(Tucker Carlson on protecting your citizens)

1. Offshoring, Globalization, Free Trade

The other posts on outsourcing/offshoring are available here. It focuses on the hidden costs and trade offs society as a whole has to make. Contrary to what many politicians and figures in the media claim, there are always costs to these kinds of agreement. These include: (a) job losses; (b) wages being driven down; (c) undercutting of local companies; (d) legal action by foreign entities; (e) industries being outsourced; and (f) losses to communities when major employers leave. Don’t believe the lies that these agreements are overwhelmingly beneficial to all.

2. Important Links

(1) https://www.international.gc.ca/trade-agreements-accords-commerciaux/topics-domaines/disp-diff/gov.aspx?lang=eng

(2) ttps://www.state.gov/nafta-investor-state-arbitrations/

(3) http://replacenafta.org/jobs-lost/

(4) https://www.epi.org/publication/webfeatures_snapshots_archive_12102003/

(5) https://www.epi.org/publication/heading_south_u-s-mexico_trade_and_job_displacement_after_nafta1/

(6) https://www.epi.org/blog/naftas-impact-workers/

(7) https://www.epi.org/publication/webfeatures_snapshots_archive_11052003/

(8) https://www.epi.org/publication/the-china-toll-deepens-growth-in-the-bilateral-trade-deficit-between-2001-and-2017-cost-3-4-million-u-s-jobs-with-losses-in-every-state-and-congressional-district/

(9) https://www.cfr.org/backgrounder/naftas-economic-impact

(10) https://www.nytimes.com/1992/10/16/us/the-1992-campaign-transcript-of-2d-tv-debate-between-bush-clinton-and-perot.html?pagewanted=all

(11) https://www.politicalresearch.org/2014/10/11/globalization-and-nafta-caused-migration-from-mexico/

3. Lawsuits Against Canada, Chapter 11

| Company | Suit Amount | Amount Settled |

|---|---|---|

| AbitibiBowater | $500M | $130M |

| Centurion Health | $160M | $0, fees unpaid |

| Chemtrade | $78.6M | $0, dismissed |

| Detroit Int’l Bridge | $3.5B | $0, dismissed |

| Dow Agro Sciences | $2M | $0, withdrew |

| Ely Lily and Co. | $500M | $0, dismissed |

| Ethyl Corp. | $201M | settled |

| Mercer International | $232M | $0, dismissed |

| Merrill & Ring | $50M | $0, dismissed |

| Mesa Power Group | $658M | $0, dismissed |

| Mobil Inv. & Murphy Oil | $66M | $17.3M |

| Pope & Talbot | $500M | $527M, USD |

| S.D. Myers | $53M | $6.9M, |

| St. Mary’s VNCA | $275M | $0, no standing |

| United Parcel Services | $160M | $0, dismissed |

| V.G. Gallo | $105M | $0, dismissed |

| Windstream Energy | $475M | $28M |

For these “finished” claims, Canada has had to pay out $709 million, plus a substantial amount in paying its own lawyers. Also, consider the following:

-DowAgro sale, under the terms of the settlement, is still allowed to use its pesticide in Canada.

-Ethyl Corp still allowed to use MMT additive.

| Company | Suit Amount | Information |

|---|---|---|

| Clayton/Bilcon | $101M | Lost, awaiting damages |

| Lone Pine Resources | $119M | Awaiting verdict |

| Mobile Investments | $20M | Awaiting verdict |

| Resolute Forest Products | $70M | Awaiting verdict |

| Tennant Energy Ltd | $116M | Awaiting verdict |

| Westmorehead Coal | $470M | Awaiting verdict |

Potentially another $896 million

To summarize, Canada has already paid out $709 million in various actions under Chapter 11 of NAFTA (plus the settlement from Ethyl Corp), and may be on the hook for $896 million more. And this doesn’t take legal fees and other court costs into account.

4. Job Losses Resulting From NAFTA

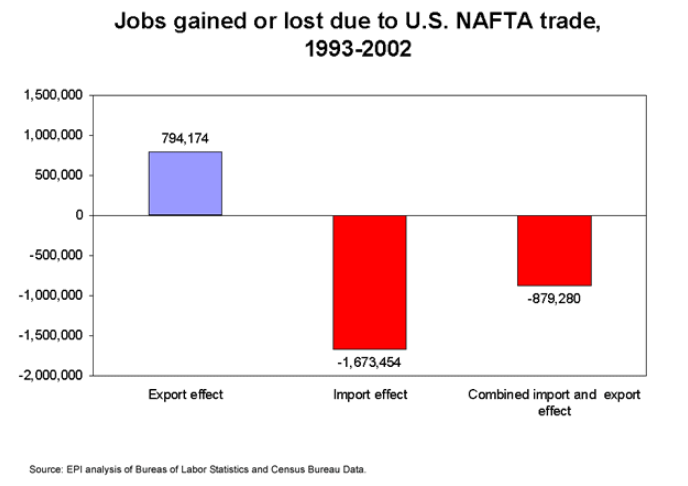

Research has been done on the effects of NAFTA. This released 2003 study, estimates that 879,000 jobs have been lost in the US as a direct result of NAFTA over a decade.

The conclusions were also troubling:

Since the North American Free Trade Agreement (NAFTA) was signed in 1993, the rise in the U.S. trade deficit with Canada and Mexico through 2002 caused the displacement of production that supported 879,280 U.S. jobs. NAFTA is a free trade and investment agreement that provided investors with a unique set of guarantees designed to stimulate foreign direct investment in Mexico and Canada. It has facilitated the movement of factories from the United States to Canada and Mexico. Most of these jobs were high-wage positions in manufacturing industries.

Proponents of new trade agreements that build on NAFTA, such as the proposed Free Trade Agreement of the Americas (FTAA), have frequently claimed that such deals create jobs and raise incomes in the United States. These claims are based only on the positive effects of exports (known as “export effects”), ignoring the negative effects of imports (known as “import effects”). Such arguments are an attempt to hide the costs of new trade deals in order to boost the reported benefits.

The problem with these claims is that they misrepresent the real effects of trade on the U.S. economy: trade both creates and destroys jobs. Increases in U.S. exports tend to create jobs in this country, but increases in imports tend to reduce jobs by displacing goods that otherwise would have been made in the United States by domestic workers. Ignoring imports and counting only exports is like balancing a checkbook by counting only deposits but not withdrawals.

This is blunt and truthful. It is high paying jobs mainly in manufacturing that have been exported in the name of “free trade”, and has harmed the US workforce.

Now, here, is another study, released in 2011, dealing specifically with Mexico and NAFTA.

As of 2010, U.S. trade deficits with Mexico totaling $97.2 billion had displaced 682,900 U.S. jobs. Of those jobs, 116,400 are likely economy-wide job losses because they were displaced between 2007 and 2010, when the U.S. labor market was severely depressed.

There is a cost to these free trade agreements. Jobs are lost domestically when it becomes cheaper to ship them to another country. Often it is manufacturing, one of the better paid jobs, where higher education isn’t needed.

Abstract promises about increased jobs and exports misrepresent the real overall effects of trade on the U.S. economy. Trade both creates and destroys jobs. While exports tend to support domestic employment, imports lead to job displacement: As imports are substituted for domestically produced goods, production that supports domestic jobs falls, displacing existing jobs and preventing new job creation.

Simply out, there are winners and losers in trade deals. Countries win if they export more than they import, and vice versa. While some trade surplus or deficit is inevitable, it is sustained deficits that drain wealth from the country and put people out of work.

While Canada or Mexico may sit smugly and know that they benefit from the trade deal with the US, this must be considered. With ever proposed expansion of free trade and liberalized trade, there is nothing to stop jobs from Canada and/or Mexico from being exported elsewhere.

For example, the US lost 3.4 million jobs to China since 2001. Canada could end up in that situation one day.

5. Free Trade Drives Down Wages

Ross Perot ran for President in 1992. He faced the incumbent, George H.W. Bush (Republican), and Bill Clinton (Democrat). While he came in third, Perot drove home this hard truth about free trade: it drives down wages. It forces Americans to compete for third world wages.

To those of you in the audience who are business people, pretty simple: If you’re paying $12, $13, $14 an hour for factory workers and you can move your factory South of the border, pay a dollar an hour for labor, hire young — let’s assume you’ve been in business for a long time and you’ve got a mature work force — pay a dollar an hour for your labor, have no health care — that’s the most expensive single element in making a car — have no environmental controls, no pollution controls and no retirement, and you don’t care about anything but making money, there will be a giant sucking sound going south.

“Why won’t everybody go South?” They say, “It’d be disruptive.” I said, “For how long?” I finally got them up from 12 to 15 years. And I said, “well, how does it stop being disruptive?” And that is when their jobs come up from a dollar an hour to six dollars an hour, and ours go down to six dollars an hour, and then it’s leveled again. But in the meantime, you’ve wrecked the country with these kinds of deals. We’ve got to cut it out.

Perot is completely right here. It will raise the wages in Mexico, while driving down American wages. And to reiterate, Canadians should not think they are immune from this sort of practice.

The Council on Foreign Relations added:

Debate persists regarding NAFTA’s legacy on employment and wages, with some workers and industries facing painful disruptions as they lose market share due to increased competition, and others gaining from the new market opportunities that were created.

But it is the common worker with a family to provide for who will really feel the pinch. It is cold comfort to be out work and be told “well, it raises trade and GDP”.

6. NAFTA Causes Carnage To Middle Class

Yet another EPI article. This one sums up the problems of NAFTA in very blunt terms.

- Job losses

- Pushes wages down

- Destruction of farms and small businesses

- Sets standards for globalization

The article is directly on point.

NAFTA affected U.S. workers in four principal ways. First, it caused the loss of some 700,000 jobs as production moved to Mexico. Most of these losses came in California, Texas, Michigan, and other states where manufacturing is concentrated. To be sure, there were some job gains along the border in service and retail sectors resulting from increased trucking activity, but these gains are small in relation to the loses, and are in lower paying occupations. The vast majority of workers who lost jobs from NAFTA suffered a permanent loss of income.

Second, NAFTA strengthened the ability of U.S. employers to force workers to accept lower wages and benefits. As soon as NAFTA became law, corporate managers began telling their workers that their companies intended to move to Mexico unless the workers lowered the cost of their labor. In the midst of collective bargaining negotiations with unions, some companies would even start loading machinery into trucks that they said were bound for Mexico. The same threats were used to fight union organizing efforts. The message was: “If you vote in a union, we will move south of the border.” With NAFTA, corporations also could more easily blackmail local governments into giving them tax reductions and other subsidies.

Third, the destructive effect of NAFTA on the Mexican agricultural and small business sectors dislocated several million Mexican workers and their families, and was a major cause in the dramatic increase in undocumented workers flowing into the U.S. labor market. This put further downward pressure on U.S. wages, especially in the already lower paying market for less skilled labor.

Fourth, and ultimately most important, NAFTA was the template for rules of the emerging global economy, in which the benefits would flow to capital and the costs to labor. The U.S. governing class—in alliance with the financial elites of its trading partners—applied NAFTA’s principles to the World Trade Organization, to the policies of the World Bank and IMF, and to the deal under which employers of China’s huge supply of low-wage workers were allowed access to U.S. markets in exchange for allowing American multinational corporations the right to invest there.

Who actually benefits from NAFTA, or similar types of deals? Not the workers, who are now forced to compete for third world wages. Not communities, who see major employers pack up and leave for better opportunities.

7. NAFTA Makes Illegal Immigration Problem Worse

NAFTA, however, did not lead to rising incomes and employment in Mexico, and did not decrease the flow of migrants. Instead, it became a source of pressure on Mexicans to migrate. The treaty forced corn grown by Mexican farmers without subsidies to compete in Mexico’s own market with corn from huge U.S. producers, who had been subsidized by the U.S. Agricultural exports to Mexico more than doubled during the NAFTA years, from $4.6 to $9.8 billion annually. Corn imports rose from 2,014,000 to 10,330,000 tons from 1992 to 2008. Mexico imported 30,000 tons of pork in 1995, the year NAFTA took effect. By 2010, pork imports, almost all from the U.S., had grown over 25 times, to 811,000 tons. As a result, pork prices received by Mexican producers dropped 56%

When nations are reduced to “economic zones”, it forces workers to compete against those in other nations for the same piece of the pie. If jobs are eliminated on a massive scale, then the pressure is on to find work. For many Mexicans, it has meant going to the US, often illegally.

Note: this not to condone illegal immigration. However, it becomes more understandable when factors like these are considered.

The “surplus labour” sure helps large employers, and further helps to drive down wages, which of course is the entire point.

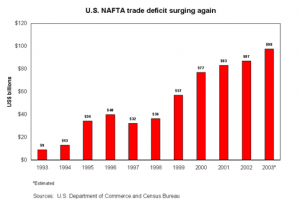

8. NAFTA Makes US Trade Deficit Worse

Here is a 2003 study on the trade deficit the US has experienced due to NAFTA.

As mentioned earlier, it is true Canada currently benefits from the US trade deficit. But as free trade expands, Canada (and other nations) could easily find themselves in the same dilemma as the US.

Sustained trade deficits bleed money from a nation.

9. NAFTA Can Override Environmental Protections

Think this is crazy? Consider some of the court action Canada has faced

CLICK HERE, for Ethyl Corp wanting $201M over MMT additive ban.

CLICK HERE, for SD Myers wants $53M for PCB ban.

CLICK HERE, for Pope & Talbot’s $500M softwood lumber suit.

CLICK HERE, for Sun Belt wanting $1.5B-$10B for lost water rights.

10. Is NAFTA Worth The Price?

Yes, it has led to economic growth and more trade. That much is indisputable. But it isn’t fair to omit some of the real costs to engaging in these free trade deals, such as TPP, or FTAA.

- Litigation over new “rights”

- Massive job losses

- Wages driven down

- Destruction to middle class

- Increased illegal immigration

- Unsustainable trade deficits

- Environmental protections are secondary

But hey, as long as the GDP keeps growing.