(Originally featured in Maclean’s as “The Resistance”)

(Garnett Genuis, CPC MP, justifies Paris Accord)

(“Conservative” AB Premier Jason Kenney endorses Carbon tax)

(“Conservative” AB Prem Jason Kenney supports Bill C-69)

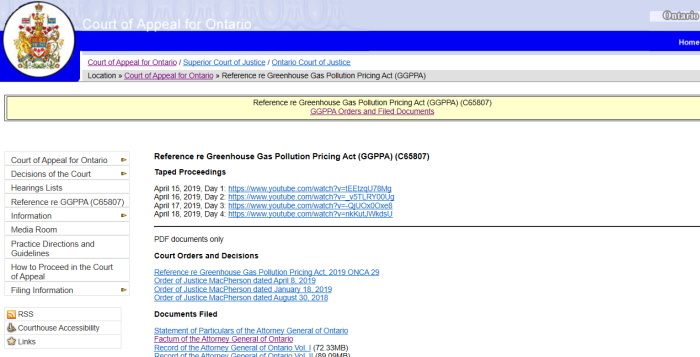

(Ontario Court of Appeals, website, contains many great links and references)

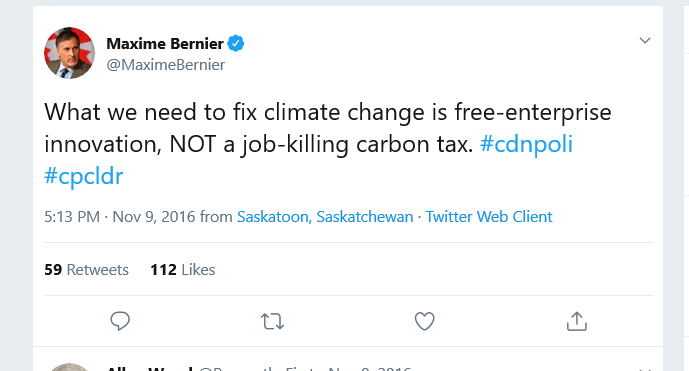

(Maxime Bernier, in 2016, against tax, but for climate change agenda)

1. Debunking The Climate Change Scam

CLICK HERE, for #1: major lies that the climate frauds tell.

CLICK HERE, for #2: review of the Paris Accord.

CLICK HERE, for #3: Bill C-97, the GHG Pollution Pricing Act.

CLICK HERE, for #4: in 3-2 decision, Sask. COA allows carbon tax.

2. Important Links

CLICK HERE, for Reference at Ontario Court of Appeals.

CLICK HERE, for Saskatchewan COA ruling.

CLICK HERE, for Ontario COA Factum (arguments).

CLICK HERE, for BC Factum (Intervenor in Ontario).

CLICK HERE, for NB Factum (Intervenor in Ontario).

CLICK HERE, for Manitoba’s position on “climate change”.

CLICK HERE, for Jason Kenney (AB).

CLICK HERE, for Jason Kenney Supporting Bill C-69.

CLICK HERE, for Jason Kenney Wanting a Provincial Carbon Tax.

CLICK HERE, for Maxime Bernier (PPC).

CLICK HERE, for Bernier again.

CLICK HERE, for factum of Intergenerational Climate Committee.

CLICK HERE, for the Factum of Canadian Taxpayers Federation.

CLICK HERE, for United Conservative Association.

3. Quotes From Sask COA Ruling

[4] The factual record presented to the Court confirms that climate change caused by anthropogenic greenhouse gas [GHG] emissions is one of the great existential issues of our time. The pressing importance of limiting such emissions is accepted by all of the participants in these proceedings.

[5] The Act seeks to ensure there is a minimum national price on GHG emissions in order to encourage their mitigation. Part 1 of the Act imposes a charge on GHG-producing fuels and combustible waste. Part 2 puts in place an output-based performance system for large industrial facilities. Such facilities are obliged to pay compensation if their GHG emissions exceed applicable limits. Significantly, the Act operates as no more than a backstop. It applies only those provinces or areas where the Governor in Council concludes GHG emissions are not priced at an appropriate level.

[6] The sole issue before the Court is whether Parliament has the constitutional authority to enact the Act. The issue is not whether GHG pricing should or should not be adopted or whether the Act is effective or fair. Those are questions to be answered by Parliament and by provincial legislatures, not by courts.

As was mentioned in the last segment, Saskatchewan “admits” that climate change is a real thing, and that emissions must be reduced drastically, in order to save the planet.

In other words, “Conservative” Premier Scott Moe fully endorsed the climate change scam. Rather, his sole argument against was that Ottawa should not intervene, and that Provinces should be left to their own devices. Specifically, Ottawa shouldn’t impose a carbon tax.

Moe is hardly alone in this. Indeed, the other “Resistance Members”

4. Quotes From Ontario Factum

6. Ontario agrees with Canada that climate change is real and that human activities are a major cause. Ontario also acknowledges that climate change is already having a disruptive effect across Canada, and that, left unchecked, its potential impact will be even more severe. Ontario agrees that proactive action to address climate change is required. That is why Ontario has put forward for consultation a made-in-Ontario plan to protect the environment, reduce greenhouse gas emissions, and fight climate change.

11. Ontario released its climate change plan, as part of its overall environment plan, for a 60-day period of public consultation on November 29, 2018. The plan will be finalized following consideration of input from that consultation. Ontario’s plan will tackle climate change in a balanced and responsible way, without placing additional burdens on Ontario families and businesses

12. “[Greenhouse gas] emissions come from virtually all aspects of Ontario’s society and economy.” There are seven primary sectors in Ontario that produce greenhouse gas emissions: transportation; industry; buildings; land use, land use change and forestry; electricity; waste; and agriculture. All but the last (which is an area of concurrent federal/provincial jurisdiction) will be discussed in turn.

13. Canada itself has publicly acknowledged the wide range of activities that can generate greenhouse gas emissions – activities as varied as homes and buildings, transport, industry, forestry, agriculture, waste, and electricity.

(Source is here.) Ontario, like Saskatchewan, does not bother questioning any of the findings. Both “Conservative” governments have no interest in getting to the truth of the scam, nor the many failed model predictions. Again, this only concerns whether Ottawa can mandate Carbon taxes on other provinces.

5.Quotes From New Brunswick Factum

1. The Intervenor, Attorney General of New Brunswick (“New Brunswick”) agrees with the factum of the Attorney General of Ontario (“Ontario”) regarding the nature of this reference and agrees with Ontario’s conclusions in every respect. New Brunswick also agrees with the climate data submitted by the Attorney General of Canada (“Canada”). This reference should not be a forum for those who deny climate change; nor should it be a showcase about the risks posed by greenhouse gas emissions (“GHG emissions”). The supporting data is relevant only to the extent that it is meaningfully connected to the constitutional question at issue.

2. The foundational climate change data provided by Canada, generally intended to portray the anticipated impacts of climate change in Canada, as well as the many references to international accord and commitments, leave an unquestionable impression of Canada’s a deep resolve to see the nation’s environmental footprint diminished. New Brunswick does not take issue with Canada’s commitment or with the importance of the overall subject matter.

3. What New Brunswick disputes is the way in which the federal Parliament has apportioned its resolve to diminish GHG emissions by imposing “backstop legislation”.

New Brunswick very explicitly states that the reference is not for anyone who denies “climate change, or global warming (or whatever it identifies as). Instead, the only issue is whether the tax imposed by the Federal Government is constitutional.

6. Quotes From BC Factum

1. Greenhouse gases might pose the most difficult collective action problem the world has ever faced. The benefits of emissions are local, but the costs are global. When people burn fossil fuels in the production or consumption of goods and services, each jurisdiction – national or subnational – exports its greenhouse gases to every other. And they all import the consequences: for all practical purposes, without regard to the extent of their own part in creating the problem.

2. The prospect of uncontrolled climate change requires that we treat the capacity of the atmosphere to hold greenhouse gases like the scarce, valuable resource it is. If total temperature increases are to be kept to 1.5˚C or 2˚C above pre-industrial averages — or indeed to any target at all — the world must ultimately reduce net emissions to zero. The global stock of greenhouse gases that can permissibly be added in the meantime is finite and must somehow be allocated. Those allocations have an economic value that individuals, industries, sub-national jurisdictions and nation states can be expected to quarrel over.

3. Under Canada’s Constitution, provinces have legislative authority to regulate or price emissions by individuals and businesses within their borders. In 2008, British Columbia enacted one of the first carbon pricing schemes. In the intervening decade, emissions were reduced compared to what they would have been, while the province enjoyed the highest economic growth in the country. But because greenhouse gases do not respect borders — while provincial legislation must — British Columbia’s actions will only counteract the negative effects of climate change on the property and civil rights of its residents if other jurisdictions follow suit

BC actually has a socialist government, which in this case is indistinguishable from self-identified “Conservative” governments.

7. Quotes From Manitoba

The Manitoba government will go to court over Ottawa’s imposition of a carbon tax.

Premier Brian Pallister revealed Wednesday his government will launch a legal challenge against the federal government, which imposed its new levy as promised on Manitoba, along with three other provinces, Monday.

“We’re going to court, sadly, to challenge the Ottawa carbon tax because Ottawa cannot impose a carbon tax on a province that has a credible greenhouse gas-reduction plan of its own, and we do,” he told reporters.

Manitoba’s Premier Pallister, who also self-identifies as a “Conservative”, doesn’t challenge the history of valid predictions or climate models. Instead, his position (like the others), is solely that Ottawa doesn’t have the authority to impose a Carbon tax on the Provinces.

8. Quotes From Alberta

The fall federal election will be “an opportunity for Canadians to say that they don’t want busy-body politicians telling them how to live their lives and taking more money out of their pockets,” said Kenney, who was sworn in as Alberta’s premier on Tuesday.

Alberta is not currently subject to the federal carbon tax because it has its own pricing scheme set up by the former NDP government. Kenney has vowed to repeal that legislation and implement his own emissions reduction plan.

Again, no mention about the scam that is climate change. No mention of how wrong all these “experts” have been. Nothing about how Carbon Dioxide is used in photosynthesis.

And Jason (Bilderberg) Kenney will very shortly go about screwing over Alberta, first with a “made in Alberta” Carbon tax, then supporting Bill C-69, despite the damage it will do to Alberta’s economy. See here, and see here.

9. From Canadian Taxpayer Federation

1. The Canadian Taxpayers Federation [the CTF] is a federally incorporated, not-for-profit citizen’s group dedicated to advocating for lower taxes, less waste, and more accountable government. The CTF is participating in this reference based on its concern that the federal carbon tax is unlikely to achieve its stated objective and will, instead, just be a ‘tax’ on the taxpayers of Ontario, despite being imposed on the taxpayers of Ontario in a manner that is contrary to section 53 of the Constitution Act, 1867. Constitution Act, 1867, at s. 53.

2. The CTF intends to use its participation in this reference to advance the following two points. First, the federal carbon tax also meets the legal criteria for being designated as a ‘tax’. Second, the federal carbon tax does not comply with the constitutionally-enshrined principle of “no taxation without representation” and, thus, the federal carbon tax is unconstitutional, at least in its application in Ontario.

For a non-profit worried about wasted taxpayer money, the CTF misses the most important part: the climate change movement is a scam based on junk science. However, no where that (or any similar arguments), be made on its behalf.

10. From United Conservative Association

1. This Reference is a case about the division of powers between the federal and provincial governments and the proper balance of federalism in Canada. The United Conservative Association (“UCA”) agrees with the positions advanced by Ontario and submits that the Greenhouse Gas Pollution Pricing Act (the ”GGPPA”) is unconstitutional.

2. By attempting to justify the enactment of the GGPPA using the national concern branch of the peace, order, and good governance (“POGG”) clause, Canada seeks to expand the federal government’s constitutional powers at the expense of the provinces.

3. Put simply, Canada is attempting to claim a new, exclusive power to regulate greenhouse gas (“GHG”) emissions throughout Canada.

Again, no mention of the junk science behind the climate change scam. The only issue is whether Ottawa has Constitutional power to impose such a tax.

11. The “Populist” Position

A second reason is that provinces are already experimenting with various ways to reduce emissions. Some have a carbon tax, others have a cap-and-trade regime, still, others are focusing on carbon capture or direct regulation. Several also have programs to subsidize electric cars or renewable energy that only seem to waste money and drive up costs to businesses and consumers.

We’ll see over time what model is most effective in reducing emissions and least detrimental to the economy. But there is no reason for Ottawa to impose another layer of government intervention on an already complex and costly series of measures whose effectiveness has yet to be demonstrated.

A third reason is that the transition to other sources of energy is already taking place, as companies respond to consumer demand for more environment-friendly products. The federal government should help it along by reducing taxes, barriers to innovation and competition, and ineffective and costly regulation. This is a real market-based policy that Conservatives should support.

“Populist” Maxime Bernier refuses to call out the scam, and instead just calls Carbon pricing ineffective. Granted, this article is from August 2016. However, Bernier will not call a spade a spade. Just like in this 2016 tweet.

But since leaving the Conservative Party, Bernier is now willing to call out climate change propaganda.

Though, to be fair, Bernier is now openly saying that Carbon Dioxide is just plant food.

12. An Outsider’s Take On This

Despite the shoddy pseudo-science behind “climate change” policies, none of the parties either in the Saskatchewan case, nor the upcoming Ontario case question it. Rather, these parties SOLELY object to the Carbon tax on the grounds that Provinces should be able to set their prices.

Controlled opposition, the whole lot.