(Information on what the International Finance Facility for Immunization, or IFFIm, really is and does)

1. Other Articles On CV “Planned-emic”

The rest of the series is here. Many lies, lobbying, conflicts of interest, and various globalist agendas operating behind the scenes. The Gates Foundation finances: the World Health Organization, the Center for Disease Control, GAVI, ID2020, John Hopkins University, Imperial College London, the Pirbright Institute, the British Broadcasting Corporation, and individual pharmaceutical companies. Also: there is little to no science behind what our officials are doing; they promote degenerate behaviour; the Australian Department of Health admits the PCR tests don’t work; the US CDC admits testing is heavily flawed; and The International Health Regulations are legally binding. See here, here, and here.

2. Important Links

(1) “https://www.kff.org/news-summary/canada-commits-cad-600m-to-gavi-cad-190m-to-gpei-over-4-years/

(2) https://www.cbc.ca/news/politics/vaccination-canada-gavi-covid-pandemic-1.5566532

(3) http://archive.is/RxcxT

(4) https://iffim.org/about-iffim

(5) http://archive.is/BCjMe

(6) https://iffim.org/investor-centre/vaccine-bonds

(7) http://archive.is/lPUOc

(8) http://polioeradication.org/

(9) http://archive.is/NTy9J (2013 archive)

(10) http://archive.is/iEvNd (2020 archive)

(11) https://www.worldbank.org

(12) http://archive.is/iHVTJ (2019 archive)

(13) http://archive.is/IPLo5 (Current)

(14) https://www.worldbank.org/en/news/speech/2018/05/15/leveraging-innovative-finance-for-realizing-the-sustainable-development-goals

(15) http://archive.is/Cpx4c

(16) https://canucklaw.ca/ccs-7-climate-bonds-a-100t-industry-intl-econ-forum-of-the-americas/

(17) https://canucklaw.ca/ccs-16-dr-shiva-ayyadurai-on-how-the-carbon-tax-works/

3. Context For This Article

Several articles in the Canuck Law series on the CV “planned-emic” have focused on the lobbying and influence peddling behind the vaccine agenda. This one covers the recent plans to hand out more money under that guise. However, there is an interesting twist here.

The Federal Government recently announced it will be giving $790 million of taxpayers’ money to 3 separate institutions. 2 of the grants (the recipients are GAVI/GPEI) are for vaccine initiatives. The other is to for so-called “vaccine bonds”, (issued by IFFIm). Of course Canada doesn’t have the money to send abroad, but that doesn’t seem to be a problem.

The specific grants:

- $125M for Int’l Finance Facility for Immunisation (IFFIm)

- $475M for GAVI, Global Alliance for Vaccines and Immunization (GAVI)

- $190M for Global Polio Eradication (GPEI)

It’s the first item on this list that is the most concerning. The $125 million to IFFIm contribution won’t be paid directly for research and development. Instead, the IFFIm will issue bonds to the World Bank, who in turn will put those bonds on the market. The World Bank will pay money back to IFFIm, less profits that the bond holders will be making on the bonds.

Obvious question: Why aren’t we giving the money targeted for the IFFIm directly to GAVI, if that’s who will use it? Why are we including at least 3 middlemen (IFFIm, World Bank, and Investors)? Why is taxpayer money — or taxpayer debt — being used to help private interests advance their stock portfolios?

We know that GAVI is heavily financed by the Gates Foundation. Also, it turns out that IFFIm has its administrative costs heavily funded by GAVI. By extension, this means that the Gates Foundation is financing the operation of IFFIm. GAVI is just being used as an intermediary here.

4. Vaccine Bonds A Growth Industry

IFFIm is a role model for socially responsible investing in global development, which faces constant funding challenges and unpredictability. Vaccine Bonds provide investors with a unique opportunity to realise an attractive and secure rate of return and diversify their portfolios while helping save young lives. It’s not a donation, it’s an investment. IFFIm has been so successful, it has changed the face of global development funding.

IFFIm’s unique financing model for global health is built upon partnerships. IFFIm receives long term, legally binding pledges from donor countries and, with the World Bank acting as Treasury Manager, turns these pledges into bonds. The money raised via Vaccine Bonds provides immediate funding for Gavi, the Vaccine Alliance. Since, 2000 Gavi has dramatically improved access to new and underused vaccines for children living in the world’s poorest countries.

Vaccine Bonds speed the availability of flexible funds for Gavi’s immunisation programmes and other initiatives on the ground, including unexpected emergencies. This saves more lives faster. Vaccine Bonds also lead to funding that is more predictable, enabling public health officials to plan vaccination campaigns well in advance. Forward planning strengthens local health systems and translates into healthier populations overall, a crucial building block for a successful economy.

So how does this work? Let’s go through the steps:

- Nations make binding pledges to pay IFFIm at a later date

- The IFFIm uses those pledges to generate bonds

- The IFFIm then sells bonds to the World Bank for cash

- The IFFIm gives its new money to GAVI for vaccines.

- The World Bank sells bonds to outside investors

- Investors make profits on their bonds (presumably)

- Nations (over time) pay their commitments to IFFIm

Something is missing from this list, correct? Investors are making money off of their bonds, or else they wouldn’t buy them. There are also salaries and administrative costs to factor in. So where is the extra money coming from?

Hypothetically, bond owners can resell the bonds to other people. That does actually happen in practice. However, that would only work for a limited time. Furthermore, the market for such bonds is fairly limited.

One option is that the IFFIm would be selling the bonds at a discount to the World Bank (but still expecting full price from the donor nations). For example, Spain might issue a pledge for $10 million, and IFFIm will sell a bond to the World Bank for $9 million. The investor(s) will get $10 million back. In this scenario, GAVI ends up with $9 million, and investors with $1 million. Of course administrative costs need to be factored in.

Another option is that the donor nations will end up footing the bill for the returns that investors get. Using Spain again, they will pledge $10 million over a period of years, but then have to pay the full bonds plus perhaps another million in interest.

Either case is horribly inefficient. By adding these middlemen, it means that nowhere near the full amount of donor money is receiving its intended target. Either money is skimmed off the initial pledge, or the pledge turns out to be far more expensive than originally thought.

This isn’t to endorse GAVI’s agenda, but giving them the money directly would have meant they actually get the full amount. This setup means that a large percentage will never be received.

Much like with the climate bonds industry, vaccine bonds don’t actually contribute to public well being. In both cases, it allows private parties to profit off of the slush funds that are generated. These bonds don’t make the weather, or vaccines, any better. The two cases have considerable overlap.

The main difference is that while the climate change industry is simply a gigantic waste of public money, the vaccines that ultimately result can do incredible harm to the people who take it.

5. A Look At IFFIm’s Financials

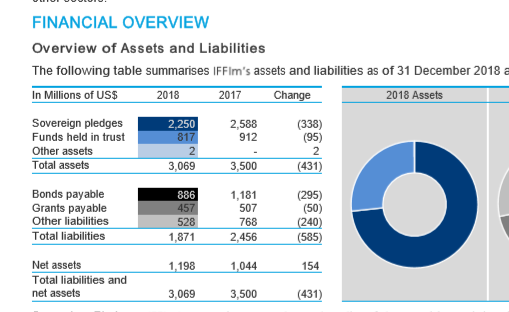

According to the latest financial statement, IFFIm is sitting on $1.198 billion in equity (or assets minus liabilities). That being said, it’s difficult to see how much solvent this operation is. The bulk of their “assets” are pledges from nations down the road.

Disclaimer: This is not professional accounting information, just a lay impression from reading through the reports.

IFFIm 2006 Trustees Report and Financial Statements

IFFIm 2007 Trustees Report and Financial Statements

IFFIm 2008 Trustees Report and Financial Statements

IFFIm 2009 Trustees Report and Financial Statements

IFFIm 2010 Trustees Report and Financial Statements

IFFIm 2011 Trustees Report and Financial Statements

IFFIm 2012 Trustees Report and Financial Statements

IFFIm 2013 Trustees Report and Financial Statements

IFFIm 2014 Trustees Report and Financial Statements

IFFIm 2015 Trustees Report and Financial Statements

IFFIm 2016 Trustees Report and Financial Statements

IFFIm 2017 Trustees Report and Financial Statements

IFFIm 2018 Trustees Report and Financial Statements

According to the most recent IFFIm annual report, these were the trustees of the company at the time. Below are their public profiles.

• Cyrus Ardalan, Board Chair: Mr Ardalan is Chairman of Citigroup Global Markets Limited and OakNorth Bank. He is also Chairman of the Financial Services Advisory Board of Alvarez and Marsal. Previously he was a Vice Chairman of Barclays Bank and has also held senior roles at BNP Paribas and the World Bank. He has served as Chairm as a member of the board of the Dubai International Financial Centre. Mr Ardalan was appointed as a director effective 1 January 2013 and as Chair of the IFFIm board effective 1 January 2018.

• Bertrand de Mazières: Mr de Mazières is the Director General for Finance at the European Investment Bank (EIB) treasury operations and its support functions for equity, lending, borrowing, and funding operations. Prior to that, he was the Chief Executive of Agence France Trésor, the division of the Ministry of Economy Management. Mr de Mazières was appointed as a director effective 18 May 2018.

• Christopher Egerton-Warburton: Mr Egerton-Warburton is an expert in the structuring and execution of innovative financing solutions and was instrumental in the creation of IFFIm. He is a partner with Lion’s Head Capital Partners, a merchant bank that provides advisory, financial structuring, capital raising and asset management services. Prior to that, he was Head of the Sovereign, Supranational and Agency team within the Debt Capital Markets group at Goldman Sachs International. Mr Egerton-Warburton was appointed as a director effective 1 January 2013 and concluded his second term as a director on 31 December 2018.

• Doris Herrera-Pol: Ms Herrera-Pol retired from the World Bank where she was the Global Head of Capital Markets. Her team was responsible for designing the World Bank’s funding strategy and managing its multi-currency funding programme in global money, capital and derivatives markets. From 2002 to 2007, she led the team re -vanilla debt products, including global bonds and emerging market bond issues. Ms Herrera-Pol was appointed as a director effective 13 November 2015 and she is a member of the audit committee.

• Fatimatou Zahra Diop: Ms Diop is a former Secretary-General of the Central Bank of West African States (BCEAO) where she was responsible for the coordination and management of the bank in its eight member countries as well as offices in Dakar and Paris. She co-founded and currently serves as Vice President of the board of Afrivac, a public-private partnership whose mission is to work with public and private sector partners to promote the need to strengthen the budgets of African countries with a view toward becoming independent from multilateral support. Ms Diop was appointed as a director effective 10 June 2015 and she is a member of the audit committee.

• Helge Weiner-Trapness: Mr Weiner-Trapness is a founding partner of Quintus Partners, an independent financial advisory firm that provides strategic and investment advisory and capital raising services to a diverse client base of corporations, private investment firms, and institutions. Prior to that, he was the Managing Director and Co-Global Head of the Financial Institutions Group at Barclays Bank in Hong Kong and previously held senior positions at Asia Pacific Land, JP Morgan Securities, and Goldman Sachs. Mr Weiner-Trapness was appointed as a director effective 17 December 2018.

• Marcus Fedder, Audit Committee Chair: Mr Fedder has been involved with microfinance for the past five years after spending more than 20 years in banking. He held senior positions at several financial institutions, including as Vice Chair of TD Securities, the Toronto Dominion Bank, with responsibility for all businesses in Europe and Asia-Pacific. Prior to that he was Treasurer of the European Bank for Reconstruction and Development, and worked at the World Bank and in derivatives, starting his career at Deutsche Bank. He is a member of the supervisory board of TCX Fund. Mr Fedder was appointed as a director effective 1 January 2013.

These aren’t doctors or any sort of scientists or medical professionals. These are bankers whose job it is to turn the slush fund into a very profitable venture.

Various nations (Canada is now one) are pledging money to the IFFIm, who then turns around and issues bonds which it sells to the World Bank. Those bonds are then sold to private investors.

The steps for this were outlined in the last section. Again, what benefit does this give to donor nations? Either the bonds are sold at a discount, or donor nations will be paying the interest as well (or perhaps both). But this does generate a nice slush fund for the banker to play around with.

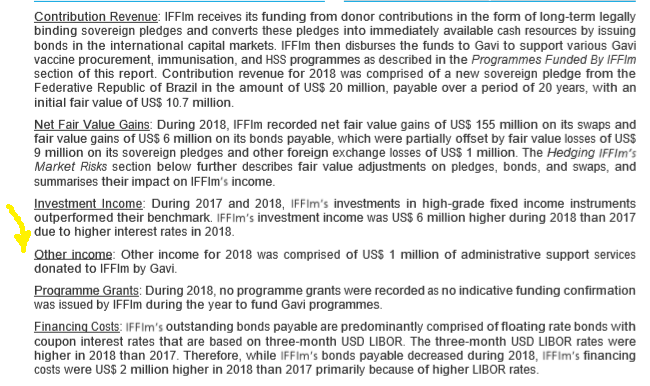

According to the last financial statement, on page 18, GAVI contributed $1 million (in U.S. dollars) to the Int’l Finance Facility for Immunization for administrative costs. Essentially this means that GAVI is funding the operation of IFFIm, or rather that the Gates Foundation is.

| Nation | Date | Years Of Bond | Amount ($USD) |

|---|---|---|---|

| Australia | 2011 | 19 | $176,463,000 |

| Australia | 2016 | 5 | $26,469,000 |

| Brazil | 2018 | 20 | $20,000,000 |

| France | 2006 | 15 | $426,931,000 |

| France | 2007 | 19 | $993,072,000 |

| France | 2017 | 5 | $171,780,000 |

| France | 2017 | 5 | $171,780,000 |

| Italy | 2006 | 20 | $542,195,000 |

| Italy | 2011 | 14 | $29,203,000 |

| Netherlands | 2017 | 5 | $91,616,000 |

| Netherlands | 2009 | 7 | $66,667,000 |

| Norway | 2006 | 5 | $127,000,000 |

| Norway | 2010 | 10 | $172,829,000 |

| South Africa | 2007 | 20 | $20,000,000 |

| Spain | 2006 | 5 | $217,015,000 |

| Sweden | 2006 | 20 | $30,851,000 |

| UK | 2010 | 19 | $319,225,000 |

Those listings are the “legally binding” pledges that various nations have made to IFFIm over the last 15 years. Doubtful that any nation ever held a referendum.

In February 2019, the IFFIm board issued a new indicative funding confirmation to Gavi of US$ 50 million comprised of US$ 45 million to help in the funding of new and underused vaccine support programmes and US$ 5 million to help in the funding of health systems strengthening programmes.

In March 2019, the IFFIm board approved a proposal for Gavi to support the Coalition for Epidemic Preparedness Innovation through the issuance of IFFIm bonds backed by a new pledge from the Kingdom of Norway to IFFIm. CEPI is a global public-private partnership whose mission is to accelerate the development of vaccines against emerging infectious diseases and enable equitable access to these vaccines for people during outbreaks. The approved arrangement will accelerate the availability of funding for programmes by drawing on capacity to raise financing on international capital markets based on long-term pledges from its Grantors.

This is from page 23 of the latest report. IFFIm approved a proposal by GAVI…. Okay, so does GAVI need to get permission from IFFIm? Bonds were issued to back a new pledge from Norway.

Considering how long this whole thing has been going on for, one has to ask if the current “pandemic” is just an excuse to upscale the existing industry.

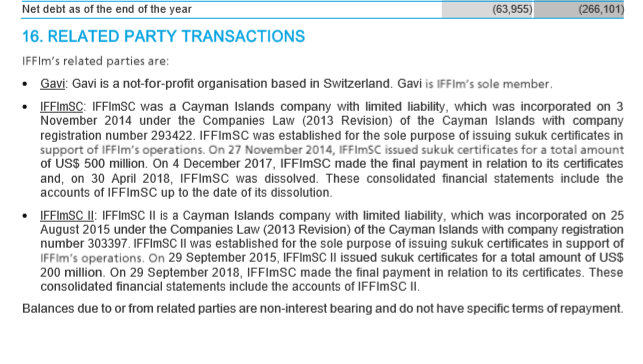

It doesn’t get much more cliché than this: The IFFIm is using 2 (yes 2) limited liability corporations (LLCs) in the Cayman Islands to issue certificates to run IFFIm’s operations. Now, the Cayman Islands is notorious for their bank secrecy laws. If the IFFIm is a completely legitimate organization, one has to wonder why they didn’t simply set up an LLC — or a trust — in the UK, where they are based.

6. Canada To Fund Global Vaxx Agenda

Canada is pledging $600 million to a global public-private partnership that works on vaccination campaigns in the world’s poorest countries, International Development Minister Karina Gould announced today.

In addition to the funding for Gavi, the Vaccine Alliance, Canada is committing $47.5 million annually over four years to support the Global Polio Eradication Initiative’s strategy, Gould said.

Gould made the announcement at the launch of the Group of Friends of Solidarity for Global Health Security virtual meeting, which she co-hosted with her counterparts from Denmark, Qatar, South Korea and Sierra Leone.

Money aside, there is something else to note: Karina Gould makes it clear that it is (supposedly) Canada’s job to provide vaccinations for the entire world.

“As a global community, we must work to ensure that those most vulnerable, including women and children, have access to vaccinations to keep them healthy wherever they live,” Gould said.

“COVID-19 has demonstrated that viruses do not know borders. Our health here in Canada depends on the health of everyone, everywhere.”

How convenient for Canada that all of the parliamentary hurdles have already been cleared for this. Raj Saini introduced M-132 back in November 2017. Hearings took place in the fall of 2018. Parliament formally adopted the recommendations in March 2019. See this piece and also this piece. The timing certainly worked out well.

Now the same pharmaceutical companies that were previously pushing for the passage of M-132 will be able to reap the rewards: Government contracts to develop vaccines. In a recent move, AbCellera received a $175.6 million grant to work on a coronavirus cure.

Rest assured, many more Government contracts will be handed out soon enough.

7. GAVI Gets Funding From Gates

This is probably the most well known link in the chain. The Bill and Melinda Gates Foundation helped found GAVI, the Global Vaccine Alliance in 1999, and has made regular contributions to it. The foundation essentially runs the show.

The Global Vaccine Alliance, as the name suggests, is an organization devoted to pushing vaccinations on the public all across the world. Bill Gates has long been a proponent of mass vaccinations.

It was addressed in part 4 and part 5 how GAVI gets some of their funding, and that GAVI has been lobbying the Federal Government for 2 years. Between March 2018 and January 2020, there are 20 communications reports, according to records from the Office of the Lobbying Commissioner. Part 6 of the series shows that many of the lobbied bureaucrats follow Bill Gates.

Crestview Strategy lobbyists have ties to various political parties across the spectrum, including the Conservative Party of Canada. This lobbying seems to have paid off, as GAVI’s fees for paid influencers have resulted in a significant Government contract.

With this announcement, the Trudeau Government will be handing $475 million to GAVI. This means that it will actually be giving $475 for Gates to control. Considering that the Bill & Melinda Gates Foundation remains one of the biggest donors to GAVI, no one can deny that Gates has significant influence over it.

8. GPEI Partners With Gates/GAVI

From its own website, it appears that the Global Polio Eradication Initiative partners with several prominent groups including:

- World Health Oranization

- Rotary

- Center for Disease Control

- UNICEF

- Bill & Melinda Gates Foundation

- GAVI (Global Vaccine Alliance)

On paper, it looks like Canada is giving $190 million ($47.5M annually for 4 years), to a separate organization, but these groups all work together.

9. World Bank A Full Partner

From this 2018 speech, the World Bank outlined just how varied and widespread its goals really were.

As you know, UNCTAD estimates that achieving the Sustainable Development Goals (SDGS) by 2030 will require $3.9 trillion to be invested in developing countries each year. It also notes that with annual investment of only $1.4 trillion, the annual investment gap is $2.5 trillion. Let me therefore take this opportunity thank the Group of Friends of SDG Finance for your leadership on mobilizing private finance to achieve these important goals. At the World Bank Group, we have equally strengthened our focus on mobilizing the private sector for development.

We have this dream of what the world should be like, and we only need $3.9 trillion per year to make it a reality. The article to too long to quote in its entirety, but there are some sections that need to be addressed.

Last year, the World Bank issued the world’s first global pandemic bond that will channel surge funding to developing countries facing the risk of a pandemic. It was designed to prevent another Ebola crisis, and was the first time that pandemic risk in low income countries was transferred to the financial markets. Such a facility, will enable the world to respond more promptly than it did when the 2013-2014 Ebola crisis happened, thereby minimizing the death toll and the negative impact on the economy.

To date we have provided $3.9 billion in catastrophe and weather risk transactions, of which nearly $2 billion has been executed in the last ten months. We have seen increased demand from clients as the frequency of extreme weather events has increased. Cat bonds that transfer risk to the capital markets have become an important complement to emergency funds, budget reserves, and contingent credit lines because it allows countries to leverage their budgets to offer greater protection when disasters strike.

Yes, pandemic bonds a are real thing, and they operate as a form of insurance. People are willing to buy these bonds when times are good, and returns are assured. However, when a pandemic (or multiple pandemics) occur, the funds get depleted pretty quickly. Hence the reluctance to payout initially.

New initiatives that we are also exploring include innovative mechanisms to expand financing for education, famine and World Bank seasoned loans to institutional investors. Examples are:

.

1) The Education Commission’s International Financing Facility for Immunization, IFFEd, a fund that will not only reduce the cost to developing countries of financing education projects but also increase the capacity of multilateral institutions to lend for education projects. IFFEd is supported by the World Bank and regional development banks. IFFEd has raised $2 billion for education with a goal of $10 billion. It is expected that every billion of aid will leverage $4 billion from development banks. On May 11, 2018 IFFEd was endorsed by the UN Secretary General.

Is the IFFed related to the IFFIm? Are funds just being moved around, or is this really the same group?

In this respect we partnered with Japan’s Government Pension Investment Fund (GPIF) on research with respect to sustainable fixed income investing. We expect this research to promote strategies for including sustainability criteria in investment decisions. We are equally conducting research for the G20 by engaging investors to come up with concrete actions to scale up long-term sustainable investments and support the SDGs.

This is rather creepy. If anyone in Japan ever reads this article, consider pulling your money out of the pension plan.

The World Bank is buying bonds from IFFIm, and those bonds are based on pledges from donor nations. Considering the globalist nature of many World Bank Initiatives, is this an underhanded way to get nations to fund projects they otherwise couldn’t sell to the public.

10. Gov’t Is Throwing Money Away

The $125 million pledge that is going to the Int’l Finance Facility for Immunisation (IFFIm), is essentially being used to create bonds for bankers to sell privately. Canadian taxpayer debt is being used to finance a portion of this slush fund, which doesn’t actually help improve global health.

The vaccine bonds in many ways parallel the climate bonds. Nations pledge large sums of money, and the handlers use those pledges to create bonds which are sold on the private market. Neither benefit the public at large, but they do make some people extremely wealthy.

As for the grants to GAVI and to GPEI, the Bill and Melinda Gates Foundation heavily finances both organizations. It is foolish to think that they are independent. Noted early, GAVI has been using the lobbying firm Crestview Strategy to push their agenda for the last 2 years. There are 20 communications reports on file.

The Federal Government has quite bluntly stated that they see providing “global health care” as critical to keeping Canadians healthy. Effectively, this is free health care for the world, paid for by Canadians. Or at least that is what Ottawa claims it believes.

Of course, mainstream outlets like the CBC won’t give you the entire story. Their job is to ensure Canadians don’t see the big picture.