Apparently it’s the International Day for Family Remittances. Despite dire predictions in early 2020 by the World Bank and others, this didn’t actually materialize. The total drop was almost insignificant.

Despite COVID-19, remittance flows remained resilient in 2020, registering a smaller decline than previously projected. Officially recorded remittance flows to low- and middle-income countries reached $540 billion in 2020, just 1.6 percent below the 2019 total of $548 billion.

Rather interesting: even as the West experienced record level unemployment rates, the drop in remittances sent abroad was almost negligible. If all these jobs were disappearing, where exactly was the money coming from? A huge drop in 2020 was predicted by the World Bank, but did not materialize.

| Year | Total ($B) | To 1st World | To 3rd World | Diff. |

|---|---|---|---|---|

| 2013 | $581B | $177B | $404B | $227B |

| 2014 | $592B | $162B | $430B | $268B |

| 2015 | $582B | $142B | $440B | $298B |

| 2016 | $573B | $144B | $429B | $285B |

| 2017 | $613B | $147B | $466B | $319B |

| 2018 | $689B | $161B | $528B | $367B |

| 2019 | $706B | $158B | $548B | $390B |

| 2020 | $702B | $162B | $540B | $378B |

According to the World Bank: “With global growth expected to rebound further in 2021 and 2022, remittance flows to low- and middle-income countries are expected to increase by 2.6 percent to US$553 billion in 2021 and by 2.2 percent to US$565 billion in 2022.”

The World Economic Forum estimated about $714B in global remittances in 2019, while the World Bank claimed $706 billion. Note: these estimates are often updated.

These global citizens are the world’s “Economic First Responders”. The money they send across the world’s borders have helped smooth the economic shocks from the pandemic, fostering stronger resilience and recovery in their home nations throughout 2020, and into 2021 and beyond, than would have been the case without these flows.

They provide an essential lifeline to their home communities by funding spending on essentials, lowering extreme poverty and supporting healthcare and education. They serve on the front lines within their host communities as medics, scientists, grocers, bus drivers, construction workers, teachers, and contribute human capital towards the functioning of a robust economy.

These actions, during an unprecedented global pandemic, serve to shine an even bigger spotlight on the criticality of remittances and those who send them. They are the resilient and inclusive global economic force. Policymakers, development experts and economists must give cross-border remittances the consideration and priority they deserve as a significant global economic engine. There has simply never been a greater need for innovation and technology that provides the on-the-ground financial support flowing instantly across borders.

A January 2021 Oxford Economics report, The Remittance Effect: A Lifeline for Developing Economies Through the Pandemic and Into Recovery, illustrates how remittances impact developing economies, both in the very short-term and in the longer-term, in a way that neither government aid nor private foreign direct investment can match, given the larger value of remittances today.

These economic first responders selflessly act to quickly wire money into the hands of loved ones back home, stimulating spending on housing, medical care, and other essentials; boosting savings, improving creditworthiness and funding investments; and supporting economic and financial stability – all of which promote economic growth. As Oxford Economics says, the “remittance multiplier effect” boosts local economic activity and ultimately GDP.

In the last several years, remittances overtook Foreign Direct Investment (FDI) as the largest external capital source in developing economies. The forecast for global FDI flows is bleak, with the United Nations Conference on Trade and Development (UNCTAD) having forecast that these flows contracted by up to 40% in 2020.

A strikingly honest take from the World Economic Forum, or at least, a look into how they view things. Sending large amounts of money out of the 1st World isn’t undermining the West, rather “Economic First Responders” are doing their part to save the planet.

It also underscores their agenda. WEF views remittances as a more effective way of doing wealth transfers to other nations. It doesn’t provoke the same backlash as foreign aid does.

These “global leaders” don’t want countries or nations. They want economic zones where employees and production can be shifted around.

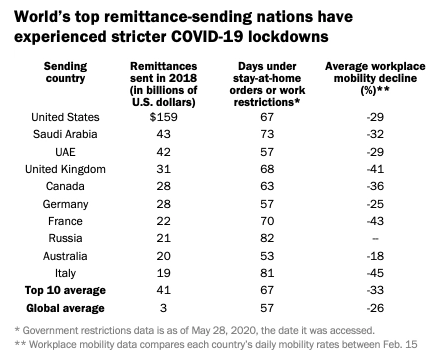

Pew Research estimated that Canada sent some $28 million USD (about $33 million CDN) abroad in the year 2018. The United States sent about $159 billion. Under the guise of “pandemic management” Canada had already experienced 63 days of business closures — keeping in mind, this article was written in June 2020. It’s actually much higher now.

One would expect remittances to plummet as businesses closed, many for good. But in the end, the overall drop in remittances was pretty insignificant. So, where did they come from? How much CERB, or other relief, was simply sent abroad?

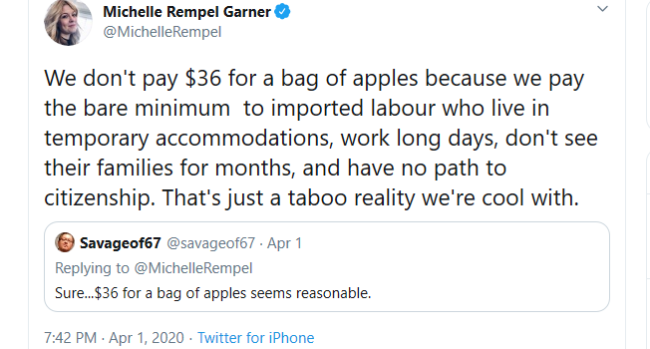

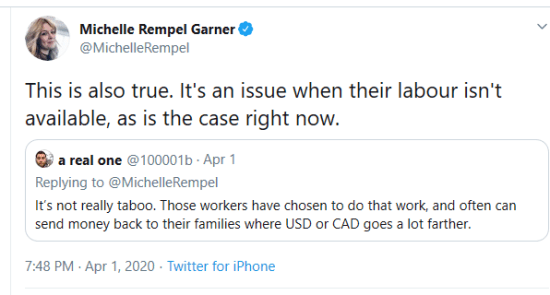

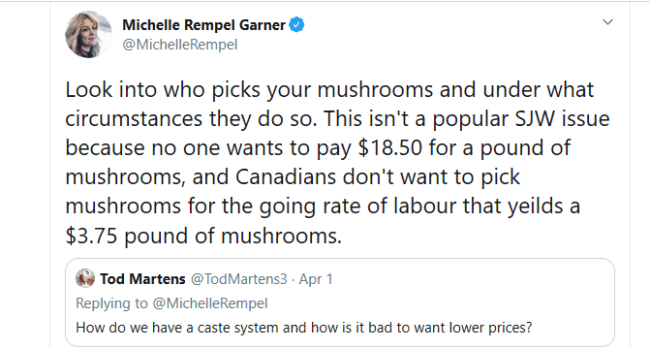

Unfortunately, too many politicians want to look good in the eyes of the world, instead of serving their own people? Here’s a great example of this sort of mindset. Since most readers are probably blocked, these are some of the tweets that are important.

https://twitter.com/MichelleRempel/status/1245542206624145409

https://twitter.com/MichelleRempel/status/1245537455660503040

https://twitter.com/MichelleRempel/status/1245543250062082054

https://twitter.com/MichelleRempel/status/1245543543877308421

Don’t worry. There will always be Canada-last politicians like Michelle Rempel-Garner in power. She’s fully aware that our programs are used to drive down wages, and to send money abroad (where it will go much further), and she STILL supports it. Seems that the focus is on growing OTHER economies.

Wages work in a supply-and-demand fashion. A low supply of workers will push up the demand, which are salaries. However, when there is a surplus of that supply of workers, it pushes down the demand, as people will work for less.

Of course, it’s much cheaper to feed a family in Guatemala than it is in Canada, even with the fees associated with sending remittances. Such people can afford to work for less. It creates a race to the bottom where most people lose in the end.

Happy International Day for Family Remittances everyone! Go be an Economic First Responder, and send some money abroad.

(1) https://www.youtube.com/watch?v=Lj6Hki3bAvk

(2) https://www.youtube.com/channel/UCTPDxhZ5d8nZgZFLTITA5LA

(3) https://www.knomad.org/publication/migration-and-development-brief-34

(4) https://www.worldbank.org/en/news/press-release/2020/04/22/world-bank-predicts-sharpest-decline-of-remittances-in-recent-history

(5) https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

(6) https://twitter.com/UNmigration

(7) https://twitter.com/IOMAsiaPacific/status/1405031130043060235

(8) https://www.iom.int/sites/default/files/remittance_inflow_trends_snapshot_web-compressed.pdf

(9) https://www.weforum.org/agenda/2021/01/remittances-key-post-covid-recovery/

(10) https://www.worldbank.org/en/news/press-release/2014/04/11/remittances-developing-countries-deportations-migrant-workers-wb

(11) https://www.worldbank.org/en/news/press-release/2016/04/13/remittances-to-developing-countries-edge-up-slightly-in-2015

(12) href=”https://www.worldbank.org/en/news/press-release/2017/04/21/remittances-to-developing-countries-decline-for-second-consecutive-year

(13) https://www.pewresearch.org/fact-tank/2020/06/22/sharp-decline-in-remittances-expected-in-2020-amid-covid-19-lockdowns-in-top-sending-nations/

(14) https://www.worldbank.org/en/news/press-release/2018/04/23/record-high-remittances-to-low-and-middle-income-countries-in-2017

(15) https://www.worldbank.org/en/news/press-release/2018/12/08/accelerated-remittances-growth-to-low-and-middle-income-countries-in-2018

(16) https://blogs.worldbank.org/psd/remittances-times-coronavirus-keep-them-flowing

(17) https://www.weforum.org/agenda/2020/07/remittances-decline-covid-19-migrants-low-income-economies/

(18) https://www.worldbank.org/en/news/press-release/2021/05/12/defying-predictions-remittance-flows-remain-strong-during-covid-19-crisis

(19) https://www.nycaribnews.com/articles/world-bank-remittance-flows-remained-resilient-in-2020/

(20) https://www.statista.com/chart/20166/top-10-remittance-receiving-countries/

(21) https://canucklaw.ca/imm-5b-global-remittances-hidden-costs-of-immigration/

How is this women a Conservative? She even has “preferred pronouns” and I recall she supported fundraiser for Tranny Activist and BC NDP Party VP Morgane Oger.

Rempel is a Calgary MP so why support the opposition in a different Province?