1. Previous Solutions Offered

A response that frequently comes up is for people to ask what to do about it. Instead of just constantly pointing out what is wrong, some constructive suggestions should be offered. This section contains a list of proposals that, if implemented, would benefit society. While the details may be difficult to implement, at least they are a starting point.

2. Important Links

(1) https://www2.gov.bc.ca/gov/content/taxes/income-taxes/corporate/credits/political-contribution

(2) https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/41st-parliament/2nd-session/bills/third-reading/gov03-3

(3) https://www.elections.ab.ca/parties-and-candidates/forms-and-guides/tax-credits/

(4) https://www.elections.sk.ca/candidates-political-parties/electoral-finance/contributions/

(5) https://www.cbc.ca/news/canada/manitoba/winnipeg-election-donation-rebate-1.4587966

(6) https://ipolitics.ca/2018/02/16/loss-per-vote-subsidy-still-hurting-ndps-pockets/

3. Context For The Article

It has been in the news a lot lately: the idea of scrapping corporate welfare. This notion is based on the simple concept that taxpayers shouldn’t have to subsidize businesses which privatize the profits.

While this is certainly valid, let’s expand that idea. Why are taxpayers forced to subsidize the voting preferences of people who donate to political candidates or parties? If a person wishes to support their local candidates, that is their choice. But how come the public has to provide tax breaks?

Whatever happened to personal responsibility?

Your donation should come from your wallet.

Practice what you preach.

And no, this article is not directed at any one party or politician. “ALL” parties and candidates should be forced to be self-sufficient. Stop reaching into the public purse to finance your campaigns.

4. Proposal In Winnipeg

Mayor Brian Bowman wants to end the practice of rebating Winnipeg election-campaign donations in a move one critic describes as a means of providing another advantage to incumbent candidates.

Bowman said in a notice of motion the city could save $700,000 by eliminating the rebates, stating “it is undesirable to fund election campaign expenses” and candidates should “solicit financial support from donors based on the strength of their platform rather than relying on taxpayer funds.“

To be fair, there is some valid criticism that this will favour incumbents who are effectively able to campaign while under the pretext of doing their jobs.

However, taxpayers shouldn’t be forced help finance voting preferences. People who wish to make donations are free to do, but should use their own money. If a party platform is so unappealing that it needs taxpayer money to encourage donations, then it probably isn’t a very good one.

5. Ending The Per-Vote Subsidy

The NDP still hasn’t adapted to losing access to the per-vote party subsidy cancelled by the Harper government, the party’s treasurer said at the NDP convention in Ottawa Friday.

The federal Conservatives had phased out the per-vote subsidy by 2015, which was a party financing policy brought about in the Chretien-era that paid out public funds to parties based on their share of the popular vote.

Party Treasurer Tania Jarzebiak said the party plans to step up its fundraising with a “big push” on monthly giving and will invest more into its fundraising capacity, and has “ambitious plans” to reach an annual revenue target of $10.5 million.

Stephen Harper was criticized for this move, claiming it was designed to bankrupt smaller parties. It’s probably true, that the move ultimately benefitted the Conservative Party.

However, he should have ended all subsidies and tax breaks, not just pick and choose. If he truly cared about public money then those tax rebates would have been scrapped as well.

6. British Columbia

The credit is calculated as the lesser of:

1) The total of:

-75% of contributions up to $100

-50% of contributions between $100 and $550

-33 1/3% of contributions in excess of $550

2) $500

In B.C. taxpayers are on the hook for up to $500 for each person who contributes to B.C. political parties in a given year.

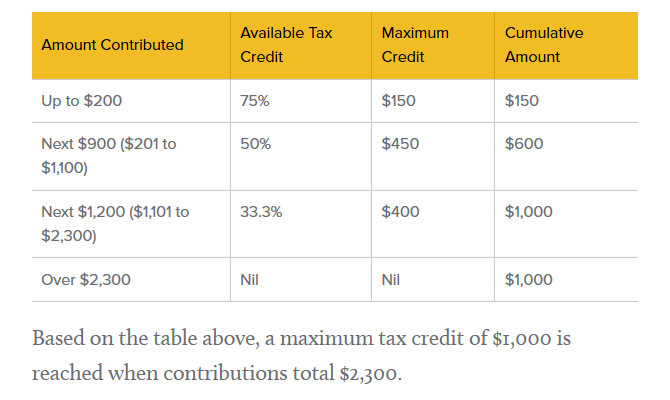

7. Alberta

According to Elections Alberta, the public has to pay up to $1000 in tax refunds to subsidize the voting preferences of people contributing to Provincial Candidates.

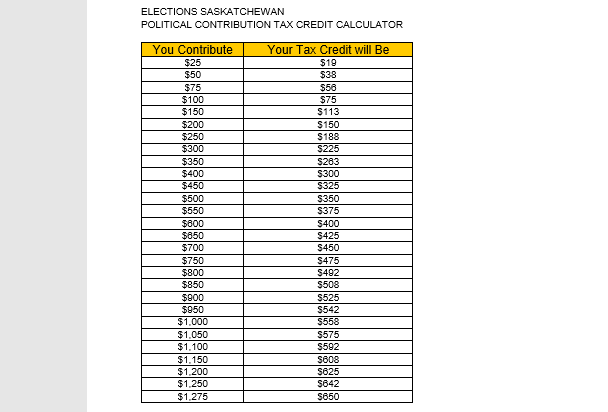

8. Saskatchewan

Taxpayers in Saskatchewan may be stuck with having to subsidize up to $650 for a resident’s political preferences. Seems that money could be better spent elsewhere.

9. Some Conclusions

The above listings are just a few examples of laws which force the public to help fund the donation choices of politically active people.

To be clear, I do not care whom you support, or what ideology the party or candidate is running on. The concern is that this subsidy amounts to corporate welfare, which we should not be paying. If the only way a person or party is able to finance a campaign is by bailouts with public money, then it probably isn’t very strong to begin with.

One final note: the common practice of “advertising” using taxpayer money is also abhorrent. True, incumbents do have an advantage in their ability to make announcements and fund plans to boost their image. That is not to be condoned either.

Discover more from Canuck Law

Subscribe to get the latest posts sent to your email.