(The Bank for International Settlements)

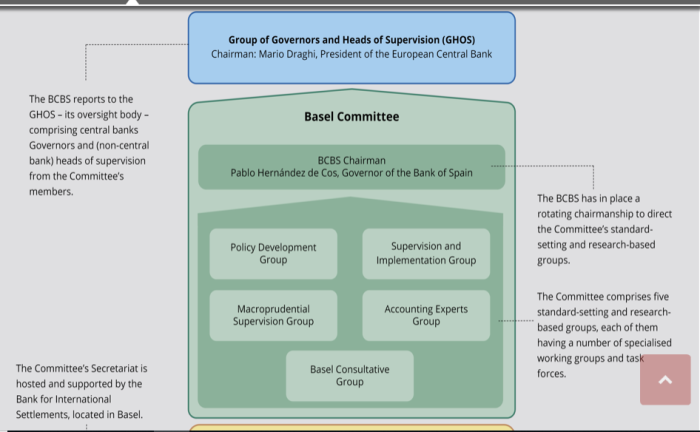

(The Basel Committee)

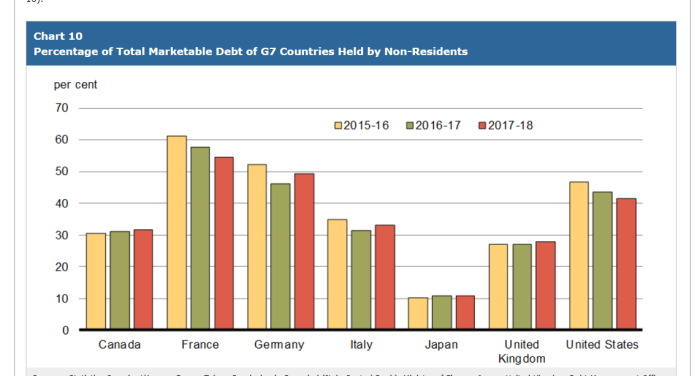

(30% of Canada’s debt held by foreigners)

(Archived debt information is available)

(Will Abrams explaining the money system)

1. Context For This Article

Are you being given straight answers about National and Provincial debts? Or are you being fed globalist approved talking points?

This article will help you identify

Sections 3-8 cover the typical talking points that globalist politicians, bankers, and media allies will spout off to an unsuspecting public.

2. Ignore Bank For International Settlements

In 1934, the Bank of Canada Act was passed, which created the Bank of Canada. After this, the Federal Government was required to make no-interest loans to help fund infrastructure and social services throughout the country.

Even though money was borrowed from the Bank of Canada, the debt did not rise, since we were printing our own money. This help true for nearly 40 years.

Then in 1974, Pierre Trudeau had Canada join the Bank of International Settlements in Switzerland. The reasons for this were never made clear. The reason the public was told was “inflation control”, but that was never explained. Now Canada, instead of creating its own money, was forced to borrow money and pay interest to outside banks, and often foreign banks. That’s right, outside parties were effectively “printing” Canadian currency and then lending it back to us. Unsurprisingly, the debt skyrocketed from $18 billion in 1974 to almost $700 billion in 2019. And this doesn’t include debt for Provinces, or Crown Corporations.

Now, when asked about central banking, it is best to change the subject. Focus on how other parties are wasteful, and that you will do a better job. If the above facts are mentioned, it will lead to awkward follow-up questions.

3. Make Hysterical Claims About Inflation

Inevitably people will ask about fiat banking. They will want to know why we allow foreigners to print our money, which we then purchase while paying interest.

At this point, it’s best to use scare tactics about uncontrolled inflation, and fiat/central banking being needed to counter act this. If the person asks for specifics or data, pivot again. Tell them that inflation would be much worse if we don’t have this system in place.

4. Focus On “Deficit”, Not Debt

A common diversionary tactic is to focus on the “deficit” and not on the debt. When pressed on this, slick politicians will dodge the issue skillfully.

Remember, the debt is the total amount of money owed, while the deficit is just the shortfall of a certain period (typically a year). Politicians routinely say they will “erase the deficit” within a certain period of time. But all that means is that the nation (or province, or state) will no longer be adding to its debt.

The debt previously accumulated will still be there, and will still be generating interest payments every year. That is what they often don’t want to publicly admit.

5. Focus On “Servicing” The Debt

Another sleight-of-hand is to avoid the words “paying down the debt”. Instead, tell people about “servicing the debt”.

Why? Because paying down the debt implies that it will be finished at some point. Obviously, that goes against the globalist agenda of having payments come out forever. Servicing, however, simply means being able to pay the interest. Servicing can also be in the form of raising the debt obligations.

Remember, you want people to think you want the debt to go away, without actually making it happen.

6. People Don’t Care About This

Rocco Galati taking the Government to court (on behalf of COMER) was an extreme example, but a serious one. People do care about the financial health and sovereignty of Canada. They don’t want outsiders, including foreign banks and foreign powers holding us hostage.

Instead, be dismissive. Repeat the talking point that fiat/central banking has nothing to do with the debt, and that no one cares about it. It’s not just environmental propaganda which these tactics can work on.

Nobody cares about central banking.

Nobody cares about it.

Nobody cares.

7. Divert Attention To Other Things

If all of the above fail, divert the conversation to something else altogether. Focus on the debt and fiscal irresponsibility of previous governments and administrations. Point out the debts left behind (while ensuring not to mention WHY those debts exist in the first place.

Perhaps someone dressed up in blackface, or was allegedly sleeping with a teenager. Maybe someone has made comments about abortion you can take out of context. Could be that a prominent person or a relative has a drinking or drug related scandal. There are plenty of ways to distract from real issues.

Also, find a minor and totally unrelated issue to get people worked up about, such as legalizing marijuana, or complaining about supply management. The sheep need to be distracted from what is really going on.

8. Summary Of Diversionary Tactics

Tactic #1: Ignore the Bank of International Settlements, Basel Committee, and fiat banking altogether unless pressed on it.

Tactic #2: If you are pressed on the above subjects, immediately repeat the claim that abandoning this system will lead to hyper inflation. Use Venezuela or Post-WW1 Germany as examples.

Tactic #3: Make sure you are talking about eliminating the deficit, and dodge the question of the overall debt.

Tactic #4: If pressed on the overall debt, make reference to “servicing” the debt, rather than paying it off completely.

Tactic #5: Be dismissive of the issue altogether. If further confronted about the predatory nature of central banking, deflect. Say that people don’t really care about the issue.

Tactic #6: Finally, divert the conversation to completely other topics entirely. This will hopefully confuse and distract people enough for them to stop caring about it.

(1) https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=1010004801#timeframe

(2) https://en.wikipedia.org/wiki/Bank_for_International_Settlements

(3) https://www.bis.org

(4) https://www.bis.org/about/member_cb.htm

(5) https://www.bis.org/bcbs/organ_and_gov.htm

(6) https://www.fin.gc.ca/pub/dmr-rgd/index-eng.asp

(7) https://www.budget.gc.ca/pdfarch/index-eng.html

(8) https://www.fin.gc.ca/pub/frt-trf/index-eng.asp

Discover more from Canuck Law

Subscribe to get the latest posts sent to your email.