Another researcher getting into the muck and filth that is the Canadian Government and administration. Here is some of the work unearthed and exposed. Worth a good long read, for anyone who is truly concerned about the future of the nation. Here are just a few of the postings. Go check out more.

In this previous post, CdnSpotlight’s work from Gab is shared on this site. Here is continuation of that fine research.

6. Goldy Hyer

Canada’s Deep State Part 6 – Goldy Hyder

Another one of Dom’s buddies at Century Initiative is Goldy Hyder, currently Pres & CEO of the Business Council of Canada since 2018, previously:

Hill+Knowlton Strategies Canada (Ottawa) 2001-2018, working his way up to Pres & CEO in 2013

Hyder, a native Albertan, was PM Joe Clark’s chief of staff (when?) prior to joining Hill+Knowlton in 2001 but there’s no mention of dates exactly when that took place

Recently named Vice Chair of ABLAC 2020 (Asia Business Leaders Advisory Council), a high-level group of Asian and Canadian business leaders convened annually by the Asia Pacific Foundation of Canada (APFC) to identify and articulate opportunities for improved Canada-Asia business engagement.

And guess who some of the APFC members are from Canada – recognize some names from my previous posts?

Barton, Wiseman, Hyder, Fukakusa (CIB) & Sabia (Porno’s Advisory Council) – ain’t that cozy?

For some lobbying in Harper’s Government.

Duffy adviser offered to share secrets with Nigel Wright, defence alleges in cross-examination.

Defence lawyer Donald Bayne suggested adviser Goldy Hyder was actually working closer with Wright and the PMO than he was with Duffy

In April 2013, Sen. Mike Duffy engaged longtime Conservative insider and communications expert Goldy Hyder to advise him on how to handle his ongoing discussions with the Prime Minister’s Office over his expense claims.

Hyder, a consultant, then contacted Nigel Wright, at the time the prime minister’s chief of staff, to say he had been engaged as a Duffy adviser. And, according to Duffy’s defence lawyer, Hyder offered to secretly share information with Wright.

“Sen. Duffy thinks that Goldy Hyder is working on his behalf,” defence lawyer Donald Bayne told Wright in court, “but really Mr. Hyder is working for you to get to where you want to go.”

“I never viewed it that way,” replied Wright. “He introduced himself as working for Sen. Duffy.”

Duffy advisor offered to share secrets with Nigel Wright.

Then there’s this moronic piece:

Jaspal Atwal, Sikh Extremist Convicted In Assassination Attempt, Invited To Trudeau Receptions In India.

The news comes as Trudeau tries to reassure Indian leaders that his government doesn’t support Sikh extremism.

Goldy Hyder, President of Hill and Knowlton Strategies and a long-time Conservative insider who was in India for part of the Canadian trip, said the Atwal furor is taking away from the positives of the Trudeau tour.

“I do think it’s unfortunate because it’s taking away from some of the things that are happening on this that, as a Canadian of a different (political) stripe, quite frankly, I’m pleased to see.”

Hyder said he didn’t think the episode would harm Trudeau’s efforts to improve trade and cultural relations with India, largely because the mistake was fixed as soon as it was discovered.

7. Jim Leech, ON Teachers’ Pension, CIB

CANADA’S DEEP STATE Part 7 – Jim Leech – Ontario Teachers Pension Plan & Architect of the Canada Infrastructure Bank.

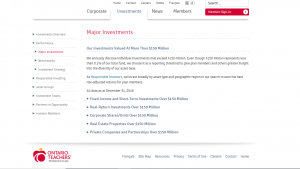

Currently the Chancellor of Queen’s University after retiring in 2014 as Pres/CEO of the Ontario Teachers’ Pension Plan (OTPP) 2001-2014, one of the world’s largest and most innovative pension funds. During his tenure as CEO, Teachers’ eliminated its funding deficit and was RANKED FIRST IN THE WORLD amongst peer plans for absolute returns and value-added returns over 5 & 10 years.

Feb.10, 2017 – he was named Special Advisor “to the Prime Minister of Canada” on the Canada Infrastructure Bank (CIB), working in collaboration with the Privy Council Office, the Minister of Infrastructure and Communities, and the Minister of Finance to expedite the swift and successful creation of the CIB

Mr. Leech is also a SENIOR ADVISOR to MCKINSEY & CO. (location & date unknown) & long-term acquaintance of Dominic Barton & Mark Wiseman.

Prior to his appointment as CEO, Mr. Leech headed Teachers’ Private Capital as Senior VP, the pension plan’s private investing arm where he oversaw the growth in private equity, venture capital, and infrastructure investments from $2B in 2001 to over $20B by 2007

–> This is when he and the fund gained world-wide attention

After retiring from OTPP in 2014, Mr. Leech was also appointed Special Advisor to the Ontario Minister of Finance to review the sustainability of the province’s electricity sector pension. His report was accepted by the government and is currently being implemented.

from a Globe & Mail interview Jan.2015:

Is there a particular metric you lean on?

“It’s funny, the whole time I was at Teachers, if you asked me on any given day what the stock market had done, I wouldn’t have been able to tell you. But in terms of meaty economic analysis, I put some weight in the World Economic Forum in Davos. That’s probably where I got the information.”

Also an Honorary Colonel in the Canadian Armed Forces

Check out this speech, from Jim Leech.

8. Michael Sabia & The Caisse

CANADA’S DEEP STATE Part 8 – Michael Sabia and the Caisse

While researching everything & everyone in this series, many questions arose while trying to understand how pension fund managers, global “investment/asset managers” and global “management consultants” became the Crime Minister’s gurus with so much power and say in this government – SO MUCH that an infrastructure bank Crown Corporation was created AND FAST.

Why?

How did the core mandate of public pensions morph into that?

Why does there seem to be an ulterior motive?

How does this fit in with China, the other key players like Barton & Wiseman, Pension Plans, immigration, the “middle class” & retiring boomers? Future posts to come.

These all came together with the deep digs on Michael Sabia and Quebec’s public pension the Caisse.

Michael Sabia is Pres & CEO of Quebec’s Pension Plan : Caisse de Depot et Placement du Quebec (CDPQ or The Caisse) since 2009. The first anglophone to head the Caisse which ruffled a lot of feathers in Quebec

Education

1976 BA political economy, University of Toronto

– met his wife, Hilary Pearson in 1st year, granddaughter of former PM Lester B.Pearson

1977-83 MA, MPhil, political economy, Yale University

Career

1986-90 Canadian department of finance, tax policy

1990-93 PRIVY COUNCIL OFFICE deputy secretary to the cabinet

—–> Why do I get bad vibes every time with the PCO or Clerk of the Privy Council?

1993-95 Canadian National Railway (CN), VP Corp Development

1995-99 CN CFO

1999-00 Bell Canada International, chief executive

2000-02 Bell Canada Enterprise (BCE), Exec.VP & COO

2002-08 BCE CEO & Pres

2009-present Caisse de Dépôt et Placement du Québec, CEO & Pres

Sabia held a number of senior positions in Canada’s federal public service incl. Deputy Secretary to the Cabinet of the Privy Council Office1986-93. As a federal govt bureaucrat, he worked on the tax overhaul that would lead to the creation of GST.

Sabia’s supervisor, Clerk of the Privy Council Paul Tellier, left the public service in 1992 to become Pres. of CN Rail, a Crown corp., Sabia followed him in 1993 to help in privatizing the company. Sabia held a number of executive positions at Canadian National Railway including the position of chief financial officer.

Tellier remained CEO at CN until Jan.2003 when he left “unexpectedly” to become Bombardier Corp’s CEO.

CANADIAN NATIONAL RAILWAY COMPANY LIMITED

On November 17, 1995, after 78 years as a Crown corporation, CN was part of the largest privatization in Canadian history through an initial public offering (IPO) that raised CAD 2.26 billion for the Canadian government.

This was led by a new management team of ex-federal government bureaucrats, including Paul Tellier and Michael Sabia who began preparing CN for privatization by improving productivity and enhancing profitability.

These objectives were achieved by massive cuts to the company’s management structure, massive layoffs (CN went from 32,000 employees to about 23,000) and the sale of its branch lines. In Tellier’s final year as CEO, the publicly traded company earned $800 million.

9. Quebec’s pension – The Caisse (CPDQ)

CANADA’S DEEP STATE Part 9 – Quebec’s pension – The Caisse (CPDQ)

Quebec has its own public pension plan and they do not contribute to CPP. It is the 2nd largest pension fund in Canada, after the Canada Pension Plan (CPP)

As at December 31, 2018, CDPQ managed assets of $309.5B invested in Canada and internationally

Established in 1965, the Caisse de Dépôt et Placement du Québec (CDPQ) initially focused on bonds before entering the Canadian stock market in 1967. Caisse manages the funds of other public pension and insurance plans, government and public employee pensions, employees of the QUEBEC CONSTRUCTION INDUSTRY and more.

— Remember the Charbonneau Commission?

It created its private equity portfolio investing in Québec companies then adopted new investment guidelines, placing greater emphasis on equity and entering the real estate market in the 80’s. In 1996, the Caisse’s Real Estate group was the leading real estate owner in Québec and the second largest in Canada.

As of 2017, CDPQ has 41 depositors, active on Canadian and international markets, holds a diversified portfolio including fixed-income securities, publicly listed shares, real estate investments, and private equity. A shareholder in more than 4,000 companies in Québec, elsewhere in Canada, and around the world, the Caisse is internationally recognized as a leading institutional investor

Based on Caisse’s success, the Ontario Teachers Pension Plan lobbied the federal gov’t in the 90’s, and won, to allow the same diversification as Caisse.

Caisse has 3 subsidiaries: Ivanhoe Cambridge, Otera Capital, & CDPQ Infra

Ivanhoé Cambridge is the real estate subsidiary of the Caisse investing in real estate assets ranging from office space & shopping centers to multi-residential buildings. In 2011 all of CDPQ’s real estate subsidiaries were merged into Ivanhoe Cambridge.

Otera Capital is a balance sheet lender in commercial real estate debt in Canada. Unknown if acquired or created by CDPQ in the 80’s

CDPQ Infra is the first Infrastructure Bank in Canada created June 2015 for its first & biggest project – the Réseau express métropolitain (REM) in the Montreal area

From 2010, this brilliant analysis foretells Caisse’s infrastructure bank – the MODEL for the new Canada Infrastructure Bank

Quebec: The most corrupt province. See here.

Why does Quebec claim so many of the nation’s political scandals?

“…the frankly disastrous state of Charest’s government. In the past two years, the government has lurched from one scandal to the next, from political financing to favouritism in the provincial daycare system to the matter of Charest’s own (long undisclosed) $75,000 stipend, paid to him by his own party, to corruption in the construction industry. Charest has stymied repeated opposition calls for an investigation into the latter, prompting many to wonder whether the Liberals, who have long-standing ties to Quebec’s construction companies, have something to hide. (Regardless, this much is true: it costs Quebec taxpayers roughly 30 per cent more to build a stretch of road than anywhere else in the country,

(much more on that topic…..)

10. Rise Of The Pensions

CANADA’S DEEP STATE – The Rise of the Pensions

Canada’s economy is, at best, stagnant

With no economic growth, there’s no new jobs, no additional income or disposable income to spend or INVEST

Canadians have also reached the limits of being taxed – trapping many in the “middle class” as the working poor near the poverty line

But the middle class drives the tax revenues of the entire country as well as the contributions to pension plans (CPP)

So when the middle class declines, when income declines, so do tax revenues, pension plan contributions, disposable income and investment/savings $

That’s why the Crime Minister & Liberals keep referring to the middle class:

Announced in the Fall Economic Statement, the Canada Infrastructure Bank – a key component of the government’s Investing in Canada plan – will provide innovative financing for infrastructure projects, and help more projects get built in Canada. It will lead to better projects that create the GOOD, WELL-PAYING JOBS NEEDED to GROW THE MIDDLE CLASS now, and strengthen Canada’s economy over the long term.

***Source: Prime Minister announces Special Advisor on the Canada Infrastructure Bank Feb.10, 2017

All of this is really about lower incomes = lower income tax revenue

from Jim Leech’s book The Third Rail: Confronting Our Pension Failures:

“Over the next 20 years (as of 2013) more than 7 million Canadian workers will retire. Baby boomers, the 45- to 65-year-olds who account for 42% of the country’s workforce, will join the largest job exodus in Canadian history, moving to the promised land of retirement.”

*** Since millennials now outnumber boomers, the “exodus” can be easily replaced, so what’s the big deal?

“UNLESS OUR CRUMBLING PENSION SYSTEM IS REFORMED, many of these retirees will find this dreamland a bewildering and disappointing mirage.”

*** Reforming the pension “system” is really what’s going on

“In the early 1980s, consumers were setting aside 20% of their DISPLOSABLE incomes to their retirement plans;

TODAY (2013) THE SAVINGS RATE IS A THREADBARE 2.5%

“Retirement savings plans meant to build Canadians’ personal war chests for their final years have failed to live up to their cheery promises of early retirement “freedom” – MARKET RETURNS ARE LOW, and FINANCIAL FEES ARE CLIMBING.

Moreover, retirement plans are now being compromised by high pension obligations and a shrinking workforce.”

*** No shrinking workforce with millennials replacing these workers, but their lower entry-level salaries don’t match the higher boomer salaries because of their decades of work experience

When public pensions got the green light from gov’ts to invest in real estate & riskier investments, those plans exploded in wealth:

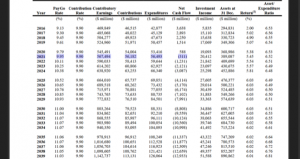

CPP from $44.5 B in 2000 to $409.5 B in 2019 – an increase of $365 B in 20 yr

CDPQ from $50 B in 1994 to $325 B in 2019 – staggering – Quebec only!

OTPP from $69 B in 2001 to $191 B in 2018

There’s also OMERS, HOOPP, etc

However, CPP became concerned with decreasing contributions as the workforce declined or retired. CPP had projected a deficiency in contributions vs. pensions being paid in 2021. That means the investment portion of the CPP portfolio has to be used to top up this deficiency.

But isn’t that what it’s for? See this report.

Source: Office of the Superintendent of Financial Institutions Canada

11. Follow The Money….

CANADA’S DEEP STATE Part 11 – Follow the Money

How governments & capitalists are STEALING Public Pension Funds

Previous posts in this series showed that middle class Canadians and all levels of government are broke, with governments heavily in debt with no real means to create additional tax revenues

But there’s TRILLIONS of $ in Canada’s Public Pension Plans

And TRILLIONS of $ of infrastructure needed WORLDWIDE

Since legislation forbids government access to these funds, this Liberal gov’t has changed the GAME by creating the Canada Infrastructure Bank

Now that gov’t has created the CIB, gov’t will now work at arm’s length, meaning no formal direct bidding process with the gov’t

That means SNC-Lavalin gets their “get out of jail free” card – they can bid on anything

And will likely get them all

In Dec.2017, Minister of Infrastructure Amarjeet Sohi (and Morneau) wrote the true mandate of the CIB in their Statement of Priorities and Accountabilities – Canada Infrastructure Bank (CIB)

“The Bank will be an innovative financing tool designed to work collaboratively with public and private sector partners to transform the way infrastructure is planned, funded and delivered in Canada”

Public & private sector partners – otherwise known as PPPs or the 3Ps or P3 – see next post in this thread

Public sector partners include Institutional Investors – otherwise known as pensions, insurance, etc

“As other countries face the same challenges of closing the infrastructure gap with private and INSTITUTIONAL CAPITAL and finding new ways to fund infrastructure, our GLOBAL PARTNERS (WHO THE HELL ARE THEY?!?) WILL BE WATCHING AND LEARNING FROM THE BANK”

Looks like Canada is the guinea pig for the “Global Partners” – see next post in this thread

Read this archived post.

12. ….And Go Follow CdnSpotlight

Should be obvious by now this account contains some real dirt that is politics in Canada. Most Canadians have no idea about the filth and corruption that our nation is immersed in. But CS lays it out.

Discover more from Canuck Law

Subscribe to get the latest posts sent to your email.

Best view i have ever seen !