Justin Trudeau (or his clone), and Theresa Tam take questions from the obedient and largely compliant media. Some highlights from the video include:

[1] No clear answer given about quarantine camps

[2] Journalists asked to be puppets and discredit alternative sources

[3] Social media censored/demonitized, made invisible by algorithm

[4] Information should be checked against official sources — not necessarily for accuracy

[5] Asking people to do testimonials, no specification it be true

[6] Innoculate people “from vaccine misinformation”

[7] Public should only trust official sources

One has to wonder why there is no skepticism whatsoever shown, and why members of the media are toeing the line like this. And there is a simple answer: money.

1. Other Articles On CV “Planned-emic”

The rest of the series is here. Many lies, lobbying, conflicts of interest, and various globalist agendas operating behind the scenes. The Gates Foundation finances: the WHO, the US CDC, GAVI, ID2020, John Hopkins University, Imperial College London, the Pirbright Institute, the BBC, and individual pharmaceutical companies. Also: there is little to no science behind what our officials are doing; they promote degenerate behaviour; the Australian Department of Health admits the PCR tests don’t work; the US CDC admits testing is heavily flawed; and The International Health Regulations are legally binding. See here, here, and here. Our democracy is thoroughly compromised, as shown: here, here, here, and here.

2. Important Links

Reminder: 2018 Fall Economic Update To Subsidize Journalism

2019 Budget For Canada

CLICK HERE, for Digital News Subscription Tax Credit.

https://archive.is/4of5V

WayBack Machine Archive

CLICK HERE, for Refundable Labour Tax Credit (25% of salaries)

https://archive.is/SKSh1

WayBack Machine Archive

CLICK HERE, for Canadian Periodical Fund. ($1.5M limit)

https://archive.is/yZP02

WayBack Machine Archive

CLICK HERE, for April 2020 announcement on media subsidies

https://archive.is/53cVu

WayBack Machine Archive

CLICK HERE, for Special Measures For Journalism (Covid)

https://archive.is/4JeLG

WayBack Machine Archive

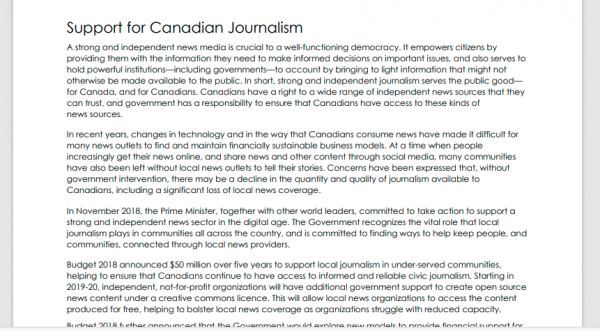

3. Reminder Of $595M Media Grant In Nov 2018

Support for Canadian Journalism

A strong and independent news media is crucial to a well-functioning democracy. It empowers citizens by providing them with the information they need to make informed decisions on important issues, and also serves to hold powerful institutions—including governments—to account by bringing to light information that might not otherwise be made available to the public. In short, strong and independent journalism serves the public good—for Canada, and for Canadians. Canadians have a right to a wide range of independent news sources that they can trust, and government has a responsibility to ensure that Canadians have access to these kinds of news sources.

A New Non-Refundable Tax Credit for Subscriptions to Canadian Digital News Media

.

To support Canadian digital news media organizations in achieving a more financially sustainable business model,

the Government intends to introduce a new temporary, non-refundable 15-per-cent tax credit for qualifying subscribers of eligible digital news media.

.

In total, the proposed access to tax incentives for charitable giving, refundable tax credit for labour costs and non-refundable tax credit for subscriptions will cost the federal government an estimated $595 million over the next five years. Additional details on these measures will be provided in Budget 2019.

It was 2 years ago that this media subsidization was covered on this site. See page 40 in the report. The goal was to keep otherwise unprofitable media afloat usin taxpayer money in order to hold the Government to account, and to promote diverse ideas.

Now, if holding the Government to account, and promoting viewpoint diversity were the results, then it “may” be worthwhile. But as we will see, that’s not the goal at all.

4. 2019 Budget Includes These Measures

Supporting Canadian Journalism

A strong and independent news media is crucial to a well-functioning democracy. Recognizing the vitally important role the media play in helping citizens make informed decisions about important issues, in the 2018 Fall Economic Statement the Government announced its intention to introduce three new tax measures to support Canadian journalism:

• A new refundable tax credit for journalism organizations.

• A new non-refundable tax credit for subscriptions to Canadian digital news.

• Access to charitable tax incentives for not-for-profit journalism.

As previously announced, the Government will establish an independent panel of experts from the Canadian journalism sector to assist the Government in implementing these measures, including recommending eligibility criteria. Given the importance of ensuring that media outlets are able to operate with full independence, the Government proposes to establish an independent administrative body that will be responsible for recognizing journalism organizations as being eligible for any of the three measures.

Further details are available in Tax Measures: Supplementary Information.

That’s from page 173 of the 2019 budget. The goal is to provide: (a) tax credits for organizations; (b) tax credits for subscribers; and (c) further tax incentives for NFP journalism. More details are listed on page 373.

Of course, there will be an “independent panel” deciding on who gets this money. It can’t be too independent, since real journalists call out the lies and fabrications of governments.

5. Digital News Subscription Tax Credit

Qualifying subscription expense

A qualifying subscription expense is the amount a subscriber paid in the year for a digital news subscription with a QCJO that does not hold a license as defined in subsection 2(1) of the Broadcasting Act. To qualify for the credit, a digital news subscription must entitle an individual to access content in digital form that is primarily original written news.

How to apply

A new form, T622, Digital News Subscription Tax Credit, and process will be published so that organizations can get confirmation that the subscriptions they offer are eligible as qualifying subscriptions. Eligible subscriptions will be published on the CRA’s webpages.

Organizations whose subscriptions no longer qualify for the credit are required to inform their subscribers.

How to claim the credit

Individuals who have entered into an agreement with a QCJO for a qualifying subscription that is eligible, can claim the credit on their income tax return for the years 2020 to 2024.

This essentially amounts to pushing propaganda, since the Government can easily decide what does and does not count as a Qualifying Canadian Journalism Organization. It effectively subsidizes (at taxpayer expenses), outlets and topics it wants to see advanced.

However, this is not the only subsidy that is now in place.

6. Refundable Labour Tax Credit (25% Of Salary)

1. What is the proposed new refundable labour tax credit?

The budget proposes to introduce a new refundable labour tax credit (Tax Credit) on qualifying labour expenditures (Qualifying Labour) payable to an eligible newsroom employee of a qualifying journalism organization (Qualified Organization).

4. What is Qualifying labour?

Qualifying Labour for a taxation year includes the salary or wages payable by a Qualified Organization to an eligible newsroom employee in respect of the portion of the taxation year throughout which the organization is a Qualified Organization. The salaries and wages will be reduced by the total of all amounts of assistance that a Qualified Organization received or is entitled to receive in respect of the salary of eligible newsroom employees. The amount of Qualifying Labour will be limited to $55,000 in respect of each eligible newsroom employee.

5. What salary and wages are eligible as Qualifying Labour?

Qualifying Labour will include salary and wages payable to an eligible newsroom employee in respect of a period on or after January 1, 2019. As such, salary and wages that are in respect of a period before January 1, 2019 will not be Qualifying Labour. In addition, salary and wages will be Qualifying Labour of an organization only if they are in respect of a period throughout which the organization is a Qualified Organization.

6. What is an eligible newsroom employee?

An eligible newsroom employee, in respect of a Qualified Organization in a taxation year, means an individual who:

is employed by the Qualified Organization in the taxation year; works, on average, a minimum of 26 hours per week throughout the portion of the taxation year in which the individual is employed by the Qualified Organization; at any time in the taxation year, has been, or is reasonably expected to be, employed by the Qualified Organization for a minimum period of 40 consecutive weeks that includes that time; spends at least 75% of their time engaged in the production of news content, including researching, collecting information, verifying facts, photographing, writing, editing, designing and otherwise preparing content; and meets any prescribed conditions.

Up to 25% of an employee’s salary (of the first $55,000) would be subsidized by the Government, or more correctly, by taxpayers. This means potentially $13,750 of an employee’s salary in total, and that’s per employee. This is designed for full time media outlets.

But these handouts aren’t limited to full time media outlets. Even part time, or infrequent periodicals can benefit from the taxpayer money.

7. Canada Periodical Fund ($1.5M Limit)

Limits of government assistance

Except for farm periodicals, we can fund up to $1.5 million per periodical.

.

Publication receiving the Government of Canada Refundable Labour Tax Credit (RLTC) are ineligible to the Aid to Publishers component of the Canada Periodical Fund.

.

The total financial assistance received from the Aid to publishers component of the Canada Periodical Fund and other levels of government (federal, provincial, territorial and municipal) cannot exceed 75% of any publisher’s total expenditures for the creation, production, marketing and distribution of magazines and non-daily newspapers.

The Canadian Periodical Fund will provide a magazine or non-daily publication with up to 75% subsidization, or $1.5 million, whichever is less. Although there are rules as to how much the publication must produce anyway, it’s still a significant amount of taxpayer money.

Also note: there is the disclaimer that “periodicals that contain offensive content in the opinion of the department of Canadian Heritage” may not receive funding.

8. Special Measures For Journalism (Covid-19)

And in case the magazine or periodical doesn’t qualify for subsidies under the Canadian Periodical Fund, there is a new program announced, the “Special Measures For Journalism”. That’s right, a special program to prop up alternative media outlets during this “pandemic”.

Objectives and expected results for the Special Measures for Journalism component

The purpose of the Special Measures for Journalism component is to provide short-term emergency financial relief to Canadian magazines and community newspapers during the COVID-19 crisis in 2020. The component will provide funds for the 2020-2021 fiscal year, to publishers that have a free circulation model or low levels of paid circulation, or are published in digital format. Please note that daily newspapers will not be eligible to this new component.

The component provides a flexibility to allow publishers to direct funds to the areas of greatest need. Recipients can spend the funds on a variety of publishing activities, such as content creation, production, distribution, or business development.

This initiative is above and beyond the $595 million expense that was announced back in 2018. This is specifically to keep media outlets going “through the pandemic”. Note: it excludes daily publications, which means that the more infrequent outlets would get it. It creates the huge conflict of interest by subsidizing outlets who most desperately need the money. And how much money?

The maximum amount that can be awarded to an eligible publication is $1,500,000.

Publication receiving the Government of Canada Refundable Labour Tax Credit (RLTC) can obtain funding from the Special Measures for Journalism component. Please note that the amount of any funding received will be deducted from the RLTC.

The total financial assistance received from Special Measures for Journalism and other levels of government (federal, provincial, territorial and municipal) cannot exceed 75% of any publisher’s total expenditures for the creation, production, marketing and distribution of magazines and community newspapers for the current fiscal year.

Again, this applies to non-daily publications, such as weekly or monthly outlets. These are typically the ones who would need it the most. Wonder if giving favourable coverage was a requirement.

If an outlet receives no subsidies, it could theoretically be subsidized under this program to the tune of 75%, or $1.5 million. If subsidies exist from other sources, it could still be topped up to reach that amount.

If a 75% subsidy amounted to $1.5 million, that would mean the organization in question ran up some $2 million in expenses in a year. Considering that non-daily outlets are excluded, most, if not all, of the less frequently published media companies would fall into these limits.

Similar to the Canadian Periodicals Fund, there is the disclaimer that “periodicals that contain offensive content in the opinion of the department of Canadian Heritage” may not receive funding.

This program is similar in many ways to the Canadian Periodical Fund, but removes many of the limitations that had been imposed.

9. Canadian Media Is Bought Off

Even for periodicals that didn’t qualify normally, there is now a grant of up to $1.5 million for the year. One has to assume that any coverage of the “pandemic” would be friendly towards the Government.

Regarding outlets that didn’t qualify beforehand, are they really going to bite the hand that feeds them? After all, if their coverage becomes too critical of the Government narrative, they may find that the CRTC concludes their content to be offensive.

Even without an access to information request, it’s possible to estimate how much an organization will take. If it’s a regular publication, and the approximately salaries are known, just multiply $13,750 times the number of employees. For less frequent publications, just multiply their total expenses by 75%. Far from exact, but these will provide rough estimates.

Now, are any of these media outlets likely to seriously challenge the Government on this “pandemic” narrative? Probably not.

Go back to the video at the start. Even Tam admits that social media censors, both by deleting content, and by using the algorithms to make them invisible.

10. Followup With Canada Revenue Agency

Hello ********,

The Government remains committed to supporting newsrooms while respecting the basic principle of journalistic independence.

Now, more than ever, strong and independent news media are essential to contribute to an informed public and an effective democracy.

To be eligible for the journalism tax measures, an organization must first be designated as a qualified Canadian journalism organization (QCJO). Once designated, a QCJO must then meet additional criteria for each of the tax measures:

· The Canadian journalism labour tax credit, a 25% refundable tax credit on salaries or wages payable in respect of an eligible newsroom employee for periods beginning on or after January 1, 2019.

· The digital news subscription tax credit, a 15% non-refundable personal income tax credit for digital news subscription costs paid by an individual to a qualified Canadian journalism organization, which applies to qualifying amounts paid after 2019 and before 2025.

· A new type of qualified donee called a registered journalism organization for not-for-profit journalism organizations, which is in effect as of January 1, 2020.

A QCJO that meets the additional criteria can claim the Canadian journalism labour tax credit by completing schedule T2SCH58 Canadian Journalism Labour Tax Credit and filing it with its return of income for the year.

The Canada Revenue Agency (CRA) has been receiving QCJO applications since December 2019. With the establishment of the Independent Advisory Board on Eligibility for Journalism Tax Measures (the Board) in March 2020, and the legislative amendments that were proposed in April 2020, the CRA is in a position to provide journalism organizations with the support they need, beginning with the QCJO designation.

You can find information about applying for QCJO designation and the application form at Qualified Canadian journalism organization.

The CRA is working with the Board to seek its recommendations on whether applicant organizations meet certain QCJO criteria related to original news content and journalistic principles and processes.

The confidentiality provisions of the Income Tax Act prevent the CRA from disclosing the names of organizations that have applied for, received, or been denied QCJO designation. We are able to advise that QCJO designations are now being issued, with files being addressed on the basis of the order they were received.

For more information on the tax measures to support journalism, please go to Frequently Asked Questions.

Sincerely,

************************

Media Relations| Relations avec les médias

Canada Revenue Agency | Agence du revenu du Canada

For media inquiries | Pour les demandes médiatiques : cra-arc.media@cra-arc.gc.ca

Like this:

Like Loading...