Allianz, Caisse des Dépôts, La Caisse de dépôt et placement du Québec (CDPQ), Folksam Group, Pension Danmark and Swiss Re initiated the Alliance at the beginning of 2019. Alecta, AMF, CalPERS, Nordea Life and Pension, Storebrand and Zurich have now joined as founding members. The Alliance brings together pension funds and insurers that are responsible for directing over USD 2.4 trillion in investments. These asset owners represent some of the largest pools of capital in the world and typically have highly diversified investment portfolios that are exposed to all sectors of the global economy.

Some 13 organizations — insurers and pension funds — representing some $2.4 trillion in assets banded together to found this group. It’s only expected to grow in numbers and overall value. That is, of course, until the eco-bubble bursts.

6. UN Principles For Responsible Investment

The UN-convened Net-Zero Asset Owner Alliance commissioned the Institute for Sustainable Futures (ISF) at the University of Technology Sydney (UTS) to apply their One Earth Climate model to sectors as defined by sector classification schemes commonly used in finance, with the aim to develop sectoral pathways to net zero by 2050 with carbon emissions (scope 1-2) and energy intensity and carbon intensity (scope 1-2) milestones in 5-year intervals for agreed high emitting sectors.

UNPRI is trying to embed the climate change agenda into all major business and pension related decisions. Recent decisions include eliminating investments for coal, and phasing out oil & gas.

7. Merging ESG Factors And Credit Risk

We, the undersigned, recognise that environmental, social and governance (ESG) factors can affect borrowers’ cash flows and the likelihood that they will default on their debt obligations. ESG factors are therefore important elements in assessing the creditworthiness of borrowers. For corporates, concerns such as stranded assets linked to climate change, labour relations challenges or lack of transparency around accounting practices can cause unexpected losses, expenditure, inefficiencies, litigation, regulatory pressure and reputational impacts.

Typically, a person’s or company’s credit risk was determined by their payment history, and ability to pay off future debts. Now, the ESG factors will be considered as well.

8. UN Environment Program, Commitments

New York, 23 September, 2019 – In one of the boldest actions yet by the world’s largest investors to decarbonize the global economy, an alliance of the world’s largest pension funds and insurers – responsible for directing more than US$ 2.4 trillion in investments – has today committed to carbon-neutral investment portfolios by 2050.

This commitment by the newly launched, United Nations-convened Net-Zero Asset Owner Alliance was announced today at the UN Secretary-General’s Climate Action Summit, which brought together governments, companies and civil society to strengthen commitments and accelerate the implementation of the Paris Agreement on Climate Change.

The Net-Zero Asset Owner Alliance is an example of investors stepping up to protect people and planet with the knowledge that companies that transform their businesses to deliver a low carbon economy will benefit most from the opportunities presented by climate change.

In the Fall of 2019, the UN Environment Programme announced this effort to transition into a low Carbon economy. Already, trillions of dollars were available for the change in investment strategy.

What to wonder what will happen to those oil & gas workers in Western Canada who have been put out of work because of political ideology. Doesn’t look like those jobs are coming back.

9. CPP Investment Board, Green Bonds

Green Bonds started off as a novelty over a decade ago. Now, they are seen as a legitimate item to invest in. It’s difficult to see to what degree this move is altruism, and what is opportunism.

But in any event, organizations like CPPIB have made the business decision that certain industries are not worth investing in. As this pattern grows, and access to capital drops, more businesses will have to downsize or shut down.

10. Low-Carbon Transition Not Voluntary

Will this “transition” be voluntary? Will people and companies be free to make their own decisions when it comes to embracing (or rejecting) the green agenda? Not really. People like Mark Carney, now head of U.N. Climate Action & Finance, have made overt threats: play ball or go bankrupt.

(1) Bill C-12: Net Zero Emissions By 2050, First Reading

(2) Bill C-232: Climate Emergency Action Framework

(3) Bill C-262: Income Tax Changes On Carbon Capture

(4) MP Dan Albas On Bills C-12/C-232

(5) Ontario Teachers’ Pension Plan Pledges 2050 Net Zero

(6) Pledge Of 8 Canadian Companies’ CEOs

(7) IISD On: Net Zero Asset Owner Alliance

(8) UN Principles For Responsible Investing, Net Zero

(9) UNPRI: No More Investments in Coal Industry

(10) UNPRI On Phasing Out Oil & Gas Industry

(11) UNPRI: ESG Now Part Of Credit Worthiness

(12) UN Environment Programme On Net Zero Movement

(13) Canada Pension Plan Investments

It is incredible, that with all the talk and regulations, what isn’t discussed is how all those reductions will be possible. We have the impression it is only about shutting down transportation and industrial productivity. Most people in government do not know how to do it, they conform to globalist super imposed criteria, timelines.

Take a look at :

https://www.strategic-enterprise.ca/Exoneration_Projects/Fuel_Systems_Technology.html

Super Atomized Fuel Systems Inc.

Vapour Induction Fuel Systems Inc.

Super Carburetor Inc.

Icosahedron Hydrogen Generator Fuel Systems Inc.

I wonder how many of those banks and pension funds and wealth managers would or have invested in any one of those fuel system companies…

Of course, they talk about transition to 2030, but nobody talks about these fuel systems or the awesome mileage and having a massive reduction in emissions…

Mainstream media & search engines censor more than political rivals, anti vaxxers, the 5G bio-weapon, toxic drug effects and nationalists and conservatives and everyday white people…they censor fuel systems….

Then of course there is the holier than thou crowd, or are they the super imposed control freaks, Zero Emissions, OK, then check out Icosahedron Hydrogen Generator Fuel Systems Inc, at the same website, Hydrogen Fuel from water…

Obviously all those banks and pension funds and wealth managers and investment CEOs don’t know that the more they talk the value of these companies and technology is going sky high. Although it does not seem like a monopoly, and they are against carbon tax and shutting down the fossil fuel industry (since they like to burn fuel) it is weird that they receive no government money or publicity. Obviously having a kick ass Canadian industry and enterprise with a global market leadership and Made in Canada is not interesting to them.

You think Tesla is rich? that is nothing! most guys want gears, carburetors, stuff they can work on, not endless computers, electronics, sensors, plastic, rotten metal, aka chinesium, mexicanium junk parts.

Most people have no idea what kind of inventions and technology development is going on in Canada. The Avro Arrow is getting redeveloped and rebuilt, a whole new auto industry with cars and trucks with high mileage fuel systems, the things that never make it in the news. Stealth business, Censored? Classified Defence technology?

It is sure good to know who the bad guys are, the traitors and control freaks, and who the good guys are, the nationalists, industrialists, the people who know or search for the truth, it all starts with people with good character, and peace, order and good government. Strategic Enterprise Development Inc. – you owe it to yourself to find out what is censored and hidden from you. And when the time comes with all the draconian measures and super imposed agendas, you will be ready and you will be free.