Get ready for increased efforts to enforce taxation rules globally. While this is promoted as a means of stopping tax cheats, it’s unlikely stop there. Once the infrastructure is fully up and operational, what’s to stop organizations like the UN from simply imposing global taxes?

1. TIWB Partners With OECD/UNDP

OECD/UNDP Partnership

The Organisation for Economic Co-operation and Development (OECD) and United Nations Development Programme (UNDP) have joined forces to extend the global reach of Tax Inspectors Without Borders (TIWB) and to scale-up operations. The partnership was launched at the Third Financing for Development conference in Addis Ababa on 13 July 2015 and was welcomed by stakeholders from business, civil society, as well as OECD and developing country governments attending the conference. The Initiative was widely hailed as capable of assisting developing countries mobilize much-needed domestic revenues in support of the post-2015 sustainable development agenda. The TIWB Initiative facilitates targeted, tax audit assistance programmes in developing countries across the globe. The TIWB Initiative is a strong response to the attention given to effective and efficient mobilisation of domestic resources in achieving the Sustainable Development Goals and the commitments made by the international community in Addis Ababa to strengthen international tax co-operation

UNDP contributes in the following ways:

.

-Through its country offices, supports development and completion of TIWB programmes in developing, countries;

-Promotes lessons learned and the sharing of good practices of TIWB country programmes with the international development community;

-Manages a roster of tax audit experts;

-Manages designated donor financial resources for TIWB activities;

-Handles contracts for retired experts (or former tax officials) participating in TIWB programmes.

The OECD contributes in the following ways:

.

-Hosts the TIWB Secretariat at the OECD offices in Paris;

-Identifies and provides support to host tax administrations on technical taxation issues and assists host and partner tax administrations in the set-up of TIWB programmes;

-Provides technical support to UNDP on selection and quality assurance of the roster of tax audit experts;

-Develops manuals, tools and research on best administrative practices in tax administrations and for TIWB Programmes.

-Monitors, assesses and reports on results of TIWB programmes.

So it isn’t just about helping certain countries get their tax money. It’s also about achieving the UN Sustainable Development Agenda goals laid out in 2015. The OECD also made their announcement about the partnership.

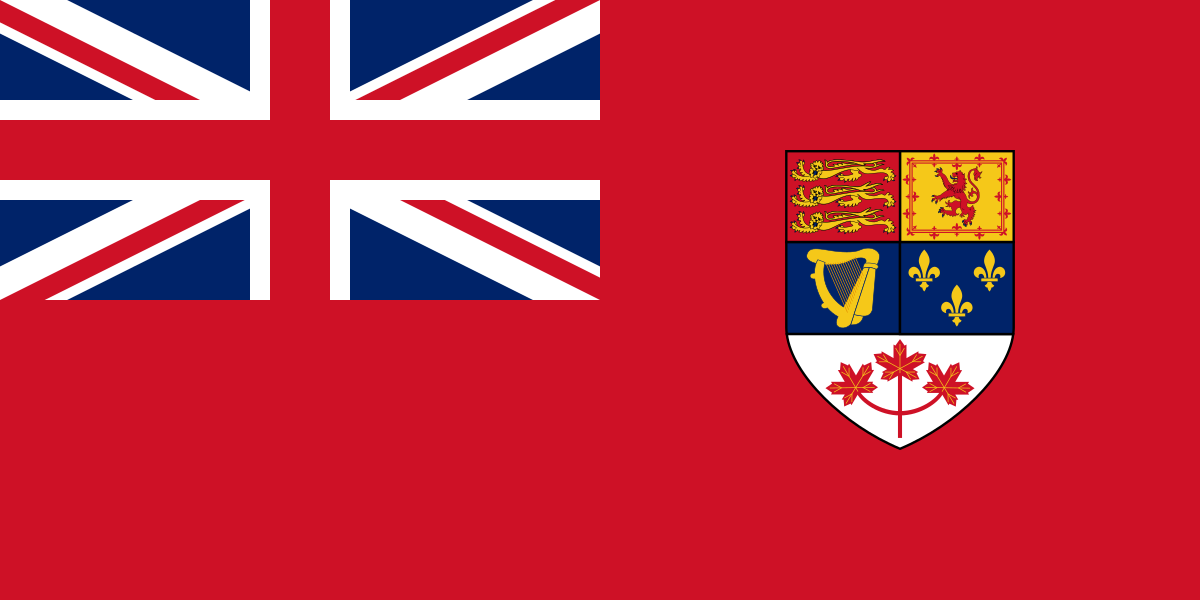

In reality, this is the equivalent, (or soon to be the equivalent), of a global tax administration. Think of the Canada Revenue Agency, just on a worldwide scale. While there seems to be nothing wrong on the surface with stoppin tax cheats, it reeks of growing intrusion into national affairs.

2. TIWB Conference September 28, 2020

This high-level event provided an opportunity to engage with government ministers and senior officials and look at the TIWB approach of bringing countries together to tackle tax avoidance, evasion and Illicit Financial Flows. The panel reflected on how the experiences from the initiative can be utilised to recover from COVID-19 and re-imagining a new future, specifically in the context of the Financing for Development in the Era of COVID-19 and Beyond process.

.

The TIWB Annual Report 2020 was launched during the event.

.

This event took place in the margins of the 75th United Nations’ General Assembly on 28 September 2020.

The Panel talks about efforts that TIWB is undertaking, and about how they can help advance the UNSDA in light of the coronavirus pandemic. How convenient it is for them.

3. Tax Inspectors Without Borders’ Donors

Seems rather strange that the World Bank and the Open Society, (George Soros), would be contributing to such a program. Or perhaps it isn’t. There are several donor nations in Europe, and Japan, also contributing.

4. World Bank Global Tax Umbrella Program

The Global Tax Program (GTP) provides an umbrella framework for tax support and leads an ongoing program of activities at both international tax and country levels focused on strengthening tax institutions and mobilizing revenues at the international and domestic levels. The GTP Program is one of the Umbrella 2.0 pilots for Trust Fund Reforms recently undertaken by the WBG.

The international community has set ambitious goals to end extreme poverty and boost inclusive and sustainable growth by 2030. Achieving the Sustainable Development Goals requires massive investment in physical and human capital. Focus is needed on the quality, fairness, and equity of domestic tax collection.

To be clear, this isn’t simply about tax collection. It’s also about seeing that those taxes are used according to the goals set out by TIWB/OECD/UNDP. There are certainly strings attached.

5. Int’l Monetary Fund On Tax Avoidance

The IMF, or International Monetary Fund, has taken an interest in tax collecting, estimating that $12 billion is in corporate shells, and another $7 billion is hidden by people overseas.

Information from the Organisation for Economic Co-operation and Development (OECD), and the Bank for International Settlements (BIS), have allowed more research and study to take place.

6. Reported By Yahoo News In 2015

Yahoo reported the launch of Tax Inspectors Without Borders back in 2015. Short article, but it covered a lot of important points. Reuters and TaxConnections addressed it as well.

7. TIWB Ultimately Pushing Policy Change

Tax Inspectors Without Borders talks about how they are helping in the 3rd World with regard to tax evasion, but they minimize a very important issue. TIWB is interested in pushing policy changes in taxation, and they are trying to get more money spent on Agenda 2030. This isn’t altruism on their part, but is ideologically motivated.

With all of this in mind, one very serious question has to be asked: will TIWB (at some point), begin calling for global taxation schemes?

Tax Inspectors Without Borders Mainpage

TIWB Partners With Both OECD/UNDP

OECD Announces Launch Of TIWB Programme

Tax Inspectors Without Borders Annual Report 2017

Tax Inspectors Without Borders Annual Report 2018

Tax Inspectors Without Borders Annual Report 2019

Tax Inspectors Without Borders Annual Report 2020

Tax Inspectors Without Borders Twitter (@TIWB_News)

Tax Inspectors Without Borders YouTube Channel

UN Development Programme YouTube Channel

World Bank Global Tax Program (Mainpage)

World Bank Global Tax Programme, 2020 Report

World Bank Global Tax Program, 2020 Report

World Bank, Taxation, Sustainable Development

International Monetary Fund On Tax Evasion

Yahoo: TIWB Started In 2015

Reuters On Covering The Launch Of TIWB

That is really interesting…if governments were so concerned about revenues, maybe domestic manufacturing production, like Made in Canada, not Made in China? Why not a debt free real money system, that pays for real goods and services, not welfare and endless programs and give aways. No problem paying $65 billion a year in interest due to the Trudeau Bank of Canada treason, for interest, as in 95% of the debt is from compound interest, as in economic genocide, or $35 billion paid to immigrants every year, plus all the other welfare state give aways. No word about the LETS, Local Exchange Trading System Eh? Maybe if there was not a war on whitey or a war against the family, or free enterprise, or the war of the Union Versus Free Enterprise, that caused endless bankrupt companies and people out of work. Or how about that zero people in government, MPs and MPPs never once mentioned Made in Canada? Do you have a problem with Made in Canada, or Made in USA? Is made in China so much better, who is at war with us on multiple theatres of operation, industries, technology and political and resource control? Endless lies about the coronavirus, and the 5G bio-weapon connection is censored. How about jurisdiction now eh. Zero tax non reporting sounds like a good idea against those who seek to super impose estate tax, inheritance tax, war against whitey, that is the founding people of Canada. As for all the other developing countries, it is interesting how many dictators and criminals sit at the UN etc et al, and only want to take from their enemy, their competitor, all out war. How many countries in the world have zero debt money creation? How much money is created by electronic debt and treasury bonds? And speaking of bonds, Climate Bonds??? Notice it is not Climate Equity, debt free equity, only debt, debt and more debt, with interest that was never printed on money that was never printed. This sounds like the European Parliament, bureaucracy that complicates things, controls, takes, oppresses and abuses, like a terrorist organization, just as that will do…Maybe 3rd world developing countries can have zero debt to the IMF world bank etc, no interest, no debt, no resource collateralized and expropriated, no problem. Maybe governments should not spend money on useless program and people, instead of being engaged in crime, treason, genocide, war, immorality and debt based money creation. How about the education system engaged in dumbed down curriculum of race traitors, stupidity, people who can’t write their names, do fraction, do math never mind a real trade, or the impossible task of high technology, defence industry technology and national security projects. Maybe smarter people with competence and skill sets that produces wealth instead of keeps poverty and welfare on the all time high list of national disgrace while the enemy is financed and allowed to dump their garbage here, while real people and families and communities suffer…would you like to argue? Or is arrogance ready for another round of total humiliation and destruction? Anyone interested in being pro-active, visionary…a super achiever? Only people in business know that it is not all profit, and in the case of regulations that make life difficult, their are a lot of expenses to keep the economic system going. Maybe governments should be more focused and national wealth producing power for everyone, empowerment for the individual and enterprise, people that create, build, imagine, invent, produce, contract, promote, people with ambition…since whitey invented mostly everything on this planet, maybe people who are at war against whitey should cease and desist, instead of tax and take, control and regulate, co-operate not compete and destroy…but no, can’t have that now, super imposed rule by idiots who are totally disqualified from governing anything…pick your jurisdiction, in Canada, the British North America Act of 1867 can build wealth on an unprecedented scale, and avoids all those problems about revenue and taxation, the 1982 illegal Constitution enforces crime, treason, genocide, war, immorality, debt, taxation, interest, stupidity, poverty, slavery, sickness and all the bad things. once upon a time, Canada was very rich and successful, then it was ruined by communists, socialists, cultural marxists, traitors, idiots and imbeciles, foreigners and people that are not real Canadians, the founding people of Canada. It’s your move…