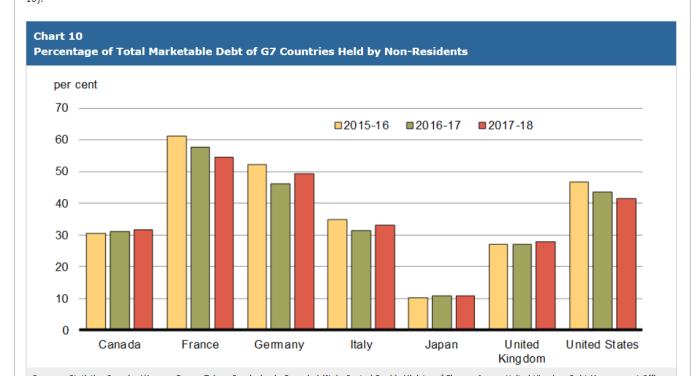

(30% of Canada’s debt held by foreigners)

(Archived debt information is available)

(If data hard to see, written information in Section #4)

(Will Abram explains the issues here)

CLICK HERE, for response from Elections Canada

1. First Email Back

Hello ****,

.

1) Budget documents going back to 1995, they are available here: https://www.budget.gc.ca/pdfarch/index-eng.html

2) The Debt Management Reports and Fiscal Reference Tables may be useful. I am still looking to see if I can find more. You may want to try reaching out to the Bank of Canada for more information.

.

Regards,

2. Second Email Back

Hello again ****,

.

After asking around, here is what I was told regarding your second question:

.

Government of Canada marketable debt, which includes treasury bills and marketable bonds, is distributed cost-effectively through competitive auctions to Government Securities Distributors, a group of banks and investment dealers in the domestic market. These Government Securities Distributors then resell securities bought at auctions to their wholesale and retail clients in the secondary market.

.

Ultimately, the majority of Government of Canada debt is held by Canadian households, institutions and governments. The participation of international investors in Government of Canada securities markets is of benefit to Canadians, as they serve to increase competition, increase the diversity of the Government’s investor base, and ultimately reduce borrowing costs for Canadian taxpayers.

.

For more information, you may also wish to review the Debt Management Report 2017-2018 (e.g., Chart 9) at https://www.fin.gc.ca/pub/dmr-rgd/index-eng.asp.

.

Hope this helps.

.

Regards,

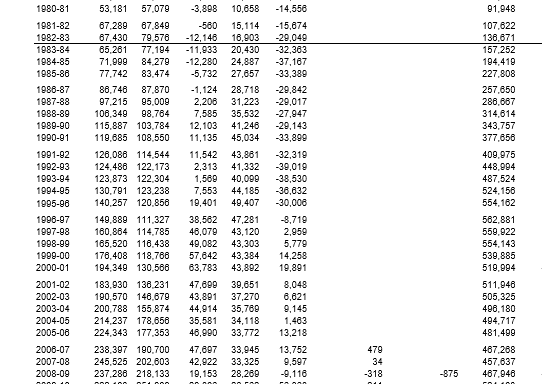

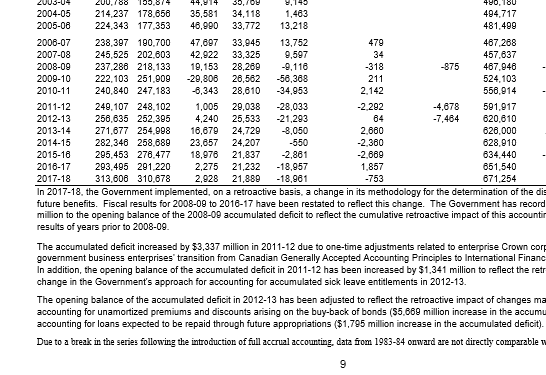

3. Information On Debt Summary

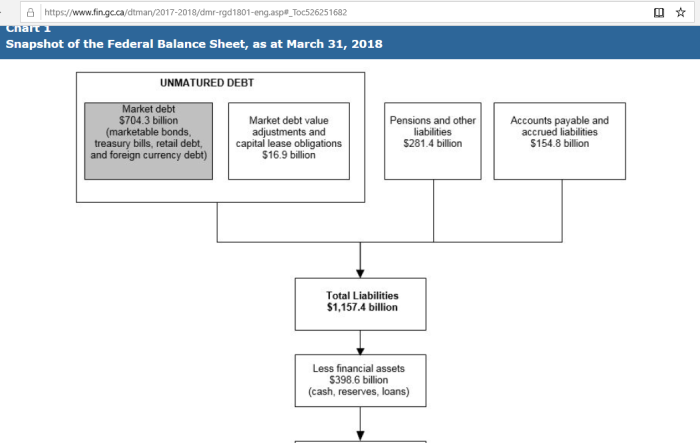

This chart, and the information from it is provided by the sources which the Ministry of Finance has provided here.

Chart 1

Snapshot of the Federal Balance Sheet, as at March 31, 2018

Unmatured debt

.

Market debt

$704.3 billion

.

(marketable bonds, treasury bills, retail debt, and foreign currency debt)

Market debt value adjustments and capital lease obligations

$16.9 billion

.

Other liabilities

.

Pensions and other liabilities

$281.4 billion

.

Accounts payable and accrued liabilities

$154.8 billion

.

Total Liabilities $1,157.4 billion

.

Less financial assets

$398.6 billion (cash, reserves, loans)

.

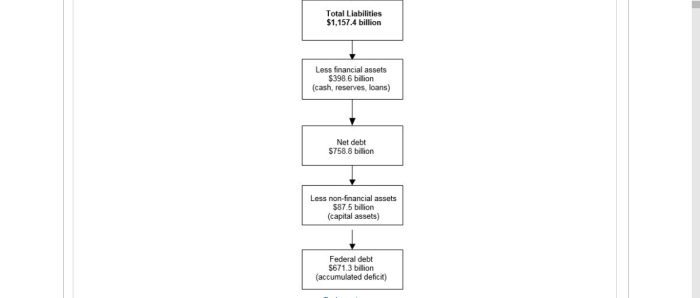

Net debt

$758.8 billion

.

Less non-financial assets

$87.5 billion (capital assets)

.

Federal debt

$671.3 billion (accumulated deficit)

4. Looking At The Debt Tables

Recent report is here. See page 9.

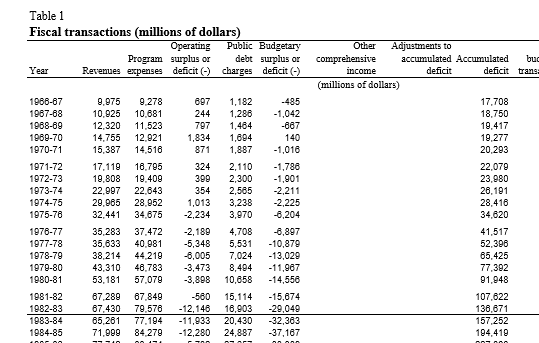

The staff was helpful enough to direct me to this table, and hence, the data within it. Now, let’s see how much interest or “Public Debt Charges” we have been paying off since 1966.

| Year | Interest ($Mil) | Cum. Since 1966 |

|---|---|---|

| 1966-67 | 1,162 | 1,162 |

| 1967-68 | 1,286 | 2,448 |

| 1968-69 | 1,464 | 3,912 |

| 1969-70 | 1,694 | 5,606 |

| 1970-71 | 1,887 | 7,493 |

| 1971-72 | 2,110 | 9,603 |

| 1972-73 | 2,110 | 11,703 |

| 1973-74 | 2,565 | 14,278 |

| 1974-75 | 3,238 | 17,516 |

| 1975-76 | 3,970 | 21,486 |

| 1976-77 | 4,708 | 26,194 |

| 1977-78 | 5,531 | 31,725 |

| 1978-79 | 7,024 | 38,749 |

| 1979-80 | 8,494 | 47,243 |

| 1980-81 | 10,658 | 57,901 |

| 1981-82 | 15,114 | 73,015 |

| 1982-83 | 16,903 | 89,918 |

| 1983-84 | 20,430 | 110,348 |

| 1984-85 | 20,430 | 110,348 |

| 1985-86 | 27,657 | 138,005 |

| 1986-87 | 28,718 | 166,723 |

| 1987-88 | 31,233 | 197,956 |

| 1988-89 | 35,532 | 233,488 |

| 1989-90 | 41,246 | 274,734 |

| 1990-91 | 45,034 | 319,768 |

| 1991-92 | 43,861 | 363,629 |

| 1992-93 | 41,332 | 404,961 |

| 1993-94 | 40,099 | 445,060 |

| 1994-95 | 44,185 | 489,245 |

| 1995-96 | 49,407 | 538,652 |

| 1996-97 | 47,281 | 585,933 |

| 1997-98 | 43,120 | 629,053 |

| 1998-99 | 43,303 | 672,356 |

| 1999-00 | 43,384 | 715,740 |

| 2000-01 | 43,384 | 715,740 |

| 2001-02 | 39,651 | 755,391 |

| 2002-03 | 37,270 | 792,661 |

| 2003-04 | 35,769 | 828,430 |

| 2004-05 | 43,384 | 871,814 |

| 2005-06 | 33,772 | 905,586 |

| 2006-07 | 33,945 | 939,531 |

| 2007-08 | 33,325 | 972,856 |

| 2008-09 | 28,269 | 1,001,125 |

| 2009-10 | 26,652 | 1,027,687 |

| 2010-11 | 28,610 | 1,056,297 |

| 2011-12 | 29,038 | 1,085,335 |

| 2012-13 | 25,533 | 1,110,868 |

| 2013-14 | 24,729 | 1,135,597 |

| 2014-15 | 24,207 | 1,159,804 |

| 2015-16 | 21,837 | 1,181,641 |

| 2016-17 | 21,232 | 1,202,873 |

| 2017-18 | 21,889 | 1,224,762 |

Note: This only applies to interest payments on the NATIONAL debt. The Provinces, particularly Ontario and Quebec, have been piling on their own debt.

To be fair, we can largely exclude the payments before 1974, which is when Trudeau Sr. forced fiat banking on Canada. That would remove $14,278M. leaving Canada with $1,210,484 in interest paid as of 2018. $1.21 trillion, just in interest (or public debt charges).

Although I didn’t get names of specific bond holders, it was not a total loss. Our debt is bought an sold, just like a collections agent would do, and about 30% is sold to foreign buyers.

5. No Political Will To End Debt

Although political parties pay lip service to the idea of balancing a budget, they tap-dance around the idea of paying it off.

Why though? If merely “balancing the budget” means paying interest payments forever, why is that all that is talked about? Why is this open-ended drain on the public purse not discussed?

Anyone who has ever held a credit card knows that it is senseless to let the charges keep accumulating. Eventually, the interest and fees will exceed the cost of the initial charge.

So why DON’T politicians want to get rid of our debt? Are these “interest” payments really a form of money laundering? Are they being told (or paid off) not to get rid of the debt?

6. Reason Behind The Debt: PRIVATE Borrowing

The idea of dumping central (fiat banking) is never brought up. Even so called “deficit hawks” never address the reason of why this exists is the first place. They never talk about the Bank for International Settlements, nor do they discuss the Basel Committee.

In 1974, Pierre Trudeau changed Canada’s monetary system, and did so without a democratic mandate. Since the 1934 Bank of Canada Act, the Federal Government had effectively been borrowing money from itself. This meant that interest payments amounted to the Canadian public being paid. See PART 1 of the series for more information.

However, since 1974, Canada has been borrowing from private lenders. Quite simply, we now have to pay other parties, instead of ourselves.

The reason for doing this has never been made clear. Vague claims have been made about stability of currency and inflation control. But a cause-and-effect has never actually been demonstrated. Nor has any benefit been shown that would counter the endless repayments, and ever growing debt.

And while this article is aimed at the Federal Government, the Provinces do not get a pass. More on them in another article.

7. Who’s Pushing For Continuation Of Scheme?

Remember this quote from the Ministry of Finance. Though specific people, institutions and parties were not named, it is reasonable to assume that this is a profitable business. After all, it is buying and selling — and reselling — national debt on the open market.

Government of Canada marketable debt, which includes treasury bills and marketable bonds, is distributed cost-effectively through competitive auctions to Government Securities Distributors, a group of banks and investment dealers in the domestic market. These Government Securities Distributors then resell securities bought at auctions to their wholesale and retail clients in the secondary market.

Ultimately, the majority of Government of Canada debt is held by Canadian households, institutions and governments. The participation of international investors in Government of Canada securities markets is of benefit to Canadians, as they serve to increase competition, increase the diversity of the Government’s investor base, and ultimately reduce borrowing costs for Canadian taxpayers.

The Ministry has been contacted again asking for specific names. If they won’t release any, then perhaps a freedom of information request will be needed. However, it’s unwise to drop names without any proof.

It’s reasonable to believe that the people profiting the most from this scheme are the ones pushing to keep fiat going. If any specifics are provided, they will be added as an update.

(1) https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=1010004801#timeframe

(2) https://en.wikipedia.org/wiki/Bank_for_International_Settlements

(3) https://www.bis.org

(4) https://www.bis.org/about/member_cb.htm

(5) https://www.bis.org/bcbs/organ_and_gov.htm

(6) https://www.fin.gc.ca/pub/dmr-rgd/index-eng.asp

(7) https://www.budget.gc.ca/pdfarch/index-eng.html

(8) https://www.fin.gc.ca/pub/frt-trf/index-eng.asp

Discover more from Canuck Law

Subscribe to get the latest posts sent to your email.