(The Bank Of Canada)

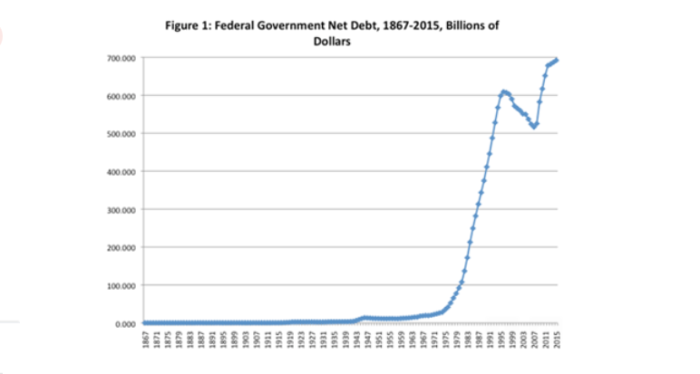

(Our debt started to spike in 1974)

(The Bank for International Settlements)

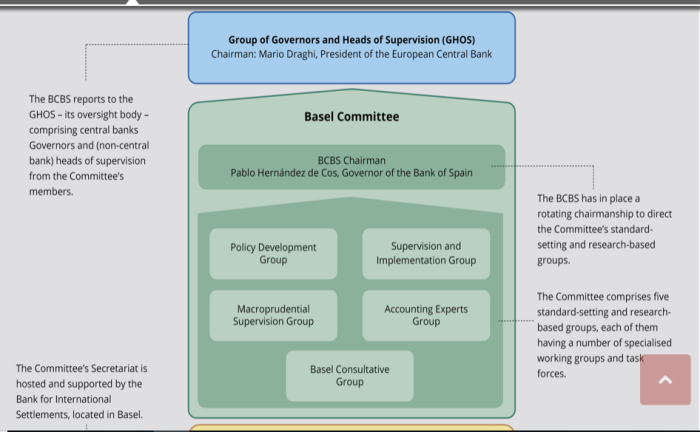

(The Basel Committee)

(30% of Canada’s debt held by foreigners)

(Archived debt information is available)

(Will Abrams explaining the money system)

(Jack Layton and Elizabeth May know full well about the international banking cartel. However they act as controlled opposition and remain silent)

This is the response to some email questions to the Bank of Canada, two weeks ago. Attached is the text of the email, minus personal identifiers.

1. Email From Bank Of Canada

Thank you for your email and your interest in the Bank of Canada.

.

For a copy of the original Bank of Canada Act, we suggest you go to Library and Archives Canada.

.

In response to your question about government borrowing in Canada, we’d like to offer a few points of clarification:

.

First, the Government of Canada has essentially funded its spending the same way since long before the Bank of Canada came into existence – namely through taxation and the issuance of marketable debt (e.g. bonds and treasury bills).

This debt was issued for investors to purchase. Financial institutions have always purchased government debt, as investments on their own balance sheets, and to sell on to customers. For a history of government debt markets in Canada, please consult the following document: http://www.bankofcanada.ca/wp-content/uploads/2010/06/pellerin.pdf.

Moreover, in the 1970s, subsequent to the first oil shock, inflation in Canada and many other advanced economies increased significantly. This led to higher costs for goods and services, and in the case of the federal government, increased spending, resulting in a rapid and sizeable increase in annual deficits. To fund those deficits, government borrowing (issuance of bonds and treasury bills) also increased. So government borrowing sources didn’t change, but the magnitude of borrowing did (see Figure 1 below).

Further, please note that while Section 18 (i) and (j) of the Bank of Canada Act does allow for the Bank of Canada to lend to the federal and provincial governments, the long-standing policy of the Bank of Canada is not to make direct loans to governments.

The Bank’s Statement of Policy Governing the Acquisition and Management of Financial Assets for the Bank of Canada’s Balance Sheet is available on our website. On page 9 of this policy, under the heading Exceptional Circumstances, Section 7.5 states:

.

“Loans or advances to the Government: The authority granted under Sections 18(i) and 18(j) of the Bank of Canada Act to make loans or advances to the Government would only be used to make a 1-business-day advance to the Government of Canada. This would only be done as appropriate to prevent the level of government deposits held at the Bank from falling below zero. Any such advances would be publicly disclosed.”

In other words, Bank of Canada direct lending to the federal government could be done in exceptional circumstance and only to address short-term cash requirements. The last loan of such type was in 1961.

There are good reasons for this policy. If the Bank were to finance government programs, the monetary base of the financial system would expand and interest rates would no longer follow a path consistent with keeping aggregate demand and supply in the Canadian economy in balance.

The result would be a significant increase in inflationary pressures throughout the Canadian economy. In effect, such a proposal would inflate the debt away, substituting an inflation tax on Canadian households in place of the debt-servicing obligations of the government. Such outcomes would be incompatible with the goal of monetary policy, which is to maintain an environment of low and stable inflation at 2 per cent.

Regarding your question about the Bank of International Settlements (BIS) may wish to contact them or visit their website. Please note that the BIS has no influence on the decision-making process for Canada’s monetary policy. The Governor of the Bank of Canada serves on the BIS Board of Directors and he is the current Chair of the BIS Audit Committee and former Chair of the Consultative Council for the Americas. Maintaining strategic working relationships with our international colleagues is an important part of the Governor’s role. Regular, open dialogue with our counterparts across the world provides us with invaluable insight into the global economy, helping us deliver on our mandate to promote the economic and financial welfare of Canadians.

We are not in a position to respond to your questions about fiscal policy or the debts of federal or provincial governments. You may wish to consult with your local MP or MLA on those questions.

.

For further information on the Bank’s roles and responsibilities and relevant economics concepts, please see our backgrounders section of our website.

.

I hope you will find this information helpful.

.

Kind regards,

2. Thoughts On The Response

(1) The Bank for International Settlements “allegedly” has no impact on Canadian monetary policy. However the BoC Governor sits on the BIS Board of Directors and is the head of the Audit Committee. Interesting.

(2) The Bank of Canada no longer funds Government spending in order to avoid inflation. Yet, would the spiraling debt cycle (over $1.2T paid, and $700B in debt) cause Government spending to eat away taxpayer dollars? This seems a case of the cure being worse than the disease.

(3) The source of borrowing didn’t change? This is a lie. The Bank of Canada used to lend the money (of course it had control over the money once). Now the money is “borrowed” from private sources.

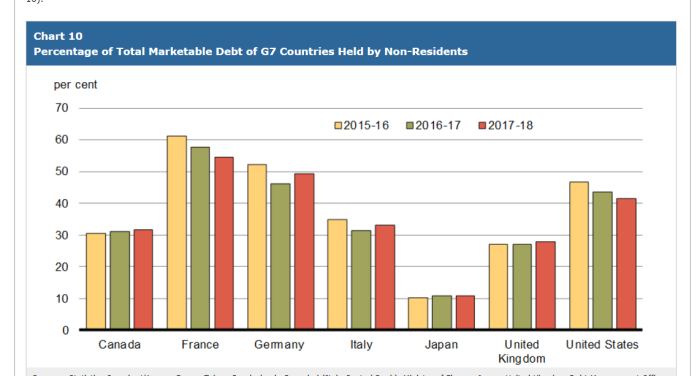

(4) How does purchasing debt from foreign powers and foreign interests, instead of using the Bank of Canada, help Canadians? Remember, about 30% of the national debt is held by foreigners.

(1) https://www.bankofcanada.ca

(2) https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=1010004801#timeframe

(3) https://en.wikipedia.org/wiki/Bank_for_International_Settlements

(4) https://www.bis.org

(5) https://www.bis.org/about/member_cb.htm

(6) https://www.bis.org/bcbs/organ_and_gov.htm

(7) https://www.fin.gc.ca/pub/dmr-rgd/index-eng.asp

(8) https://www.budget.gc.ca/pdfarch/index-eng.html

(9) https://www.fin.gc.ca/pub/frt-trf/index-eng.asp

Discover more from Canuck Law

Subscribe to get the latest posts sent to your email.