(Social Security Administration)

(2019 Annual Report to Congress)

(Signatories to the 2019 report)

1. Pensions, Benefits, Worker Entitlements

The public is often unaware of what is happening with their pensions and other social benefits. Often, changes are made with little to no input from the people who are directly impacted by it. Where exactly are the pension funds being held, and is it secure? Unfortunate, but we need to constantly be on top of these things.

2. Important Links

On the American situation:

CLICK HERE, for the 2019 Annual Report to Congress.

CLICK HERE, for an interesting powerpoint on liability calculation.

CLICK HERE, for a 2018 paper: UNFUNDED OBLIGATION AND TRANSITION COSTS FOR THE OASDI PROGRAM

CLICK HERE, for the Brookings Institute & privatization.

3. Side Note On Signatories

Although unrelated to the long term problems with the Social Security program, it is worth pointing out — as a side note — some scandals with 2 people involved. Steve Mnuchin, is long suspected or corruption, and Alex Acosta was the Prosecutor who previously let Jeffrey Epstein off on child sex charges.

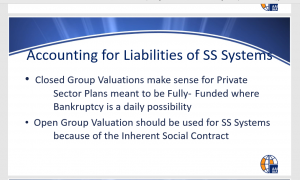

4. Open-Group v.s. Closed Group Valuation

From this presentation. The author makes the assumption that “open-group valuation” should be used for public pensions such as Social Security, while private pensions should rely on “closed-group valuation” methods of accounting.

The difference is this:

Open-group valuation principles mean that a pension is solvent and in good shape as long as it’s current assets and payouts are able to keep up with the demands of retirees at the moment. It doesn’t require that the pension plan be fully funded. The reasoning is there is a “social contract”, and that the Government can raise more money (tax more) to cover the shortfalls.

Closed-group valuation principles require that “all” liabilities be taken into account. The is a far more accurate method, as payments from all workers are considered, if those who won’t retire for decades. The rationale is that private companies could go bankrupt at any time, and need to take the actual amounts into account.

For obvious reasons, the closed-group valuation method is a far more accurate approach in calculating the health of pension plans. It forces “all” assets and liabilities to be disclosed.

To be fair, it is a valid point that private pension funds cannot exactly just “take more money” to cover their shortfalls. Still, the open-group approach is very misleading.

5. The Approach Explained in 2018 Paper

1. Introduction In calculating the unfunded obligation of the Old-Age and Survivors Insurance and Disability Insurance (OASDI) program, we include the entire cost of paying scheduled benefits in full and on time, even after trust fund reserves are depleted. However, when the trust fund reserves are depleted, current law limits expenditures to the amount of continuing income received by the fund. Thus, the measures of unfunded obligation represent the shortfall of financial resources scheduled under current law to cover the cost associated with timely payment of scheduled benefits for the period.

The unfunded obligation for any program must be defined on the basis of the intended funding method for the program. Because the OASDI program is financed on essentially a current-cost or pay-as-you-go basis, the open group unfunded obligation measure is appropriate. Programs that are intended to be essentially fully advance-funded require the use of other measures, reflecting a closed group perspective, to assess their unfunded obligation (or liability). However, these closed group measures are more accurately described as theoretical measures of “transition cost” for the OASDI program. Estimates of the unfunded obligation vary depending on the valuation period and the assumptions used. Transition cost measures also vary depending on which plan participants are included.

(See this source.) This paper explains that the open-group valuation method is appropriate because people will always be paying into it. While this is a valid point, it doesn’t take away from the growing amount of unfunded liabilities.

In fact, it helps to conceal just how much the program owes and still is obligated to pay out. The only way this works is with an infinitely growing population, and ever growing contributions.

Basically, a giant Ponzi scheme, where participation is mandatory, under threat of arrest and detention.

6. Quotes From 2019 Report

In 2018 At the end of 2018, the OASDI program was providing benefit payments1 to about 63 million people: 47 million retired workers and dependents of retired workers, 6 million survivors of deceased workers, and 10 million disabled workers and dependents of disabled workers. During the year, an estimated 176 million people had earnings covered by Social Security and paid payroll taxes on those earnings. The total cost of the program in 2018 was $1,000 billion. Total income was $1,003 billion, which consisted of $920 billion in non-interest income and $83 billion in interest earnings. Asset reserves held in special issue U.S. Treasury securities grew from $2,892 billion at the beginning of the year to $2,895 billion at the end of the year.

Short-Range Results Under the Trustees’ intermediate assumptions, Social Security’s total cost is projected to be less than its total income in 2019 and higher than its total income in 2020 and all later years. Social Security’s cost has exceeded its non-interest income since 2010. For 2019, program cost is projected to be less than total income by about $1 billion and exceed non-interest income by about $81 billion.

This information is from the overview (Page 2). it states that on paper, the revenue generated (both from employee deductions and from interest/dividends generated was slightly higher than the payments it distributed.

On paper, this seems fine. However, getting to the “long-range results” it tells a different story. However, it still relies on the “open-group valuation” method.

The projected OASDI annual cost rate increases from 13.91 percent of taxable payroll for 2019 to 16.62 percent for 2040 and to 17.47 percent for 2093, a level that is 4.11 percent of taxable payroll more than the projected income rate (the ratio of non-interest income to taxable payroll) for 2093. For last year’s report, the Trustees estimated the OASDI cost for 2093 at 17.72 percent, or 4.36 percent of payroll more than the annual income rate for that year. Expressed in relation to the projected gross domestic product (GDP), OASDI cost generally rises from 4.9 percent of GDP for 2019 to about 5.9 percent by 2039, then declines to 5.8percent by 2052, and then generally increases to 6.0 percent by 2093.

For the 75-year projection period, the actuarial deficit is 2.78 percent of taxable payroll, decreased from 2.84percent of taxable payroll in last year’s report. The closely-related open-group unfunded obligation for OASDI over the 75-year period is 2.61 percent of taxable payroll, decreased from 2.68 percent of payroll in last year’s report. The open-group unfunded obligation for OASDI over the 75-year period is $13.9 trillion in present value and is $0.7 trillion more than the measured level of $13.2 trillion a year ago. If the assumptions, methods, starting values, and the law had all remained unchanged, the actuarial deficit would have increased to 2.90 percent of taxable payroll, and the unfunded obligation would have risen to about 2.74 percent of taxable payroll and $13.7 trillion in present value due to the change in the valuation date.

(Those quotes from page 4) Using the “open-group” method, the unfunded liabilities over 75 years is $13.9 trillion, or adding the equivalent of $185 billion/year. The authors also state a few blunt facts in the conclusion

Conclusion Under the intermediate assumptions, the projected hypothetical combined OASI and DI Trust Fund asset reserves become depleted and unable to pay scheduled benefits in full on a timely basis in 2035. At the time of depletion of these combined reserves, continuing income to the combined trust funds would be sufficient to pay 80 percent of scheduled benefits. The OASI Trust Fund reserves are projected to become depleted in 2034, at which time OASI income would be sufficient to pay 77 percent of OASI scheduled benefits. DI Trust Fund asset reserves are projected to become depleted in 2052, at which time continuing income to the DI Trust Fund would be sufficient to pay 91 percent of DI scheduled benefits.

Lawmakers have a broad continuum of policy options that would close or reduce Social Security’s long-term financing shortfall. Cost estimates for many such policy options are available at www.ssa.gov/OACT/solvency/provisions/

A few points to take away here

(A) Old Age Survivors Insurance (OASI) will become depleted in 2034, and only able to pay 77% of its obligations.

(B) Disability Insurance (DI) will be depleted in 2052, and only able to pay 91% of obligations by then.

(C) Raising deductions taken from employees is necessary.

But this is using open-group valuation methods of accounting. So how much

7. Getting An Answer On Unfunded Liabilities

It has been difficult getting an accurate answer on the true size of the Social Security deficit. Estimates range from $10 trillion to over $100 trillion.

The government cited $13.7 trillion in liabilities using the less accurate “open-group” valuation. Still, that is an awful lot of money, even if it is the full amount.

8. Why Not Reform Or Privatize?

The Brookings Institute explains in this article why efforts to privatize or reform Social Security have so far gone no where. Media scare is not the only reason for this.

Any transition to a private system must overcome a major financial hurdle, however. Social Security has accumulated trillions of dollars in liabilities to workers who are already retired or who will retire soon. To make room for a new private system, policymakers must find funds to pay for these liabilities while still leaving young workers enough money to deposit in new private accounts. This requires scaling back past liabilities – by cutting benefits – or increasing contributions from current workers. Most large-scale privatization plans also involve major new federal borrowing. Consequently, if a balanced budget amendment becomes part of the constitution, it would torpedo any attempt to replace most of Social Security with a private retirement system.

Privatizing Social Security can boost workers’ rate of return by allowing retirement contributions to be invested in private assets, such as stocks, which yield a better return than the present pay-as-you-go retirement system. Returns can be boosted still further if the government borrows on a massive scale to pay for past Social Security liabilities, allowing workers to invest a larger percentage of their pay in high-yielding assets. Exactly the same rate of return can be obtained, however, if the current public system is changed to allow Social Security reserves to be invested in private assets.

The article is blunt about the situation.

The system DEPENDS ON a constant inflow of new money from younger workers in order to stay solvent. If current workers were to start pulling their money from Social Security (and saving or investing elsewhere), the program would be immediately strapped for cash. This means benefits cuts to those receiving it, and higher premiums for those paying into it.

Of course, as workers who remain have to pay higher premiums, they, quite reasonably, will look for other options. This could easily create a snowball effect where more and more people pull their contributions. This will cause the collapse of Social Security.

So it’s not really the “privatization” boogeyman here. It is that the system needs an ever growing pool of new money to pay off retirees.

Yes, it’s a government run Ponzi scheme.

9. Government Pensions Are Ponzi Schemes

As was demonstrated in previous articles, the Canadian Pension Plan has almost a trillion dollars in unfunded liabilities. While claiming to have almost $400 billion in assets, the truth is that the full size of liabilities put it well in the hole.

The U.S. Social Security system faces the same issues, although the scope is worse. Even the open-group accounting method lists $13 trillion in liabilities.

There are efforts to “reform” which include: (a) raising premiums; (b) cutting benefits; and (c) raising the age of retirement. However, this may just be like shuffling the deck chairs on the Titanic. Futile. As long as a fund depends on paying off retirees with the contributions of workers, it is set up for failure.

Letting workers invest in private funds will hasten the demise, as it would deplete the funds needed to pay off existing retirees.

One has to shake their head. Bernie Madoff ran a Ponzi scheme and was sent to prison. As would any private citizen. But when the government does it, it’s called a social safety net.

Same conclusion as before: Americans are pretty screwed.