It’s one thing to talk about remittances being sent abroad, but where is it going? A quick look at the top recipients shows an unsurprising result. The largest amounts of money are sent to places which bring the most people to Canada annually. This has China, India and the Philippines at the top of the list.

The exact formula for these projections isn’t released, but it’s likely due to limited surveys, information from financial institutions and organizations, and some extrapolation. The numbers can’t be taken as exact, but just a rough idea of what’s going on. StatsCan also has its own estimates.

Pew Research On Remittances From Canada In 2017 (Top 60)

| RANK | DESTINATION | ESTIMATED AMOUNT | RUNNING TALLY |

|---|---|---|---|

| 1 | China | $4,144,000,000 | $4,144,000,000 |

| 2 | India* | $2,877,000,000 | $7,021,000,000 |

| 3 | Philippines | $2,370,000,000 | $9,391,000,000 |

| 4 | France | $1,297,000,000 | $10,688,000,000 |

| 5 | Italy | $1,072,000,000 | $11,760,000,000 |

| 6 | Vietnam | $953,000,000 | $12,713,000,000 |

| 7 | Lebanon* | $853,000,000 | $13,566,000,000 |

| 8 | Germany | $810,000,000 | $14,376,000,000 |

| 9 | United States | $662,000,000 | $15,038,000,000 |

| 10 | United Kingdom | $569,000,000 | $15,607,000,000 |

| 11 | Pakistan* | $562,000,000 | $16,169,000,000 |

| 12 | Sri Lanka | $488,000,000 | $16,617,000,000 |

| 13 | Belgium | $459,000,000 | $17,076,000,000 |

| 14 | Hungary | $436,000,000 | $17,512,000,000 |

| 15 | Nigeria | $436,000,000 | $17,948,000,000 |

| 16 | Portugal | $409,000,000 | $18,357,000,000 |

| 17 | Poland | $341,000,000 | $18,698,000,000 |

| 18 | South Korea | $327,000,000 | $19,025,000,000 |

| 19 | Jamaica | $315,000,000 | $19,340,000,000 |

| 20 | Bermuda | $285,000,000 | $19,625,000,000 |

| 21 | Egypt | $269,000,000 | $19,894,000,000 |

| 22 | Netherlands | $181,000,000 | $20,075,000,000 |

| 23 | Czech Republic | $177,000,000 | $20,252,000,000 |

| 24 | El Salvador | $157,000,000 | $20,409,000,000 |

| 25 | Mexico | $156,000,000 | $20,565,000,000 |

| 26 | Japan | $153,000,000 | $20,718,000,000 |

| 27 | Haiti | $144,000,000 | $20,862,000,000 |

| 28 | Guatemala | $142,000,000 | $21,004,000,000 |

| 29 | Romania | $139,000,000 | $21,143,000,000 |

| 30 | Hong Kong | $136,000,000 | $21,279,000,000 |

| 31 | Austria | $133,000,000 | $21,412,000,000 |

| 32 | Kenya | $123,000,000 | $21,535,000,000 |

| 33 | Croatia | $119,000,000 | $21,654,000,000 |

| 34 | Morocco | $114,000,000 | $21,768,000,000 |

| 35 | Colombia | $113,000,000 | $21,881,000,000 |

| 36 | Ukraine | $108,000,000 | $21,989,000,000 |

| 37 | Spain | $107,000,000 | $22,096,000,000 |

| 38 | Denmark | $101,000,000 | $22,197,000,000 |

| 39 | Australia | $98,000,000 | $22,295,000,000 |

| 40 | Switzerland | $91,000,000 | $22,386,000,000 |

| 41 | Iran | $90,000,000 | $22,476,000,000 |

| 42 | Ghana | $82,000,000 | $22,558,000,000 |

| 43 | Thailand | $79,000,000 | $22,637,000,000 |

| 44 | Bangladesh | $78,000,000 | $22,715,000,000 |

| 45 | Uganda | $76,000,000 | $22,791,000,000 |

| 46 | Israel* | $71,000,000 | $22,862,000,000 |

| 47 | Sweden | $66,000,000 | $22,928,000,000 |

| 48 | Serbia | $62,000,000 | $22,990,000,000 |

| 49 | Slovakia | $62,000,000 | $23,052,000,000 |

| 50 | Guyana | $59,000,000 | $23,111,000,000 |

| 51 | Russia | $59,000,000 | $23,179,000,000 |

| 52 | Peru | $57,000,000 | $23,227,000,000 |

| 53 | Tanzania | $57,000,000 | $23,284,000,000 |

| 54 | Qatar | $54,000,000 | $23,338,000,000 |

| 55 | South Africa | $52,000,000 | $23,390,000,000 |

| 56 | Jordan | $48,000,000 | $23,438,000,000 |

| 57 | Algeria | $45,000,000 | $23,483,000,000 |

| 58 | Bosnia-Herzegovina | $41,000,000 | $23,524,000,000 |

| 59 | Ecuador | $39,000,000 | $23,563,000,000 |

| 60 | Finland | $38,000,000 | 23,601,000,000 |

| n/a | All Others | $958,000,000 | $24,559,000,000 |

*Indicates not all transactions between certain countries can be estimated.

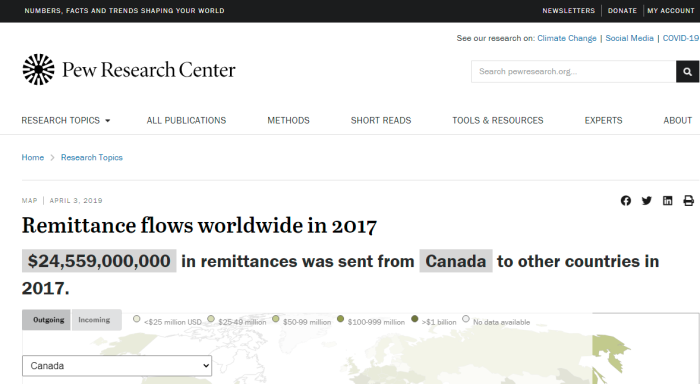

Pew Research is just one group that tracks and estimates remittances by country in a particular year. They put that figure for money leaving Canada in 2017 to be about $24.6 billion. To be fair, these are calculated to a large degree by computer modelling, so take it with a grain of salt. Still, it’s a starting place to look.

Pew and the World Bank openly admit that remittances are used by many countries to prop up their economies to a large degree.

Now, an argument “could” be made that these remittances have an overall benefit globally, and there’s the poverty reduction aspect. But in that case, public officials should just be honest about it, and not pretend that the aim is all to benefit the host country.

The United States is believed to be the largest source of remittances, with about $150 billion sent abroad annually.

The World Bank has written in opposition to the idea of taxing remittances. They openly admit that it would significantly cut into the amount of money the destination country receives.

There’s more to it than simply sending money abroad. Keep in mind, restaurants and hotels are among the largest users of programs like for Temporary Foreign Workers. For the last 2 years, they have been heavily subsidized by the taxpayers. Chains are included in this list as well.

As for agriculture workers, Ottawa has been using public money to subsidize the quarantine costs of people entering the country. Now, we’re not going to actually stop the entry of people coming in during a “deadly pandemic”, with high unemployment levels. The Government will just use tax dollars to offset a financial burden imposed on employers.

Why would businesses be supporting these programs for all these years? It’s economical to. Simply put, increasing the supply of labour drives down the relative value, or wages. Also, it’s much easier to support a family in a country with a lower cost of living, even with the remittance fees.

Anyhow, just something to think about when it’s reported that we need more and more people to come here. There are other factors at play.

(1) https://www.statcan.gc.ca/en/blog/cs/sending-money

(2) https://www.pewresearch.org/global/interactives/remittance-flows-by-country/

(3) https://apps.cra-arc.gc.ca/ebci/hacc/cews/srch/pub/bscSrch

(4) https://www.pewresearch.org/fact-tank/2018/01/29/remittances-from-abroad-are-major-economic-assets-for-some-developing-countries/

(5) https://search.open.canada.ca/en/qp/id/aafc-aac,AAFC-2021-QP-00003

(6) https://blogs.worldbank.org/peoplemove/why-taxing-remittances-bad-idea

(7) https://canucklaw.ca/imm-5c-remittances-remain-high-even-as-unemployment-rates-soared-in-2020/

(8) https://canucklaw.ca/imm-5b-global-remittances-hidden-costs-of-immigration/