This article will focus on data from the U.S. Customs and Border Protection, or USCBP. It sheds light on just how bad things are with their borders, particularly the side with Mexico. There have been many interests vested in not securing it. Consequently, people flood in illegally, since there’s little reason not to at least try.

Why should Canadians care about this?

The answer is simple: it’s not just an American problem. Open borders threatens nations in general. Not only that, many of those illegal aliens will surely be working their way to Canada, given the generous welfare benefits available.

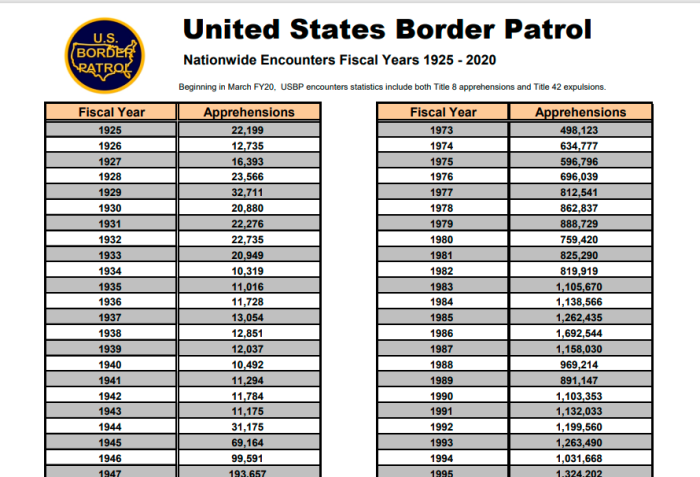

There’s also some historical data, going back 100 years on total apprehensions.

The following data is by no means all of the information that CBP releases, including on weapons and drugs. It’s just a portion of it. But it should be alarming to anyone who takes border security seriously.

Total Customs And Border Patrol Enforcement Actions

| YEAR | TOTALS | OFFICE OF FIELD OPS | US BORDER PATROL |

|---|---|---|---|

| FY 2017 | 526,901 | 216,370 | 310,531 |

| FY 2018 | 683,178 | 281,881 | 404,142 |

| FY 2019 | 1,148,024 | 288,523 | 859,501 |

| FY 2020 | 646,822 | 241,786 | 405,036 |

| FY 2021 | 1,956,519 | 294,352 | 1,662,167 |

| FY 2022 | 2,766,582 | 551,930 | 2,214,652 |

| FY 2023 | 3,201,144 | 1,137,452 | 2,063,692 |

| FY 2024* | 1,981,177 | 809,460 | 1,171,717 |

* Beginning in March FY20, OFO Encounters statistics include both Title 8 Inadmissibles and Title 42 Expulsions. To learn more, visit Title-8-and-Title-42-Statistics. Inadmissibles refers to individuals encountered at ports of entry who are seeking lawful admission into the United States but are determined to be inadmissible, individuals presenting themselves to seek humanitarian protection under our laws, and individuals who withdraw an application for admission and return to their countries of origin within a short timeframe.

** Beginning in March FY20, USBP Encounters statistics include both Title 8 Apprehensions and Title 42 Expulsions. To learn more, visit Title-8-and-Title-42-Statistics. Apprehensions refers to the physical control or temporary detainment of a person who is not lawfully in the U.S. which may or may not result in an arrest.

Inadmissible Foreign Criminals And Outstanding Warrants

| YEAR | OFO C.N.E | NCIC** | USBP C.N.E | USBP Warrants | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FY 2017 | 10,596 | 7,656 | 8,531 | 2,675 | |||||||||

| FY 2018 | 11,623 | 5,929 | 6,698 | 1,550 | |||||||||

| FY 2019 | 12,705 | 8,546 | 4,269 | 4,153 | |||||||||

| FY 2020 | 7,009 | 7,108 | 2,438 | 2,054 | |||||||||

| FY 2021 | 6,567 | 8,979 | 10,763 | 1,904 | |||||||||

| FY 2022 | 16,993 | 10,389 | 15,267 | 949 | |||||||||

| FY 2023 | 20,166 | 11,509 | 15,267 | 988 | |||||||||

| FY 2024*** | 11,626 | 6,946 | 10,337 | 587 |

| YEAR | OC | NO | DE | JA | FE | MA | AP | MY | JN | JL | AU | SE | TOT |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 98K | 67K | 69K | 60K | 90K | 88K | 64K | 89K | 93K | 77K | 75 | 45 | 913K |

| 2022 | 83K | 58K | 45K | 50K | 60K | 44K | 53K | 47K | 61K | 54K | 60K | 41K | 656K |

| 2023 | 37K | 39K | 40K | 49K | 70K | 56K | 36K | 41K | 44K | 50K | 49K | 39K | 549K |

| 2024* | 37K | 48K | 34K | 37K | 67K | 51K | 46K | – | – | – | – | – | 321K |

* FY 2024, or Fiscal Year 2024, ends on September 30th, 2024

Data represents pounds that were seized, rounded for space considerations. For example, 58K means 58,000 pounds of narcotics.

Source: https://www.cbp.gov/newsroom/stats/drug-seizure-statistics

Types Of Drugs Seized 2021-2024

| YEAR | MJ | ME | CO | FE | HE | KH | KE | EC | LSD | OTH |

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 319K | 192K | 98K | 11K | 5K | 203K | 22K | 1K | 38 | 73K |

| 2022 | 155K | 175K | 70K | 15K | 2K | 175K | 14K | 1K | 36 | 49K |

| 2023 | 150K | 140K | 81K | 27K | 2K | 70K | 8K | 649 | 11 | 71K |

| 2024* | 110K | 105K | 41K | 11K | 513 | 5K | 9K | 321 | 6 | 39K |

MJ = Marijuana

ME = Methamphetamine

CO = Cocaine

FE = Fentanyl

HE = Heroin

KH = Khat (Catha Edulis)

EC = Ecstasy

LSD = LSD

OTH = Other Drugs

Source: https://www.cbp.gov/newsroom/stats/drug-seizure-statistics

* FY 2024, or Fiscal Year 2024, ends on September 30th, 2024

Weapons And Firearms Seized

| YEAR | AM | CA | MA | OG | RE | SC | SI | BA | TOTAL |

|---|---|---|---|---|---|---|---|---|---|

| FY 2021 | 345,757 | – | 419 | 230,761 | 181 | – | 18,036 | – | 595,154 |

| FY 2022 | 1,029,554 | – | 516 | 115,902 | 253 | – | 1,272 | – | 1,147,497 |

| FY 2023 | 501,368 | 847 | 7,532 | 34,181 | 324 | 357 | 2,457 | 544 | 547,610 |

| FY 2024* | 243,783 | 178 | 6,475 | 47,719 | 175 | 238 | 1,907 | 3,282 | 303,756 |

AM = Ammunition

CA = Case

MA = Magazine

OG = Other Gun Parts

RE = Receiver

SC = Scope

SI = Silencer/Muffler

BA = Vest/Body Armour

* FY 2024, or Fiscal Year 2024, ends on September 30th, 2024

Source: https://www.cbp.gov/newsroom/stats/weapons-and-ammunition-seizures

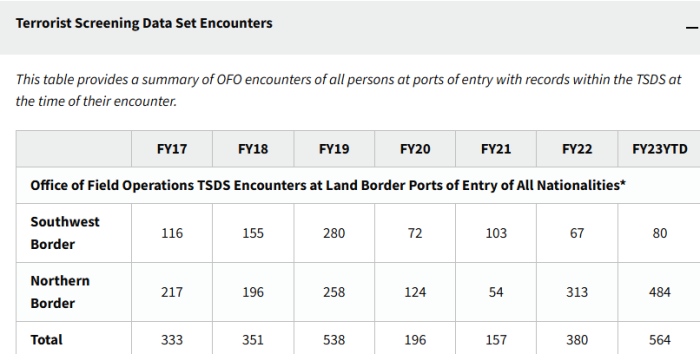

Terrorist Screening Encounters

| YEAR | SOUTHERN BORDER | NORTHERN BORDER | TOTAL |

|---|---|---|---|

| FY 2017 | 116 | 217 | 333 |

| FY 2018 | 155 | 196 | 351 |

| FY 2019 | 280 | 258 | 538 |

| FY 2020 | 72 | 124 | 196 |

| FY 2021 | 103 | 54 | 157 |

| FY 2022 | 67 | 313 | 380 |

| FY 2023 | 80 | 484 | 564 |

| FY 2024* | 24 | 172 | 196 |

| YEAR | SOUTHERN BORDER | NORTHERN BORDER | TOTAL |

|---|---|---|---|

| FY 2017 | 2 | 0 | 2 |

| FY 2018 | 6 | 0 | 6 |

| FY 2019 | 0 | 3 | 3 |

| FY 2020 | 3 | 0 | 3 |

| FY 2021 | 15 | 1 | 16 |

| FY 2022 | 98 | 0 | 98 |

| FY 2023 | 169 | 3 | 172 |

| FY 2024* | 80 | 1 | 81 |

* FY 2024, or Fiscal Year 2024, ends on September 30th, 2024

Source: https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics

Arrests Of Non-Citizen Gang Members

| YEAR | 18TH ST. | MS-13 | PAISAS | OTHER | TOTAL |

|---|---|---|---|---|---|

| FY 2015 | 84 | 335 | 73 | 352 | 844 |

| FY 2016 | 47 | 253 | 119 | 283 | 702 |

| FY 2017 | 61 | 228 | 53 | 194 | 536 |

| FY 2018 | 145 | 413 | 62 | 188 | 808 |

| FY 2019 | 168 | 464 | 90 | 254 | 976 |

| FY 2020 | 36 | 72 | 93 | 162 | 363 |

| FY 2021 | 28 | 113 | 79 | 128 | 348 |

Source: https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics-fy2023

Note: More recent data breaks down data among many other gangs. However, most have had just a few members detained at the border.

Arrests of Non-Citizens with Criminal Convictions

| FISCAL YEAR | TOTAL ARRESTS |

|---|---|

| FY 2017 | 8,531 |

| FY 2018 | 6,698 |

| FY 2019 | 4,269 |

| FY 2020 | 2,438 |

| FY 2021 | 10,763 |

| FY 2022 | 12,028 |

| FY 2023 | 15,267 |

| FY 2024* | 10,337 |

* FY 2024 ends on September 30th, 2024

Source: https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics/criminal-noncitizen-statistics

Records checks of available law enforcement databases following the apprehension of an individual may reveal a history of criminal conviction(s). That conviction information is recorded in a U.S. Customs and Border Protection database, from which the data below is derived.

Total Criminal Convictions by Type Of Non-Citizens

| YEAR | ABSV | ROB | DUI | HOM | DRUG | IRE | WEAP | SEX | OTH |

|---|---|---|---|---|---|---|---|---|---|

| FY 2017 | 692 | 595 | 1,596 | 3 | 1,249 | 4,502 | 173 | 137 | 1,851 |

| FY 2018 | 524 | 347 | 1,113 | 3 | 871 | 3,920 | 106 | 80 | 1,364 |

| FY 2019 | 299 | 184 | 614 | 2 | 449 | 2,663 | 66 | 58 | 814 |

| FY 2020 | 208 | 143 | 364 | 3 | 386 | 1,261 | 49 | 156 | 580 |

| FY 2021 | 1,178 | 825 | 1,629 | 60 | 2,138 | 6,160 | 336 | 488 | 2,691 |

| Fy 2022 | 1,142 | 896 | 1,614 | 62 | 2,239 | 6,797 | 309 | 365 | 2,891 |

| FY 2023 | 1,254 | 864 | 2,493 | 29 | 2,055 | 8,790 | 307 | 284 | 3,286 |

| FY 2024* | 662 | 412 | 1,778 | 20 | 942 | 6,368 | 142 | 133 | 1,933 |

* Fiscal Year 2024 runs October 1, 2023- September 30, 2024.

Source: https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics/criminal-noncitizen-statistics

The FY total displays the total CES apprehensions but does not equal the sum of data by category because the same apprehension can have multiple NCIC Charges that are included in multiple categories.

“Other” includes any conviction not included in the categories above.

ABSV = Assault, Battery, Domestic Violence

ROB = Burglary, Robbery, Larceny, Theft, Fraud

DUI = Driving Under The Influence

HOM = Homicide: Murder, Manslaughter, etc….

DRUG = Illegal Drug Possession, Trafficking

IRE = Illegal Re-Entry

WEAP = Illegal Weapons Possession, Transport, Trafficking

SEX = Sexual Offences

OTH = Categories Not Listed Above

Historical Data On Apprehensions: 1925 – 2020

| YEAR | TOTAL | YEAR | TOTAL | YEAR | TOTAL |

|---|---|---|---|---|---|

| 1925 | 22,199 | 1926 | 12,735 | 1927 | 16,393 |

| 1928 | 23,566 | 1929 | 32,711 | 1930 | 20,880 |

| 1931 | 22,276 | 1932 | 22,735 | 1933 | 20,949 |

| 1934 | 10,319 | 1935 | 11,016 | 1936 | 11,728 |

| 1937 | 13,054 | 1938 | 12,851 | 1939 | 12,037 |

| 1940 | 10,492 | 1941 | 11,294 | 1942 | 11,784 |

| 1943 | 11,175 | 1944 | 31,175 | 1945 | 69,164 |

| 1946 | 99,591 | 1947 | 193,657 | 1948 | 192,779 |

| 1949 | 288,253 | 1950 | 468,339 | 1951 | 509,040 |

| 1952 | 528,815 | 1953 | 835,311 | 1954 | 1,028,246 |

| 1955 | 225,186 | 1956 | 68,420 | 1957 | 46,225 |

| 1958 | 40,504 | 1959 | 32,996 | 1960 | 28,966 |

| 1961 | 29,384 | 1962 | 29,897 | 1963 | 38,861 |

| 1964 | 42,879 | 1965 | 52,422 | 1966 | 79,610 |

| 1967 | 94,778 | 1968 | 123,519 | 1969 | 172,391 |

| 1970 | 231,116 | 1971 | 302,517 | 1972 | 396,495 |

| 1973 | 498,123 | 1974 | 634,777 | 1975 | 596,796 |

| 1976 | 696,039 | 1977 | 812,541 | 1978 | 862,837 |

| 1979 | 888,729 | 1980 | 759,420 | 1981 | 825,290 |

| 1982 | 819,919 | 1983 | 1,105,670 | 1984 | 1,138,566 |

| 1985 | 1,262,435 | 1986 | 1,692,544 | 1987 | 1,158,030 |

| 1988 | 969,214 | 1989 | 891,147 | 1990 | 1,103,354 |

| 1991 | 1,132,033 | 1992 | 1,199,560 | 1993 | 1,263,490 |

| 1994 | 1,031,668 | 1995 | 1,324,202 | 1996 | 1,549,876 |

| 1997 | 1,412,953 | 1998 | 1,555,776 | 1999 | 1,579,010 |

| 2000 | 1,676,438 | 2001 | 1,266,214 | 2002 | 955,310 |

| 2003 | 931,557 | 2004 | 1,160,395 | 2005 | 1,189,075 |

| 2006 | 1,089,092 | 2007 | 876,704 | 2008 | 723,825 |

| 2009 | 556,041 | 2010 | 463,382 | 2011 | 340,252 |

| 2012 | 364,768 | 2013 | 420,789 | 2014 | 486,651 |

| 2015 | 337,117 | 2016 | 415,816 | 2017 | 310,531 |

| 2018 | 414,142 | 2019 | 859,501 | 2020 | 405,036 |

* FY 2020 ended on September 30th, 2020

Source: https://www.cbp.gov/newsroom/media-resources/stats (pdf file) (archive)

Again, this is nowhere near all the information that the CBP puts out. It’s just a snapshot of the people, drugs, weapons and more that have been stopped. It’s alarming to think how many people, drugs and weapons aren’t being caught.

(1) https://www.cbp.gov/

(2) https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics

(3) https://www.cbp.gov/newsroom/stats/drug-seizure-statistics

(4) https://www.cbp.gov/newsroom/stats/weapons-and-ammunition-seizures

(5) https://www.cbp.gov/newsroom/stats/southwest-land-border-encounters

(6) https://www.cbp.gov/newsroom/stats/cbp-enforcement-statistics/criminal-noncitizen-statistics

(7) https://www.cbp.gov/newsroom/media-resources/stats

(8) U.S. Border Patrol Total Apprehensions (FY 1925 – FY 2020) (508)

Changes To Safe Third Country Agreement Won’t Close All Loopholes

Starting on March 25th, people illegally entering Canada from the United States to claim asylum will no longer be able to bypass immediate deportation simply by crossing between ports. A new change is expected to apply the same standard regardless of where they cross.

However, it’s not anywhere near the “fix” that it’s being made out to be.

Sean Fraser, Minister of Immigration, spread the notice on Friday.

To address irregular migration, we are expanding the Safe Third Country Agreement to apply not only at designated ports of entry, but across the entire land border, including internal waterways, ensuring fairness and more orderly migration between our two countries. This change will come into effect at 12:01 A.M (EDT) on Saturday, March 25, 2023. Canada also announced we will welcome 15,000 migrants on a humanitarian basis from the Western Hemisphere over the course of the year, with a path to economic opportunities to address forced displacement, as an alternative to irregular migration.

Even if this were to be applied, and Roxham Road effectively closed, the Safe Third Country Agreement has a number of other loopholes built into it to ensure a steady stream of crossers. This applies to “refugees” fleeing from the United States. More on that later in the article.

And what are the numbers on people illegally crossing into Canada over the last several years? Keep in mind, these are just official statistics.

| PROVINCE/TERRITORY | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|

| Newfoundland | 0 | 0 | 0 | 0 | 0 | 0 |

| Prince Edward Island | 0 | 0 | 0 | 0 | 0 | 0 |

| Nova Scotia | 0 | 0 | 0 | 0 | 0 | 0 |

| New Brunswick | 10 | 5 | 5 | ? | ? | 25 |

| Quebec | 1,335 | 1,295 | 785 | 875 | 1,035 | 2,595 |

| Ontario | 2,660 | 2,340 | 1,995 | 2,630 | 2,790 | 3,7935 |

| Manitoba | 20 | 15 | 25 | 10 | 225 | 505 |

| Saskatchewan | ? | ? | ? | ? | ? | 30 |

| Alberta | 35 | 40 | 35 | 65 | 70 | 120 |

| British Columbia | 125 | 85 | 110 | 130 | 170 | 220 |

| Yukon | 0 | 0 | 0 | 0 | 0 | 5 |

| Northwest Territories | 0 | 0 | 0 | 0 | 0 | 0 |

| Nunavut | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTALS | 4,185 | 3,770 | 2,955 | 3,715 | 4,290 | 7,365 |

Illegals were still coming into Canada via land border crossings during the Harper years. Interestingly though, it only receives major attention when Liberals are in power. A cynic may wonder why.

| YEAR: 2017 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 245 | 19 | 46 | 5 | 315 |

| February | 452 | 142 | 84 | 0 | 678 |

| March | 654 | 170 | 71 | 2 | 897 |

| April | 672 | 146 | 32 | 9 | 859 |

| May | 576 | 106 | 60 | 0 | 742 |

| June | 781 | 63 | 39 | 1 | 884 |

| July | 2,996 | 87 | 51 | 0 | 3,314 |

| August | 5,530 | 80 | 102 | 0 | 5,712 |

| September | 1,720 | 78 | 79 | 4 | 1,881 |

| October | 1,755 | 67 | 68 | 8 | 1,890 |

| November | 1,539 | 38 | 46 | 0 | 1,623 |

| December | 1,916 | 22 | 40 | 0 | 1,978 |

| TOTAL | 18,836 | 1,018 | 718 | 22 | 20,593 |

| YEAR: 2018 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 1,458 | 18 | 41 | 0 | 1,517 |

| February | 1,486 | 31 | 48 | 0 | 1,565 |

| March | 1,884 | 53 | 33 | 0 | 1,970 |

| April | 2,479 | 50 | 31 | 0 | 2,560 |

| May | 1,775 | 36 | 53 | 0 | 1,869 |

| June | 1,179 | 31 | 53 | 0 | 1,263 |

| July | 1,552 | 51 | 31 | 0 | 1,634 |

| August | 1,666 | 39 | 39 | 3 | 1,747 |

| September | 1,485 | 44 | 68 | 4 | 1,601 |

| October | 1,334 | 23 | 37 | 0 | 1,394 |

| November | 978 | 23 | 18 | 0 | 1,019 |

| December | 1,242 | 11 | 27 | 0 | 1,280 |

| TOTAL | 18,518 | 410 | 479 | 7 | 19,419 |

| YEAR: 2019 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 871 | 1 | 16 | 1 | 888 |

| February | 800 | 1 | 6 | 2 | 808 |

| March | 967 | 13 | 22 | 0 | 1,002 |

| April | 1,206 | 15 | 25 | 0 | 1,246 |

| May | 1,149 | 27 | 20 | 0 | 1,196 |

| June | 1,536 | 26 | 5 | 0 | 1,567 |

| July | 1,835 | 23 | 15 | 1 | 1,874 |

| August | 1,712 | 26 | 22 | 2 | 1,762 |

| September | 1,706 | 19 | 17 | 0 | 1,737 |

| October | 1,595 | 18 | 8 | 1 | 1,622 |

| November | 1,118 | 9 | 21 | 0 | 1,148 |

| December | 1,646 | 2 | 5 | 2 | 1,653 |

| TOTAL | 16,136 | 180 | 182 | 9 | 16,503 |

| YEAR: 2020 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 1,086 | 7 | 7 | 0 | 1,100 |

| February | 976 | 2 | 2 | 0 | 980 |

| March | 930 | 7 | 18 | 0 | 955 |

| April | 1 | 0 | 5 | 0 | 6 |

| May | 17 | 0 | 4 | 0 | 21 |

| June | 28 | 1 | 3 | 1 | 33 |

| July | 29 | 2 | 17 | 0 | 48 |

| August | 15 | 3 | 0 | 0 | 18 |

| September | 30 | 4 | 7 | 0 | 41 |

| October | 27 | 0 | 4 | 0 | 31 |

| November | 24 | 0 | 8 | 0 | 32 |

| December | 26 | 2 | 8 | 0 | 36 |

| TOTAL | 3,189 | 28 | 84 | 1 | 3,302 |

| YEAR: 2021 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 28 | 1 | 10 | 0 | 39 |

| February | 39 | 0 | 1 | 0 | 40 |

| March | 29 | 5 | 2 | 0 | 36 |

| April | 29 | 2 | 2 | 0 | 33 |

| May | 12 | 3 | 13 | 0 | 28 |

| June | 11 | 0 | 6 | 0 | 17 |

| July | 28 | 5 | 6 | 0 | 39 |

| August | 63 | 2 | 11 | 0 | 76 |

| September | 150 | 0 | 19 | 0 | 169 |

| October | 96 | 0 | 17 | 0 | 113 |

| November | 832 | 1 | 12 | 0 | 845 |

| December | 2,778 | 0 | 33 | 0 | 2,811 |

| TOTAL | 4,095 | 19 | 132 | 0 | 4,246 |

| YEAR: 2022 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 2,367 | 0 | 16 | 0 | 2,383 |

| February | 2,154 | 1 | 9 | 0 | 2,164 |

| March | 2,492 | 2 | 8 | 0 | 2,502 |

| April | 2,791 | 3 | 8 | 3 | 2,805 |

| May | 3,449 | 3 | 40 | 1 | 3,493 |

| June | 3,066 | 3 | 14 | 3 | 3,086 |

| July | 3,645 | 3 | 29 | 0 | 3,677 |

| August | 3,234 | 5 | 10 | 0 | 3,249 |

| September | 3,650 | 10 | 0 | 0 | 3,660 |

| October | 3,901 | 16 | 34 | 0 | 3,951 |

| November | 3,731 | 23 | 34 | 0 | 3,788 |

| December | 4,689 | 3 | 52 | 1 | 4,745 |

| TOTALS | 39,171 | 72 | 289 | 7 | 39,540 |

And of course, this has continued into 2023. This is because…. reasons.

| YEAR: 2023 | |||||

|---|---|---|---|---|---|

| MONTH | QUEBEC | MANITOBA | B.C. | OTHERS | TOTAL |

| January | 4,875 | 19 | 100 | 0 | 4,994 |

| February | 4,517 | 5 | 53 | 0 | 4,575 |

| TOTALS | 9,392 | 24 | 153 | 0 | 9,569 |

Keep in mind, there are a number of “exceptions” that will let people enter from the United States anyway. These include:

(1) Family member exceptions

Refugee claimants may qualify under this category of exceptions if they have a family member who:

- is a Canadian citizen

- is a permanent resident of Canada

- is a protected person under Canadian immigration legislation

- has made a claim for refugee status in Canada that has been accepted by the Immigration and Refugee Board of Canada (IRB)

- has had his or her removal order stayed on humanitarian and compassionate grounds

- holds a valid Canadian work permit

- holds a valid Canadian study permit, or

- is over 18 years old and has a claim for refugee protection that has been referred to the IRB for determination. (This claim must not have been withdrawn by the family member, declared abandoned or rejected by the IRB or found ineligible for referral to the IRB.)

(2) Unaccompanied minors exception

Refugee claimants may qualify under this category of exceptions if they are minors (under the age of 18) who:

- are not accompanied by their mother, father or legal guardian

- have neither a spouse nor a common-law partner, and

- do not have a mother, a father or a legal guardian in Canada or the United States.

(3) Document holder exceptions

Refugee claimants may qualify under this category of exceptions if they:

- hold a valid Canadian visa (other than a transit visa)

- hold a valid work permit

- hold a valid study permit

- hold a travel document (for permanent residents or refugees) or other valid admission document issued by Canada, or

- are not required (exempt) to get a temporary resident visa to enter Canada but require a U.S.–issued visa to enter the U.S.

(4) Public interest exceptions

Refugee claimants may qualify under this category of exceptions if:

- they have been charged with or convicted of an offence that could subject them to the death penalty in the U.S. or in a third country. However, a refugee claimant is ineligible if he or she has been found inadmissible in Canada on the grounds of security, for violating human or international rights, or for serious criminality, or if the Minister finds the person to be a danger to the public.

Even if a ride through the Quebec crossing isn’t an option for everyone, there are enough exceptions that a lot of people will still qualify. A cynic may wonder if this is being done in an effort to help obscure the true numbers of how many are entering Canada.

In any event, why this sudden announcement? It could be over recent revelations that New York City was paying for tickets to ship illegals to Canada. The “solution” to Quebec’s problem has been to start relocating illegals elsewhere in Canada, which left a bad taste.

Even so-called “based” U.S. State Governors like Ron DeSantis (Florida), and Greg Abbott (Texas) are doing the same thing. Of course, no one ever voted for any of this.

But this recent announcement is at least a step in the right direction.

ARTICLE 8

1. The Parties shall develop standard operating procedures to assist with the implementation of this Agreement. These procedures shall include provisions for notification, to the country of last presence, in advance of the return of any refugee status claimant pursuant to this Agreement.

2. These procedures shall include mechanisms for resolving differences respecting the interpretation and implementation of the terms of this Agreement. Issues which cannot be resolved through these mechanisms shall be settled through diplomatic channels.

3. The Parties agree to review this Agreement and its implementation. The first review shall take place not later than 12 months from the date of entry into force and shall be jointly conducted by representatives of each Party. The Parties shall invite the UNHCR to participate in this review. The Parties shall cooperate with UNHCR in the monitoring of this Agreement and seek input from non-governmental organizations.

As mentioned many times, the UNHCR is actually a party to this border agreement. This means that the decisions really aren’t strictly between Canada and the U.S. This detail isn’t reported by any mainstream outlet in Canada.

The UNCHR also publishes instructional guides on how to circumvent border controls. They should be a decision maker…. why exactly?

Thanks to a 2019 change, Canada scrapped the Designated Country of Origin practice. This had labelled dozens of countries (mainly in Europe) as “safe”, and led to an expedited deportation process for those apply from there.

While it’s nice to close the loophole that exists in between official border ports, the issues are much larger than that.

(1) https://pm.gc.ca/en/news/news-releases/2023/03/24/working-united-states-grow-our-clean-economies-and-create-good-middle

(2) https://twitter.com/SeanFraserMP/status/1639393921179570184

(3) https://twitter.com/SeanFraserMP/status/1639403782508367875

(4) https://public-inspection.federalregister.gov/2023-06351.pdf

(5) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/processed-claims.html

(6) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2017.html

(7) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2018.html

(8) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2019.html

(9) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2020.html

(10) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2021.html

(11) https://www.canada.ca/en/immigration-refugees-citizenship/services/refugees/asylum-claims/asylum-claims-2022.html

(12) https://www.cbc.ca/news/canada/montreal/roxham-road-quebec-new-york-asylum-seekers-1.6748192

(13) https://www.cbc.ca/news/canada/montreal/roxham-road-quebec-new-york-asylum-seekers-1.6748192

(14) https://www.ntd.com/desantis-granted-more-power-to-relocate-illegal-aliens-to-blue-states_900749.html

(15) https://www.realclearpolitics.com/video/2022/09/16/texas_gov_greg_abbott_we_will_stop_bussing_illegal_immigrants_to_blue_states_when_biden_secures_the_border.html#!

(16) https://www.canada.ca/en/immigration-refugees-citizenship/corporate/mandate/policies-operational-instructions-agreements/agreements/safe-third-country-agreement/final-text.html

(17) https://www.canada.ca/en/immigration-refugees-citizenship/corporate/mandate/policies-operational-instructions-agreements/agreements/safe-third-country-agreement/final-text.html

(18) https://www.canada.ca/en/immigration-refugees-citizenship/news/2019/05/canada-ends-the-designated-country-of-origin-practice.html

(19) https://www.unhcr.ca/wp-content/uploads/2019/09/what-to-know-about-irregular-border-crossings-Aug2019-en.pdf?ea.tracking.id=SOC19_UNR&utm_source=twitter&utm_medium=social&utm_campaign=CA_PS_EN_canada_Tweet&utm_content=border-facts

(U.S.) HR 61: Bill To Expand Scope Of Hate Crimes Introduced

Remember the mass shooting in Buffalo last year that was supposedly based on the “replacement theory”? It had been predicted that this would lead to more calls for gun control, and it did.

But the other shoe has dropped. House Resolution 61 has been introduced to expand hate crime laws within the U.S., and to specifically target a certain type of crime. It was sponsored by Congresswoman Sheila Jackson Lee, a Democrat from Texas.

What’s particularly alarming is how many of the terms in this Bill are not clearly defined. (See archive.) This makes it difficult to enforce, but enables it to be selectively applied. In a practical sense: it has the potential to make debate much trickier, and easier to shut down.

Yes, this is in the United States, but something similar could easily come to Canada in the not too distant future. Don’t dismiss the possibility.

To state the obvious: this is only focused on one group of people.

A BILL

To prevent and prosecute white supremacy inspired hate

crime and conspiracy to commit white supremacy in-

spired hate crime and to amend title 18, United States

Code, to expand the scope of hate crimes.

1 Be it enacted by the Senate and House of Representa-

2 tives of the United States of America in Congress assembled,

3 SECTION 1. SHORT TITLE.

4 This Act may be cited as the ‘‘Leading Against White

5 Supremacy Act of 2023’’.

6 SEC. 2. WHITE SUPREMACY INSPIRED HATE CRIME.

7 (a) IN GENERAL.—A person engages in a white su-

8 premacy inspired hate crime when white supremacy ide

2

1 ology has motivated the planning, development, prepara-

2 tion, or perpetration of actions that constituted a crime

3 or were undertaken in furtherance of activity that, if effec-

4 tuated, would have constituted a crime.

5 (b) CONSPIRACY.—A conspiracy to engage in white

6 supremacy inspired hate crime shall be determined to

7 exist—

8 (1) between two or more persons engaged in the

9 planning, development, preparation, or perpetration

10 of a white supremacy inspired hate crime; or

11 (2) between two or more persons—

12 (A) at least one of whom engaged in the

13 planning, development, preparation, or per-

14 petration of a white supremacy inspired hate

15 crime; and

16 (B) at least one of whom published mate-

17 rial advancing white supremacy, white suprema-

18 cist ideology, antagonism based on ‘‘replace-

19 ment theory’’, or hate speech that vilifies or is

20 otherwise directed against any non-White per-

21 son or group, and such published material—

22 (i) was published on a social media

23 platform or by other means of publication

24 with the likelihood that it would be viewed

25 by persons who are predisposed to engag-

3

•HR 61 IH

1 ing in any action in furtherance of a white

2 supremacy inspired hate crime, or who are

3 susceptible to being encouraged to engage

4 in actions in furtherance of a white su-

5 premacy inspired hate crime;

6 (ii) could, as determined by a reason-

7 able person, motivate actions by a person

8 predisposed to engaging in a white suprem-

9 acy inspired hate crime or by a person who

10 is susceptible to being encouraged to en-

11 gage in actions relating to a white suprem-

12 acy inspired hate crime; and

13 (iii) was read, heard, or viewed by a

14 person who engaged in the planning, devel-

15 opment, preparation, or perpetration of a

16 white supremacy inspired hate crime.

17 (c) DEPARTMENT OF JUSTICE AUTHORITY, EN-

18 FORCEMENT, MONITORING, AND REPORTING.—The De-

19 partment shall have authority to conduct operations and

20 activities pursuant to this section, specifically—

21 (1) with regard to information or evidence ob-

22 tained by the Department of any action cited in this

23 section, the Department shall have the authority to

24 investigate, intercede, and undertake other actions

25 that it deems necessary and appropriate to interdict,

4

•HR 61 IH

1 mitigate, or prevent such action from culminating in

2 violent activity;

3 (2) the Department shall have the authority to

4 prosecute persons who engaged in actions cited in

5 this section; and

6 (3) the Uniform Crime Reporting Program in

7 the Department of Justice shall maintain records of

8 white supremacy inspired hate crimes and related

9 actions cited in this section, and enforcement actions

10 in response thereto.

11 The Department shall provide annual reports to the ap-

12 propriate committees in Congress that shall include infor-

13 mation cited in this paragraph.

14 SEC. 3. CRIMINAL OFFENSE.

15 Section 249(a)(1) of title 18, United States Code, is

16 amended—

17 (1) in the matter preceding subparagraph (A)

18 by inserting after ‘‘race, color, religion, or national

19 origin of any person’’ the following: ‘‘, or because of

20 a white supremacy based motivation against any

21 person’’; and

22 (2) in subparagraph (B)—

23 (A) in clause (i), by striking ‘‘or’’ at the

24 end;

5

•HR 61 IH

1 (B) in clause (ii), by striking the period

2 and inserting ‘‘; or’’; and

3 (C) by adding at the end the following:

4 ‘‘(iii) the offense was in furtherance of

5 a white supremacy based motivation.’’.

6 SEC. 4. FINDINGS.

7 Section 4702 of the Matthew Shepard and James

8 Byrd Jr. Hate Crimes Prevention Act (18 U.S.C. 249

9 note) is amended by adding at the end the following:

10 ‘‘(11) Mass shootings and other hate crimes

11 motivated by white supremacy have been increasing

12 in frequency and intensity. These heinous and viru-

13 lent crimes are inspired by conspiracy theories, bla-

14 tant bigotry, and mythical falsehoods such as ‘‘re-

15 placement theory’’. All instances must be prevented

16 and severe criminal penalties must be applied to

17 their perpetrators.’’.

There is a section in HR 61 that states: Department of Justice shall maintain records of white supremacy inspired hate crimes and related actions cited in this section. Does this mean that groups that talk about the ongoing replacement in the West will be looked at? (As if they aren’t already).

Also, will law enforcement to more than simply monitor and keep records? Will there be active involvement in setting up undercover operations or honeypots?

The Bill also talks about postings on the internet which people who are “susceptible to being encouraged” might read or view the content. This is another slippery slope. It seems designed to force authors to water down whatever they say because of what some random person “might” say or do.

Census data — Government distributed — in countries across the West have shown considerable demographic changes (or replacement, depending on your slant) over the last 60 or so years. Was it racist to have generated this information in the first place? Is it racist to openly and honestly discuss what is happening?

Moreover, the mainstream media has addressed this topic many times in the last few decades. It’s openly predicted that most countries in the West will be majority non-white by the end of this century, if not sooner. This is hardly a secret.

Hate crimes are already illegal in the U.S. So, why is this specific Bill necessary?

To play devil’s advocate here: this could simply be about grandstanding. It wouldn’t be the first time a politician put forth legislation they never planned to advance in order to score points. Then again, it may not be the case.

The vague and undefined definitions and explanations are possibly the worst part, as there are no actual standards to be applied.

(1) https://www.congress.gov/118/bills/hr61/BILLS-118hr61ih.pdf

(2) BILLS 118 House Resolution 61

(3) https://www.congress.gov/member/sheila-jackson-lee/J000032

(4) https://www.npr.org/2022/05/16/1099034094/what-is-the-great-replacement-theory

(5) https://www.businessinsider.com/buffalo-mass-shooting-latest-linked-to-great-replacement-theory-2022-5?op=1

Declaration on the North American Partnership for Equity and Racial Justice

It’s the most harmless sounding names that are most chilling.

The Government of Canada has announced a new agreement with the United States and Mexico: The Declaration on the North American Partnership for Equity and Racial Justice. Mélanie Joly, Foreign Affairs Minister, also tweeted about it.

While this sounds fine enough, the vague wording of much of the text is cause for concern.

Considering the lengths that these countries have gone in establishing equal rights, it seems unproductive to keep pushing the narrative that there’s all these hate groups and institutions. It comes across as having the effect of making peaceful co-existence impossible, and maybe that’s the point.

It’s unclear what exactly “racial justice” would involve. If it were simply equal rights, then it would be very different to oppose. But would it be reparations? This idea has been floated in recent years. Perhaps it involves affirmative action or quotas in various institutions.

To address the obvious: this document doesn’t advocate for “equality”. That would be equal rights and opportunities between people. That would be fine. Instead, it calls for “equity”, which is equality of outcome, and sounds pretty much like Communism.

There’s a bit of a bait-and-switch here as the document calls on partners to: “root out the barriers to equal opportunity”. However, they are pushing equity (equality of outcome), while attempting to persuade others that it’s about equal opportunity.

Declaration between the Government of the United Mexican States, the Government of Canada, and the Government of the United States of America.

Across our three nations, generations of leaders have fought to build democracies where people from richly diverse histories and cultures share the equal promise of freedom and inclusion. Our diversity is North America’s greatest strength, as it boosts innovation, leads to economic growth, enriches our democracies, and advances our security.

Yet in spite of our progress, many across North America continue to face intersecting forms of systemic racism, discrimination and hate because of who they are, whom they love, the language they speak, their nation of origin, the color of their skin, and their religion or beliefs. Discrimination on the basis of race, ethnicity, national origin, sex, sexual orientation, gender identity, age, disability, religion, belief, language, and socio-economic status persist throughout our region and in each of our countries. Tribal Nations and Indigenous peoples, who have lived in North America since time immemorial, continue to face unacceptable disparities and barriers, as do other communities with lived experience of discrimination and racism. Systemic racism, expressions of white supremacy and discrimination in all forms diminish our economic growth, limit our prosperity, undermine national and regional security, and threaten the durability of our democracies. To unleash North America’s full and vast potential, we must comprehensively address these barriers and challenges.

Building on efforts in our respective countries to advance equity and racial justice, at the 2021 North American Leaders’ Summit President Andrés Manuel López Obrador, Prime Minister Justin Trudeau, and President Joseph R. Biden, Jr. declared their commitment to building just, inclusive, and equitable democracies that combat systemic racism and discrimination in all forms. Following that declaration, we committed to working together to create a North America in which every individual has an equal opportunity to achieve their full potential and equal participation in social, cultural, economic, and political life.

We now establish this North American Partnership as a reflection of our common commitments to advancing equity and racial justice within our countries, and our intent to work collaboratively to address systemic forms of discrimination and honor the diverse tapestry of histories, customs, cultures, languages, identities, ethnicities, abilities, and beliefs that make North America strong.

In recognition of our close ties and shared vision, the Participants in this Partnership will:

(1) Work within our own countries to affirmatively advance equity and racial justice, and to comprehensively root out the barriers to equal opportunity that marginalized communities continue to face.

(2) Establish a Trilateral Racial Equity and Inclusion Expert Network to facilitate the exchange of information to share best practices and innovative strategies developed across our three countries for advancing equity and racial justice in our public policies and societies, and to help identify further action areas for the Partnership. In establishing this expert exchange, we will seek opportunities to engage communities with lived experience of racism and discrimination on driving solutions to protect the rights of members of marginalized communities; advance health equity and economic inclusion; address racial and other disparities in the justice system, access to the ballot, and educational opportunities; and reflect the diversity of our nations in our federal public services workforce.

(3) Collaborate together to advance equity and racial justice through our participation in regional and multilateral organizations, such as the United Nations and other fora. This includes advancing the rights and aspirations enshrined in multilateral commitments, such as the UN Declaration on the Rights of Indigenous Peoples, the International Decade for People of African Descent, the UN Sustainable Development Goals, and other joint undertakings.

Discrimination against people “for who they love”, is presumably referring to adults of the same sex. However, it wouldn’t take much to expand that to include pedophilia, as the language is very vague. As for gender identity, many would agree that this has been forced on the public far too much already.

“Reflect[ing] the diversity of our nations in our federal public services workforce” is code for hiring quotas. Most people can agree that a merit-based civil service is the best way to have it. Social engineering shouldn’t push that principle aside

As for “address racial and other disparities in the justice system”, does this mean something like Gladue Rights across the continent? This would be race-based discounts in criminal court, due to overrepresentation of certain groups.

This agreement also endorses the United Nations Sustainable Development Agenda (Agenda 2030), and connects equity and racial justice to that.

The claim that certain groups “face unacceptable disparities and barriers” is telling, even if hard to understand. Disparities simply refers to differences in overall outcomes. This can be for many reasons, and is not necessarily discrimination. But it goes on imply that these differences are the direct result of some barriers that are put in place. This follows the assumption that groups of people would essentially be the same if others wouldn’t oppress them in some way.

An obvious example is the long debunked wage gap. Just because men and woman — on average — make different personal and lifestyle choices, doesn’t mean discrimination took place.

While the text sounds well meaning enough, domestic implementation of such ideals would invite even more Government overreach and interference.

And a logistical question: what would happen to people who decide that they want nothing to do with such a system? What punishments would they face?

(1) https://www.canada.ca/en/canadian-heritage/campaigns/federal-anti-racism-secretariat/declaration-partnership-equality-racial-justice.html

(2) https://twitter.com/melaniejoly/status/1612801847076749314

(3) https://www.state.gov/declaration-on-the-north-american-partnership-for-equity-and-racial-justice/

(4) https://www.state.gov/declaration-on-the-north-american-partnership-for-equity-and-racial-justice-2/

Entering Canada Illegally: February 2017 – September 2022 Source Countries

Now for something that isn’t covered much by mainstream (or alternative) media. Who exactly is coming into Canada illegally, in between official border ports of entry? What are the numbers? Fortunately, the Immigration and Refugee Board has at least some information to share.

As readers will know, the overwhelming majority of people coming illegally are entering through Roxham Road in Quebec. They should be turned away, but aren’t.

Let’s look at some hard numbers:

| RANK | COUNTRY | INTAKE | ACC | REJ | ABAN | WD&O | RESOLVED | PENDING |

|---|---|---|---|---|---|---|---|---|

| 1 | Nigeria | 16,834 | 5,408 | 7,716 | 204 | 2,329 | 15,657 | 1,177 |

| 2 | Haiti | 14,621 | 2,534 | 5,024 | 380 | 827 | 8,765 | 5,856 |

| 3 | Columbia | 5,158 | 2,217 | 664 | 62 | 168 | 3,111 | 2,047 |

| 4 | Turkey | 3,451 | 1,889 | 48 | 27 | 33 | 1,997 | 1,454 |

| 5 | Pakistan | 2,859 | 1,401 | 775 | 30 | 138 | 2,344 | 515 |

| 6 | D.R. Congo | 2,540 | 604 | 626 | 38 | 210 | 1,478 | 1,062 |

| 7 | Sudan | 1,825 | 1,418 | 130 | 28 | 82 | 1,658 | 167 |

| 8 | Angola | 1,808 | 568 | 524 | 22 | 103 | 1,217 | 591 |

| 9 | Yemen | 1,353 | 1,076 | 55 | <20 | <20 | 1,159 | 194 |

| 10 | Eritrea | 1,274 | 1,026 | <20 | <20 | 117 | 1,215 | 59 |

| n/a | All Others | 21,674 | 11,199 | 4,555 | 456 | 1,469 | 17,679 | 3,996 |

| n/a | Total | 73,397 | 29,340 | 20,177 | 1,265 | 5,498 | 56,280 | 17,118 |

ACC = Accepted

REJ = Rejected

ABAN = Abandoned

WD&O = Withdrawn And Other

**The IRB lists some totals as <20, and they claim that this is done for privacy reasons. The logic seems to be that if there were only a few who crossed, it would be easier to identify them.

Over 73,000 people have come illegally since 2017, less than 6 years ago. The above totals are from February 2017 through September 2022. The I.R.B. claims that it didn’t have access to such information prior to this. Nonetheless, it’s a good snapshot at what’s going on.

Isn’t this lovely? The bulk of the people ILLEGALLY entering Canada are from the 3rd World. They’ve already passed on at least one safe country — the United States — one that gets hundreds of thousands of applications per year.

And again, this could be stopped very quickly. However, politicians (of all stripes) actively work against the interests of their own citizens.

(1) https://www.irb-cisr.gc.ca/en/statistics/Pages/irregular-border-crossers-countries.aspx

(2) https://archive.vn/hkz3h

(3) Wayback Machine

Supreme Court Reserves Decision On Challenge To Safe Third Country Agreement

The Supreme Court of Canada recently heard a challenge to strike down the Safe Third Country Agreement (S3CA), on grounds that it violates the Charter of Rights. This was based on 3 consolidated cases of people attempting to enter Canada from the U.S., and being denied.

The primary NGOs acting were: (a) Amnesty International; (b) the Canadian Council for Refugees; and (c) the Canadian Council of Churches. However, there were others who piled on, demanding open borders for people entering Canada illegally.

- Appellant Canadian Council for Refugees et al.

- Appellant Minister of Citizenship and Immigration Minister of Public Safety and Emergency Preparedness

- Intervener Association québécoise des avocats et avocates en droit de l’immigration

- Intervener David Asper Centre for Constitutional Rights et al

- Intervener National Council of Canadian Muslims et al

- Intervener Canadian Association of Refugee Lawyers

- Intervener Queen’s Prison Law Clinic

- Intervener Canadian Civil Liberties Association

- Intervener British Columbia Civil Liberties Association

- Intervener Advocates for the Rule of Law

- Intervener Rainbow Railroad

- Intervener HIV AIDS Legal Clinic of Ontario

- Intervener Canadian Lawyers for International Human Rights et al

- Intervener Rainbow Refugee Society

It’s strange that virtually any special interest group can get standing as an intervenor to attack our borders. Meanwhile, actual citizens don’t have standing to demand that laws and borders be enforced.

For context, it’s important to realize that attacking the function of a border is not new. In fact, these groups have been at it for a long time. Here are some of their efforts. Note: these listings are not exclusive.

Efforts appear to have kicked off after January 1, 1989. This was based on changes to the procedures for determining whether applicants come within the definition of a Convention Refugee.

First attempt to remove “safe country” designation:

April 26, 1989, the Federal Court dismissed an application to strike from the Attorney General of Canada. This had been brought on the basis that the Canadian Council of Churches did not have standing to bring the action and had not demonstrated a cause of action.

March 12, 1990, the Federal Court of Appeals refused to hear the challenge of this idea, since no country had yet been designated a “safe country”. In other words, the Canadian Council of Churches had simply fought the concept of a safe country designation.

January 23, 1992, the Supreme Court disallowed the challenge on the grounds that the CCC lacked the necessary standing, and that there were other, more effective ways to achieve their results.

Second attempt to remove “safe country” designation:

December 2004, the Canada/U.S. Safe Third Country Agreement comes into effect. It’s worth noting that it’s really a 3-way treaty that includes the UNHCR, or United Nations High Commission on Refugees. Of course, there are also limitation and exceptions that make it largely worthless.

November 29, 2007, the Federal Court ruled that the S3CA violated Sections 7 and 15 of the Canadian Charter, and that they couldn’t be “saved” as reasonable limitations under Section 1. Ottawa decided to appeal that ruling.

June 27, 2008, the previous ruling was set aside on the grounds that appearing at a border port meant they could be turned away, and that it wasn’t a breach of international obligations.

Third attempt to remove “safe country” designation:

July 23, 2015, the Federal Court allowed reconsideration of refugee applications from people coming from Hungary and Serbia. Up until this point, those countries were considered “safe” under the Designation Country of Origin (DCO) policy. This meant that approximately 40 countries — mainly in Europe — were viewed as safe. As a result, there would be mechanisms to expedite the process (and deportations) of claimants from there.

May 17, 2019, the Trudeau Government ended the DCO practice. This meant that no source country would automatically be considered “safe”, for people coming to Canada. Considering the S3CA was still in place, that left the United States as the only country that people could be turned away from (close to automatically). The list (and dates) are still available for reference.

Fourth attempt to remove “safe country” designation:

July 22, 2020, the Federal Court ruled that Section 7 of the Charter (security of the person) was violated by the S3CA. While Section 15 (equality) was cited as well, the Judge declined to rule on that provision. Barring an appeal, or legislative changes, the treaty was effectively dead.

April 15, 2021, the Federal Court of Appeals overturned that decision. Section 7 was no violated after all. Now, there had been a cross appeal, as the initial Judge declined to address Section 15. That was dismissed as well, meaning the S3CA was restored to its original form.

October 6, 2022, the Supreme Court hears arguments on striking down the S3CA on constitutional grounds. The decision is reserved, and it’s unclear when the ruling will occur. This is where we are today.

There’s a certain hypocrisy that needs to be pointed out: Refugee groups attack the S3CA, at least partially on the grounds that the U.S. is an unsafe country, and that they need better protection. In the meantime, these same groups promote refugee resettlement into America, as it’s a safe haven. In other words, whether or not the U.S. is safe depends entirely on who the audience is.

Of course, there was never any consultation with Canadians as to whether this is what they really wanted. It’s outrageous that the citizens might want to weigh in.

There’s also another elephant in the room that needs to be addressed: having lax border policies makes it easier to smuggle (or worse, traffic) people into another country. This does nothing to address that problem, but more on that elsewhere on the site.

(1) https://scc-csc.ca/case-dossier/info/sum-som-eng.aspx?cas=39749

(2) https://scc-csc.ca/case-dossier/info/af-ma-eng.aspx?cas=39749

(3) https://www.canlii.org/en/ca/fct/doc/1989/1989canlii9436/1989canlii9436.html

(4) https://www.canlii.org/en/ca/fca/doc/1990/1990canlii8019/1990canlii8019.html

(5) https://www.canlii.org/en/ca/scc/doc/1992/1992canlii116/1992canlii116.html

(6) https://www.canada.ca/en/immigration-refugees-citizenship/corporate/mandate/policies-operational-instructions-agreements/agreements/safe-third-country-agreement/final-text.html

(7) https://www.canlii.org/en/ca/fct/doc/2007/2007fc1262/2007fc1262.html

(8) https://www.canlii.org/en/ca/fca/doc/2008/2008fca229/2008fca229.html

(9) https://www.canlii.org/en/ca/fct/doc/2015/2015fc892/2015fc892.html

(10) https://www.canada.ca/en/immigration-refugees-citizenship/news/2019/05/canada-ends-the-designated-country-of-origin-practice.html

(11) https://www.canlii.org/en/ca/fct/doc/2020/2020fc770/2020fc770.html

(12) https://www.canlii.org/en/ca/fca/doc/2021/2021fca72/2021fca72.html